Growing Popularity of Robo Advisors in Recent Years

Based on the customers' preferences, Robo-advisors provides automated deposit that differs from company to company per the investor's needs. More importance is given to the client's preferences at odds with incalculable constraints and risks, which are then automated to fit in with investors precisely. Approximately USD 2.76 trillion is expected to be managed by robo advisors in 2023.

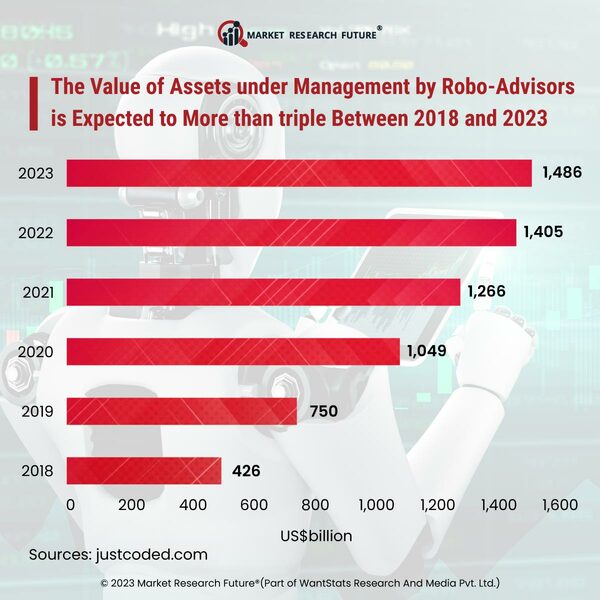

The experts follow the market scenario to provide their investors with a balanced way of investing their penny with less risk, to meet the client's need in a futuristic way balancing their deposit. Robo-advisors have been in the market for a decade, and the financial sector achieving new heights with technology has made it an adapted online service. Automated investment advice has taken the shape of robo-advisors in the later phase, which recommends and guides the investors about the best-trusted way to finance their funds. There has been a rise of about 1.7 trillion approximately in the worldwide assets managed by robo-advisors since 2020; the sector dealt with USD 1 trillion in the beginning. By 2025 it is expected to reach a value of USD 2.9 trillion, per a trusted platform's reports.

Over the years, robo-advisors have gained popularity because of time management and profitable asset management. These are expected to grow more than USD 4.5 trillion by 2027, while in 2017, the estimated revenue of robo-advisors was USD 7.1 billion; by the end of 2023, it is expected to produce sales of approximately USD 110 billion. Robo-advisors greatly help investors due to easy accessibility, more efficiency than human advisors, and tax harvesting.