Industry Videos

Information and Communications Technology

Brain Computer Interface Market Insights 201-2024

Software

BIM Software Market Insights 2019-2025

Information and Communications Technology

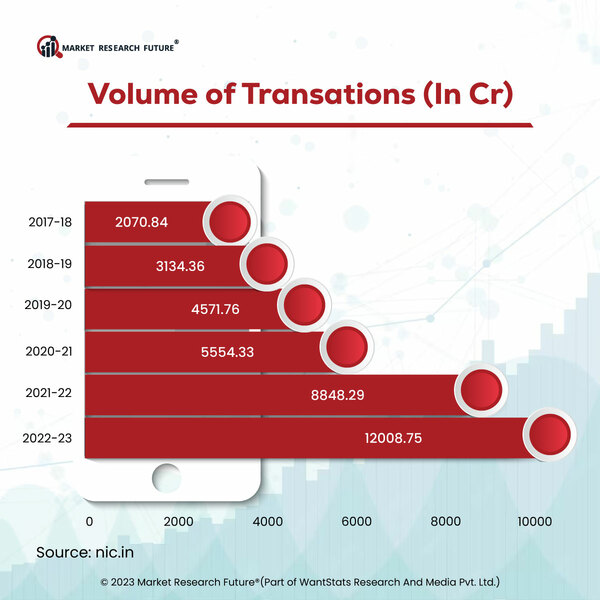

Big Data Market Insights 2018-2023

Software

Audit Software Market Insights 2019-2025

Food, Beverages & Nutrition

Botanical Extracts Market Research Report 2019-2025