Investors View Big Tech Rally to Grow Further as Recession Worries Still Rules

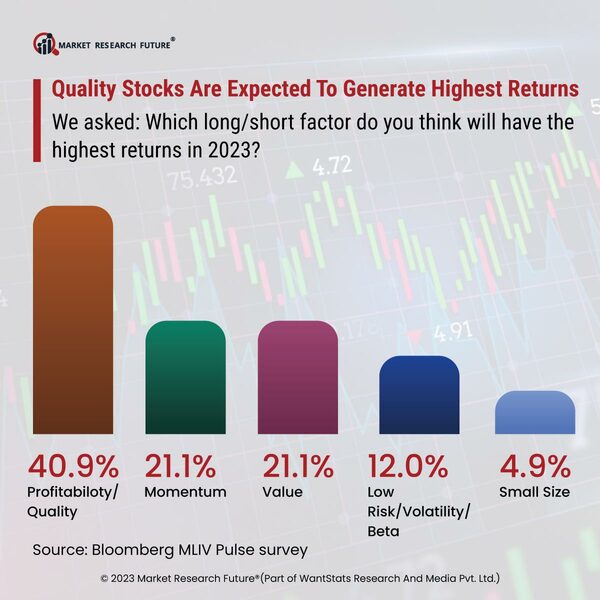

The Big Tech rally in 2023 will continue further as the risk of the United States recession pushes investors into stocks that offer profitable growth in lean time, per the latest Markets Live Pulse survey (MLIV). Of the 492 participants, 41 percent said buying quality stocks would yield the highest returns in 2023. It includes taking long positions in companies like Microsoft Corp. and Apple Inc.

Less clarity on interest rates and the economy is boosting the appeal of stocks with a strong cash flow and promising revenue growth, even though they come with hefty price tags. The tech-heavy Nasdaq 100 has clawed its losses from an end-2021 peak through a low in 2022, thus gaining momentum with the growing buzz around artificial intelligence (A.I.). In the words of the chief equity strategist at Bloomberg Intelligence, "An extraordinary captivation with the U.S. large-cap tech is seen that can be taken as a big driver of investment for a long time." In the MLIV Pulse Survey, quality beats beat momentum, value, and low risk/ volatility/beta as the winning strategy for buying stocks that score highly while selling their opposites.

Citigroup Inc. in May 2023 raised tech to be overweight and U.S. stocks to neutral while expecting a boost from artificial intelligence and an end to the Federal Reserve's rate hikes. At the same time, it is known that tech will outperform at the cost of prices. The information given by Yahoo Finance, according to the 42 percent of respondents following interest rates at 23 percent, recession is the largest risk for stocks in 2024. However, inflation has slowed down, but it is still elevated, and credit conditions are tighter too, but the labor market stays robust, and consumers continue to spend. According to Yahoo Finance, anticipating a recession is such a scenario that frames the thought process and limits visibility.