Water Soluble Fertilizers Size

Market Size Snapshot

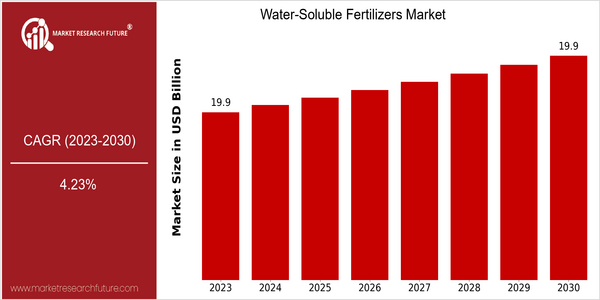

| Year | Value |

|---|---|

| 2023 | USD 19.89 Billion |

| 2030 | USD 19.89 Billion |

| CAGR (2023-2030) | 4.23 % |

Note – Market size depicts the revenue generated over the financial year

The global water-soluble fertilizers market is currently valued at USD 19.89 billion in 2023, with projections indicating a steady market size of USD 19.89 billion by 2030, reflecting a compound annual growth rate (CAGR) of 4.23% during the forecast period. This stability in market size suggests a mature sector that is experiencing gradual growth driven by increasing agricultural productivity demands and the rising adoption of precision farming techniques. The market's growth trend is indicative of a shift towards more efficient nutrient delivery systems, which are essential for enhancing crop yields and sustainability in agricultural practices. Several factors are propelling this market forward, including advancements in fertilizer formulations and the growing emphasis on sustainable agriculture. Innovations such as controlled-release fertilizers and the integration of smart technologies in farming are enhancing the effectiveness of water-soluble fertilizers. Key players in the industry, such as Nutrien Ltd., Yara International, and Haifa Group, are actively engaging in strategic initiatives, including partnerships and investments in research and development, to introduce new products that cater to the evolving needs of farmers. These efforts not only aim to improve crop nutrition but also align with global sustainability goals, further solidifying the market's growth trajectory.

Regional Market Size

Regional Deep Dive

The Water-Soluble Fertilizers Market is experiencing significant growth across various regions, driven by increasing agricultural productivity demands and the shift towards precision farming techniques. In North America, Europe, Asia-Pacific, the Middle East and Africa, and Latin America, the market dynamics are influenced by factors such as technological advancements, regulatory frameworks, and changing consumer preferences towards sustainable agricultural practices. Each region presents unique opportunities and challenges, with varying levels of adoption of water-soluble fertilizers based on local agricultural practices and economic conditions.

Europe

- In Europe, the market is heavily influenced by the European Union's Green Deal, which aims to make agriculture more sustainable, thereby increasing the demand for environmentally friendly fertilizers, including water-soluble varieties.

- Key players like BASF and Haifa Group are investing in research and development to create advanced formulations that meet the stringent regulatory standards set by the EU, which is expected to enhance market growth.

Asia Pacific

- The Asia-Pacific region is witnessing rapid growth in the water-soluble fertilizers market, driven by the increasing population and the need for higher agricultural yields, with companies like ICL and Yara International expanding their presence in countries like India and China.

- Government initiatives in countries such as India, promoting the use of modern agricultural techniques and fertilizers, are expected to significantly boost the adoption of water-soluble fertilizers in the region.

Latin America

- Latin America is experiencing a surge in the adoption of water-soluble fertilizers, particularly in Brazil and Argentina, where the agricultural sector is rapidly modernizing and seeking efficient nutrient solutions.

- Local companies, along with international players like Mosaic and Yara, are focusing on developing tailored products that cater to the specific needs of crops in the region, which is expected to drive market growth.

North America

- The adoption of water-soluble fertilizers in North America is being propelled by the increasing trend of precision agriculture, with companies like Nutrien and Yara North America leading the charge in innovation and product development.

- Recent regulatory changes, such as the Environmental Protection Agency's (EPA) initiatives to promote sustainable farming practices, are encouraging farmers to adopt more efficient fertilizer solutions, including water-soluble options.

Middle East And Africa

- In the Middle East and Africa, the market is shaped by the need for efficient water management in agriculture, with water-soluble fertilizers being favored for their ability to enhance nutrient uptake in arid conditions.

- Organizations like the Food and Agriculture Organization (FAO) are promoting sustainable agricultural practices, which include the use of water-soluble fertilizers, to improve food security in the region.

Did You Know?

“Did you know that water-soluble fertilizers can increase nutrient uptake efficiency by up to 30% compared to traditional fertilizers, making them a preferred choice for modern farming practices?” — International Fertilizer Association (IFA)

Segmental Market Size

The Water-Soluble Fertilizers segment plays a crucial role in the agricultural sector, particularly in enhancing crop yield and quality. This segment is currently experiencing growth, driven by increasing demand for efficient nutrient delivery systems in agriculture. Key factors propelling this demand include the rising need for sustainable farming practices and the growing adoption of precision agriculture technologies that optimize resource use. Currently, the adoption of water-soluble fertilizers is in a mature phase, with notable leaders such as Yara International and Haifa Group implementing advanced formulations in various regions, including North America and Europe. Primary applications include fertigation in greenhouse farming and hydroponics, where precise nutrient management is essential. Trends such as the push for organic farming and government initiatives promoting sustainable agriculture further catalyze growth in this segment. Additionally, innovations in formulation technologies, such as controlled-release and slow-release fertilizers, are shaping the future landscape of water-soluble fertilizers, enhancing their effectiveness and environmental compatibility.

Future Outlook

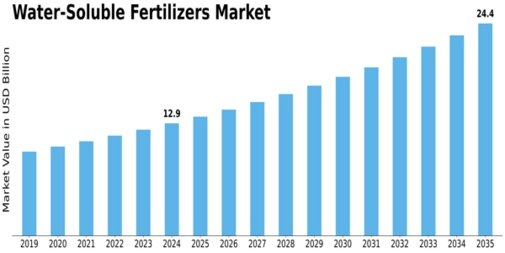

The Water-Soluble Fertilizers Market is poised for steady growth from 2023 to 2030, with a projected compound annual growth rate (CAGR) of 4.23%. This growth trajectory is expected to elevate the market value from approximately $19.89 billion in 2023 to around $25.00 billion by 2030. The increasing demand for high-efficiency fertilizers, driven by the need for enhanced agricultural productivity and sustainable farming practices, will be a significant factor in this expansion. As global populations rise and arable land decreases, the adoption of water-soluble fertilizers is anticipated to increase, with penetration rates expected to reach 30% in key agricultural regions by 2030, up from 20% in 2023. Key technological advancements, such as the development of slow-release formulations and precision agriculture techniques, will further bolster market growth. Additionally, supportive government policies aimed at promoting sustainable agriculture and reducing chemical runoff are likely to encourage the adoption of water-soluble fertilizers. Emerging trends, including the integration of digital farming solutions and the increasing popularity of organic and bio-based fertilizers, will also shape the market landscape. As stakeholders in the agricultural sector continue to prioritize efficiency and sustainability, the water-soluble fertilizers market is set to become a cornerstone of modern agricultural practices.

Leave a Comment