China Bailed Out Countries by Lending Bilateral Emergency Loans

China is in the spotlight on providing bilateral emergency loans, a new report found by the AidData research lab at Virginia's College of William and Mary. This is usually a non-transparent practice o the Chinese. The researchers also identified those 22 countries that were bailed out by the Chinese loans when they ran into liquidity problems between 2000 and 2021.

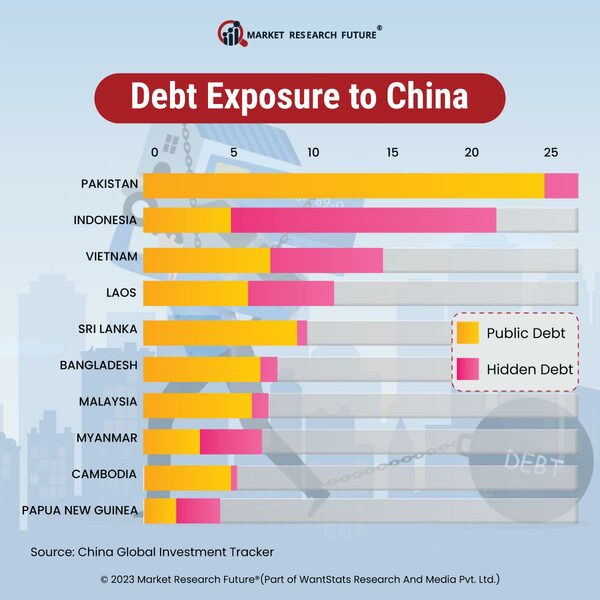

According to the reports, the countries utilized these loans for many years. They rolled over their loans into the subsequent years, including countries like Pakistan, Argentina, Mongolia, and Sri Lanka. The report says the latter country even tapped China's central bank for the first time in 2021 before it defaulted on its debt in 2022. Mongolia and Argentina were also identified as countries in dire financial distress since the early 2010s. Thus, we were using China as a lender of the last resort despite the country’s terms of loans being less favourable than the lower-interest bailouts offered by the U.S. Fed or the IMF. Also, the Chinese bailouts include countries experiencing major inflation events, Egypt, Turkey, and Pakistan.

The reports found that the bailout amounts provided China to remain relatively low in the 2000s and early 2010s before shooting up from 2015 onwards. Again, climbing up to $100 billion for the two decades. The two most common ways these loans work are through a liquidity swap with the Chinese Central Bank. As per the reports, outstanding balances of around $40 billion were located in 2021 through credit lines from Chinese state-owned banks.