Fall in Oil Prices with Growing Demand of Fuel from the Top Global Consumers in May 2023

Oil prices fell in May 2023 upon the demand for fuel in top global oil consumers. The consumers like the United States and China offset the bullish sentiment on tightening supplies from the organization of the petroleum exporting countries plus (OPEC+) cuts and renewal in the U.S. buying for reserves.

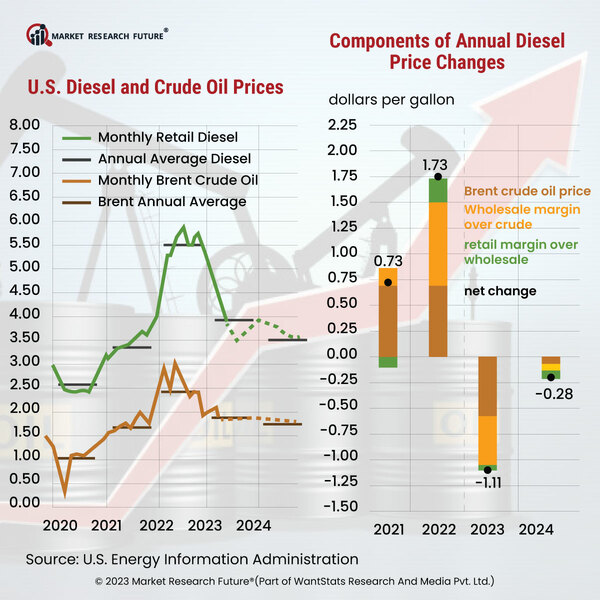

According to Reuters data, Brent crude futures fell 26 cents to USD73.91 a barrel by 0638 Greenwich Mean Time (GMT). The United States West Texas Intermediate Crude also fell 20 cents, USD69.34 a barrel.

In the second week of May 2023, Brent crude and West Texas Intermediate Crude fell for a consecutive week. It is the most extended stripe of weekly declines since September 2022, which concerns the United States, which could enter a recession in the first two weeks of June 2023. CMC Market analysts believe that oil prices are still under pressure due to slow demands upon China's economic reopening is doubtful. Investors sought safe places to invest as the U.S. dollar since it is strengthening the currency and making dollar-denominated products more expensive for the holders of other currencies. Also, global crude supplies could tighten as the OPEC+ grouping, the Organization of the Petroleum Exporting Countries, and its allies (Russia is also a part of) are making additional output cuts, reducing the sour crude availability.

An announcement made by the group in April stated that some members would cut output further by around 1.16 barrels each day, bringing the total volume of cuts to 3.66 million barrels per day, as per Reuters calculations.