新興市場の拡大

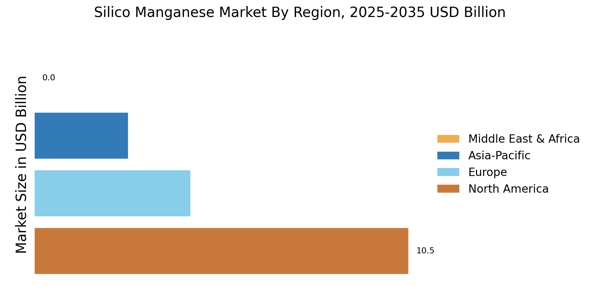

新興市場はシリコマンガン市場の形成において重要な役割を果たしています。アジアやアフリカの国々は急速な工業化を遂げており、鉄鋼およびその合金の需要が増加しています。これらの地域が発展するにつれて、インフラや建設資材の必要性が高まり、それに伴いシリコマンガンの需要が増加します。2025年には、新興市場におけるシリコマンガンの消費が約6%増加すると予測されており、拡大する産業基盤を反映しています。この成長は、製造業者がこれらの市場に存在感を確立する機会を提供し、シリコマンガン市場における市場シェアを向上させることにつながります。これらの地域への拡大は、戦略的なパートナーシップやコラボレーションを生む可能性もあり、業界の成長をさらに強化するでしょう。

合金製造における技術革新

シリコマンガンの生産における技術革新は、シリコマンガン市場に大きな影響を与えています。改良された溶鉱技術やエネルギー効率の良いプロセスなどの革新が、生産効率を向上させ、コストを削減しています。例えば、電気アーク炉の採用により、合金化プロセスが効率化され、より高い収率と低い排出量が実現されています。これらの進展は、シリコマンガンの品質を向上させるだけでなく、持続可能な慣行への業界のシフトにも合致しています。その結果、製造業者はこれらの技術に投資する可能性が高く、シリコマンガン市場の成長をさらに促進するでしょう。最先端技術の統合は、シリコマンガンの新しい用途の開発にもつながり、市場の範囲を拡大する可能性があります。

鉄鋼業界からの需要の高まり

シリコマンガン市場は、主に鉄鋼セクターによって需要が著しく増加しています。シリコマンガンは、鉄鋼生産において重要な合金剤であり、強度と耐久性を向上させます。インフラプロジェクトや建設活動が拡大するにつれて、高品質な鋼の需要が高まります。2025年には、鉄鋼生産量が約19億トンに達する見込みであり、堅調な成長軌道を示しています。この鋼の需要の増加は、さまざまな鋼種を生産するために不可欠なシリコマンガンの消費の増加と直接関連しています。したがって、シリコマンガン市場は成長の見込みがあり、製造業者は鉄鋼業界の高まる要求に応えるために努力しています。

鉄合金生産における使用の増加

シリコマンガン市場は、フェロアロイ生産におけるシリコマンガンの利用増加によって大きな影響を受けています。フェロアロイは、製鋼に不可欠であり、その特性を向上させるためにシリコマンガンを主要成分として必要とします。フェロアロイの需要は、さまざまな産業、特に自動車や建設における高性能材料の必要性の高まりにより、増加すると予測されています。2025年には、フェロアロイ市場は約5%の成長率を示すと期待されており、シリコマンガンの需要をさらに押し上げるでしょう。この傾向は、フェロアロイ部門とシリコマンガン市場との間に強い相関関係があることを示唆しており、フェロアロイの生産が増加するにつれて、シリコマンガンの消費も増加することを示しています。

持続可能な実践への注目の高まり

持続可能性は、シリコマンガン市場において重要な焦点となっています。環境規制が厳しくなる中、製造業者は持続可能な生産慣行をますます採用しています。これには、再生可能エネルギー源の使用や廃棄物削減戦略の実施が含まれます。持続可能性へのシフトは、規制要件を満たすだけでなく、環境意識の高い消費者にもアピールします。2025年には、シリコマンガンの生産のかなりの部分が持続可能な方法から得られると予想されており、市場の30%以上を占める可能性があります。この傾向は、シリコマンガン市場内の企業の評判を高め、競争の激しい環境で有利な位置に立たせるかもしれません。