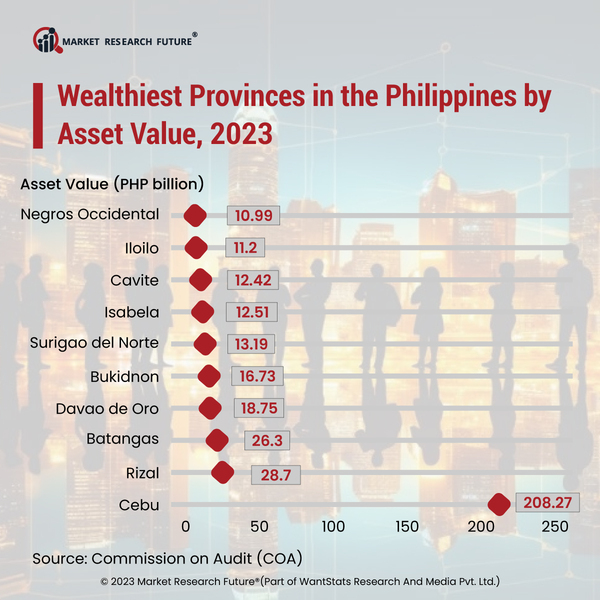

Cebu Remains Wealthiest Province In The Philippines In 2023

Cebu has retained its position as the wealthiest province in the Philippines in 2023, with total assets of PHP 208.27 billion, according to the Commission on Audit (COA). This is followed by Rizal and Batangas, with total assets of PHP 28.7 billion and PHP 26.3 billion, respectively.

The COA said that the wealth of the provinces is based on their total assets, which include cash and investments, properties, and receivables.

The report said that the wealth of the provinces is a reflection of their economic activity and development. The provinces with the highest levels of economic activity and development tend to have the highest levels of wealth.

The COA said that the wealth of the provinces is also a testament to the hard work and dedication of their people. The people of the wealthy provinces have contributed to the economic development of their provinces, which has led to their increased wealth.

The report said that the COA will continue to monitor the wealth of the provinces and will provide recommendations to the government on how to improve the wealth of the less wealthy provinces.