Growth in GDP Presses The Fear of Stagflation for 2023 in The United States

With its recent gross domestic product (GDP) reports for the first quarter of 2023, the United States presses the fears of stagflation. One of the largest economies had estimated the fear of stagflation in the early April reports for the first quarter of 2023. Still, the advance reading for the second quarter of the US economy has stopped this fear of stagflation.

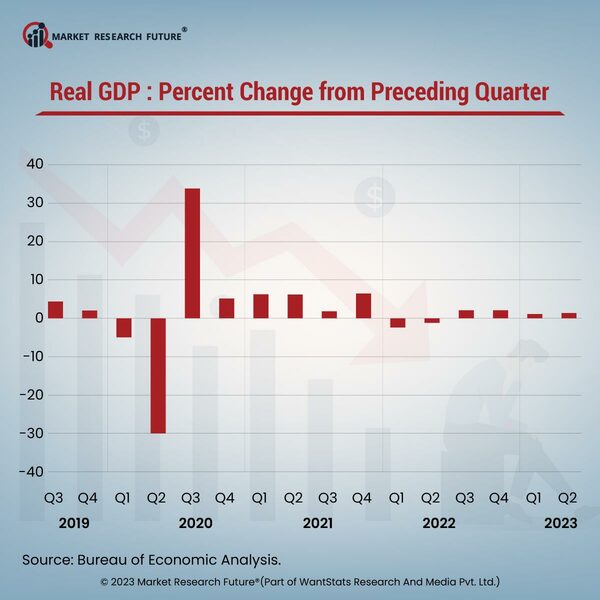

Based on the data released by the Bureau of Economic Analysis, the annual GDP growth rate is expected to accelerate to 2.4 percent in the second quarter of 2023, up from 2 percent noted in the first quarter for the same economic year. This reading has gone beyond the expectations of the analysts. The gross domestic product (GDP) estimation for 2023 is based on the source data being taken from the source agency in advance or incomplete. According to the Bureau of Economic Analysis, the growth acceleration in the real GDP for the first quarter shows an increased number of consumers expenditure, local and state government spending, private sector investments, and others. The consumer's spending is one of the primary factors increasing the services and goods. The goods covered gasoline, vehicles, recreational ones, and energy goods. The services comprise healthcare, housing and utilities, transportation, banking, and insurance. The increases in the private sector investments increased both farm and nonfarm inventories; the local and state government expenditure also increased compensation for government employees.

As per the data, the price index of personal consumption expenditure has accelerated to 2.6 percent in the second quarter of 2023 at an annual rate of 4.1 percent in the first quarter of the same year. Stagflation in the US could have caused stunted economic growth, rising unemployment, and high inflation.