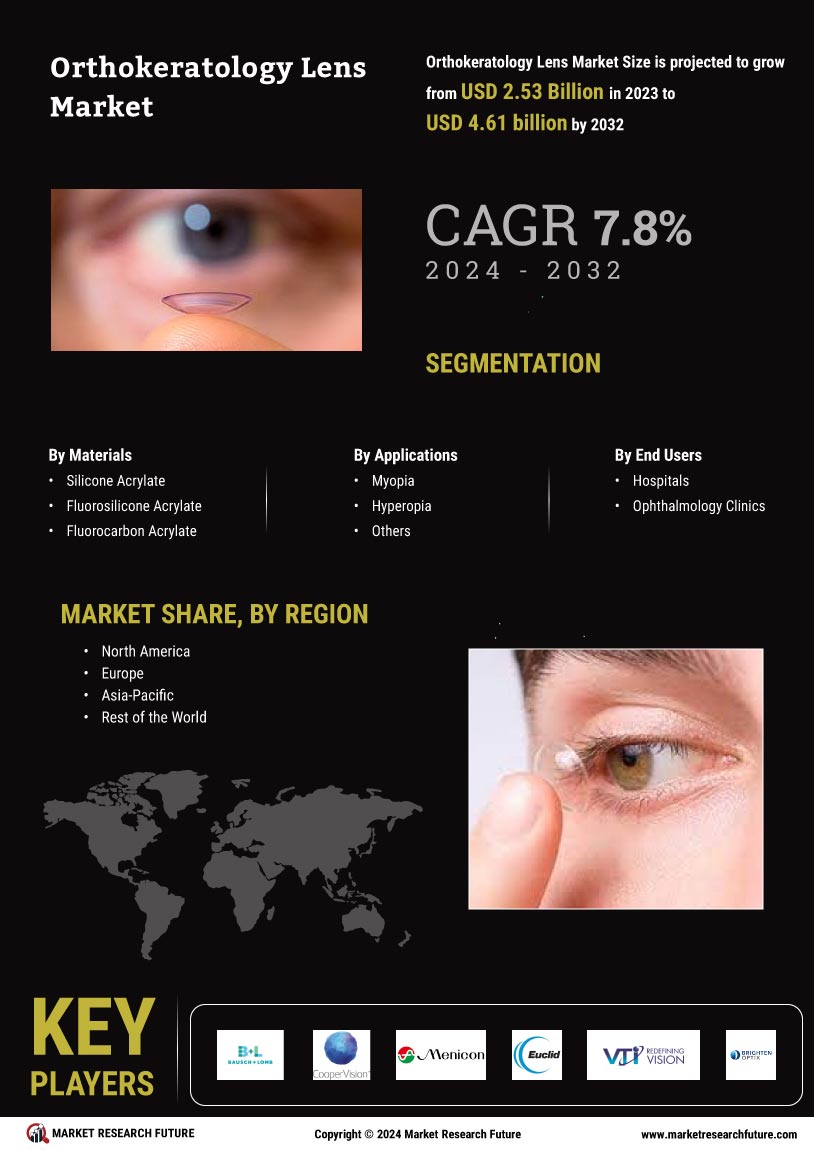

世界のオルソケラトロジーレンズ市場の概要

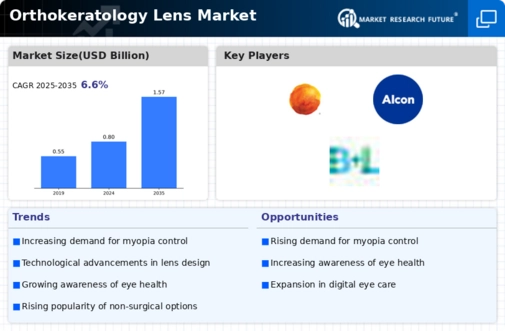

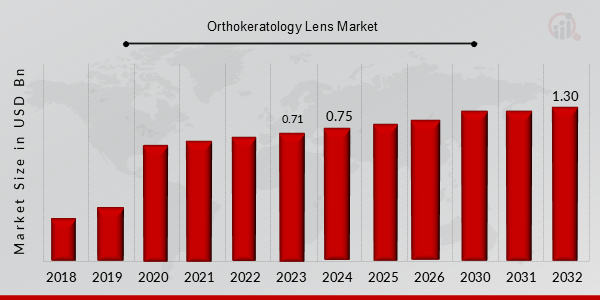

pオルソケラトロジーレンズ市場は、2023年に7億1,000万米ドルと評価され、予測期間(2024年~2032年)中に6.60%のCAGRで成長し、2024年の8億米ドルから2032年には13億米ドルに達すると予測されています。屈折異常の増加、遠視、近視、乱視などの疾患の診断数の増加、そして主要企業による研究開発活動の活発化は、オルソケラトロジーレンズ市場シェアを押し上げる主要な市場牽引要因です。オルソケラトロジーレンズ市場動向

ul- 非外科的視力矯正治療に対する消費者の嗜好の変化が市場成長を牽引

子供がオルソケラトロジーレンズを好む大きな要因の一つは、屈折異常を矯正するための選択肢が限られていることです。子供がこれらのレンズを使用する機会が増えているもう一つの要因は、日中にコンタクトレンズや眼鏡を着用する必要がなくなることです。さらに、技術の進歩によりレンズの装着が容易になったことで、一般の人々がレンズへの認知度を高め、オルソケラトロジーレンズ市場のCAGRを押し上げています。例えば、特殊コンタクトレンズメーカーのScotlensは、2021年9月にAvizorと提携し、オルソケラトロジーレンズの新たな開封動画を公開し、この選択肢への認知度向上を図りました。その結果、主要な市場プレーヤーによる製品承認および製品発売数の増加、およびこれらのレンズの技術開発と利点の増加により、非外科的屈折異常矯正処置におけるオルソケラトロジーレンズ市場の収益成長の機会が促進されると予想されます。

出典:一次調査、二次調査、MRFRデータベース、アナリストレビュー

オルソケラトロジーレンズ市場セグメントの洞察

h3オルソケラトロジーレンズ材料の洞察 p材料に基づいて、オルソケラトロジーレンズ市場の区分には、シリコーンアクリレート、フルオロシリコーンアクリレート、フルオロカーボンアクリレートが含まれます。 2022年にはシリコーンアクリレートセグメントが過半数のシェアを占め、オルソケラトロジーレンズ市場の収益の約44~49%を占めました。シリコーンは非常に柔軟性が高いため、コンタクトレンズの素材として人気があります。シリコーンアクリレートレンズの生産は、フルオロアクリレートの高い屈折率などの利点によって推進されてきました。そのため、シリコーンアクリレートオルソケラトロジーレンズのさまざまな利点が、このセグメントの成長を後押しすると予想されています。屈折異常の治療に使用されるオルソケラトロジーレンズのFDA承認の増加と、レンズ設計および材料の技術的進歩が、世界市場の成長を牽引すると予想されています。オルソケラトロジーレンズの用途に関する洞察

p用途によって、オルソケラトロジーレンズ市場のデータは近視、遠視、その他に分かれています。近視セグメントは2022年に市場を支配し、2022年から2030年の予測期間において最も急速に成長するセグメントになる可能性があります。近視は世界中で子供や高齢者の間で増加しており、患者は屈折矯正手術よりも非侵襲的な治療法を選択する傾向が強まっており、この分野の成長を後押ししています。Investigative Ophthalmology and Visual Science誌によると、約19億人が近視であり、これは世界人口の約27.08%に相当します。近視は今後数年間、世界中で永久的な失明につながる主要な要因の一つとなるでしょう。オルソケラトロジーレンズは、この年齢層で近視の有病率が高いことから、子供の間で人気があります。 WHOによると、2050年までに52.13%の人々が近視になると予測されています。オルソケラトロジーレンズは、特に子供の近視の進行を遅らせるのに役立ち、セグメント市場の成長を促進します。2022年1月: Euclid Systems Corporationは、Global Specialty Lens Symposiumと協力し、近視の認識を高め、高度なオルソケラトロジーレンズと積極的な近視管理について眼科医を教育しました。

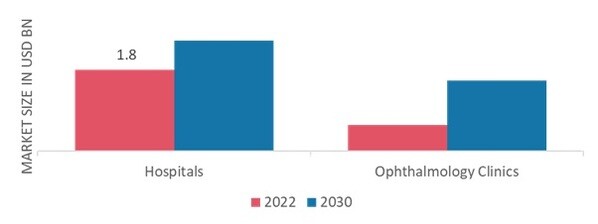

オルソケラトロジーレンズエンドユーザーの洞察

pエンドユーザーに基づいて、世界のオルソケラトロジーレンズ業界は、病院と眼科クリニックに分割されています。病院は2022年に最も顕著なセグメント収益シェアを占めました。緑内障や白内障などの眼関連疾患の発生率の増加により、病院におけるオルソケラトロジーレンズへの投資機会は継続的に増加しており、市場の成長を牽引しています。高度な治療設備の整備により、病院におけるオルソケラトロジーレンズの導入が増加しており、このセグメントの成長をさらに促進すると予想されます。しかしながら、オルソケラトロジーレンズの適用状況は世界中の病院によって異なる可能性があり、市場拡大の制約となる可能性があります。さらに、複数の病院が様々な屈折異常に対応する複合眼科センターを開設しており、このセグメントの成長を加速させると予測されています。図2:オルソケラトロジーレンズ市場(エンドユーザー別、2023年および2024年) 2032年(10億米ドル) strong出典:一次調査、二次調査、MRFRデータベース、アナリストレビュー

strong出典:一次調査、二次調査、MRFRデータベース、アナリストレビュー

オルソケラトロジーレンズ業界は、予測期間を通じて眼科クリニック分野で大幅なCAGRを経験すると予想されています。患者費用が低いため、個人は眼科クリニックを好みます。視力低下の患者数の増加は、眼科クリニックの需要の増加をもたらすと予想されます。新興経済国における眼科医の増加は、眼科クリニックの需要を高め、セグメントの成長を押し上げると予想されます。さらに、サービスが行き届いていないいくつかの経済圏の眼科クリニックにおける高度な眼科関連技術ソリューションへのアクセスの増加が、セグメントの成長を促進すると見込まれています。 眼科クリニックにおける世界的な競争の激化は、予測期間中にオルソケラトロジーレンズの需要を押し上げると見込まれています。

オルソケラトロジーレンズの地域別洞察

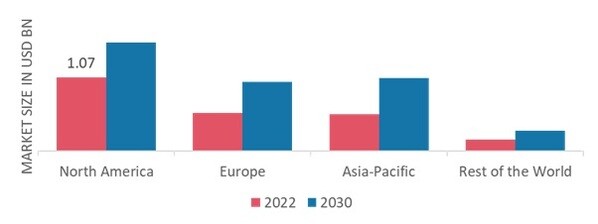

p地域別に、この調査では、北米、ヨーロッパ、アジア太平洋、およびその他の世界の市場洞察を提供しています。北米のオルソケラトロジーレンズ市場は、2022年に10億7000万米ドルに達し、調査期間中に大幅なCAGR成長を示すことが予想されています。 オルソケラトロジーレンズの最近の進歩、オーバーナイトオルソケラトロジーレンズの導入、柔軟性と選択肢は、北米市場の成長を牽引するいくつかの要因です。 視力障害の症例数の増加と、カナダと米国におけるオルソケラトロジーレンズの使用増加が相まって、地域全体で多くの成長機会が生まれると予想されます。さらに、ジョンソン・エンド・ジョンソン ビジョン、クーパービジョン、ボシュロムといった米国の主要市場プレーヤーは、今後数年間でオルソケラトロジーレンズの地域市場シェアを拡大すると予想されています。例えば、2021年4月、ジョンソン・エンド・ジョンソン ビジョンはメニコンと提携し、同社の専門知識とJJビジョンの視野、科学、そして能力を融合させ、増加する小児近視症例への対応を目指しました。メニコンは提携の一環として治療用コンタクトレンズの開発を行い、JJ Visionは新製品群の拡充に注力します。さらに、市場レポートで調査対象となった主要国は、米国、ドイツ、カナダ、フランス、英国、スペイン、イタリア、日本、インド、オーストラリア、中国、韓国、ブラジルです。

図3:オルソケラトロジーレンズ市場シェア 2023年 地域別(%) strong出典:一次調査、二次調査、MRFRデータベース、アナリストレビュー

strong出典:一次調査、二次調査、MRFRデータベース、アナリストレビュー

欧州のオルソケラトロジーレンズ市場は、高齢者人口の増加と、手術や従来の眼鏡なしで視覚的な問題を矯正したいという志向により、2番目に大きな市場シェアを占めています。さらに、高品質な治療の提供を促進するための政府の取り組みの増加も、この地域におけるオルソケラトロジーレンズ市場の需要を押し上げています。近視や老眼などの眼疾患の蔓延に伴い、医療従事者によるオルソケラトロジーレンズの使用は増加すると予想されています。技術の進歩とCE認証を取得する製品数の増加は、この地域の成長をさらに後押しすると期待されています。さらに、ドイツのオルソケラトロジーレンズ市場は最大の市場シェアを占め、英国のオルソケラトロジーレンズ市場は欧州地域で最も急速に成長した市場でした。

アジア太平洋地域のオルソケラトロジーレンズ市場は、SEEDやProCorneaなどの先進製品の採用と、この地域における高齢者人口の増加により、2022年から2030年にかけて最も高いCAGRで成長すると予想されています。さらに、眼疾患に対する意識の高まりと、この地域における主要企業の事業拡大・新規参入が市場成長を牽引すると見込まれています。例えば、2020年12月には、メニコンアルファコーポレーションの子会社が、中国におけるオルソケラトロジーレンズの取扱量と事業拡大を目的として、中国現地法人ALPHA (WUXI) Co. Ltdを設立しました。さらに、アジア諸国における眼科クリニックや病院の増加も、予測期間中にオルソケラトロジーレンズの需要を押し上げると予想されています。さらに、中国のオルソケラトロジーレンズ市場は最大の市場シェアを占め、インドのオルソケラトロジーレンズ市場はアジア太平洋地域で最も急速に成長している市場となっています。

オルソケラトロジーレンズ主要市場プレーヤーと競合分析

世界中で屈折異常が拡大しているため、大手市場プレーヤーはオルソケラトロジーレンズ治療の需要の高まりに応えることに注力しています。オルソケラトロジーレンズ業界では、患者ごとに特別に作製された硬性レンズを使用して角膜の曲率を変更することで、非外科的な屈折異常矯正を提供しています。業界のプレーヤーは、新製品の導入、契約上の取り決め、買収と合併、研究開発投資の増加、他の組織との共同作業など、さまざまな戦略的市場開発イニシアチブを追求して世界的な足跡を拡大しています。

メニコン株式会社、クーパービジョン株式会社、ユークリッドシステムズ株式会社、アルコン株式会社など、オルソケラトロジーレンズ市場の大手プレーヤーは、効率的で費用対効果の高いオルソケラトロジーレンズを製造するために、研究開発に多額の投資を行っています。これらのレンズを現地で製造して運用コストを削減することは、世界のオルソケラトロジーレンズ業界の製造会社が消費者に利益をもたらし、市場セクターを拡大するために使用する主要なビジネス戦略の1つです。

ジョンソン・エンド・ジョンソンジョンソンビジョン(JJV)はジョンソン・エンド・ジョンソンの子会社で、ジョンソン・エンド・ジョンソン ビジョンケア(コンタクトレンズ)とジョンソン・エンド・ジョンソン サージカルビジョンの2つの部門で構成されています。同社が提供するサービスには、眼内レンズ、超音波乳化吸引システム、レーザー視力矯正システム、粘弾性レンズ、マイクロケラトーム、白内障および屈折矯正手術で使用される関連製品などがあります。同社は24か国で事業を展開し、約60か国で製品を販売しています。ジョンソン・エンド・ジョンソン ビジョンは、2021年5月に近視管理用の初のオルソケラトロジーレンズのFDA承認を取得しました。

また、クーパービジョンは、130か国以上の眼科専門家とレンズ装用者にサービスを提供する世界的なコンタクトレンズ会社です。同社は、科学的および技術的進歩に基づいて、さまざまな革新的なソフトコンタクトレンズを開発しています。1980年に設立され、米国カリフォルニア州に本社を置いています。 Cooper Companies Inc は、オルソケラトロジーレンズの大手製造・販売業者である CE GP Specialists Inc を買収しました。これは、CooperVision の特殊眼科事業を拡大し、近視の重症度と罹患率の増加に対応するためです。

オルソケラトロジーレンズ市場の主要企業には以下が含まれます。

- Bausch ロム株式会社

- 一般開業医

- メニコン株式会社

- プロコーニア・オランダ

- ユークリッド・システムズ株式会社

- ヴィジョニアリング・テクノロジーズ株式会社

- ブライトン・オプティクス

- アルコン株式会社

- コンタマック株式会社

2022年9月:ジョンソン・エンド・ジョンソン ビジョンケアは、最大6.00ディオプターまで拡張されたACUVUE Abiliti夜間治療レンズが、オルソケラトロジーレンズ業界向けに米国FDAの承認を取得したと発表しました。

2022年6月:クーパービジョンは、北欧地域におけるオルソケラトロジーおよび強膜コンタクトレンズのサプライヤーであるEnsEyesの買収を発表しました。 EnsEyesは、クーパービジョンのアイケア部門に加わります。

2022年4月:

オルソケラトロジーレンズ市場のセグメンテーション

strongオルソケラトロジーレンズ材料の展望

- シリコーンアクリレート

- フルオロシリコーンアクリレート

- フルオロカーボンアクリレート

オルソケラトロジーレンズの用途展望

- 近視

- 遠視

- その他

オルソケラトロジーレンズのエンドユーザーの展望

- 病院

- 眼科医院

オルソケラトロジーレンズの地域別展望

-

北アメリカ

米国

カナダ

ヨーロッパ

ドイツ

フランス

イギリス

イタリア

スペイン

残りの部分ヨーロッパ

アジア太平洋

中国

日本

インド

オーストラリア

韓国

オーストラリア

その他のアジア太平洋地域

残りの部分世界

中東

アフリカ

ラテンアメリカ

FAQs

What is the projected growth of the Orthokeratology Lens market?

The Orthokeratology Lens market is the expected increase in total market value of 1.52 USD billion over a defined forecast period 2025–2035. It is driven by factors such as demand trends, technological advances, regulatory changes, and geographic expansion.

What is the size of the Orthokeratology Lens market?

Orthokeratology Lens market size was valued at approximately 0.75 billion USD in 2024. This figure will reach 1.52 billion USD covering all regions (America, Europe, Asia, MEA and ROW), focusing its segments / services / distribution channels till 2035.

What is the CAGR of the Orthokeratology Lens market?

Orthokeratology Lens market is expected to grow at a CAGR of 6.62% between 2025 and 2035.

How much will the Orthokeratology Lens market be worth by 2035?

Orthokeratology Lens market is expected to be worth of 1.52 billion USD, reflecting growth driven by usage, technology and global demands by the end of 2035.

How will the Orthokeratology Lens market perform over the next 10 years?

Over the next 10 years the Orthokeratology Lens market is expected to shift from usd billion 0.75 to 1.52 billion USD, led by adoption of advanced tech, demographic trends, regulatory approvals, with potential headwinds from 2025 to 2035.

Which region held the largest revenue share in the orthokeratology lens market?

North America had the largest revenue share of the global market.

このレポートの無料サンプルを受け取るには、以下のフォームにご記入ください

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”