Bank of England Raising Bank Rates To Stop Inflation

The Bank of England (BOE) has consecutively raised interest rates for the 12th time as it tries to stop prices from rising so quickly. The bank rate increased to 4.5 percent from 4.25 percent following a meeting of the Monetary Policy Committee.

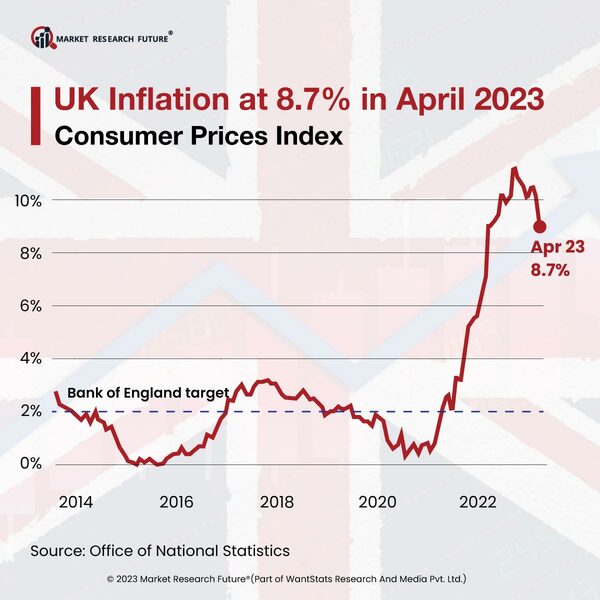

According to the National Statistics (ONS), prices rose 8.7 percent from April 2023. There has been a series of bank rate increases since December 2021 to control inflation. The BOE will be keen to dampen the economy, but the peak would still be lower than the initial predictions after the 2022 minibudget. According to the government's English Housing Survey, only a third of households have mortgages. As per BOE, four million households will face higher monthly mortgage bills in 2023. An estimated 356,000 borrowers could face difficulties with repayments by July 2024.

The rise in the bank rate to 4.5 percent from 4.25 percent implies those on a tracked mortgage will pay about 24 pounds more a month, and those on a standard variable rate would face a 15 pounds rise. Compared to pre-December 2021, the average tracker mortgage customer will pay about 417 pounds more monthly, and variable rate mortgage holders will pay about 266 pounds more.

As consumers spend more after easing restrictions due to the pandemic, the prices are rising quickly globally. The bank has been putting up with the rates to combat inflation. By raising interest rates, it helps to control inflation by making it more expensive to borrow money.