European Central Bank Scrutinizes Bank Liquidity

The European central bank is focusing on scrutinizing lenders' liquidity reserves and may lay down strict guidelines for individual firms by the end of 2023. The bank's annual review of the risks faced by the banks will pay mindful attention to the management of liquid funds, including the potential for higher standards on critical metrics like the liquidity coverage ratio.

The collapse of Credit Suisse in March 2023 and Silicon Valley Bank in the United States has raised questions on how truly prepared banks are to take the strain on deposits; the effectiveness of the metrics investor and using regulators to measure their capacity to withstand a crisis.

Liquidity is a part of banking supervision; therefore, watchdogs are more focused on pressing bank capital and credit risk issues. The European Central Bank started to review liquidity more closely in the latter part of 2021 due to higher inflation because of rising funding costs. Also, the collapse of the US lenders has heightened the scrutiny.

According to Yahoo Finance, the European Central Bank will initially receive the results of its annual review of the risks banks face over the summer of 2023. Later in 2023, the officials will split the banks into different groups, depending on how dangerous their business models are to fund outflows. Deposits by wealthy clients are more likely to be focused because individual withdrawals quickly drain a bank's liquidity reserves, one of the reasons which led to the crisis at Credit Suisse. Swiss regulators declared that Credit Suisse's liquidity would be acceptable just before the emergency weekend rescue done by competitor United Bank of Switzerland (UBS).

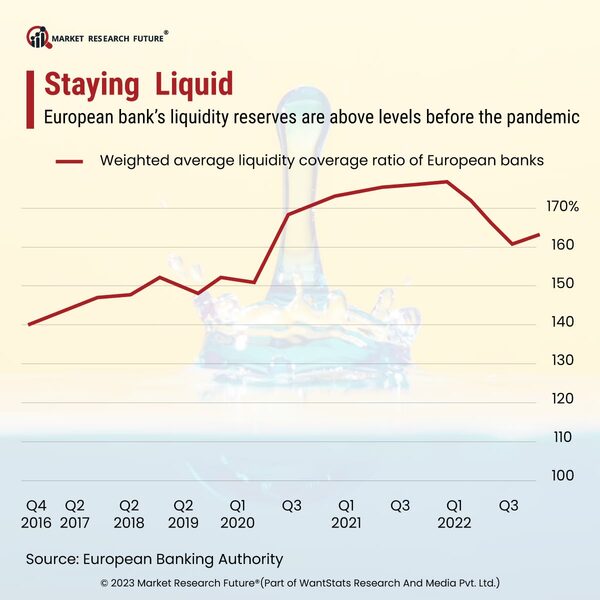

According to data from the European Banking Authority, the average ratio for European banks stood at 165 percent in the fourth quarter of 2022, above 100 percent at a minimum. The individual lenders publish their own figures but do not add any additional requirements on top of the minimum.