世界の鋳物用コークス市場の概要

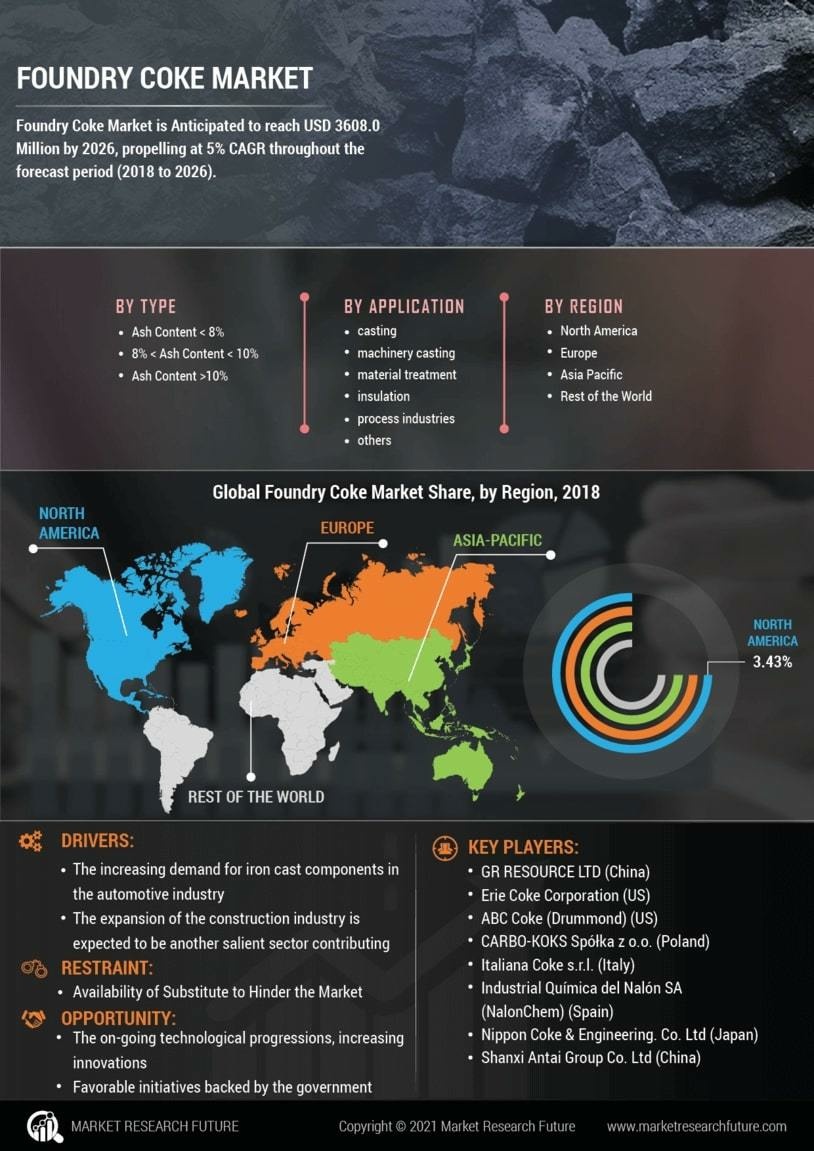

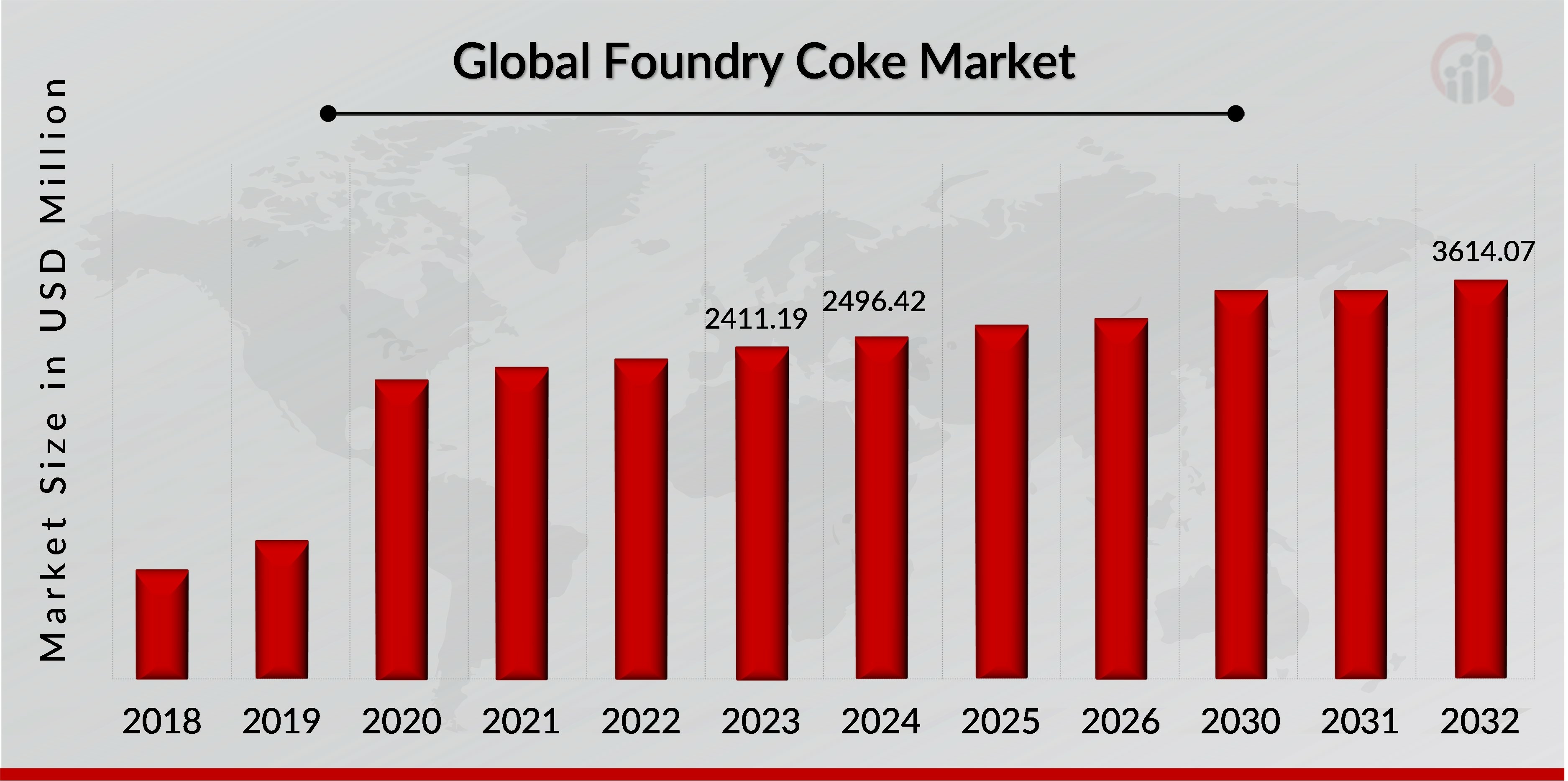

p鋳物用コークス市場規模は、2023年に24億1,119万米ドルと評価されました。鋳物用コークス市場産業は、2024年の24億9,642万米ドルから2032年には36億1,407万米ドルに成長すると予測されており、予測期間(2024~2032年)中に4.73%の年平均成長率(CAGR)を示します。鋳物用コークスは、加熱蒸留された石炭から作られています。通常、副産物回収法または非回収炉(またはビーハイブ法)という2つのよく知られた方法を使用して製造されます。米国では、鋳物用コークス製造業者は主に副産物回収法を使用しています。他のいくつかの国、特に中国では、古いビーハイブ法を主要製造方法として採用しています。鋳物用コークスは、製鉄工場において、溶融鉄を製造するキューポラ炉の燃料源としてのみ使用されるコークスの一種です。また、溶融鉄の燃料としてだけでなく、溶融製品への炭素供給源としても機能します。生成された溶融鉄は、様々な形状の鋳鉄製品の製造に利用され、様々な産業で利用されます。鋳物用コークスは、低灰分、高炭素分、高発熱量、緻密な組織、高強度、そして(冶金用コークスよりも)大きな粒度といった特徴を有しており、これらが鋳鉄工場での使用を可能にしています。また、高い発熱量のため、冶金用コークスよりもコスト効率に優れています。必要な炉温を達成し、より少ない量と時間で優れた溶解を実現します。鋳物用コークスは、自動車部品、機械、断熱材の鋳造など、様々な用途に使用されています。鋳物用コークスは自動車産業において、特にエンジンブロック、ブレーキドラム、シリンダーヘッドなどの鋳鉄部品の製造において重要な役割を果たしています。キューポラ炉の燃料および還元剤としての役割により、金属の効率的な溶解が保証され、自動車部品に必要な強度と耐久性を備えた高品質の鋳物が生産されます。鋳物用コークスの低い不純物レベルと一貫した品質は、これらの重要な自動車部品の精度と信頼性を実現するために不可欠です。

出典:二次調査、一次調査、MRFRデータベース、アナリストレビュー

鋳物用コークス市場の動向

ul-

自動車業界における鋳鉄の高い需要

世界の自動車部門は、一人当たり所得の増加、生活水準の向上、自動車製造の増加により成長すると予測されており、鋳鉄の需要が高まり、結果として、予測期間中に鋳物用コークス市場の拡大が促進されると予想されます。

さらに、鋳鉄は電気自動車部品の製造にもある程度使用されています。電気自動車製造への投資は世界中で大幅に増加しています。国際エネルギー機関(IEA)が発表したデータによると、2030年までに1億2,500万台の電気自動車(EV)が路上を走行することになります。ブルームバーグ・ニュー・エナジー・ファイナンス(BNEF)によると、2030年までにヨーロッパが電気自動車市場で最大のシェアを占めると予想されています。したがって、電気自動車の製造と販売の増加に伴い、鋳鉄部品の需要も増加すると予想され、その結果、予測期間中の鋳物用コークス市場の成長が促進されると予測されています。

-

インフラと建設活動の拡大

この需要を牽引している主な要因の1つは、道路、鉄道、橋梁、トンネルなどの交通網の拡張です。これらのプロジェクトには大量の鉄鋼が必要であり、これは高炉で鋳物用コークスを使用して生産されます。特に急速に都市化が進む地域での商業ビルや住宅の建設も、鋳物用コークスの需要増加に貢献しています。政府と民間部門はスマートシティ、住宅プロジェクト、商業スペースに投資しており、鉄鋼と鋳物用コークスの消費をさらに押し上げています。

中英ビジネス協議会によると、2022年8月、中国政府は建設業界を後押しするインフラ大規模プロジェクトの成長のために1兆米ドルを投資すると発表しました。さらに、インド・ブランド・エクイティ財団によると、インドは2025年の経済成長目標である5兆米ドルを達成するためには、インフラを強化する必要がある。政府は、近年の一連の取り組みを通じて、未来志向のインフラ整備への強いコミットメントを示している。特に、1.3兆米ドルの予算を投じたガティ・シャクティ計画は、インフラ分野における体系的かつ効果的な改革を推進する先駆者として、大きな進展をもたらしている。これらの取り組みは、「スマートシティ・ミッション」や「すべての人のための住宅」といったプログラムにも好影響を与えている。さらに、サウジアラビアは、エネルギー、石油化学、製油所、インフラ、農業、鉱物資源、鉱業など、様々な分野にわたり、インドに最大1,000億米ドルを投資する意向を表明している。さらに、欧州委員会は2024年に、EUのインフラ戦略投資ツールであるコネクティング・ヨーロッパ・ファシリティ(CEF)から70億ユーロを超えるEU補助金を受け取る134の交通プロジェクトを選定すると発表している。この資金は、現在のCEF輸送プログラムにおける最大の割り当てとなります。特に、総資金の約80%が鉄道プロジェクトに向けられており、EUの輸送ネットワークの強化と近代化に対する強いコミットメントを反映しています。これらの共同の取り組みは、強力なインフラフレームワークを確立し、経済成長を促進し、持続可能な開発を促進するという政府と組織のコミットメントを示しています。

鋳物用コークス市場の洞察

h3鋳物用コークス市場:タイプ別洞察 p鋳物用コークス市場のセグメンテーションは、タイプに基づいて、市場は灰分含有量 8%、8% 灰分含有量 10%、および10% 灰分含有量としてセグメント化されています。2023年には、灰分含有量 8%のセグメントが47.34%の市場収益シェアを生み出し、予測期間中に5.13%のCAGRを経験すると予想されます。灰分は、燃料に含まれる研磨剤や触媒残渣などの無機汚染物質や可溶性金属成分の量として定義されます。燃焼プロセスにおいて、これらの化合物は酸化され、灰となります。この灰は、インジェクター、燃料ポンプ、ピストン、セグメントの摩耗を引き起こす可能性があり、同時にエンジン内に堆積物を形成します。鋳物用コークスを金属生産プロセスで有効に活用するには、灰分含有量が8%を超えてはなりません。灰とは、可燃性物質が完全に燃焼した後に残る残留物の量を指します。さらに、灰は溶融金属を汚染し、最終製品に欠陥を引き起こします。鋳物用コークスは燃料としてだけでなく還元剤としても使用される高炉において、灰分含有量が低いほど燃焼効率が向上し、温度制御が向上します。これは、溶融鉄の必要な化学組成を維持するのに役立ち、生産される鋼鉄や鉄の全体的な品質を向上させます。さらに重要なのは、灰分が減ると、不純物に対する追加のフラックスが必要なくなり、プロセスがある程度複雑になるため、生産コストを削減できることです。したがって、金属の生産と処理で高い基準を維持するためには、鋳造用コークスの灰分を8%未満にする必要があります。炭素タイプ別鋳造用コークス市場洞察

p鋳造用コークス市場の区分は、炭素タイプに基づいて、市場は冶金コークス、石油コークス、ピッチコークス、無煙炭コークス、その他に分類されています。 2023年には、冶金コークスセグメントが73.73%の市場収益シェアを生み出し、予測期間中に4.81%のCAGRを経験すると予想されます。 冶金コークスはソフトドリンクのように聞こえますが、違います。これは、独特の種類の石炭から得られる加工炭素製品です。石炭を極めて高温に加熱すると、コークスに精製することができ、製鉄と製鋼の両方で使用されます。適切な石炭原料の選択は、コークス製造プロセスで最も重要なプロセスの一つです。冶金用石炭は、冶金用コークスの製造に使用される石炭の一種です。コークスの製造に使用できる冶金用石炭には、強粘結炭と半軟粘結炭の2種類があります。Grande Cache Coal社によると、これらの石炭は、過熱した炉に入れると溶融、膨張し、再び固まるため、コークスの製造に最適です。また、これらの種類の石炭は不純物の含有量も低いです。Grande Cache Coal社によると、3つ目のタイプの冶金用石炭であるPCIは、より高価なコークスの代わりとして製鉄で時々使用されます。コークスは、冶金用石炭を約2,000°F(約1,000℃)に加熱することで製造されます。世界石炭協会によると、このプロセスは炉内で12~36時間かけて完了します。炉から出たコークスは、水または空気で約1.5~2.5MPaまで冷却され、その後貯蔵庫に送られるか、高炉に直接送られます。米国エネルギー情報局によると、最終製品の重量は元の原料の約3分の2です。コークスは主に鉄の製造に使用され、鉄は鋼鉄の主原料として使用されます。金属製錬タイプ別鋳物用コークス市場

p金属製錬の種類に基づいて、鋳物用コークス市場は、鉄製錬、非鉄金属製錬、鉄および非鉄合金製錬、および鋼製錬に分類されます。2023年には、鉄製錬セグメントが41.27%という最大の市場収益シェアを占め、予測期間中に5.06%のCAGRで成長すると予想されています。金属製錬は数千年にわたって行われてきたプロセスであり、人類の文明において重要な役割を果たしてきました。これは、鉱石から金属を抽出するプロセスです。このプロセスから、人類は私たちの世界を形成するツール、構造、革新を思いつくことができました。製錬は現代産業の基盤を形成しています。鉄は、建物、自動車、飛行機、さらには電子機器など、様々な用途に使用できる有用な金属へと加工される鉱石です。製錬において最も広く使用され、最も基本的な金属は鉄です。その汎用性と豊富さから、冶金学において非常に重要な存在となっています。鉄の製錬は、製錬において鉄鉱石から鉄を抽出するために特に用いられるプロセスです。鉄酸化物を還元して溶融鉄を生成し、それを任意の形状の棒やインゴットに鋳造します。鉄鉱石は、実際には鋼鉄生産の原料です。製錬とは、鉄鉱石を加熱して鉄を不純物から分離させるプロセスです。こうして鉄と炭素がさらに結合することで、鋼鉄生産の基盤が作られます。この多用途の材料は、現代の産業と建設に革命をもたらしました。用途別鋳物用コークス市場

p用途に基づいて、鋳物用コークス市場は、機械鋳造、自動車部品鋳造、断熱材、材料処理、その他に分類されます。 2023年には、自動車部品鋳造セグメントが50.60%で最大の市場収益シェアを占め、予測期間中に5.01%のCAGRで成長すると予想されています。 自動車部品鋳造における鋳物用コークスの使用は、車両の信頼性と性能を維持するために不可欠です。 たとえば、エンジンブロックは、優れた耐熱性、寸法安定性、構造的完全性が求められる重要な部品です。 鋳物用コークスはこれらの特性の実現に役立ち、エンジンブロックがエンジンが受ける高温と機械的ストレスに耐えることを可能にします。自動車産業の成長と革新が続く中、高品質の鋳造金属部品に対する需要は依然として堅調であり、予測期間中、世界の鋳造市場における自動車部品鋳造セグメントの成長を牽引するでしょう。石炭由来の高炭素材料である鋳物用コークスは、自動車部品の鋳造において、主に燃料および溶融金属製造時の還元剤として使用されます。高い発熱量により、鉄鋼の溶解に必要な高温を実現します。さらに、鋳物用コークスは炉内に理想的な化学環境を作り出し、溶融金属中の不純物の低減を促進します。鋳物用コークス市場 strong地域別分析

p地域別に見ると、鋳物用コークス市場は北米、ヨーロッパ、アジア太平洋、中東・アフリカ、南米に分類されます。 2023年には、アジア太平洋地域が41.99%という最大の市場収益シェアを占め、2024~2032年の予測期間には4.99%のCAGRで成長すると見込まれています。アジア太平洋地域は、鉄鋼生産の急増と急速な工業化により、鋳物用コークス市場をリードしています。鋳物用コークスの大規模な消費者には、大規模な製鉄プロセスを基盤とする中国やインドなどの国が含まれます。中国は世界最大の鉄鋼生産国および消費国であるため、世界の鋳物用コークス需要に大きな影響を与えています。この地域には、すでに整備されたインフラ、拡大する産業基盤、鉄鋼生産ユニットへの大規模な投資という利点があります。さらに、アジア太平洋諸国の生産コストの低さと豊富な石炭埋蔵量が、この地域をリードする要因となっています。コークスの主要生産者と供給者がこの地域でしのぎを削っており、この地域の存在感を高めています。経済成長と都市化により、建設・製造業向けの鉄鋼需要が高まっています。したがって、鋳物用コークスの需要もそれに応じて増加します。それに加えて、アジア太平洋市場は競争が激しく、技術的にダイナミックであるため、効率的で汚染が少ないです。これらすべての要因が組み合わさって、アジア太平洋地域は鋳物用コークス市場で主導的な役割を維持しています。鋳物用コークス市場の主要市場プレーヤーと競合の洞察

p競争環境は、世界で事業を展開する企業による主要な開発の分析を提供します。鋳物用コークスの世界市場は、自動車産業からの需要の増加により、予測期間中に大幅に成長すると予想されます。自動車産業の成長、機械鋳造の需要の増加、乗用車の販売増加が、市場成長を牽引する主な要因です。市場は消費の面で強力な数字を表しており、毎年成長すると予想されます。WZK Victoria SA、OKK Koksovny、a.s.、Italiana Coke s.r.l.、Quimica del Nalon、GR Resource Ltd、Hickman、Williams Company、日本コークス工業株式会社、ドラモンドカンパニー株式会社、Marut Enterprises、Sesa Goa Iron Oreは、鋳物用コークス市場で活動している主要企業です。鋳物用コークス市場は非常に細分化されており、Drummond Company, Inc.、日本コークス工業株式会社、OKK Koksovny, a.s.などのリーダーは、業界での経験、多様な製品ポートフォリオ、強力な収益基盤、世界的な流通ネットワークにより、世界の鋳物用コークスで最大のシェアを占めています。OKK Koksovny, a.sの基本事業は、上部シレジア炭田で採掘される良質の原料炭からコークスを生産することであり、ヨーロッパや世界の他の地域でも採掘されています。この会社は、コークス生産でヨーロッパのトップに属しています。また、イタリアーナ・コークスは、冶金、鉄鋼、断熱製品用のコークス製造におけるヨーロッパのリーダーです。

WZK Victoria SA:Wa?brzyskie Zak?ady Koksownicze Victoria SA(Koksownicze Victoria SA)は、ヨーロッパの鋳物用コークスの主要生産者の1つです。同社は、100 mm以上の鋳造用コークスの粒度で優位に立っています。Koksownicze Victoria SAは、国内のコークス輸出全体の5%以上を占めています。同社は、鋳造用コークス、冶金用コークス、工業用コークス、炭素ベース製品という4つの主要製品ラインを通じてヨーロッパ全土で事業を展開しています。同社は、年間約60万トンの鋳造用コークスを生産しています。 Koksownicze Victoria SAは小売業者へのコークスの販売を開始し、販売・流通網の拡大において他のメーカーよりも優位に立っています。

OKK Koksovny, a.s.: OKK Koksovny, a.s.(OKK)は、ヨーロッパにおける鋳物用コークスの大手メーカーです。同社は、鋳造・冶金、特殊冶金、加熱、その他の用途向けに幅広いコークスを提供しています。さらに、その他の製品には、高温の石炭乾留で生成される化学製品も含まれます。鋳物用コークスは、鋳鉄、玄武岩をベースとした断熱材、ガラス繊維の製造に使用されます。同社はオストラバ市内にコークス製造ユニット(スヴォボダ工場)を所有しています。スヴォボダ工場には4つのコークス炉と合計210基の炉があり、年間800トンを生産しています。また、同社はチェココークス製造協会の会員でもあります。 2013年12月6日現在、OKK Koksovny, a.s.はMTX Koksovny a.s.(Metalimex)の子会社として事業を展開しています。

鋳物用コークス市場の主要企業は以下の通りです。

ul- WZK Victoria SA

- OKK Koksovny, a.s.

- Quimica del Nalon

- GR Resource Ltd

- Hickman

- Williams Company

- 日本コークス工業株式会社

- ドラモンド・カンパニー

- マルット・エンタープライズ

- セサ・ゴア鉄鉱石

- 灰分含有量 8%

- 8% 灰分含有量 10%

- 10% 灰分含有量

- 冶金用コークス

- 石油コークス

- ピッチコークス

- 無煙炭コークス

- その他

- 鉄製錬

- 非鉄金属製錬

- 鉄鋼および非鉄合金製錬

- 製鋼

- 機械鋳造

- 自動車部品鋳造

- 断熱材

- 材料処理

- その他

- 北部アメリカ

- アメリカ

- カナダ

- メキシコ

- ヨーロッパ

- ドイツ

- フランス

- イギリス

- スペイン

- イタリア

- ロシア

- ヨーロッパのその他の地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- 残りの部分アジア太平洋

- 中東・アフリカ

- 南アフリカ

- GCC諸国

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

FAQs

What is the current valuation of the Foundry Coke Market?

The Foundry Coke Market was valued at 2496.42 USD Million in 2024.

What is the projected market valuation for the Foundry Coke Market in 2035?

The market is projected to reach 4151.38 USD Million by 2035.

What is the expected CAGR for the Foundry Coke Market during the forecast period?

The expected CAGR for the Foundry Coke Market from 2025 to 2035 is 4.73%.

Who are the key players in the Foundry Coke Market?

Key players include China National Coal Group, Shanxi Coking Coal Group, and ArcelorMittal, among others.

What are the different types of foundry coke based on ash content?

Types include Ash Content < 8% valued at 999.0 to 1700.0 USD Million, 8% < Ash Content < 10% at 800.0 to 1300.0 USD Million, and 10% < Ash Content valued at 697.42 to 1151.38 USD Million.

How does metallurgical coke compare to other carbon types in terms of market valuation?

Metallurgical Coke leads with a valuation range of 1000.0 to 1700.0 USD Million, surpassing Petroleum Coke and others.

このレポートの無料サンプルを受け取るには、以下のフォームにご記入ください

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”