Tech Turmoil in 2025: Magnificent Seven Stocks Slide as Tesla Leads Market Decline

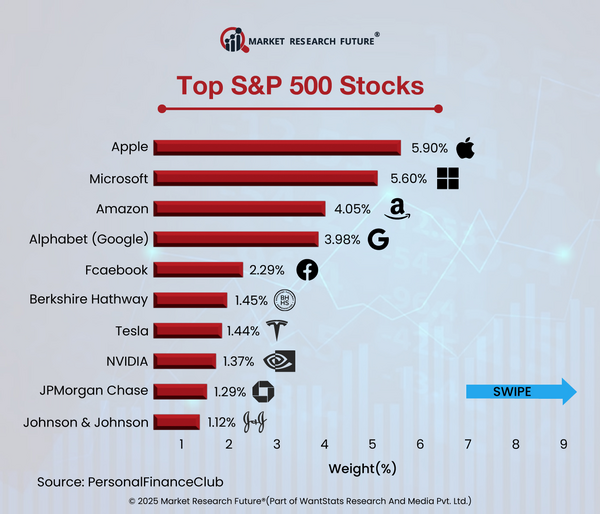

With the "Magnificent Seven”- Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla leading the fall, the US stock market saw a significant dip in early 2025. Usually seen as market drivers, these IT behemoths found themselves in the correction zone and substantially affected the S&P 500 with their extensive market capitalization.

Tesla suffered a significant drop; since December 2024, its stock price has been about half-turned. Several factors helped to cause this downturn:

- Sales Underperformance: Throughout important areas, Tesla's sales in February 2025 lagged below Year-over-year U.S. sales fell by 2percent; China witnessed a 49 percent reduction; Germany saw a 76 percent loss. Negative brand impressions, more competition in China, and weaker demand patterns in the U.S. and the EU will help explain this fall.

- Increased Competition: With traditional automakers and Chinese firms launching new models, the market for electric vehicles (EVs) has become increasingly competitive. The sell-off results from investors reevaluating Tesla's market position in response to increased competitiveness.

- Political Involvement of the CEO: Elon Musk's participation in political affairs, notably his position in the Trump government, has harmed Tesla's reputation, especially internationally. Protests and boycotts brought about by this relationship have further impacted sales and investor confidence.

Challenges also beset the larger IT industry. Goldman Sachs projected that Magnificent Seven's stock market dominance would fade in 2025, implying that these businesses are trading around fair value and might have to maintain strong rates of growth to preserve share values.

By comparison, equities from China and Europe have shown fortitude. Profiting from government support and an emphasis on artificial intelligence, Chinese tech companies have outpaced American rivals. With a 15.74 percent return year-to-date, the Invesco China Technology ETF exceeded the S&P 500's 1.38 percent rise.

With the MSCI Europe Index up 6.84 percent year-to-date, European markets have also drawn investors looking for a bargain. This change points to a diversification tendency among investors driven by worries about the values of American technology equities.