Water Soluble Pods Packaging Market Trends

Water Soluble Pods Packaging Market Research Report Information By End User (Detergents, Hand Wash, Dishwash and Others), By Material (Poly Vinyl Alcohol and Others), By Thickness (Below 30 Micro Meter, 31-60 Micro Meter and 61 Micro Meter Thickness), By Product (Single Layer Water Pods, Dual Layer Water Pods and Multi Chamber Water Pods), And By Region (North America, Europe, Asia-Pacific, And...

Market Summary

The Global Water Soluble Pods Packaging Market is projected to experience substantial growth from 0.28 USD Billion in 2024 to 2.05 USD Billion by 2035.

Key Market Trends & Highlights

Global Water Soluble Pods Packaging Key Trends and Highlights

- The market is expected to grow at a compound annual growth rate (CAGR) of 19.85% from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 2.05 USD Billion, indicating a robust expansion.

- in 2024, the market is valued at 0.28 USD Billion, showcasing the initial stages of growth.

- Growing adoption of eco-friendly packaging solutions due to increasing environmental awareness is a major market driver.

Market Size & Forecast

| 2024 Market Size | 0.28 (USD Billion) |

| 2035 Market Size | 2.05 (USD Billion) |

| CAGR (2025-2035) | 20.00% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

NOBLE INDUSTRIES (U.S.), Aicello Corporation (Japan), Mitsubishi Chemical Corporation (Japan), MonoSol, LLC (Japan), SEKISUI CHEMICAL CO., LTD. (Japan), Mondi Group (U.K.), Arrow Greentech Ltd (India), Cortec Corporation (U.S.), Guangdong Proudly New Material Technology Corp. (China), Aquapak (U.K.), Soltec Development (Spain), Jiangmen Cinch Packaging Materials Co., Ltd. (China), Changzhou Water Soluble Co., Ltd. (China), Fujian Zhongsu Biodegradable Films Co., Ltd. (China), Amtrex Nature Care Pvt. Ltd. (India)

Market Trends

Growing demand for packaging for organic personal care products and cosmetics is driving the market growth

The rising need for packaging for organic personal care products and cosmetics is one of the major factors boosting the growth of the market for water-soluble pods packaging. Growing public knowledge of environmental and health issues is one of the major factors influencing demand. Producers of organic cosmetics are searching for environmentally friendly and sustainable packaging solutions to promote their products as natural. Additionally, cosmetic companies are working with packaging businesses to develop efficient packaging options for their products. Water-soluble pod packaging will be more popular during the projection period as a result of its biodegradability.

Such elements are anticipated to have a favorable effect on market expansion during the anticipated term.

The development of environmentally friendly and sustainable detergent solutions is one of the major trends in water-soluble pod packaging that is driving market expansion. Globally, people are becoming more and more concerned about environmental contamination. Furthermore, it has been claimed that chemical-based detergents might damage people's skin and, over time, degrade the softness and quality of their clothing. Organic and created from natural materials rather than synthetic ones that are harmful to human health, eco-friendly products are typically made from these materials.

Due to the potentially harmful effects of detergents generated from synthetic materials, consumers prefer organic and eco-friendly detergents comprised of natural ingredients, which will further boost the expansion of the targeted market throughout the forecast period.

Due to the related benefits, especially in fields where workers must deal with poisonous or hazardous substances, there is a substantial rise in demand for water soluble pod packing. This packaging would provide a safer way for the workers or employees to handle these chemicals in order to prevent direct contact with these dangerous components. Because plastic packaging produces a lot of waste and takes up a lot of storage space, the majority of enterprises attempt to avoid using it.

Thus, driving the water soluble pods packaging market revenue.July 2023: Nestlé, a major food and beverage company, announced an investment in a startup developing water-soluble pod packaging for coffee and other products. This move signaled a growing interest from big brands in sustainable packaging solutions for single-serve items September 2023: A new application emerged for water-soluble pods: packaging for single-dose personal care products like shampoo and conditioner. This could expand the market reach of the technology beyond food and beverage

The increasing emphasis on sustainable packaging solutions is driving innovation in the water soluble pods packaging sector, as manufacturers seek to meet consumer demand for environmentally friendly products.

U.S. Environmental Protection Agency

Water Soluble Pods Packaging Market Market Drivers

Regulatory Support

Government regulations promoting environmentally friendly packaging are influencing the Global Global Water Soluble Pods Packaging Market Industry. Many countries are implementing policies aimed at reducing plastic waste, which encourages manufacturers to explore alternative packaging solutions. For example, initiatives that incentivize the use of biodegradable materials are likely to boost the adoption of water soluble pods. This regulatory support not only fosters innovation but also aligns with global sustainability goals, thereby enhancing market growth. As regulations tighten, companies that adapt to these changes may gain a competitive edge in the evolving packaging landscape.

Sustainability Trends

The increasing emphasis on sustainability is a pivotal driver for the Global Global Water Soluble Pods Packaging Market Industry. As consumers become more environmentally conscious, brands are compelled to adopt eco-friendly packaging solutions. Water soluble pods, which dissolve in water and reduce plastic waste, align with this trend. For instance, major brands are integrating these pods into their product lines to appeal to eco-aware consumers. The market is projected to grow from 0.28 USD Billion in 2024 to an estimated 2.05 USD Billion by 2035, indicating a robust shift towards sustainable packaging solutions.

Convenience and Efficiency

The demand for convenience in product usage is propelling the Global Global Water Soluble Pods Packaging Market Industry forward. Water soluble pods offer an easy-to-use solution for consumers, eliminating the need for measuring and reducing mess. This convenience is particularly appealing in sectors such as laundry and dishwashing, where precise dosing is crucial. As households increasingly seek efficient cleaning solutions, the adoption of water soluble pods is likely to rise. The anticipated compound annual growth rate of 19.85% from 2025 to 2035 suggests a strong market response to this consumer preference for convenience.

Technological Advancements

Technological innovations in packaging materials are driving the Global Global Water Soluble Pods Packaging Market Industry. Advances in polymer science have led to the development of more effective and efficient water soluble films, enhancing product performance and shelf life. These innovations enable manufacturers to create pods that are not only functional but also appealing to consumers. As technology continues to evolve, it is expected that the market will witness the introduction of new formulations and designs, further stimulating growth. The ongoing research and development in this area could lead to significant market expansion in the coming years.

Rising Demand in Various Sectors

The versatility of water soluble pods is contributing to the growth of the Global Global Water Soluble Pods Packaging Market Industry across multiple sectors. Industries such as household cleaning, personal care, and agriculture are increasingly adopting these pods for their convenience and effectiveness. For instance, in agriculture, water soluble pods containing fertilizers are gaining traction due to their ease of application and reduced environmental impact. This cross-industry appeal is likely to drive market growth, as more sectors recognize the benefits of water soluble packaging solutions. The projected market growth from 0.28 USD Billion in 2024 to 2.05 USD Billion by 2035 underscores this trend.

Market Segment Insights

Water Soluble Pods Packaging End User Insights

The water soluble pods packaging market segmentation, based on end user includes Detergents, Hand Wash, Dishwash and Others. The detergents segment dominated the market. The capacity of detergent pods to produce substantially less packaging waste for landfills supports category growth. The segment is expected to be supported by the ongoing research efforts being made by different companies to develop cutting-edge detergent pods.

Water Soluble Pods Packaging Material Insights

The water soluble pods packaging market segmentation, based on material, includes Poly Vinyl Alcohol and Others. The poly vinyl alcohol category generated the most income. This market's expansion is expected to be fueled by the rising need for packaging solutions that are sustainable and kind to the environment in a variety of applications. Since poly vinyl alcohol has a hydrophilic character, it is probably the best raw material for making water soluble pod packing.

Since it is used to cover hazardous fertilizers, which further ensures contactless handling of dangerous chemicals, the agriculture industry is thought to be the material's major consumer.

Figure 1: Water Soluble Pods Packaging Market, by Material, 2022 & 2032 (USD Billion)Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Water Soluble Pods Packaging Thickness Insights

The water soluble pods packaging market segmentation, based on thickness, includes Below 30 Micro Meter, 31-60 Micro Meter and 61 Micro Meter Thickness. The 31-60 micro meter category generated the most income. It is predicted that the rapid development of detergent pods with this kind of thickness will support segment expansion. With this investment, the company also plans to improve the thickness and shape of its current laundry detergent pods. The category is anticipated to grow with the advent of such developments around the globe.

Water Soluble Pods Packaging Product Insights

The water soluble pods packaging market segmentation, based on product, includes Single Layer Water Pods, Dual Layer Water Pods and Multi Chamber Water Pods. The multi chamber water pods category generated the most income. The industry is expected to be driven by the high demand for these pods from several hand wash producers around the world. The pods will transform into a hassle-free liquid soap once the bottle is filled with water. The startup has sold nearly a million pods since its introduction by grabbing consumers' attention during the dispersion process.

Get more detailed insights about Water Soluble Pods Packaging Market Research Report - Global Forecast by 2034

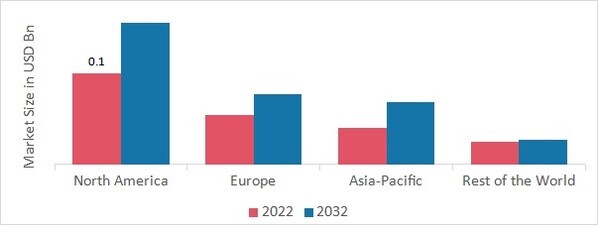

Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American water soluble pods packaging market area will dominate this market due of the growing demand for organic cosmetics among consumers, the expansion of the packaging industry, and growing awareness of plastic pollution. Additionally, throughout the course of the projection period, the water-soluble pods packaging market will develop in North America because to the considerable rise in demand for biodegradable polymers, particularly in the consumer goods industries.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: WATER SOLUBLE PODS PACKAGING MARKET SHARE BY REGION 2022 (USD Billion)  Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe water soluble pods packaging market accounts for the second-largest market share. Growing awareness about plastic pollution, increased desire for organic cosmetics, and expanding demand for personal care items could all be factors driving the market for water soluble pod packaging in the area. Further, the German water soluble pods packaging market held the largest market share, and the UK water soluble pods packaging market was the fastest growing market in the European region

The Asia-Pacific Water Soluble Pods Packaging Market is expected to grow at the fastest CAGR from 2023 to 2032 due to the region's growing need for these packages. Due to the growth of the packaging sector and the rising popularity of organic cosmetics in this area, this region also dominates the market. Moreover, China’s water soluble pods packaging market held the largest market share, and the Indian water soluble pods packaging market was the fastest growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the water soluble pods packaging market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, water soluble pods packaging industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the water soluble pods packaging industry to benefit clients and increase the market sector. In recent years, the water soluble pods packaging industry has offered some of the most significant advantages to medicine.

Major players in the water soluble pods packaging market are attempting to increase market demand by investing in research and development operations includes NOBLE INDUSTRIES (U.S.), Aicello Corporation (Japan), Mitsubishi Chemical Corporation (Japan), MonoSol, LLC (Japan), SEKISUI CHEMICAL CO., LTD. (Japan), Mondi Group (U.K.), Arrow Greentech Ltd, (India), Cortec Corporation (U.S.), Guangdong Proudly New Material Technology Corp. (China), Aquapak (U.K.), Soltec Development (Spain), Jiangmen Cinch Packaging Materials Co., Ltd. (China), Changzhou Water Soluble Co., Ltd. (China), Fujian Zhongsu Biodegradable Films Co., Ltd. (China), Amtrex Nature Care Pvt. Ltd. (India)

Plastic and other chemical products are produced and sold by Sekisui Chemical Co Ltd (Sekisui Chemical), a chemical firm. The business caters to the automotive and transportation industries by providing polyolefin foam, industrial tapes, semiconductor materials, and photosensitive materials. In addition, the company serves the construction and infrastructure industries with functional resins and fire-resistant materials, the life science industry with testing tools, items that help drug discovery, and the industrial sector with adhesives and plastic containers.

The Cortec Corporation produces and sells corrosion protection products. Inhibiting additives, fluids, adhesives, plastics, and metalworking, packaging, powder, concrete protection, increased lubricant, water treatment, surface preparation, and coating products are all provided by the company. It also supplies vapor phase and migrating corrosion inhibitors. In the State of Minnesota, Cortec conducts business.

Key Companies in the Water Soluble Pods Packaging Market market include

Industry Developments

- Q2 2024: Mitsubishi Chemical Group Launches New Water-Soluble Pod Packaging for Personal Care Market Mitsubishi Chemical Group announced the commercial launch of a new line of water-soluble pod packaging specifically designed for single-serve personal care products, expanding its sustainable packaging portfolio.

- Q1 2024: Constantia Flexibles Expands Water-Soluble Pods Production Facility in Germany Constantia Flexibles completed the expansion of its German manufacturing facility to increase production capacity for water-soluble pods packaging, targeting the European homecare and personal care sectors.

- Q2 2024: Aicello Corporation Announces Strategic Partnership with European Detergent Brand for Water-Soluble Pods Aicello Corporation entered into a partnership with a leading European detergent manufacturer to supply water-soluble pod packaging for its new eco-friendly laundry product line.

- Q2 2024: Sekisui Chemical Co., Ltd. Unveils Next-Generation Water-Soluble Film for Pods Packaging Sekisui Chemical Co., Ltd. launched a next-generation water-soluble film with enhanced solubility and strength, aimed at improving the performance of pods packaging in both homecare and industrial applications.

- Q1 2024: Unilever Pilots Water-Soluble Pods for Dishwashing in UK Market Unilever began a pilot program in the UK to test water-soluble pods for dishwashing products, part of its broader sustainability initiative to reduce plastic waste in packaging.

- Q2 2024: Procter & Gamble Invests in New Water-Soluble Pods Manufacturing Line in France Procter & Gamble announced a multi-million euro investment to establish a new manufacturing line for water-soluble pods at its French facility, aiming to meet growing European demand for sustainable packaging.

- Q2 2024: Henkel Partners with Packaging Startup to Develop Biodegradable Water-Soluble Pods Henkel entered a partnership with a packaging technology startup to co-develop biodegradable water-soluble pods for its laundry and cleaning product lines.

- Q1 2024: Aicello Corporation Opens New R&D Center for Water-Soluble Packaging Innovation Aicello Corporation inaugurated a new research and development center focused on advancing water-soluble packaging materials and applications.

- Q2 2024: Procter & Gamble Launches Plant-Based Water-Soluble Pods for North American Market Procter & Gamble introduced a new line of plant-based water-soluble pods for laundry applications, targeting environmentally conscious consumers in North America.

- Q1 2024: EcoPack Solutions Raises $20 Million Series B to Scale Water-Soluble Pods Production EcoPack Solutions, a startup specializing in water-soluble pods packaging, secured $20 million in Series B funding to expand its manufacturing capacity and accelerate product development.

- Q2 2024: Dow Chemical Announces Collaboration with Major Detergent Brand for Water-Soluble Pods Dow Chemical entered a collaboration with a major global detergent brand to supply advanced water-soluble film technology for the brand’s next-generation pods.

- Q1 2024: GreenPods Technologies Secures Patent for Novel Water-Soluble Packaging Material GreenPods Technologies received a patent for its innovative water-soluble packaging material, designed to improve pod integrity and dissolution performance in various applications.

Future Outlook

Water Soluble Pods Packaging Market Future Outlook

The Global Water Soluble Pods Packaging Market is projected to grow at a 20.00% CAGR from 2025 to 2035, driven by sustainability trends, consumer demand for convenience, and advancements in biodegradable materials.

New opportunities lie in:

- Develop innovative formulations for eco-friendly pod materials to enhance market appeal.

- Expand distribution channels in emerging markets to capture new consumer segments.

- Invest in R&D for multifunctional pods that cater to diverse household needs.

By 2035, the market is expected to achieve substantial growth, reflecting evolving consumer preferences and technological advancements.

Market Segmentation

Water Soluble Pods Packaging Product Outlook (USD Billion, 2018-2032)

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

Water Soluble Pods Packaging End User Outlook (USD Billion, 2018-2032)

- Detergents

- Hand Wash

- Dishwash

- Others

Water Soluble Pods Packaging Material Outlook (USD Billion, 2018-2032)

- Poly Vinyl Alcohol

- Others

Water Soluble Pods Packaging Regional Outlook (USD Billion, 2018-2032)

- US

- Canada

Water Soluble Pods Packaging Thickness Outlook (USD Billion, 2018-2032)

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 0.28 Billion |

| Market Size 2025 | USD 0.33 Billion |

| Market Size 2035 | 2.05 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 20.00% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2020-2024 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | End User, Material, Thickness, Product, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | NOBLE INDUSTRIES (U.S.), Aicello Corporation (Japan), Mitsubishi Chemical Corporation (Japan), MonoSol, LLC (Japan), SEKISUI CHEMICAL CO., LTD. (Japan), Mondi Group (U.K.), Arrow Greentech Ltd, (India), Cortec Corporation (U.S.), Guangdong Proudly New Material Technology Corp. (China), Aquapak (U.K.), Soltec Development (Spain), Jiangmen Cinch Packaging Materials Co., Ltd. (China), Changzhou Water Soluble Co., Ltd. (China), Fujian Zhongsu Biodegradable Films Co., Ltd. (China), Amtrex Nature Care Pvt. Ltd. (India) |

| Key Market Opportunities | Water-soluble packaging advancements |

| Key Market Dynamics | Rapid development of sustainable and eco-friendly detergent products |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the water soluble pods packaging market?

The water soluble pods packaging market size was valued at USD 0.2 Billion in 2022.

What is the growth rate of the water soluble pods packaging market?

The market is projected to grow at a CAGR of 20.00% during the forecast period, 2025-2034.

Which region held the largest market share in the water soluble pods packaging market?

North America had the largest share in the market

Who are the key players in the water soluble pods packaging market?

The key players in the market are NOBLE INDUSTRIES (U.S.), Aicello Corporation (Japan), Mitsubishi Chemical Corporation (Japan), MonoSol, LLC (Japan), SEKISUI CHEMICAL CO., LTD. (Japan), Mondi Group (U.K.), Arrow Greentech Ltd, (India), Cortec Corporation (U.S.), Guangdong Proudly New Material Technology Corp. (China), Aquapak (U.K.), Soltec Development (Spain), Jiangmen Cinch Packaging Materials Co., Ltd. (China), Changzhou Water Soluble Co., Ltd. (China), Fujian Zhongsu Biodegradable Films Co., Ltd. (China), Amtrex Nature Care Pvt. Ltd. (India).

Which material led the water soluble pods packaging market?

The poly vinyl alcohol category dominated the market in 2022.

Which end user had the largest market share in the water soluble pods packaging market?

The detergents category had the largest share in the market

-

Table of Contents

-

Executive Summary

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumptions

- Limitations

-

Research Methodology

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value Chain Analysis

-

Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT

- Overview

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

-

GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL

- Overview

- Poly Vinyl Alcohol

- Others

-

GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS

- Overview

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

-

GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, BY END USER

- Overview

- Detergents

- Hand Wash

- Dishwash

- Others

-

GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, BY REGION

- Overview

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market Share Analysis

- Major Growth Strategy in the Global Water soluble pods packaging Market,

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Global Water soluble pods packaging Market,

-

Key developments and Growth Strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales & Operating Income, 2022

- Major Players R&D Expenditure. 2022

-

COMPANY PROFILES

-

NOBLE INDUSTRIES (U.S.)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Aicello Corporation (Japan)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Mitsubishi Chemical Corporation (Japan)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

MONOSOL, LLC (JAPAN)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

SEKISUI CHEMICAL CO., LTD. (JAPAN)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Mondi Group (U.K.)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

ARROW GREENTECH LTD, (INDIA)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

CORTEC CORPORATION (U.S.)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Guangdong Proudly New Material Technology Corp. (China)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Aquapak (U.K.)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Soltec Development (Spain)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Jiangmen Cinch Packaging Materials Co., Ltd. (China)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Changzhou Water Soluble Co., Ltd. (China)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Fujian Zhongsu Biodegradable Films Co., Ltd. (China)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Amtrex Nature Care Pvt. Ltd. (India)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

NOBLE INDUSTRIES (U.S.)

-

APPENDIX

- References

- Related Reports

-

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, SYNOPSIS, 2025-2034

- TABLE 2 GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, ESTIMATES & FORECAST, 2025-2034 (USD BILLION)

- TABLE 3 GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 4 GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 5 GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 6 GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 7 NORTH AMERICA: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 8 NORTH AMERICA: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 9 NORTH AMERICA: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 10 NORTH AMERICA: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 11 US: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 12 US: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 13 US: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 14 US: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 15 CANADA: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 16 CANADA: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 17 CANADA: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 18 CANADA: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 1 EUROPE: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 2 EUROPE: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 3 EUROPE: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 4 EUROPE: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 5 GERMANY: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 6 GERMANY: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 7 GERMANY: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 8 GERMANY: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 9 FRANCE: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 10 FRANCE: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 11 FRANCE: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 12 FRANCE: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 13 ITALY: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 14 ITALY: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 15 ITALY: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 16 ITALY: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 17 SPAIN: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 18 SPAIN: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 19 SPAIN: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 20 SPAIN: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 21 UK: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 22 UK: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 23 UK: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 24 UK: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 25 REST OF EUROPE: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 26 REST OF EUROPE: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 27 REST OF EUROPE: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 28 REST OF EUROPE: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 29 ASIA-PACIFIC: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 30 ASIA-PACIFIC: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 31 ASIA-PACIFIC: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 32 ASIA-PACIFIC: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 33 JAPAN: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 34 JAPAN: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 35 JAPAN: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 36 JAPAN: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 37 CHINA: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 38 CHINA: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 39 CHINA: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 40 CHINA: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 41 INDIA: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 42 INDIA: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 43 INDIA: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 44 INDIA: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 45 AUSTRALIA: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 46 AUSTRALIA: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 47 AUSTRALIA: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 48 AUSTRALIA: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 49 SOUTH KOREA: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 50 SOUTH KOREA: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 51 SOUTH KOREA: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 52 SOUTH KOREA: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 53 REST OF ASIA-PACIFIC: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 54 REST OF ASIA-PACIFIC: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 55 REST OF ASIA-PACIFIC: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 56 REST OF ASIA-PACIFIC: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 57 REST OF THE WORLD: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 58 REST OF THE WORLD: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 59 REST OF THE WORLD: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 60 REST OF THE WORLD: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 61 MIDDLE EAST: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 62 MIDDLE EAST: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 63 MIDDLE EAST: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 64 MIDDLE EAST: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 65 AFRICA: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 66 AFRICA: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 67 AFRICA: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 68 AFRICA: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION)

- TABLE 69 LATIN AMERICA: WATER SOLUBLE PODS PACKAGING MARKET, BY PRODUCT, 2025-2034 (USD BILLION)

- TABLE 70 LATIN AMERICA: WATER SOLUBLE PODS PACKAGING MARKET, BY MATERIAL, 2025-2034 (USD BILLION)

- TABLE 71 LATIN AMERICA: WATER SOLUBLE PODS PACKAGING MARKET, BY THICKNESS, 2025-2034 (USD BILLION)

- TABLE 72 LATIN AMERICA: WATER SOLUBLE PODS PACKAGING MARKET, BY END USER, 2025-2034 (USD BILLION) LIST OF FIGURES

- FIGURE 1 RESEARCH PROCESS

- FIGURE 2 MARKET MATERIAL FOR THE GLOBAL WATER SOLUBLE PODS PACKAGING MARKET

- FIGURE 3 MARKET DYNAMICS FOR THE GLOBAL WATER SOLUBLE PODS PACKAGING MARKET

- FIGURE 4 GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, SHARE (%), BY PRODUCT, 2022

- FIGURE 5 GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, SHARE (%), BY MATERIAL, 2022

- FIGURE 6 GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, SHARE (%), BY THICKNESS, 2022

- FIGURE 7 GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, SHARE (%), BY END USER, 2022

- FIGURE 8 GLOBAL WATER SOLUBLE PODS PACKAGING MARKET, SHARE (%), BY REGION, 2022

- FIGURE 9 NORTH AMERICA: WATER SOLUBLE PODS PACKAGING MARKET, SHARE (%), BY REGION, 2022

- FIGURE 10 EUROPE: WATER SOLUBLE PODS PACKAGING MARKET, SHARE (%), BY REGION, 2022

- FIGURE 11 ASIA-PACIFIC: WATER SOLUBLE PODS PACKAGING MARKET, SHARE (%), BY REGION, 2022

- FIGURE 12 REST OF THE WORLD: WATER SOLUBLE PODS PACKAGING MARKET, SHARE (%), BY REGION, 2022

- FIGURE 13 GLOBAL WATER SOLUBLE PODS PACKAGING MARKET: COMPANY SHARE ANALYSIS, 2022 (%)

- FIGURE 14 NOBLE INDUSTRIES (U.S.): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 15 NOBLE INDUSTRIES (U.S.): SWOT ANALYSIS

- FIGURE 16 AICELLO CORPORATION (JAPAN): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 17 AICELLO CORPORATION (JAPAN): SWOT ANALYSIS

- FIGURE 18 MITSUBISHI CHEMICAL CORPORATION (JAPAN): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 19 MITSUBISHI CHEMICAL CORPORATION (JAPAN): SWOT ANALYSIS

- FIGURE 20 MONOSOL, LLC (JAPAN): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 21 MONOSOL, LLC (JAPAN): SWOT ANALYSIS

- FIGURE 22 SEKISUI CHEMICAL CO., LTD. (JAPAN).: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 23 SEKISUI CHEMICAL CO., LTD. (JAPAN).: SWOT ANALYSIS

- FIGURE 24 MONDI GROUP (U.K.): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 25 MONDI GROUP (U.K.): SWOT ANALYSIS

- FIGURE 26 ARROW GREENTECH LTD, (INDIA): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 27 ARROW GREENTECH LTD, (INDIA): SWOT ANALYSIS

- FIGURE 28 CORTEC CORPORATION (U.S.): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 29 CORTEC CORPORATION (U.S.): SWOT ANALYSIS

- FIGURE 30 GUANGDONG PROUDLY NEW MATERIAL TECHNOLOGY CORP. (CHINA): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 31 GUANGDONG PROUDLY NEW MATERIAL TECHNOLOGY CORP. (CHINA): SWOT ANALYSIS

- FIGURE 32 AQUAPAK (U.K.): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 33 AQUAPAK (U.K.): SWOT ANALYSIS

- FIGURE 34 SOLTEC DEVELOPMENT (SPAIN): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 35 SOLTEC DEVELOPMENT (SPAIN): SWOT ANALYSIS

- FIGURE 36 JIANGMEN CINCH PACKAGING MATERIALS CO., LTD. (CHINA): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 37 JIANGMEN CINCH PACKAGING MATERIALS CO., LTD. (CHINA): SWOT ANALYSIS

- FIGURE 38 CHANGZHOU WATER SOLUBLE CO., LTD. (CHINA): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 39 CHANGZHOU WATER SOLUBLE CO., LTD. (CHINA): SWOT ANALYSIS

- FIGURE 40 FUJIAN ZHONGSU BIODEGRADABLE FILMS CO., LTD. (CHINA): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 41 FUJIAN ZHONGSU BIODEGRADABLE FILMS CO., LTD. (CHINA): SWOT ANALYSIS

- FIGURE 42 AMTREX NATURE CARE PVT. LTD. (INDIA): FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 43 AMTREX NATURE CARE PVT. LTD. (INDIA): SWOT ANALYSIS

Water Soluble Pods Packaging Market Segmentation

Water Soluble Pods Packaging End User Outlook (USD Billion, 2018-2032)

- Detergents

- Hand Wash

- Dishwash

- Others

Water Soluble Pods Packaging Material Outlook (USD Billion, 2018-2032)

- Poly Vinyl Alcohol

- Others

Water Soluble Pods Packaging Thickness Outlook (USD Billion, 2018-2032)

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

Water Soluble Pods Packaging Product Outlook (USD Billion, 2018-2032)

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

Water Soluble Pods Packaging Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

- North America Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- North America Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- North America Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- North America Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

US Outlook (USD Billion, 2018-2032)

- US Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- US Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- US Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- US Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

Mexico Outlook (USD Billion, 2018-2032)

- Mexico Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- Mexico Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- Mexico Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- Mexico Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

- North America Water Soluble Pods Packaging by End User

Europe Outlook (USD Billion, 2018-2032)

- Europe Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- Europe Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- Europe Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- Europe Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

Germany Outlook (USD Billion, 2018-2032)

- Germany Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- Germany Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- Germany Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- Germany Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

France Outlook (USD Billion, 2018-2032)

- France Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- France Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- France Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- France Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

UK Outlook (USD Billion, 2018-2032)

- UK Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- UK Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- UK Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- UK Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

ITALY Outlook (USD Billion, 2018-2032)

- ITALY Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- ITALY Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- ITALY Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- ITALY Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

SPAIN Outlook (USD Billion, 2018-2032)

- Spain Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- Spain Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- Spain Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- Spain Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

Rest Of Europe Outlook (USD Billion, 2018-2032)

- Rest Of Europe Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- REST OF EUROPE Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- REST OF EUROPE Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- REST OF EUROPE Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

- Europe Water Soluble Pods Packaging by End User

Asia-Pacific Outlook (USD Billion, 2018-2032)

- Asia-Pacific Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- Asia-Pacific Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- Asia-Pacific Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- Asia-Pacific Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

China Outlook (USD Billion, 2018-2032)

- China Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- China Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- China Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- China Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

Japan Outlook (USD Billion, 2018-2032)

- Japan Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- Japan Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- Japan Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- Japan Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

India Outlook (USD Billion, 2018-2032)

- India Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- India Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- India Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- India Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

Australia Outlook (USD Billion, 2018-2032)

- Australia Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- Australia Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- Australia Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- Australia Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

- Rest of Asia-Pacific Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- Rest of Asia-Pacific Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- Rest of Asia-Pacific Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- Rest of Asia-Pacific Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

- Asia-Pacific Water Soluble Pods Packaging by End User

Rest of the World Outlook (USD Billion, 2018-2032)

- Rest of the World Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- Rest of the World Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- Rest of the World Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- Rest of the World Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

Middle East Outlook (USD Billion, 2018-2032)

- Middle East Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- Middle East Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- Middle East Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- Middle East Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

Africa Outlook (USD Billion, 2018-2032)

- Africa Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- Africa Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- Africa Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- Africa Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

Latin America Outlook (USD Billion, 2018-2032)

- Latin America Water Soluble Pods Packaging by End User

- Detergents

- Hand Wash

- Dishwash

- Others

- Latin America Water Soluble Pods Packaging by Material

- Poly Vinyl Alcohol

- Others

- Latin America Water Soluble Pods Packaging by Thickness

- Below 30 Micro Meter

- 31-60 Micro Meter

- 61 Micro Meter Thickness

- Latin America Water Soluble Pods Packaging by Product

- Single Layer Water Pods

- Dual Layer Water Pods

- Multi Chamber Water Pods

- Rest of the World Water Soluble Pods Packaging by End User

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment