Fed Is Moving Faster Than Its Past Records In Order To Control The Inflation

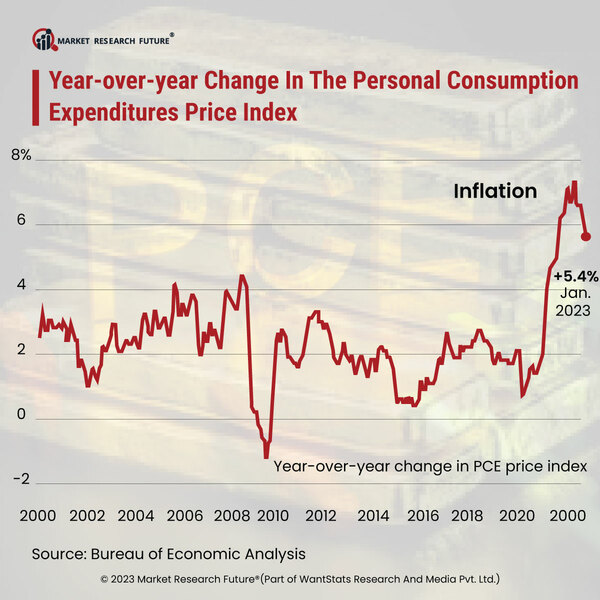

Due to the slow economic conditions globally, the low-interest rates have led the Federal Reserve to take decisive actions to get hold of inflation. It has been happening since the past 14 months to raise the federal funds' target rate by 500 basis points from March 2022.

Based on recent surveys, the Fed raised its policy rate by 425 basis points for federal funds. But no other tightening cycle for the hike in interest rates in the last 40 years could come even closer to the current process based on scope and speed. Even long back, when the Fed was battling record-high inflation, the federal funds rate peaked at nearly 20 percent in 1980 or 1981.

At a press conference, the 16th chair of Fed, Jerome Powell, said they had raised the interest rates by 5 percent to achieve a monetary policy stance. It is sufficiently limiting to return inflation to 2 percent over time. He added stability in price leads to a good economy that works for everyone. The Fed is moving faster than its records to control inflation. Also, the hardship caused by the inflation, Fed is determined strongly to back down to its 2 percent goal, as mentioned by Powell.

The capital markets are sensitive toward the Fed rate increase. Since stocks and bonds expect the Fed's moves, especially when Fed officials report those moves in advance. They did the same in 2023 even. Also, higher Fed rates make bonds and bank deposits more attractive. But at the same time, they also weaken the economy and corporate profits.