Increasing Interest Rate Affects China’s Metal Market in 2024

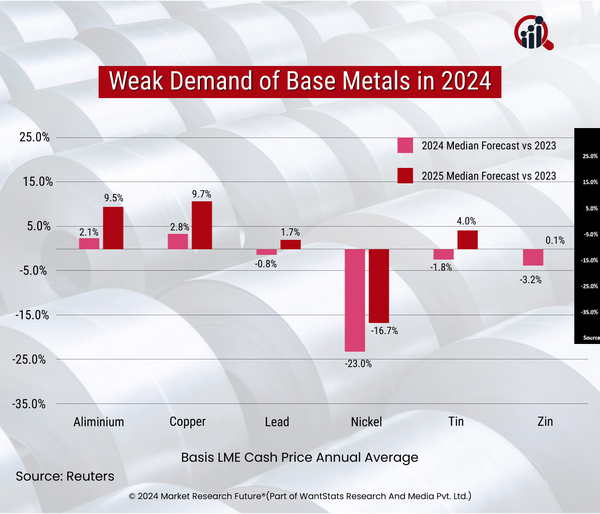

Metals demand in the global market faces specific changes in 2024. Experts claim that metal demand is slowing down due to geopolitical issues and an increased interest rate in 2024. It anticipates continuing throughout the year. This may lead to certain global economic failures in the global metal market in 2024.

Based on the surveys, China's economic growth is responsible for the slower demand for industrial metals in 2024. China's slower economic growth in 2024 is affecting the industrial economy globally. Hence, it is necessary to find solutions to the metal market issues to meet the industrial demand. Experts claim that even if there is an increase in the demand for metals globally, the industry is facing a downward momentum in China. This is due to China's slower economic progress in industrial activity for 2024. In China, the construction sector experiences a slower rate of development. There is a lack of investment in construction activities. Hence, it will lead to less demand for industrial metals in 2024.In contrast, the United States is progressing significantly in the construction sector. Hence, it leads to growing demand for metals in the industrial sector. The construction market in the United States has shown progress due to increasing sustainable building, transportation infrastructures, and many other industrial happenings that boost the metal market. However, China's metal market shows sluggish demands, citing geopolitical conflicts and the nation's rising interest rates.

Experts claim that the market may continue to support affordable price rates of some base metals in 2024. However, supply chain disruptions due to trade restrictions can lead to less supply of aluminum and copper. Hence, it can affect the Chinese metal market in 2024. The survey suggests that the primary metal market may fall to 2.2 percent in 2024 after a hike of 5.7 percent in 2024. Hence, it is one of the main reasons for the lower metal production in China and India. Simultaneously, metal prices like copper may rise higher in 2024 due to its demand in the sustainability market.