Top Industry Leaders in the Power Management IC Market

The Competitive Landscape of the Power Management IC's Market

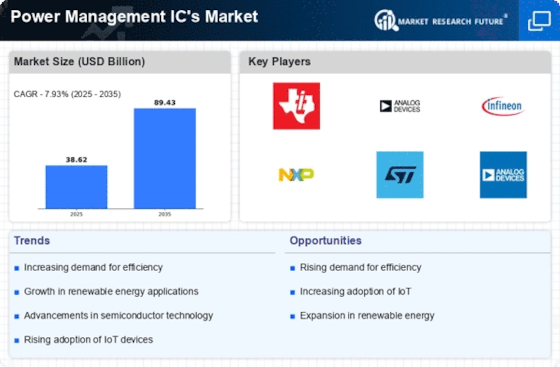

The power management IC (PMIC) market, encompassing integrated circuits controlling and optimizing power delivery within electronic devices, navigates a dynamic landscape fueled by the relentless demand for miniaturization, efficiency, and performance. Established players and innovative newcomers battle it out for market share, offering diverse solutions across various applications.

Some of the Power Management IC's companies listed below:

- Mitsubishi Corporation

- ABB Limited

- Allegro MicroSystems Inc.

- Renesas Electronics Corporation

- Nordic Semiconductor

- Texas Instruments Inc.

- Analog Device Inc.

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Dialogue Semiconductor

Strategies Adopted by Leaders

- Product Portfolio Breadth and Depth: Offering a comprehensive range of PMICs for various applications, from mobile devices and wearables to industrial systems and automotive electronics, caters to diverse customer needs and market segments.

- Technological Innovation and Feature Integration: Continuous investment in R&D focuses on advancements like higher efficiency levels, smaller footprints, integrated functionalities (DC-DC converters, buck-boost regulators), and advanced monitoring capabilities, ensuring cutting-edge offerings.

- Focus on Specific Applications and Verticals: Targeting segments like battery-powered devices with low-power PMICs, high-voltage solutions for industrial automation, or automotive-grade PMICs for harsh environments expands market reach and caters to specialized needs.

- Strategic Partnerships and Acquisitions: Collaborations with device manufacturers, software developers, and technology providers accelerate technology integration, access new markets, and broaden expertise.

- Focus on User Experience and Design Support: Providing comprehensive design tools, reference designs, and technical support facilitates faster product development and fosters customer loyalty.

Factors for Market Share Analysis:

- Performance and Efficiency: Delivering high conversion efficiency, low power consumption, and robust performance under varied conditions sets players apart and caters to diverse application demands.

- Form Factor and Integration Level: Offering compact PMICs with high levels of feature integration minimizes board space, simplifies design, and attracts manufacturers seeking miniaturization.

- Cost-Effectiveness and Price Point: Striking a balance between performance, features, and competitive pricing is crucial for attracting budget-conscious customers and expanding market penetration.

- Technical Support and Design Resources: Providing robust technical support, reference designs, and application expertise accelerates customer development cycles and fosters trust and loyalty.

- Focus on Reliability and Safety: Ensuring high reliability, meeting relevant safety standards, and offering robust protection features against over-current, over-voltage, and thermal issues are crucial for critical applications and brand reputation.

New and Emerging Companies:

- Niche Market Focus: Targeting specific segments like ultra-low-power PMICs for wearable devices, wireless charging solutions, or PMICs with integrated sensors for IoT applications opens up new market opportunities.

- Open-source Hardware and Software: Utilizing open-source hardware designs and software libraries allows them to offer cost-effective solutions and attract engineers and device makers seeking greater flexibility and customization.

- Direct-to-Customer Online Sales: Leveraging online platforms and social media marketing enables them to bypass traditional distribution channels and reach customers directly, often at competitive prices.

- Focus on Emerging Technologies: Integrating technologies like gallium nitride (GaN) transistors for higher efficiency, advanced battery management algorithms, or AI-powered power optimization positions them at the forefront of future PMIC advancements.

Industry Developments:

Oct 2023- Amidst the emergence of local brands and the swift transition to electric vehicles in the largest automotive market globally, Japanese carmaker Mitsubishi Motors has decided to discontinue production of automobiles in China and will be handing over its joint venture stake to its Chinese associate. The Chinese state-owned car giant announced that Mitsubishi and Mitsubishi Corporation will sell GAC Group their respective 30% and 20% shares in GAC Mitsubishi Motors for CNY1 (14 US cents). The Changsha facility of GAC Mitsubishi will enable GAC Aion to reach 600,000 units annually in capacity. In the first nine months of this year, it sold 351,000 automobiles, increasing 93% over the same period last year, and it set goals to produce and sell one million cars by 2025. According to GAC, the restructuring of the JV can maximize the revitalization and use of its core assets, address the production capacity bottleneck at GAC Aion, save time and money by not having to build a new factory, take advantage of the market opportunity to develop NEVs, prevent the dissolution and liquidation of the JV, and facilitate the rehiring of employees.

Aug 2023- After being established as a branch of Royal Philips NV, NXP Semiconductors is amenable to establishing a fabrication facility in India, provided that the nation's ecosystem is developed appropriately. NXP, a company valued at $13 billion, possesses six front-end wafer production facilities in total. Two of these are in Chandler, Arizona, and Austin, Texas, while the other two are in the Netherlands and Singapore. Additionally, it owns testing and assembly facilities in Malaysia, Thailand, Taiwan, China, and Taiwan. India is offering a $10 billion cash incentive pool to international chipmakers who wish to establish fabrication, manufacturing, testing, and packaging facilities in the nation. The Semicon India initiative of the Center provides an initial investment subsidy of up to 50%.