Growing Applications in Healthcare

The healthcare sector is emerging as a significant driver for the 3D Image Sensor Market, with applications ranging from medical imaging to surgical navigation. The ability to capture high-resolution 3D images is transforming diagnostic procedures and enhancing surgical precision. Technologies such as 3D ultrasound and endoscopy are increasingly relying on advanced image sensors to provide clearer and more accurate visualizations. As healthcare providers seek to improve patient outcomes and operational efficiencies, the demand for 3D image sensors is expected to rise. Market analysts project that the healthcare segment could account for a substantial share of the overall market, potentially reaching USD 1 billion by 2027, underscoring the importance of this sector in driving market growth.

Technological Advancements in Sensor Design

Technological advancements in sensor design are playing a pivotal role in shaping the 3D Image Sensor Market. Innovations such as improved pixel architecture, enhanced light sensitivity, and advanced signal processing algorithms are enabling the development of more efficient and compact sensors. These advancements not only enhance the performance of 3D image sensors but also reduce manufacturing costs, making them more accessible to a wider range of applications. As a result, the market is witnessing an influx of new players and products, further stimulating competition and innovation. The integration of artificial intelligence and machine learning into sensor technologies is also expected to drive future growth, as these technologies can significantly improve image processing capabilities.

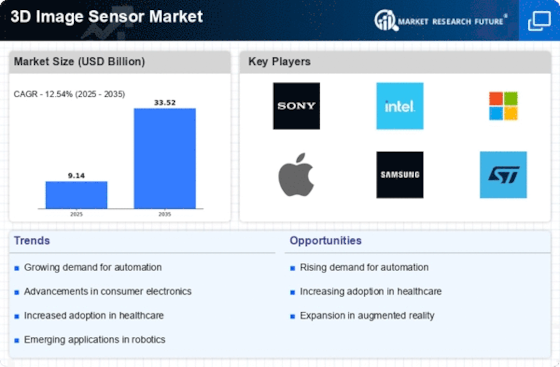

Rising Demand for Enhanced Imaging Solutions

The 3D Image Sensor Market is experiencing a notable surge in demand for enhanced imaging solutions across various sectors. This demand is primarily driven by the need for high-resolution imaging capabilities in applications such as augmented reality, virtual reality, and advanced robotics. As industries increasingly adopt these technologies, the market for 3D image sensors is projected to grow significantly. According to recent estimates, the market is expected to reach a valuation of approximately USD 5 billion by 2026, reflecting a compound annual growth rate of around 20%. This growth indicates a robust interest in 3D imaging technologies, which are essential for improving user experiences and operational efficiencies in diverse applications.

Expansion of Smart Devices and IoT Integration

The expansion of smart devices and the integration of Internet of Things (IoT) technologies are significantly influencing the 3D Image Sensor Market. As smart devices become more prevalent, the need for advanced imaging capabilities is increasing. 3D image sensors are being integrated into smartphones, tablets, and smart home devices, enhancing functionalities such as facial recognition, gesture control, and environmental mapping. This trend is expected to continue, with market forecasts indicating that the adoption of 3D image sensors in consumer electronics could grow by over 25% in the next few years. The convergence of 3D imaging with IoT applications is likely to create new opportunities for innovation and market expansion.

Increasing Investment in Research and Development

The 3D Image Sensor Market is benefiting from increasing investment in research and development by key players and technology firms. This investment is aimed at exploring new applications and improving existing technologies, which is crucial for maintaining competitive advantage. Companies are focusing on developing sensors that can operate in diverse environments, including low-light conditions and extreme temperatures. Furthermore, partnerships between technology firms and research institutions are fostering innovation and accelerating the development of next-generation 3D image sensors. This trend is likely to enhance the overall market landscape, as new and improved products are introduced, catering to the evolving needs of various industries.