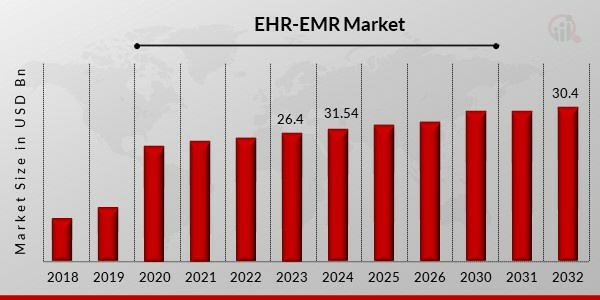

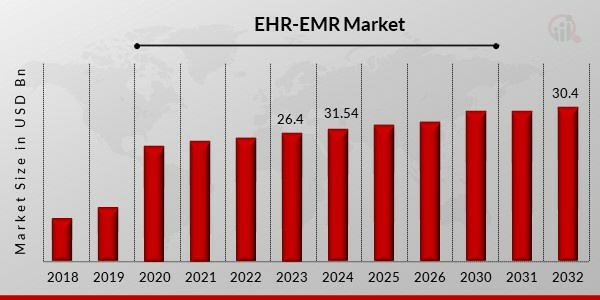

EHR-EMR市場概要EHR-EMR市場規模は2023年に264億米ドルと評価され、2024年の315.4億米ドルから2032年には304億米ドルに成長すると予測されています。予測期間(2024~2032年)における年平均成長率(CAGR)は6.21%です。EHR/EMRは、患者の電子的に保存された健康情報をデジタル形式で体系的にグループ化できるため、広く利用されています。デジタル保存されたデータは、さまざまな医療関係者間で共有可能です。 EHR/EMRは通常、投薬情報、病歴、アレルギー情報、放射線画像、請求情報、患者の人口統計情報、その他の情報パラメータで構成されています。

COVID-19 EHR-EMR市場分析EHR-EMR 市場の動向

推進要因EHR の採用拡大

近代化プログラムにより、多くの病院で EHR の採用が急増しており、これが今後の EMR-EHR 市場価値の押し上げ要因になると予測されています。

患者の電子医療記録の維持管理に関する政府の取り組み

医療 IT の技術開発、文書記録の代替、医療記録管理のニーズの高まりが、医療業界の成長における EHR の推進力となっています。

EHR-EMR の適用に伴う臨床的メリット

機会アジア太平洋の未開拓市場で EHR-EMR の採用が拡大

資金調達の改善により APAC 地域で EHR-EMR の採用が拡大し、世界の EHR-EMR 市場が変革すると予測されています。

課題EMR の実装コストが高く、 EHR

EHR-EMR に関連するコスト抑止は、EHR-EMR 市場規模の拡大を妨げる要因になると予測されています。

データ セキュリティの懸念

データ改ざんの事例の増加は、予測期間中の EHR-EMR 市場の実装に対する信頼感の低下につながると予測されています。

EHR-EMR 市場セグメントの洞察

コンポーネント別

ソフトウェア セグメントは、コンポーネント別に見ると最も急速に成長しているセグメントであり、2030 年までに 2,870 万米ドルに達すると見込まれています。

アプリケーション別

専門分野ベースのセグメントは、予測期間中に 5.30% の CAGR で EHR-EMR 市場で最も急速に成長しているセグメントです。

配信モード別オンプレミス

EHR-EMR 市場の地域分析北米地域が幸運な成長を見せる北米地域の EHR-EMR 市場は、EHR-EMR 市場で主要なシェアを占めています。2017 年には 49% という大きな EHR-EMR 市場シェアを占めました。これは、主要プレーヤーとこの地域の技術的に高度な医療インフラに起因しています。この地域では、電子健康記録 (EHR) / 電子医療記録 (EMR) の共同実装が見られると予測されています。

ヨーロッパ地域の市場は技術力を頼りにするヨーロッパは、EHR-EMR 市場で第 2 位の主要地域です。長期にわたる病気の罹患率の増加と、電子健康記録(EHR)/電子医療記録(EMR)の推進に対する政府の支援の増加が、市場の発展を促進しています。

健康意識がアジア太平洋地域の EHR-EMR 市場を活性化アジア太平洋地域の EHR-EMR 市場は、予測期間を通じて 6.77% の最高 CAGR で成長すると予想されています。アジア太平洋地域の規制は、主に電子医療記録システムへの理解の深まりとその重要性の高まり、そして政府のプログラムや政策への対応によるものです。

EHR-EMR市場の競争環境EHR-EMR市場で認知されている企業は以下の通りです。

- GE Healthcare (米国)、

- Allscripts Healthcare Solutions (米国)、

- Cerner Corporation (米国)、

- Advanced Data Systems Corporation (米国)、

- Athenahealth Inc. (米国)、

- AdvancedMD (米国)、

- eClinicalWorks (米国)

最近の開発2021年1月 Adena Health Systemは、オハイオ州立大学ウェクスナー医療センターとの関係を強化した後、Epic EHRを適用すると発表しました。Epic Systemsの顧客であるオハイオ州立大学ウェクスナー医療センターは、Adenaおよび州内の多数の他のパートナーと連携します。Adenaは、医療センターの資産と医療ITの専門知識に影響を与え、EHRプラットフォームをさらに強化し、患者ケアを向上できます。

2020年12月 ケンタッキー州に拠点を置く医療システムであるCHI Saint Joseph Healthは、患者ケアを向上させ、135の拠点間で相互運用性を確保するため、Epic Systems EHRを発表します。州内20地区の診療所、病院、プライマリケア施設は、1月にEHRの変換を開始します。COVID-19の伝染の間、病院の過密とウイルスの拡散を制限するための社会的距離の必要性により、遠隔医療の統合は賞賛されて拡大しました。この医療システムは、2人以上のユーザー間でチャット、ビデオ、音声によるコミュニケーションを可能にする統合型遠隔医療プラットフォームを披露しました。

2020年11月 サウジアラビアの国際医療センター(IMC)は、InterSystems TrakCareを採用した中東および北アフリカ(MENA)地域の最先端の医療機関となりました。王国でメイヨークリニックケアネットワークの最初のメンバーとして知られるこの学際的な医療サプライヤーは、ジェッダの病院とクリニックでTrakCare電子医療記録(EMR)方式を適用します。これらには、ファーストクリニック、IMC病院、タダウィセンター、ペトロラービグクリニック、ファーストスキャンが含まれます。IMCのTrakCareは、同じ治療内のすべての臨床、財務、管理データを統合します。包括的な収益サイクル管理モジュールは、多くの運用プロセスの機械化においてゲームチェンジャーとなることが証明されます。

2020年12月 Cerner Corporationは、コミュニティおよびクリティカルアクセス病院向けにカスタマイズされたCerner Millennium電子健康記録(EHR)のクラウドベース配信モデルであるCommunityWorksに昇格する米国全土の新規顧客を発表しました。CommunityWorksは、ケア継続中の臨床データと財務データを含む患者の健康履歴の統合デジタル記録を提供します。Cernerは、このモデルを通じて従来のソリューションとサービスを評価し、予測可能な技術支出を伴う中規模から小規模の地方病院に経済的なビジネスモデルを提供できます。

2021年1月 ピーターズバーグ(アラスカ州)医療センターは、新しいCerner EHRシステムの導入計画を進めており、病院の取締役会は130万米ドルのEHRアプリケーションプロジェクトの提案を承認しました。この新システムは、病院が6年前に導入した既存の電子医療記録(EHR)に代わるものです。EHRの資金は、医療センター全体の技術革新のために州から交付された助成金から賄われます。また、病院はCOVID-19パンデミックへの対応として、この積立金の一部を遠隔医療インフラの刷新にも活用しました。

EHR-EMR市場のセグメンテーションEHR-EMRコンポーネントの展望 - ソフトウェア

- サービスとコンサルティング

- ハードウェア

EHR-EMR アプリケーションの展望 - 専門分野別

- 一般アプリケーション

EHR-EMR 提供形態の展望 - オンプレミスモデル

- クラウドベース

EHR-EMR エンドユーザー展望 - 病院・クリニック

- 外来診療

- 診断センター

EHR-EMR 市場の動向

推進要因EHR の採用拡大

近代化プログラムにより、多くの病院で EHR の採用が急増しており、これが今後の EMR-EHR 市場価値の押し上げ要因になると予測されています。

患者の電子医療記録の維持管理に関する政府の取り組み

医療 IT の技術開発、文書記録の代替、医療記録管理のニーズの高まりが、医療業界の成長における EHR の推進力となっています。

EHR-EMR の適用に伴う臨床的メリット

アジア太平洋の未開拓市場で EHR-EMR の採用が拡大

EMR の実装コストが高く、 EHR

オンプレミス

EHR-EMR 市場の地域分析北米地域が幸運な成長を見せる北米地域の EHR-EMR 市場は、EHR-EMR 市場で主要なシェアを占めています。2017 年には 49% という大きな EHR-EMR 市場シェアを占めました。これは、主要プレーヤーとこの地域の技術的に高度な医療インフラに起因しています。この地域では、電子健康記録 (EHR) / 電子医療記録 (EMR) の共同実装が見られると予測されています。

ヨーロッパ地域の市場は技術力を頼りにするヨーロッパは、EHR-EMR 市場で第 2 位の主要地域です。長期にわたる病気の罹患率の増加と、電子健康記録(EHR)/電子医療記録(EMR)の推進に対する政府の支援の増加が、市場の発展を促進しています。

健康意識がアジア太平洋地域の EHR-EMR 市場を活性化アジア太平洋地域の EHR-EMR 市場は、予測期間を通じて 6.77% の最高 CAGR で成長すると予想されています。アジア太平洋地域の規制は、主に電子医療記録システムへの理解の深まりとその重要性の高まり、そして政府のプログラムや政策への対応によるものです。

EHR-EMR市場の競争環境EHR-EMR市場で認知されている企業は以下の通りです。

- GE Healthcare (米国)、

- Allscripts Healthcare Solutions (米国)、

- Cerner Corporation (米国)、

- Advanced Data Systems Corporation (米国)、

- Athenahealth Inc. (米国)、

- AdvancedMD (米国)、

- eClinicalWorks (米国)

最近の開発2021年1月 Adena Health Systemは、オハイオ州立大学ウェクスナー医療センターとの関係を強化した後、Epic EHRを適用すると発表しました。Epic Systemsの顧客であるオハイオ州立大学ウェクスナー医療センターは、Adenaおよび州内の多数の他のパートナーと連携します。Adenaは、医療センターの資産と医療ITの専門知識に影響を与え、EHRプラットフォームをさらに強化し、患者ケアを向上できます。

2020年12月 ケンタッキー州に拠点を置く医療システムであるCHI Saint Joseph Healthは、患者ケアを向上させ、135の拠点間で相互運用性を確保するため、Epic Systems EHRを発表します。州内20地区の診療所、病院、プライマリケア施設は、1月にEHRの変換を開始します。COVID-19の伝染の間、病院の過密とウイルスの拡散を制限するための社会的距離の必要性により、遠隔医療の統合は賞賛されて拡大しました。この医療システムは、2人以上のユーザー間でチャット、ビデオ、音声によるコミュニケーションを可能にする統合型遠隔医療プラットフォームを披露しました。

2020年11月 サウジアラビアの国際医療センター(IMC)は、InterSystems TrakCareを採用した中東および北アフリカ(MENA)地域の最先端の医療機関となりました。王国でメイヨークリニックケアネットワークの最初のメンバーとして知られるこの学際的な医療サプライヤーは、ジェッダの病院とクリニックでTrakCare電子医療記録(EMR)方式を適用します。これらには、ファーストクリニック、IMC病院、タダウィセンター、ペトロラービグクリニック、ファーストスキャンが含まれます。IMCのTrakCareは、同じ治療内のすべての臨床、財務、管理データを統合します。包括的な収益サイクル管理モジュールは、多くの運用プロセスの機械化においてゲームチェンジャーとなることが証明されます。

2020年12月 Cerner Corporationは、コミュニティおよびクリティカルアクセス病院向けにカスタマイズされたCerner Millennium電子健康記録(EHR)のクラウドベース配信モデルであるCommunityWorksに昇格する米国全土の新規顧客を発表しました。CommunityWorksは、ケア継続中の臨床データと財務データを含む患者の健康履歴の統合デジタル記録を提供します。Cernerは、このモデルを通じて従来のソリューションとサービスを評価し、予測可能な技術支出を伴う中規模から小規模の地方病院に経済的なビジネスモデルを提供できます。

2021年1月 ピーターズバーグ(アラスカ州)医療センターは、新しいCerner EHRシステムの導入計画を進めており、病院の取締役会は130万米ドルのEHRアプリケーションプロジェクトの提案を承認しました。この新システムは、病院が6年前に導入した既存の電子医療記録(EHR)に代わるものです。EHRの資金は、医療センター全体の技術革新のために州から交付された助成金から賄われます。また、病院はCOVID-19パンデミックへの対応として、この積立金の一部を遠隔医療インフラの刷新にも活用しました。

EHR-EMR市場のセグメンテーションEHR-EMRコンポーネントの展望 - ソフトウェア

- サービスとコンサルティング

- ハードウェア

EHR-EMR アプリケーションの展望 - 専門分野別

- 一般アプリケーション

EHR-EMR 提供形態の展望 - オンプレミスモデル

- クラウドベース

EHR-EMR エンドユーザー展望 - 病院・クリニック

- 外来診療

- 診断センター

北米地域の EHR-EMR 市場は、EHR-EMR 市場で主要なシェアを占めています。2017 年には 49% という大きな EHR-EMR 市場シェアを占めました。これは、主要プレーヤーとこの地域の技術的に高度な医療インフラに起因しています。この地域では、電子健康記録 (EHR) / 電子医療記録 (EMR) の共同実装が見られると予測されています。

ヨーロッパ地域の市場は技術力を頼りにするヨーロッパは、EHR-EMR 市場で第 2 位の主要地域です。長期にわたる病気の罹患率の増加と、電子健康記録(EHR)/電子医療記録(EMR)の推進に対する政府の支援の増加が、市場の発展を促進しています。

健康意識がアジア太平洋地域の EHR-EMR 市場を活性化アジア太平洋地域の EHR-EMR 市場は、予測期間を通じて 6.77% の最高 CAGR で成長すると予想されています。アジア太平洋地域の規制は、主に電子医療記録システムへの理解の深まりとその重要性の高まり、そして政府のプログラムや政策への対応によるものです。

EHR-EMR市場の競争環境EHR-EMR市場で認知されている企業は以下の通りです。

- GE Healthcare (米国)、

- Allscripts Healthcare Solutions (米国)、

- Cerner Corporation (米国)、

- Advanced Data Systems Corporation (米国)、

- Athenahealth Inc. (米国)、

- AdvancedMD (米国)、

- eClinicalWorks (米国)

最近の開発2021年1月 Adena Health Systemは、オハイオ州立大学ウェクスナー医療センターとの関係を強化した後、Epic EHRを適用すると発表しました。Epic Systemsの顧客であるオハイオ州立大学ウェクスナー医療センターは、Adenaおよび州内の多数の他のパートナーと連携します。Adenaは、医療センターの資産と医療ITの専門知識に影響を与え、EHRプラットフォームをさらに強化し、患者ケアを向上できます。

2020年12月 ケンタッキー州に拠点を置く医療システムであるCHI Saint Joseph Healthは、患者ケアを向上させ、135の拠点間で相互運用性を確保するため、Epic Systems EHRを発表します。州内20地区の診療所、病院、プライマリケア施設は、1月にEHRの変換を開始します。COVID-19の伝染の間、病院の過密とウイルスの拡散を制限するための社会的距離の必要性により、遠隔医療の統合は賞賛されて拡大しました。この医療システムは、2人以上のユーザー間でチャット、ビデオ、音声によるコミュニケーションを可能にする統合型遠隔医療プラットフォームを披露しました。

2020年11月 サウジアラビアの国際医療センター(IMC)は、InterSystems TrakCareを採用した中東および北アフリカ(MENA)地域の最先端の医療機関となりました。王国でメイヨークリニックケアネットワークの最初のメンバーとして知られるこの学際的な医療サプライヤーは、ジェッダの病院とクリニックでTrakCare電子医療記録(EMR)方式を適用します。これらには、ファーストクリニック、IMC病院、タダウィセンター、ペトロラービグクリニック、ファーストスキャンが含まれます。IMCのTrakCareは、同じ治療内のすべての臨床、財務、管理データを統合します。包括的な収益サイクル管理モジュールは、多くの運用プロセスの機械化においてゲームチェンジャーとなることが証明されます。

2020年12月 Cerner Corporationは、コミュニティおよびクリティカルアクセス病院向けにカスタマイズされたCerner Millennium電子健康記録(EHR)のクラウドベース配信モデルであるCommunityWorksに昇格する米国全土の新規顧客を発表しました。CommunityWorksは、ケア継続中の臨床データと財務データを含む患者の健康履歴の統合デジタル記録を提供します。Cernerは、このモデルを通じて従来のソリューションとサービスを評価し、予測可能な技術支出を伴う中規模から小規模の地方病院に経済的なビジネスモデルを提供できます。

2021年1月 ピーターズバーグ(アラスカ州)医療センターは、新しいCerner EHRシステムの導入計画を進めており、病院の取締役会は130万米ドルのEHRアプリケーションプロジェクトの提案を承認しました。この新システムは、病院が6年前に導入した既存の電子医療記録(EHR)に代わるものです。EHRの資金は、医療センター全体の技術革新のために州から交付された助成金から賄われます。また、病院はCOVID-19パンデミックへの対応として、この積立金の一部を遠隔医療インフラの刷新にも活用しました。

EHR-EMR市場のセグメンテーションEHR-EMRコンポーネントの展望 - ソフトウェア

- サービスとコンサルティング

- ハードウェア

EHR-EMR アプリケーションの展望 - 専門分野別

- 一般アプリケーション

EHR-EMR 提供形態の展望 - オンプレミスモデル

- クラウドベース

EHR-EMR エンドユーザー展望 - 病院・クリニック

- 外来診療

- 診断センター

アジア太平洋地域の EHR-EMR 市場は、予測期間を通じて 6.77% の最高 CAGR で成長すると予想されています。アジア太平洋地域の規制は、主に電子医療記録システムへの理解の深まりとその重要性の高まり、そして政府のプログラムや政策への対応によるものです。

EHR-EMR市場の競争環境EHR-EMR市場で認知されている企業は以下の通りです。

- GE Healthcare (米国)、

- Allscripts Healthcare Solutions (米国)、

- Cerner Corporation (米国)、

- Advanced Data Systems Corporation (米国)、

- Athenahealth Inc. (米国)、

- AdvancedMD (米国)、

- eClinicalWorks (米国)

最近の開発2021年1月 Adena Health Systemは、オハイオ州立大学ウェクスナー医療センターとの関係を強化した後、Epic EHRを適用すると発表しました。Epic Systemsの顧客であるオハイオ州立大学ウェクスナー医療センターは、Adenaおよび州内の多数の他のパートナーと連携します。Adenaは、医療センターの資産と医療ITの専門知識に影響を与え、EHRプラットフォームをさらに強化し、患者ケアを向上できます。

2020年12月 ケンタッキー州に拠点を置く医療システムであるCHI Saint Joseph Healthは、患者ケアを向上させ、135の拠点間で相互運用性を確保するため、Epic Systems EHRを発表します。州内20地区の診療所、病院、プライマリケア施設は、1月にEHRの変換を開始します。COVID-19の伝染の間、病院の過密とウイルスの拡散を制限するための社会的距離の必要性により、遠隔医療の統合は賞賛されて拡大しました。この医療システムは、2人以上のユーザー間でチャット、ビデオ、音声によるコミュニケーションを可能にする統合型遠隔医療プラットフォームを披露しました。

2020年11月 サウジアラビアの国際医療センター(IMC)は、InterSystems TrakCareを採用した中東および北アフリカ(MENA)地域の最先端の医療機関となりました。王国でメイヨークリニックケアネットワークの最初のメンバーとして知られるこの学際的な医療サプライヤーは、ジェッダの病院とクリニックでTrakCare電子医療記録(EMR)方式を適用します。これらには、ファーストクリニック、IMC病院、タダウィセンター、ペトロラービグクリニック、ファーストスキャンが含まれます。IMCのTrakCareは、同じ治療内のすべての臨床、財務、管理データを統合します。包括的な収益サイクル管理モジュールは、多くの運用プロセスの機械化においてゲームチェンジャーとなることが証明されます。

2020年12月 Cerner Corporationは、コミュニティおよびクリティカルアクセス病院向けにカスタマイズされたCerner Millennium電子健康記録(EHR)のクラウドベース配信モデルであるCommunityWorksに昇格する米国全土の新規顧客を発表しました。CommunityWorksは、ケア継続中の臨床データと財務データを含む患者の健康履歴の統合デジタル記録を提供します。Cernerは、このモデルを通じて従来のソリューションとサービスを評価し、予測可能な技術支出を伴う中規模から小規模の地方病院に経済的なビジネスモデルを提供できます。

2021年1月 ピーターズバーグ(アラスカ州)医療センターは、新しいCerner EHRシステムの導入計画を進めており、病院の取締役会は130万米ドルのEHRアプリケーションプロジェクトの提案を承認しました。この新システムは、病院が6年前に導入した既存の電子医療記録(EHR)に代わるものです。EHRの資金は、医療センター全体の技術革新のために州から交付された助成金から賄われます。また、病院はCOVID-19パンデミックへの対応として、この積立金の一部を遠隔医療インフラの刷新にも活用しました。

EHR-EMR市場のセグメンテーションEHR-EMRコンポーネントの展望 - ソフトウェア

- サービスとコンサルティング

- ハードウェア

EHR-EMR アプリケーションの展望 - 専門分野別

- 一般アプリケーション

EHR-EMR 提供形態の展望 - オンプレミスモデル

- クラウドベース

EHR-EMR エンドユーザー展望 - 病院・クリニック

- 外来診療

- 診断センター

2021年1月 Adena Health Systemは、オハイオ州立大学ウェクスナー医療センターとの関係を強化した後、Epic EHRを適用すると発表しました。Epic Systemsの顧客であるオハイオ州立大学ウェクスナー医療センターは、Adenaおよび州内の多数の他のパートナーと連携します。Adenaは、医療センターの資産と医療ITの専門知識に影響を与え、EHRプラットフォームをさらに強化し、患者ケアを向上できます。

2020年12月 ケンタッキー州に拠点を置く医療システムであるCHI Saint Joseph Healthは、患者ケアを向上させ、135の拠点間で相互運用性を確保するため、Epic Systems EHRを発表します。州内20地区の診療所、病院、プライマリケア施設は、1月にEHRの変換を開始します。COVID-19の伝染の間、病院の過密とウイルスの拡散を制限するための社会的距離の必要性により、遠隔医療の統合は賞賛されて拡大しました。この医療システムは、2人以上のユーザー間でチャット、ビデオ、音声によるコミュニケーションを可能にする統合型遠隔医療プラットフォームを披露しました。

2020年11月 サウジアラビアの国際医療センター(IMC)は、InterSystems TrakCareを採用した中東および北アフリカ(MENA)地域の最先端の医療機関となりました。王国でメイヨークリニックケアネットワークの最初のメンバーとして知られるこの学際的な医療サプライヤーは、ジェッダの病院とクリニックでTrakCare電子医療記録(EMR)方式を適用します。これらには、ファーストクリニック、IMC病院、タダウィセンター、ペトロラービグクリニック、ファーストスキャンが含まれます。IMCのTrakCareは、同じ治療内のすべての臨床、財務、管理データを統合します。包括的な収益サイクル管理モジュールは、多くの運用プロセスの機械化においてゲームチェンジャーとなることが証明されます。

2020年12月 Cerner Corporationは、コミュニティおよびクリティカルアクセス病院向けにカスタマイズされたCerner Millennium電子健康記録(EHR)のクラウドベース配信モデルであるCommunityWorksに昇格する米国全土の新規顧客を発表しました。CommunityWorksは、ケア継続中の臨床データと財務データを含む患者の健康履歴の統合デジタル記録を提供します。Cernerは、このモデルを通じて従来のソリューションとサービスを評価し、予測可能な技術支出を伴う中規模から小規模の地方病院に経済的なビジネスモデルを提供できます。

2021年1月 ピーターズバーグ(アラスカ州)医療センターは、新しいCerner EHRシステムの導入計画を進めており、病院の取締役会は130万米ドルのEHRアプリケーションプロジェクトの提案を承認しました。この新システムは、病院が6年前に導入した既存の電子医療記録(EHR)に代わるものです。EHRの資金は、医療センター全体の技術革新のために州から交付された助成金から賄われます。また、病院はCOVID-19パンデミックへの対応として、この積立金の一部を遠隔医療インフラの刷新にも活用しました。

EHR-EMR市場のセグメンテーションEHR-EMRコンポーネントの展望 - ソフトウェア

- サービスとコンサルティング

- ハードウェア

EHR-EMR アプリケーションの展望 - 専門分野別

- 一般アプリケーション

EHR-EMR 提供形態の展望 - オンプレミスモデル

- クラウドベース

EHR-EMR エンドユーザー展望 - 病院・クリニック

- 外来診療

- 診断センター

- ソフトウェア

- サービスとコンサルティング

- ハードウェア

EHR-EMR アプリケーションの展望 - 専門分野別

- 一般アプリケーション

EHR-EMR 提供形態の展望 - オンプレミスモデル

- クラウドベース

EHR-EMR エンドユーザー展望 - 病院・クリニック

- 外来診療

- 診断センター

- オンプレミスモデル

- クラウドベース

EHR-EMR エンドユーザー展望 - 病院・クリニック

- 外来診療

- 診断センター

FAQs

What is the projected market valuation of the EHR-EMR market by 2035?

The EHR-EMR market is projected to reach a valuation of 54.4 USD Billion by 2035.

What was the market valuation of the EHR-EMR market in 2024?

In 2024, the EHR-EMR market was valued at 28.04 USD Billion.

What is the expected CAGR for the EHR-EMR market during the forecast period 2025 - 2035?

The expected CAGR for the EHR-EMR market during the forecast period 2025 - 2035 is 6.21%.

Which companies are considered key players in the EHR-EMR market?

Key players in the EHR-EMR market include Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, and others.

What are the main components of the EHR-EMR market?

The main components of the EHR-EMR market include software, services & consulting, and hardware.

このレポートの無料サンプルを受け取るには、以下のフォームにご記入ください

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”