Global market valuation was derived through revenue triangulation and unit shipment analysis across voltage classes and end-use applications. The methodology included:

Identification of 40+ key PMIC manufacturers across North America, Europe, Asia-Pacific, and emerging markets, encompassing integrated device manufacturers (IDMs) and fabless power semiconductor companies

Product mapping across DC-DC converters (buck, boost, buck-boost), linear regulators (LDOs), LED drivers, battery management ICs, power switching ICs, and voltage reference circuits

Analysis of reported and modeled annual revenues specific to power management product portfolios, excluding discrete power transistors and power modules

Coverage of manufacturers representing 78-82% of global PMIC market share in 2024

Extrapolation using bottom-up (unit shipment volume × Average Selling Price by application segment and voltage rating) and top-down (manufacturer revenue validation against distribution channel data) approaches to derive segment-specific valuations for automotive power management, consumer electronics power subsystems, industrial motor drive controls, and telecommunications infrastructure power supplies

Trade & Standards Bodies: SEMI (Semiconductor Equipment), JEDEC (JESD standards), IPC (electronics manufacturing), Bluetooth SIG, USB Implementers Forum (power delivery specifications)

Energy & Regulatory: California Energy Commission (CEC) efficiency standards, EU Ecodesign Directive for external power supplies, Energy Star specifications

Automotive: SAE International (automotive electronics standards), AEC-Q100 qualification data

Patent & Innovation: PatSnap semiconductor patent analytics, IEEE Spectrum technology trends

Supply Chain: DSCC (Display Supply Chain Consultants), Techcet (semiconductor materials)

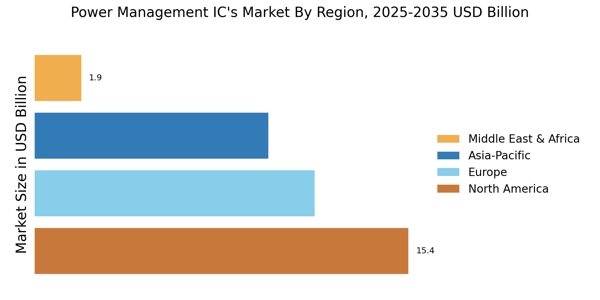

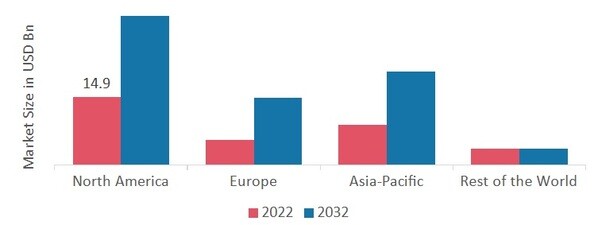

出典:二次研究、一次研究、MRFRデータベース、アナリストレビューアジア太平洋地域の電力管理IC市場は、製造部門の成長とデータセンターの増加に伴い、産業活動が急速に増加しているため、2番目に大きな市場シェアを占めています。さらに、中国の電力管理IC市場は最大の市場シェアを持ち、インドの電力管理IC市場はアジア太平洋地域で最も成長が早い市場でした。ヨーロッパの電力管理IC市場は、2023年から2032年にかけて最も高いCAGRで成長することが予想されています。これは、発電所や再生可能エネルギー源への投資の増加と先進技術の適用によるものです。さらに、ドイツの電力管理IC市場は最高の市場シェアを持ち、英国の電力管理IC市場はヨーロッパ地域で最も成長が早い市場でした。

出典:二次研究、一次研究、MRFRデータベース、アナリストレビューアジア太平洋地域の電力管理IC市場は、製造部門の成長とデータセンターの増加に伴い、産業活動が急速に増加しているため、2番目に大きな市場シェアを占めています。さらに、中国の電力管理IC市場は最大の市場シェアを持ち、インドの電力管理IC市場はアジア太平洋地域で最も成長が早い市場でした。ヨーロッパの電力管理IC市場は、2023年から2032年にかけて最も高いCAGRで成長することが予想されています。これは、発電所や再生可能エネルギー源への投資の増加と先進技術の適用によるものです。さらに、ドイツの電力管理IC市場は最高の市場シェアを持ち、英国の電力管理IC市場はヨーロッパ地域で最も成長が早い市場でした。