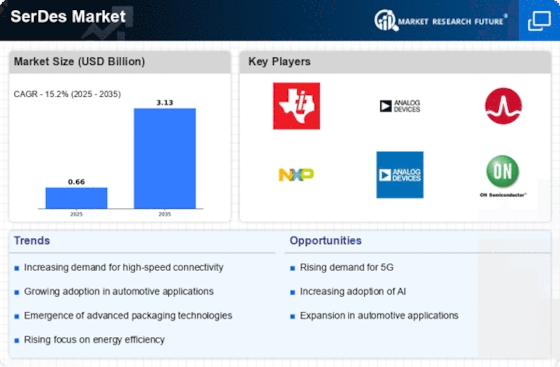

5G技術の採用の増加

5G技術の継続的な展開は、高速データ伝送と低遅延を必要とするため、SerDes市場を推進しています。5Gネットワークがますます普及する中、これらの要件をサポートできるSerDes市場ソリューションの需要は急増する可能性があります。最近の推定によれば、2025年までに5G接続数は10億を超えると予測されており、これはSerDes市場に大きな影響を与える可能性があります。この傾向は、製造業者が5Gアプリケーションに関連するデータレートと帯域幅の増加に対応できるSerDes市場製品の開発に注力していることを示しています。その結果、企業は通信およびデータセンターの進化するニーズに応える革新的なSerDes市場ソリューションを創出するために、研究開発に投資しています。

自動車電子機器の進歩

自動車業界は、電気自動車(EV)や高度運転支援システム(ADAS)の台頭により変革を遂げています。この変化は、これらの技術が堅牢なデータ通信ソリューションを必要とするため、SerDes市場に大きな影響を与えています。自動車電子市場は、車両システムの複雑さの増加により、年間約8%の成長率で成長すると予測されています。車両がより接続され、自動化されるにつれて、さまざまな電子部品間の通信を促進できる高速度のSerDes市場ソリューションの需要が高まると考えられます。メーカーは、自動車アプリケーションの厳しい要件を満たすSerDes市場技術の開発に投資することが期待されており、その結果、SerDes市場内で有利なポジションを確保することができるでしょう。

人工知能と機械学習の出現

人工知能(AI)および機械学習(ML)技術の統合が進む中、SerDes市場に影響を与えています。これらの技術は膨大なデータ処理能力を必要とし、そのためには高性能なSerDes市場ソリューションが求められます。自動車、ヘルスケア、金融などのさまざまな分野でAIおよびMLアプリケーションが増加するにつれて、これらのアプリケーションをサポートできるSerDes市場製品の需要が高まると予想されています。アナリストは、AI市場が2025年までに5000億米ドルを超える評価に達すると予測しており、これにより効率的なデータ通信ソリューションの必要性がさらに高まるでしょう。この傾向は、SerDes市場の製造業者がAIおよびMLアプリケーションの特有の要件に応える専門的な製品の開発に注力し、市場での地位を強化する可能性があることを示唆しています。

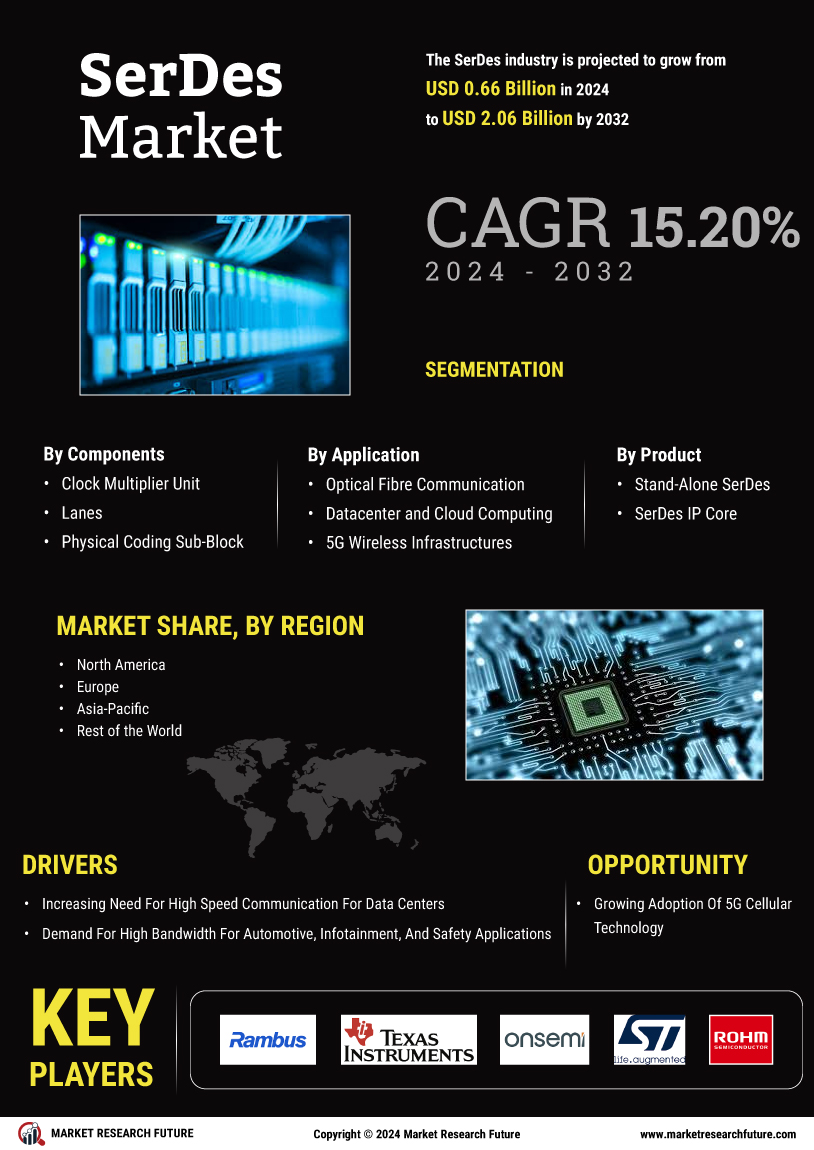

データセンターインフラの成長

データセンターインフラの拡張は、SerDes市場の重要な推進要因です。組織がクラウドコンピューティングやビッグデータ分析にますます依存する中、効率的なデータ処理とストレージソリューションの需要が高まっています。報告によると、データセンターマーケットは2025年までに年平均成長率が10%を超えると予測されています。この成長は、サーバーとストレージデバイス間の高速通信を促進できる高度なSerDes市場技術を必要とします。その結果、SerDes市場ではデータ転送速度を向上させ、レイテンシを低減し、全体的なデータセンターのパフォーマンスを改善する製品への需要が急増しています。企業はこれらのトレンドに沿ったSerDes市場ソリューションの開発を優先し、急速に進化する市場で競争力を維持することが期待されます。

高性能コンピューティングの需要の高まり

高性能コンピューティング(HPC)への需要が高まっており、これは科学研究、金融、エンジニアリングなどのさまざまな業界における高度な計算能力の必要性によって推進されています。この傾向は、HPCシステムが大量のデータを処理するために効率的なデータ転送ソリューションを必要とするため、SerDes市場に大きな影響を与えています。HPC市場は2025年までに約7%の年平均成長率で成長すると予測されており、これによりSerDes市場技術への投資が増加する可能性があります。組織が計算能力を向上させようとする中で、これらのシステムをサポートできる高速SerDes市場ソリューションの必要性が高まると考えられます。これは、HPCアプリケーション向けに特別に設計された製品の需要がSerDes市場で急増する可能性があることを示唆しており、イノベーションと競争を促進するでしょう。