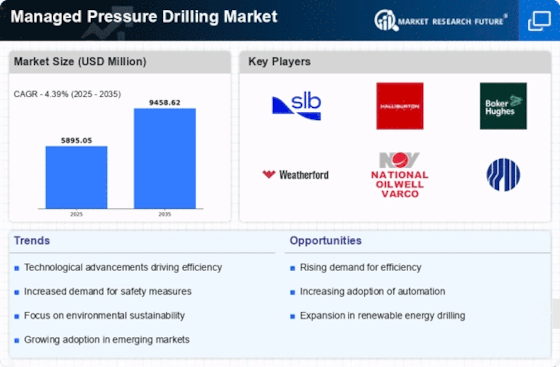

マネージドプレッシャードリリング市場は、現在、技術革新と効率的な掘削ソリューションに対する需要の高まりによって推進される動的な競争環境に特徴づけられています。シュルンベルジェ(米国)、ハリバートン(米国)、ベーカー・ヒューズ(米国)などの主要プレーヤーが最前線に立ち、それぞれが市場ポジションを強化するための独自の戦略を採用しています。シュルンベルジェ(米国)は、デジタル技術への投資を通じて革新を強調し、掘削作業の最適化とコスト削減を目指しています。一方、ハリバートン(米国)は、サービス提供と地理的なリーチを拡大するために戦略的パートナーシップや買収に焦点を当てており、ベーカー・ヒューズ(米国)はデータ分析の専門知識を活用して掘削業務の運用効率と持続可能性を向上させています。これらの戦略は、技術的な差別化と運用の卓越性にますます焦点を当てた競争環境に寄与しています。

ビジネス戦略に関しては、企業は製造のローカライズとサプライチェーンの最適化を行い、市場の需要に対する応答性を高めています。マネージドプレッシャードリリング市場は、いくつかの主要プレーヤーがさまざまなセグメントに影響を及ぼしているため、適度に分散しているようです。この分散は、多様なサービスと革新を可能にしますが、確立された企業と新規参入者の間の競争を激化させる要因ともなります。

2025年8月、シュルンベルジェ(米国)は、先進的なAI駆動の掘削ソリューションを開発するために、主要な技術企業との戦略的パートナーシップを発表しました。このコラボレーションは、予測保守能力を向上させ、クライアントのダウンタイムと運用コストを削減することが期待されています。この動きの戦略的重要性は、シュルンベルジェがサービス提供に最先端の技術を統合することにコミットしていることにあり、ますます技術主導の市場で競争優位を提供する可能性があります。

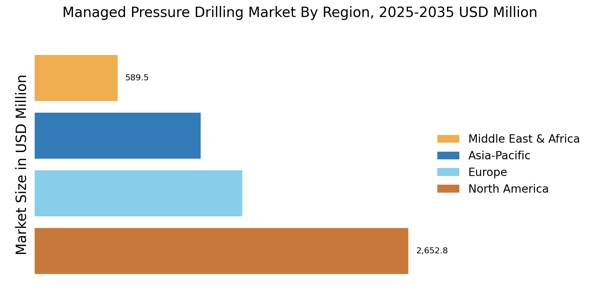

2025年9月、ハリバートン(米国)は、北米市場での足場を大幅に拡大するために、地域の掘削サービス会社を買収しました。この買収は、ハリバートンのサービス能力を広げるだけでなく、掘削活動が再活性化している地域での市場シェアを強化するために戦略的に重要です。このような動きは、ハリバートンが競争が激化する中で自らの地位を強化するための積極的なアプローチを示しています。

2025年7月、ベーカー・ヒューズ(米国)は、掘削作業の生態学的影響を軽減することを目的とした新しい環境に優しい掘削流体のスイートを発表しました。この取り組みは、企業が環境に配慮した実践を優先するようになっているという業界全体のトレンドを反映しています。この発表は、ベーカー・ヒューズを持続可能な掘削ソリューションのリーダーとして位置づけ、環境コンプライアンスにますます関心を持つクライアントを引き付ける可能性があります。

2025年10月現在、マネージドプレッシャードリリング市場は、デジタル化、持続可能性、人工知能の統合を強調するトレンドを目撃しています。戦略的アライアンスはますます重要になっており、企業は現代の掘削課題の複雑さを乗り越えるためにリソースと専門知識を結集しようとしています。今後、競争の差別化は、従来の価格競争から革新、技術の進歩、サプライチェーンの信頼性に焦点を当てる方向に進化する可能性が高く、急速に変化する市場における適応力の重要性を強調しています。