London Emerges as Global Leader in Sustainable Finance for Green Transition

Sustainability demands a constant flow of finances in the energy market for the clean energy transition. In the era of renewables, sustainable finance is vital to support the progress of green transformation. Hence, sustainable finance is a crucial factor in the clean energy transition. In 2024, surveys show London is the global leader in sustainable finance globally.Research conducted for investments in sustainable finance suggests that sustainable finance in London provides numerous products and services for the clean energy transition. These services would support the green energy transition to achieve net zero emissions by the end of 2050. Clean energy transition requires development in the energy market, promoting the shift towards renewables. The shift from conventional fuels to renewable sources of energy includes certain investments. This includes large areas and setups for the production of renewables. Sustainable finance defines the procedure of environmental, social, and governance (ESG) factors before investing in renewables. This leads to long-term financial support to attain sustainability in the environment. Therefore, sustainable finance is essential to achieve clean energy transition within the targeted period. Funding is significant in the energy sector's shift; sustainable finances are important nowadays.

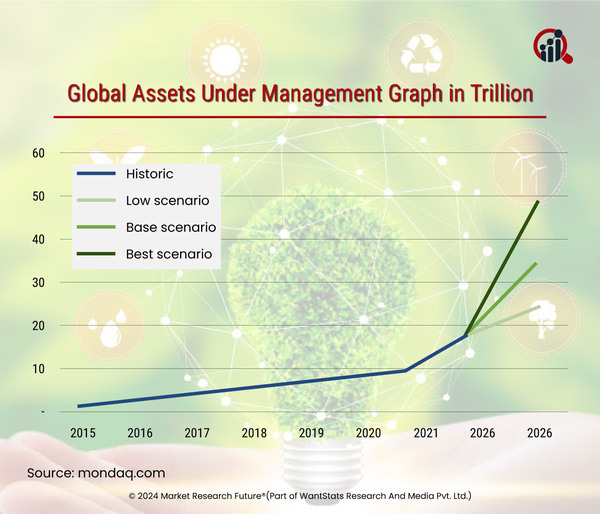

Sustainable finance focuses on specific activities that lessen the negative impacts on the environment. This can lead to a fast-paced environmental transformation to attain net zero emissions by 2050. In London's financial sector, asset managers and other investors are investing in strengthening sustainable finance to achieve a clean energy transition. Sustainable finance aids the nation's economic development as well. Experts claim this financial support helps the growth of green tech. Furthermore, green tech can provide data on carbon footprints that positively control the clean energy transition. Therefore, economic growth in the clean energy sector is necessary to achieve growth and transformation.