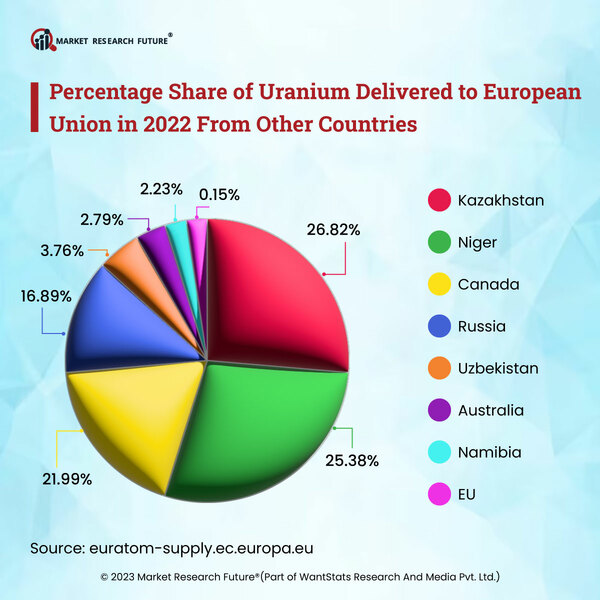

Niger is the Second Largest Supplier of Uranium to the European Union

The uranium price witnessed a slight upward trend after the existing government's overthrow in July 2023 in Niger. Uranium, as a radioactive metal, is used for fuel reactors.

The experts also expect that the price may rise further, as one of the sources said that uranium spot price reached up to USD 56.25 for a pound towards the end of July 2023. The price was USD 58.15 for a pound last week of July 2023. In 2022, the fuel loaded in the European Union had an average advancement assay of 3.93 percent of the product, with 80 percent falling between 3.03 and 4.83 percent. A total of 11 327 tU of uranium was loaded into the reactors in 2022, which comprised uranium feed, savings from MOX fuel, reprocessed uranium, and other materials. All these mentioned materials together have given the amount of feed material from domestic secondary sources. Together, these materials provided 3 percent of the European Union's annual requirement for natural uranium. Using 57 tU of reprocessed uranium and 10 993 tU of natural uranium together as feed, 1 602 natural fuel was produced that was loaded in the reactor in 2022.

Niger produces a tiny percentage of the global production of natural uranium. Still, in 2022, Niger was the second largest supplier of natural uranium to the European Union having a share of 25.38 percent as reported by the Euratom supply agency (ESA). The sources also mentioned that European Union is not going to face any immediate risk even if Niger stops the supplies of uranium in 2023 because it has enough uranium inventories to fuel its nuclear power reactors for the next three years.