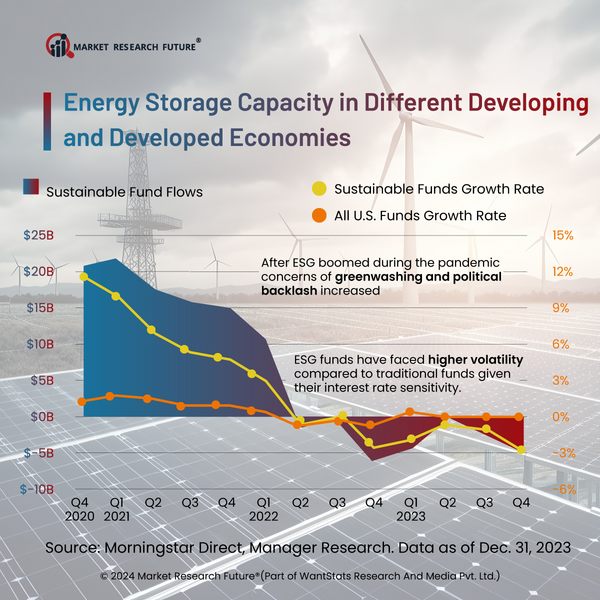

Declining Growth Rate Of ESG Funds In The United States

Globally, nations are investing mindfully in sustainable development to achieve clean energy transition goals in the next three decades. Developed countries like the United States are engaged in sustainable investments. However, the ESG (environment, social, and governance) shares have failed in the United States, whereas Europe will see a steady flow of ESG funds in 2024.

Studies show a comparison between the two regions, Europe and the United States, to get better insights into ESG funds usage. ESG in the United States focuses on the shares from different companies that are interested in scoring more in three fields. These three fields are the ESG- Environment, Social, and Governance. Therefore, the sustainable approaches from the United States were expected to grow according to the ESG investments. However, the United States faces a downward trend in the ESG funds. This is due to underperformance from bigger tech companies in the last two years, starting in 2024. The United States faces such a situation in 2024, and the big tech companies must take out billions of dollars from sustainable funds as the economy demands. Europe maintains investing in ESG due to strong support from the nation's administration and support for investment in ESG products in 2024. Therefore, Europe ranks higher in the ESG funds and investment list, leaving behind the United States in 2024.

Based on a survey, Europe shows increased income penetration from different sources in the ESG funds in the last quarter of 2023. However, the United States suffered from a lack of funds. Instead, investors took up the ESG funds simultaneously in 2023. Experts revealed that European sustainable funds outperformed the United States by adding a new margin of USD 3.3 billion in the fourth quarter of 2023. The clean energy transition needs a strong position in the economies with stable ESG funds to support the transformation. However, clean energy funds have gained downward momentum globally due to instability in the renewable energy market. The growth of renewable energy is uncertain in the United States, too. Therefore, ESG funds are equally important for the clean energy transition by 2050.