Exxon’s Profits Depend on the Surge in Oil Prices

Oil prices are increasing in October 2023 due to several geopolitical issues in the Middle East region. ExxonMobil, one of the largest oil and gas companies in the United States, is trading worldwide, announcing its third-quarter earnings in October 2023.

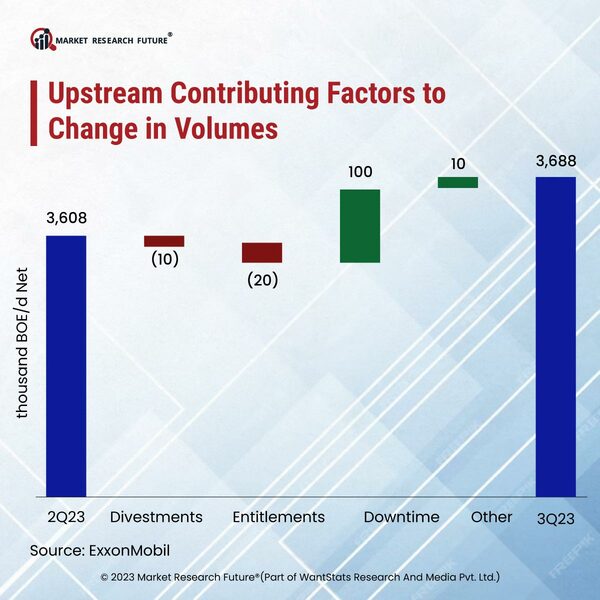

Exxon Mobil released its third-quarter earnings for 2023, which shows USD 9.1 billion compared to the second-quarter revenues of USD 7.9 billion. The third quarter of 2023 reported higher oil prices, increasing the third quarter earnings of ExxonMobil. The company still loses Wall Street's expectations for the third quarter earnings profit in 2023. Amidst the high oil prices, meeting the market standards to gain profit in the third quarter of 2023 was challenging. Several reasons contribute to higher quarter-on-quarter profit, such as the company's focus on safety, environmental, and other factors leading to a hike in records of refining throughputs along with a hike in crude prices, handling big projects, and reduction in emissions that significantly impact the environment.

Experts say that the third quarter earnings grew with a strong performance in operating that resulted from higher quarter-on-quarter profits in 2023. ExxonMobil revealed that the company anticipates another USD 2.1 billion boost in its third-quarter earnings from high oil prices and strong refining margins. However, ExxonMboil witnessed its highest third-quarter refinery throughput of USD 4.2 million barrels per day globally 2023. As a result, following the earning reports in 2023, the shares of ExxonMobil rose by 0.4 percent in the market due to strong cash flows.Exxon Mobil also focuses on the net zero achievement of zero greenhouse gas emissions by 2030. Therefore, the company is introducing several technologies, recycling methods, water sharing, and other safety initiatives. As a result, Exxon collaborated with Pioneer Natural Resources in an agreement of USD 59.5 billion that assures returns in double digits, recovering more resources and reducing emissions.