Water Soluble Fertilizer Market Share

Water Soluble Fertilizer Market Research Report Information By Product Type (Nitrogenous, Micronutrients, Phosphatic, and Potassium), Field Type (Fields and Horticulture Crops), Application (Fertigation and Foliar), and By Region (North America, Europe, Asia-Pacific, and the Rest of the World) - Forecast Till 2035

Market Summary

As per Market Research Future Analysis, the Water Soluble Fertilizer Market was valued at USD 21258.85 million in 2024 and is projected to grow to USD 0.00 million by 2035, with a CAGR of 0.00% from 2025 to 2035. The increasing population and government investments in agriculture are driving demand for water-soluble fertilizers. The nitrogenous segment dominated the market in 2021, contributing USD 6,624.1 million, while horticulture crops accounted for 65-70% of market revenue. Fertigation is the leading application method, holding 55-60% of the market share.

Key Market Trends & Highlights

The market is witnessing significant trends driven by consumer preferences and agricultural practices.

- Rising demand for high-value crops and organic agriculture is boosting market growth.

- Nitrogenous fertilizers accounted for 38.13% of the market share in 2021, with a projected CAGR of 7.8%.

- Horticulture crops are expected to grow at a CAGR of 7.4%, driven by government investments.

- Fertigation, contributing 55-60% of market revenue, is anticipated to grow at a CAGR of 7.3%.

Market Size & Forecast

| 2024 Market Size | USD 21258.85 Billion |

| 2035 Market Size | USD 0.00 million |

| CAGR (2023-2035) | 0.00% |

| Largest Regional Market Share | Asia-Pacific. |

Major Players

Key players include The Mosaic Company, Yara International, Eurochem Group, Coromandel International, Nutrien Ltd., SQM S.A, Qatar Fertilizer Company, Koch Industries, Inc., and Haifa Negev Technologies Ltd.

Market Trends

There is a rising demand for high-value crops and organic agriculture as consumers become more aware of the health and environmental benefits of these products. The consumers rising awareness regarding organic farming has created lucrative growth for organic fertilizers. Key manufacturers in the market have started manufacturing environment-friendly fertilizers products by using natural and non-harmful materials. High-value crops are crops that are typically sold at a higher price due to their unique characteristics or attributes, such as flavor, quality, or nutritional content.

These crops can include specialty fruits and vegetables, herbs, and spices, as well as niche crops such as quinoa and kale. Organic agriculture refers to a production system that emphasizes the use of natural fertilizers and processes, rather than synthetic chemicals, to grow crops and raise livestock. Organic agriculture aims to promote soil health and biodiversity, reduce pollution, and minimize the negative impacts of farming on the environment. Demand for high-value crops and organic agriculture has increased in recent years as consumers become more interested in the health and environmental impacts of their food choices.

In addition, the trend toward plant-based and sustainable diets has also contributed to the demand for these products. For Instance, According to FiBL, Europe's total farmland's organic area share grew from 3.1% in 2018 to 3.4% in 2020. Similarly, in Latin America, the percentage of organic farming rose from 1.1% in 2018 to 1.4% in 2020. The need for fertilizers is growing with an increasing demand for organic food items.

The water-soluble fertilizers demand is projected to witness continuous growth during the forthcoming years due to the rising requirement of specialty fertilizers to enhance the production of high-quality crops. The growing world population in several developing and under-developed countries has raised concerns over food security and existing food production solutions. Growing initiatives by the government to promote specialty fertilizers and the launch of programs to educate farmers about the novel fertilizer type and its benefits will aid the market growth.

The increasing adoption of precision agriculture techniques is driving a notable rise in the demand for water soluble fertilizers, as they provide essential nutrients in a readily available form, thereby enhancing crop yield and quality.

United States Department of Agriculture (USDA)

Water Soluble Fertilizer Market Market Drivers

Rising Demand for High-Quality Crops

The Global Water Soluble Fertilizer Market Industry experiences a surge in demand driven by the increasing need for high-quality crops. As global populations grow, the pressure on agricultural productivity intensifies. Water soluble fertilizers provide essential nutrients that enhance crop yield and quality, making them a preferred choice among farmers. In 2024, the market is projected to reach 20.7 USD Billion, reflecting the growing adoption of advanced agricultural practices. This trend is likely to continue, as farmers seek to maximize their output and meet the nutritional needs of a burgeoning population.

Market Segment Insights

Water Soluble Fertilizer Product Type Insights

Figure 2: Water Soluble Fertilizer Market, By Product Type, 2021 & 2032 (USD Million)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Water Soluble Fertilizer Field Type Insights

Based on field type, the Water Soluble Fertilizer market segmentation includes fields and horticulture crops. The horticulture crops segment held the majority share in 2021 contributing to around ~65-70% of the Water Soluble Fertilizer market revenue. Horticultural crops are utilized to improve the living environment and diversify human meals. Examples of horticultural crops include fruits, vegetables, flowers, ornamentals, and lawn grasses. These crops are often grown on a smaller scale and with more intensive management than agronomic crops. Some horticultural plants are raised for their aesthetic appeal and recreational purposes.

Besides this, the growing government investment in order to boost the horticulture sector is likely to increase the demand as well as sales of water-soluble fertilizers in the upcoming years which in turn would boost its market growth. For instance, in October 2022, The Environment Secretary announced a further USD 15.04 million investment in automation and robotics through the Farming Innovation Programme, in addition to the more than USD 84.25 million already spent on industry-led research and development.

The fund will match funds for initiatives that will promote economic growth, ensure food security, and uphold environmental obligations under the name "UK Research and Innovation" (UKRI). Robots that search for fruits and vegetables, automated vegetable harvesters, and novel types of fertilizer are examples of previous supported initiatives. The Horticulture crops segment is expected to grow at a market CAGR of 7.4%.

Water Soluble Application Gender Insights

Based on application, the Water Soluble Fertilizer market segmentation includes fertigation and foliar. The fertigation segment held the majority share in 2021 contributing to around ~55-60% of the Water Soluble Fertilizer market revenue. Fertigation is the process of applying fertilizers or nutrients through an irrigation system to an agricultural system. The nutrient inputs are dissolved in water and then immediately absorbed by plants when they take up water. Farmers in ancient Rome actually used sewage to water their crops, but the name has changed greatly since then.

It is a combination of the terms "fertilizer" and "irrigation," and it has been around as a concept for hundreds of years. Moreover, sprinkler, drip, and soaker irrigation systems are just a few of the irrigation techniques that can be utilized in conjunction with fertigation, but drip irrigation is the most advantageous and compatible. Fertigation is thought to be the most exact and regulated way to apply fertilizer when compared to band or broadcast approaches, and it often requires less fertilizer overall than other methods.

Fertigation is also frequently used in soilless or hydroponic growth systems because it is by far the simplest method for giving plants in these environments the precise nourishment they require. Due to their significance in the growth and development of plants, phosphorus, potassium, and nitrogen are the most often employed substances in fertigation systems owing to their importance in the growth and development of crops. Besides this, the various benefits offered by the fertigation system are likely to increase its demand among farmers in the upcoming years which in turn would boost its market growth.

The fertigation segment is expected to grow at a market CAGR of 7.3%.

Get more detailed insights about Water Soluble Fertilizer Market Research Report—Global Forecast till 2032

Regional Insights

By Region, the study segments the market into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific Water Soluble Fertilizer market has held the largest market share among the region in the Water Soluble Fertilizer market. Asia-Pacific is the most populated region in the world, consisting of some of the major economies, including China, India, Japan and others. The growing innovations by major players operating in the region are likely to create huge opportunities for its market growth. For instance, in October 2020, Gujarat State Fertilizer and Chemicals India Ltd launched calcium nitrate and boronated calcium nitrate.

In agriculture, calcium nitrate is used as a water-soluble fertilizer. Additionally, this chemical is utilized to strengthen cement concrete as well as for wastewater treatment. Furthermore, in July 2018, Transworld Furtichem Pvt. Ltd, a significant fertilizer manufacturer in India, and Compo Expert Gmbh, a leading producer of specialty fertilizers for commercial use and a portfolio company of the international private equity firm XIO Group with its London headquarters, have agreed to a strategic partnership. Transworld Furtichem will cooperate with Compo Expert for the brands NovaTec and Basfoliar in India as a result of this extensive and forward-looking collaboration.

The development of new technologies, localization of production, and joint commercialization of the highly effective, ecologically friendly Compo Expert fertilizer products will be closely coordinated between the parties.

Apart from this, the recent export of various types of water-soluble fertilizer is set to boost its market growth. For instance, according to MRFR analysis, in 2021, India exported more than 84 thousand metric tonnes of nitrogenous fertilizers. The South Asian nation also exported 29.12 thousand metric tonnes of potash and 49.32 thousand metric tonnes of phosphate fertilizers that year. Furthermore, the prices of some water-soluble fertilizers were USD 1102.69/MT, including mono ammonium phosphate, potassium nitrate USD 1123.69/MT and urea phosphate were USD 984.54/MT.

The major countries studied are the US, Canada, Mexico, the UK, France, Germany, Italy, Spain, China, India, Japan, Australia and New Zealand, South America, the Middle East, and Africa.

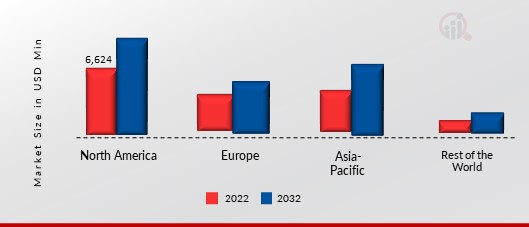

Figure 3: WATER SOLUBLE FERTILIZER MARKET SHARE BY REGION, 2022 & 2032 (USD Million)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

The North American region includes major markets such as the US, Canada, and Mexico. The growing production of various types of fertilizer across the region such as potassium, ammonia, nitrogen and many more is set to positively influence its market growth. For instance, according to the International Fertilizer Association in 2020, ammonia was manufactured in the United States in 36 domestic plants, and it was transported throughout the nation by pipeline, rail, barge, and truck.

The United States produced 11.6% of the world's nitrogen in 2018, placing it second behind China, which produced 24.6% of it, and ahead of India, the third-largest producer with 11.3% of the world's supply. In terms of phosphate output, the U.S. came in second place with 9.9% of worldwide production, below China (37.7%), but ahead of India (9.8%), which generated 9.8% of the world's supply. Canada produced the most potassium potash, accounting for 31.9% of the world's supply. Belarus comes in second place, producing 16.5% of the world's supply.

In addition, the U.S. ranks seventh with a share of roughly 4.6% in nitrogen exports.

Europe basically includes the UK, Germany, France, Italy, Spain, and Rest of the Europe are all included in the analysis of the European market. Europe continues to hold a significant share in the global Water-Soluble Fertilizer market, owing to the presence of major players in the region coupled with the various strategies adopted by them to expand its product portfolio. For instance, in February 2022, EuroChem Group a leading worldwide fertilizer manufacturer announced that, after the submission of a legally binding bid, it has entered into an exclusive agreement to acquire the nitrogen business of the Borealis group.

In the centre of significant crop-producing regions in Austria and France, Borealis runs fertilizer production facilities. Borealis is one of Europe's top fertilizer manufacturers, supplying roughly four million tonnes of products annually in Western, Central, and South East Europe through the Borealis L.A.T distribution network, including approximately 0.08 million tonnes of technical nitrogen solutions and approximately 0.15 million tonnes of melamine. Apart from this, the recent government policies regarding fertilizer are expected to positively influence its market growth.

For example, in July 2019, European Union introduced a new regulation which intends to synchronize standards for all Member States and allow the free circulation of fertilizing products within the European Union.

Key Players and Competitive Insights

The key players are increasing their investment in research & development to innovate and add new features in the water soluble fertilizer which is expected to boost the growth of the market further. In addition, the companies’ strategic initiatives including expansion to new markets that have significant growth potential, entering into long-term contracts and agreements with domestic and international raw material suppliers, mergers and acquisitions, and technological innovation & incorporation in the manufacturing facilities are used by different players in the market to strengthen their presence in the market.

Moreover, the competitors in the water soluble Fertilizer industry must incorporate sustainable materials and production techniques to capitalize on the trend of increasing demand for environment-friendly products across the globe.

One of the key business strategies deployed by the water soluble fertilizer industry to gain a competitive advantage among the competitors is on lowering their environmental footprint and investing in research and development along with strategic growth initiatives such as acquisitions and product launches to strengthen their market position and capture a large consumer base.

The Mosaic Company is a parent company of IMC Global Inc. and the Cargill Crop Nutrition fertilizer business of Cargill. The company is engaged in manufacturing and marketing concentrated phosphate and potash crop nutrients. The company has been organized into three business segments which include Phosphates, Potash, and Mosaic Fertilizantes. The phosphates segment is operated in Florida, which manufactures concentrated phosphate crop nutrients and phosphate-based animal feed ingredients, and processing plants in Louisiana. The potash business segment operates its manufacturing facilities in Canada and the U.S. and its sales include domestic and international sales.

And Mosaic Fertilizantes segment includes five phosphate rock mines, four phosphate chemical plants, and a potash mine in Brazil. The company is serving its products to more than 40 countries, which covers North America & South America business locations in 9 countries

Yara International is a crop nutrition company a produces, distributes, and sells nitrogen-based mineral fertilizers and related industrial products. The company operates in 60 countries globally and the business area comprises the bases chemicals, mining applications, and transport reagents commercial units, with production plants in Germany, Brazil, South Africa, Sweden, France, and Malaysia. The company’s regional segment Europe, the Americas, Asia-Pacific, and Africa operates in a fully integrated setup, compromising production, supply chain, and commercial operations, producing and delivering existing fertilizers solutions, in addition, to commercializing and new offerings under the guidance of Farming Solutions.

The company also owns a few the brands like YaraTera, YaraBela, YaraMila, YaraLiva, YaraVita, YaraRega, and YaraSuna.

Eurochem Group (Eurochem) is a manufacturer of nitrogen, phosphate, and potash fertilizers and also certain industrial and mining products. The company is engaged in activities spanning mining, logistic, fertilizer production, and distribution. The company not only manufactures phosphate fertilizers, and nitrogen fertilizers but also urea, ammonia, ammonium nitrate, urea ammonium nitrate, complex fertilizers, nitrate phosphate, and many more. The company operates its manufacturing facilities in North America, Europe, Asia-Pacific, and Africa. And Russia, Belgium, Lithuania, and China are the countries that are engaged in producing nitrogen, phosphate, and potash fertilizers.

Key Companies in the Water Soluble Fertilizer Market market include

Industry Developments

June 2022: Koch Ag & Energy Solutions (KAES), an American provider of value-added agriculture and energy solutions, “successfully” completed its acquisition of the Jorf Fertilizer Company III (JCF III). JCF III is owned by OCP Group, Morocco’s phosphates mining and fertilizer giant. With this acquisition with Koch has reached a new stage through the establishment of a Moroccan-based Joint-Venture, which confirms the common goal to provide farmers with high-quality and reliable Moroccan phosphate fertilizers.

July 2022: EuroChem Group AG announced that it has entered exclusive negotiations to acquire the nitrogen business of the Borealis group after having submitted a binding offer. This acquisition will result in creating opportunities for further growth in the European market together with Borealis’ company.

October 2019: SQM launches a new water-soluble product for European markets that is potassium nitrate with iodine. Containing 13.7% nitrogen, and 46.3% potassium, Ultrasoline K Plus is backed by more than 100 field trials with growers says the company. This product will deliver distinct benefits for root growth, above-ground plant growth, photosynthesis, nitrogen metabolism, abiotic stress tolerance, and less fruit rot.

Future Outlook

Water Soluble Fertilizer Market Future Outlook

The Global Water Soluble Fertilizer Market is projected to grow at a 7.48% CAGR from 2024 to 2035, driven by increasing agricultural productivity and sustainable farming practices.

New opportunities lie in:

- Develop advanced formulations targeting specific crop needs to enhance yield.

- Leverage digital agriculture technologies for precision application of fertilizers.

- Expand distribution networks in emerging markets to capture new customer segments.

By 2035, the market is expected to exhibit robust growth, reflecting evolving agricultural demands and innovation.

Market Segmentation

Water Soluble Fertilizer Regional Outlook

- US

- Canada

- Mexico

Water Soluble Fertilizer Field Type Outlook

- Fields

- Horticulture Crops

Water Soluble Fertilizer Application Outlook

- Fertigation

- Foliar

Water Soluble Fertilizer Product Type Outlook

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2035 | USD 37,144.16 Million |

| Compound Annual Growth Rate (CAGR) | 0.00% (2025 - 2035) |

| Base Year | 2024 |

| Forecast Period | 2025 - 2035 |

| Historical Data | 2020, 2021 |

| Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product Type, Field Type, Application, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The U.S, Canada, Mexico, the UK, France, Germany, Italy, Spain, China, India, Japan, Australia and New Zealand, South America, the Middle East, and Africa |

| Key Companies Profiled | The Mosaic Company (US), Yara International (Norway), Eurochem Group (Switzerland), Coromandel International (India), Nutrien Ltd. (Canada), SQM S.A (Chile), Qatar Fertilizer Company (Qatar), Koch Industries, Inc. (US), Haifa Negev Technologies Ltd (Israel), and ICL Growing Solutions (Israel) |

| Key Market Opportunities | · Increasing need for agricultural productivity · Numerous benefits provided by water soluble fertilizers |

| Key Market Dynamics | · Strategic Merger and Acquisition |

| Market Size 2024 | 21258.85 |

| Market Size 2025 | 22793.79 |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Water Soluble Fertilizer market?

The Water Soluble Fertilizer market is valued at USD 17,371.3 million in 2021

How Big is the US Water Soluble Fertilizer market?

The US Water Soluble Fertilizer market is valued at 3,343.9 million in 2021

What is the growth rate of the Water Soluble Fertilizer market?

The Water Soluble Fertilizer market is expected to grow at a CAGR of 7.2% during the forecast period

Which region held the largest market share in the Water Soluble Fertilizer market?

Asia Pacific held the largest share market in the Water Soluble Fertilizer market

Who are the key players in the Water Soluble Fertilizer market?

The key players include The Mosaic Company, Yara International, Eurochem Group, Coromandel International, and Nutrien Ltd.

Which Water Soluble Fertilizer product type led the Water Soluble Fertilizer market?

Nitrogenous is the leading segment in the Water Soluble Fertilizer market in 2022,

Which Category had the largest market share in the Water Soluble Fertilizer market?

Which Category had the largest market share in the Water Soluble Fertilizer market?

-

Table of Contents

-

Executive Summary 17

-

MARKET ATTRACTIVENESS ANALYSIS 19

- GLOBAL WATER-SOLUBLE FERTILIZER MARKET, BY PRODUCT TYPE 20

- GLOBAL WATER-SOLUBLE FERTILIZER MARKET, BY FIELD TYPE 21

- GLOBAL WATER-SOLUBLE FERTILIZER MARKET, BY APPLICATION 22

- GLOBAL WATER-SOLUBLE FERTILIZER MARKET, BY REGION 23

-

MARKET ATTRACTIVENESS ANALYSIS 19

-

Market Introduction 24

- DEFINITION 24

- Scope of the Study 24

- RESEARCH OBJECTIVE 24

- MARKET STRUCTURE 25

- KEY BUYING CRITERIA 26

-

Research Methodology 27

- RESEARCH PROCESS 27

- PRIMARY RESEARCH 28

- SECONDARY RESEARCH 29

- MARKET SIZE ESTIMATION 30

- FORECAST MODEL 31

- LIST OF ASSUMPTIONS & LIMITATIONS 32

-

MARKET DYNAMICS 33

- INTRODUCTION 33

-

DRIVERS 34

- HIGH DEMAND FOR HIGH-VALUE CROPS AND ORGANIC AGRICULTURE 34

- NUMEROUS BENEFITS PROVIDED BY WATER SOLUBLE FERTILIZERS 34

- DRIVERS IMPACT ANALYSIS 35

-

RESTRAINT 35

- INCREASING PRICES OF FERTILIZERS 35

- RESTRAINTS IMPACT ANALYSIS 36

-

OPPORTUNITY 36

- INCREASING NEED FOR AGRICULTURAL PRODUCTIVITY 36

-

CHALLENGE 37

- EXPORT RESTRICTIONS 37

-

MARKET FACTOR ANALYSIS 38

-

VALUE CHAIN ANALYSIS 38

- RAW MATERIAL PROCUREMENT 39

- PROCESSING 39

- PACKAGING 39

- SUPPLY CHAIN ANALYSIS 40

-

PORTER’S FIVE FORCES MODEL 41

- THREAT OF NEW ENTRANTS 42

- BARGAINING POWER OF SUPPLIERS 42

- THREAT OF SUBSTITUTES 42

- BARGAINING POWER OF BUYERS 42

- INTENSITY OF RIVALRY 42

-

VALUE CHAIN ANALYSIS 38

-

GLOBAL WATER-SOLUBLE FERTILIZERS MARKET, BY PRODUCT TYPE 43

-

OVERVIEW 43

- GLOBAL WATER-SOLUBLE FERTILIZERS MARKET ESTIMATES & FORECAST, BY PRODUCT TYPE, 2020–2032 44

-

NITROGENOUS 46

- NITROGENOUS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 46

-

MICRONUTRIENTS 47

- MICRONUTRIENTS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 47

-

PHOSPHATIC 48

- PHOSPHATIC: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 49

-

POTASSIUM 50

- POTASSIUM: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 50

-

OVERVIEW 43

-

GLOBAL WATER-SOLUBLE FERTILIZERS MARKET, BY FIELD TYPE 52

-

OVERVIEW 52

- GLOBAL WATER-SOLUBLE FERTILIZERS MARKET ESTIMATES & FORECAST, BY FIELD TYPE, 2020–2032 53

-

FIELDS 53

- FIELDS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 54

- FIELDS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 54

-

HORTICULTURE CROPS 54

- HORTICULTURE CROPS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 55

- HORTICULTURE CROPS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 55

-

OVERVIEW 52

-

GLOBAL WATER-SOLUBLE FERTILIZERS MARKET, BY APPLICATION 56

-

OVERVIEW 56

- GLOBAL WATER-SOLUBLE FERTILIZERS MARKET ESTIMATES & FORECAST, BY APPLICATION, 2020–2032 57

-

FERTIGATION 57

- FERTIGATION: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 58

-

FOLIAR 58

- FOLIAR: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 59

-

OVERVIEW 56

-

GLOBAL WATER-SOLUBLE FERTILIZER MARKET, BY REGION 60

- OVERVIEW 60

-

NORTH AMERICA 62

- US 67

- CANADA 70

- MEXICO 73

-

EUROPE 76

- GERMANY 81

- UK 84

- FRANCE 87

- SPAIN 90

- ITALY 93

- REST OF EUROPE 96

-

ASIA-PACIFIC 99

- CHINA 104

- JAPAN 107

- INDIA 110

- AUSTRALIA & NEW ZEALAND 113

- REST OF ASIA-PACIFIC 116

-

REST OF THE WORLD 119

- SOUTH AMERICA 123

- MIDDLE EAST 126

- AFRICA 129

-

Competitive Landscape 132

- INTRODUCTION 132

- MARKET STRATEGY ANALYSIS 132

-

KEY PLAYERS OPERATING IN THE FIVE COUNTRIES: 132

- US 132

- UK 132

- GERMANY 133

- INDIA 133

- CHINA 133

- COMPETITIVE BENCHMARKING 134

-

KEY DEVELOPMENTS & GROWTH STRATEGIES 135

- NEW PRODUCT LAUNCH 135

- MERGER & ACQUISITIONS 135

-

COMPANY PROFILES 136

-

THE MOSAIC COMPANY 136

- COMPANY OVERVIEW 136

- FINANCIAL OVERVIEW 137

- PRODUCTS OFFERED 137

- KEY DEVELOPMENTS 138

- SWOT ANALYSIS 138

- KEY STRATEGIES 138

-

YARA INTERNATIONAL 139

- COMPANY OVERVIEW 139

- FINANCIAL OVERVIEW 139

- PRODUCTS OFFERED 140

- KEY DEVELOPMENTS 140

- SWOT ANALYSIS 141

- KEY STRATEGIES 141

-

EUROCHEM GROUP 142

- COMPANY OVERVIEW 142

- FINANCIAL OVERVIEW 142

- PRODUCTS OFFERED 142

- KEY DEVELOPMENTS 142

- SWOT ANALYSIS 143

- KEY STRATEGIES 143

-

COROMANDEL INTERNATIONAL 144

- COMPANY OVERVIEW 144

- FINANCIAL OVERVIEW 145

- PRODUCTS OFFERED 146

- KEY DEVELOPMENTS 146

- SWOT ANALYSIS 147

- KEY STRATEGIES 147

-

NUTRIEN LTD. 148

- COMPANY OVERVIEW 148

- FINANCIAL OVERVIEW 148

- PRODUCTS OFFERED 149

- KEY DEVELOPMENTS 149

- SWOT ANALYSIS 149

- KEY STRATEGIES 149

-

SQM S.A. 150

- COMPANY OVERVIEW 150

- FINANCIAL OVERVIEW 150

- PRODUCTS OFFERED 151

- KEY DEVELOPMENTS 151

- KEY STRATEGIES 152

-

QATAR FERTILIZER COMPANY 153

- COMPANY OVERVIEW 153

- FINANCIAL OVERVIEW 153

- PRODUCTS OFFERED 153

- KEY DEVELOPMENTS 153

- KEY STRATEGIES 153

-

KOCH INDUSTRIES, INC. 154

- COMPANY OVERVIEW 154

- FINANCIAL OVERVIEW 154

- PRODUCTS OFFERED 154

- KEY DEVELOPMENTS 154

- KEY STRATEGIES 155

-

HAIFA NEGEV TECHNOLOGIES LTD 156

- COMPANY OVERVIEW 156

- FINANCIAL OVERVIEW 156

- PRODUCTS OFFERED 156

- KEY DEVELOPMENTS 157

- KEY STRATEGIES 157

-

ICL GROWING SOLUTIONS 158

- COMPANY OVERVIEW 158

- FINANCIAL OVERVIEW 158

- PRODUCTS OFFERED 158

- KEY DEVELOPMENTS 159

- KEY STRATEGIES 159

-

THE MOSAIC COMPANY 136

-

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 PRIMARY INTERVIEWS 28

- TABLE 2 LIST OF ASSUMPTIONS & LIMITATIONS 32

- TABLE 3 GLOBAL WATER-SOLUBLE FERTILIZERS MARKET ESTIMATES & FORECAST, BY PRODUCT TYPE, 2020–2032 (USD MILLION) 44

- TABLE 4 GLOBAL WATER-SOLUBLE FERTILIZERS MARKET VOLUME ESTIMATES & FORECAST, BY PRODUCT TYPE, 2020–2032 (KILO TONS) 45

- TABLE 5 NITROGENOUS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (USD MILLION) 46

- TABLE 6 NITROGENOUS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (KILO TON) 46

- TABLE 7 MICRONUTRIENTS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (USD MILLION) 47

- TABLE 8 MICRONUTRIENTS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (KILO TON) 48

- TABLE 9 PHOSPHATIC: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (USD MILLION) 49

- TABLE 10 PHOSPHATIC: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (KILO TONS) 49

- TABLE 11 POTASSIUM: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (USD MILLION) 50

- TABLE 12 POTASSIUM: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (KILO TONS) 50

- TABLE 13 GLOBAL WATER-SOLUBLE FERTILIZERS MARKET ESTIMATES & FORECAST, BY FIELD TYPE, 2020–2032 (USD MILLION) 53

- TABLE 14 GLOBAL WATER-SOLUBLE FERTILIZERS MARKET VOLUME ESTIMATES & FORECAST, BY FIELD TYPE, 2020–2032 (KILO TONS) 53

- TABLE 15 FIELDS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (USD MILLION) 54

- TABLE 16 FIELDS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (KILO TONS) 54

- TABLE 17 HORTICULTURE CROPS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (USD MILLION) 55

- TABLE 18 HORTICULTURE CROPS: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (KILO TONS) 55

- TABLE 19 GLOBAL WATER-SOLUBLE FERTILIZERS MARKET ESTIMATES & FORECAST, BY APPLICATION, 2020–2032 (USD MILLION) 57

- TABLE 20 GLOBAL WATER-SOLUBLE FERTILIZERS MARKET VOLUME ESTIMATES & FORECAST, BY APPLICATION, 2020–2032 (KILO TONS) 57

- TABLE 21 FERTIGATION: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (USD MILLION) 58

- TABLE 22 FERTIGATION: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (KILO TONS) 58

- TABLE 23 FOLIAR: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (USD MILLION) 59

- TABLE 24 FOLIAR: MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (KILO TONS) 59

- TABLE 25 GLOBAL WATER-SOLUBLE FERTILIZER MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (USD MILLION) 61

- TABLE 26 GLOBAL WATER-SOLUBLE FERTILIZER MARKET ESTIMATES & FORECAST, BY REGION, 2020–2032 (KILO TONS) 61

- TABLE 27 NORTH AMERICA: WATER-SOLUBLE FERTILIZER MARKET ESTIMATES & FORECAST, BY COUNTRY, 2020–2032 (USD MILLION) 63

- TABLE 28 NORTH AMERICA: WATER-SOLUBLE FERTILIZER MARKET ESTIMATES & FORECAST, BY COUNTRY, 2020–2032 (KILO TONS) 63

- TABLE 29 NORTH AMERICA: WATER-SOLUBLE FERTILIZER MARKET, BY PRODUCT TYPE, 2020–2032 (USD MILLION) 64

- TABLE 30 NORTH AMERICA: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY PRODUCT TYPE, 2020–2032 (KILO TONS) 65

- TABLE 31 NORTH AMERICA: WATER-SOLUBLE FERTILIZER MARKET, BY FIELD TYPE, 2020–2032 (USD MILLION) 65

- TABLE 32 NORTH AMERICA: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY FIELD TYPE, 2020–2032 (KILO TONS) 66

- TABLE 33 NORTH AMERICA: WATER-SOLUBLE FERTILIZER MARKET, BY APPLICATION, 2020–2032 (USD MILLION) 66

- TABLE 34 NORTH AMERICA: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY APPLICATION, 2020–2032 (KILO TONS) 66

- TABLE 35 US: WATER-SOLUBLE FERTILIZER MARKET, BY PRODUCT TYPE, 2020–2032 (USD MILLION) 67

- TABLE 36 US: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY PRODUCT TYPE, 2020–2032 (KILO TONS) 68

- TABLE 37 US: WATER-SOLUBLE FERTILIZER MARKET, BY FIELD TYPE, 2020–2032 (USD MILLION) 68

- TABLE 38 US: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY FIELD TYPE, 2020–2032 (KILO TONS) 69

- TABLE 39 US: WATER-SOLUBLE FERTILIZER MARKET, BY APPLICATION, 2020–2032 (USD MILLION) 69

- TABLE 40 US: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY APPLICATION, 2020–2032 (KILO TONS) 69

- TABLE 41 CANADA: WATER-SOLUBLE FERTILIZER MARKET, BY PRODUCT TYPE, 2020–2032 (USD MILLION) 70

- TABLE 42 CANADA: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY PRODUCT TYPE, 2020–2032 (KILO TONS) 71

- TABLE 43 CANADA: WATER-SOLUBLE FERTILIZER MARKET, BY FIELD TYPE, 2020–2032 (USD MILLION) 71

- TABLE 44 CANADA: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY FIELD TYPE, 2020–2032 (KILO TONS) 72

- TABLE 45 CANADA: WATER-SOLUBLE FERTILIZER MARKET, BY APPLICATION, 2020–2032 (USD MILLION) 72

- TABLE 46 CANADA: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY APPLICATION, 2020–2032 (KILO TONS) 72

- TABLE 47 MEXICO: WATER-SOLUBLE FERTILIZER MARKET, BY PRODUCT TYPE, 2020–2032 (USD MILLION) 73

- TABLE 48 MEXICO: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY PRODUCT TYPE, 2020–2032 (KILO TONS) 74

- TABLE 49 MEXICO: WATER-SOLUBLE FERTILIZER MARKET, BY FIELD TYPE, 2020–2032 (USD MILLION) 74

- TABLE 50 MEXICO: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY FIELD TYPE, 2020–2032 (KILO TONS) 75

- TABLE 51 MEXICO: WATER-SOLUBLE FERTILIZER MARKET, BY APPLICATION, 2020–2032 (USD MILLION) 75

- TABLE 52 MEXICO: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY APPLICATION, 2020–2032 (KILO TONS) 75

- TABLE 53 EUROPE: WATER-SOLUBLE FERTILIZER MARKET ESTIMATES & FORECAST, BY COUNTRY, 2020–2032 (USD MILLION) 77

- TABLE 54 EUROPE: WATER-SOLUBLE FERTILIZER MARKET ESTIMATES & FORECAST, BY COUNTRY, 2020–2032 (KILO TONS) 77

- TABLE 55 EUROPE: WATER-SOLUBLE FERTILIZER MARKET, BY PRODUCT TYPE, 2020–2032 (USD MILLION) 78

- TABLE 56 EUROPE: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY PRODUCT TYPE, 2020–2032 (KILO TONS) 79

- TABLE 57 EUROPE: WATER-SOLUBLE FERTILIZER MARKET, BY FIELD TYPE, 2020–2032 (USD MILLION) 79

- TABLE 58 EUROPE: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY FIELD TYPE, 2020–2032 (KILO TONS) 80

- TABLE 59 EUROPE: WATER-SOLUBLE FERTILIZER MARKET, BY APPLICATION, 2020–2032 (USD MILLION) 80

- TABLE 60 EUROPE: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY APPLICATION, 2020–2032 (KILO TONS) 80

- TABLE 61 GERMANY: WATER-SOLUBLE FERTILIZER MARKET, BY PRODUCT TYPE, 2020–2032 (USD MILLION) 81

- TABLE 62 GERMANY: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY PRODUCT TYPE, 2020–2032 (KILO TONS) 82

- TABLE 63 GERMANY: WATER-SOLUBLE FERTILIZER MARKET, BY FIELD TYPE, 2020–2032 (USD MILLION) 82

- TABLE 64 GERMANY: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY FIELD TYPE, 2020–2032 (KILO TONS) 83

- TABLE 65 GERMANY: WATER-SOLUBLE FERTILIZER MARKET, BY APPLICATION, 2020–2032 (USD MILLION) 83

- TABLE 66 GERMANY: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY APPLICATION, 2020–2032 (KILO TONS) 83

- TABLE 67 UK: WATER-SOLUBLE FERTILIZER MARKET, BY PRODUCT TYPE, 2020–2032 (USD MILLION) 84

- TABLE 68 UK: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY PRODUCT TYPE, 2020–2032 (KILO TONS) 85

- TABLE 69 UK: WATER-SOLUBLE FERTILIZER MARKET, BY FIELD TYPE, 2020–2032 (USD MILLION) 85

- TABLE 70 UK: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY FIELD TYPE, 2020–2032 (KILO TONS) 86

- TABLE 71 UK: WATER-SOLUBLE FERTILIZER MARKET, BY APPLICATION, 2020–2032 (USD MILLION) 86

- TABLE 72 UK: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY APPLICATION, 2020–2032 (KILO TONS) 86

- TABLE 73 FRANCE: WATER-SOLUBLE FERTILIZER MARKET, BY PRODUCT TYPE, 2020–2032 (USD MILLION) 87

- TABLE 74 FRANCE: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY PRODUCT TYPE, 2020–2032 (KILO TONS) 88

- TABLE 75 FRANCE: WATER-SOLUBLE FERTILIZER MARKET, BY FIELD TYPE, 2020–2032 (USD MILLION) 88

- TABLE 76 FRANCE: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY FIELD TYPE, 2020–2032 (KILO TONS) 89

- TABLE 77 FRANCE: WATER-SOLUBLE FERTILIZER MARKET, BY APPLICATION, 2020–2032 (USD MILLION) 89

- TABLE 78 FRANCE: WATER-SOLUBLE FERTILIZER MARKET VOLUME, BY APPLICATION, 2020–2032 (KILO TONS) 89

- TABLE 79 SPAIN: WATER-SOLUBLE FERTILIZER MARKET, BY

Water Soluble Fertilizer Market Segmentation

Water Soluble Fertilizer Product Type Outlook (USD Million, 2020-2032)

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

Water Soluble Fertilizer Field Type Outlook (USD Million, 2020-2032)

- Fields

- Horticulture Crops

Water Soluble Fertilizer Application Outlook (USD Million, 2020-2032)

- Fertigation

- Foliar

Water Soluble Fertilizer Regional Outlook (USD Million, 2020-2032)

- North America Outlook (USD Million, 2020-2032)

- North America Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- North America Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- North America Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- US Outlook (USD Million, 2020-2032)

- US Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- US Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- US Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- Canada Outlook (USD Million, 2020-2032)

- Canada Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Canada Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- Canada Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- Mexico Outlook (USD Million, 2020-2032)

- Mexico Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Mexico Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- Mexico Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- Europe Outlook (USD Million, 2020-2032)

- Europe Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Europe Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- Europe Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- Germany Outlook (USD Million, 2020-2032)

- Germany Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Germany Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- Germany Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- UK Outlook (USD Million, 2020-2032)

- UK Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- UK Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- UK Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- France Outlook (USD Million, 2020-2032)

- France Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Europe Water Soluble Fertilizer by Product Type

- North America Water Soluble Fertilizer by Product Type

- France Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- France Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- Spain Outlook (USD Million, 2020-2032)

- Spain Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Spain Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- Spain Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- Italy Outlook (USD Million, 2020-2032)

- Italy Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Italy Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- Italy Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- Rest of Europe Outlook (USD Million, 2020-2032)

- Rest of Europe Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Rest of Europe Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- Rest of Europe Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- Asia-Pacific Outlook (USD Million, 2020-2032)

- Asia-Pacific Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Asia-Pacific Water Soluble Fertilizer by Product Type

- Asia-Pacific Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- Asia-Pacific Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- China Outlook (USD Million, 2020-2032)

- China Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- China Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- China Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- Japan Outlook (USD Million, 2020-2032)

- Japan Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Japan Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- Japan Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- India Outlook (USD Million, 2020-2032)

- India Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- India Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- India Water Soluble Fertilizer by Application

- Fertigation

- Fertigation

- Foliar

- Australia & New Zealand Outlook (USD Million, 2020-2032)

- Australia & New Zealand Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Australia & New Zealand Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- Australia & New Zealand Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- Rest of Asia-Pacific Outlook (USD Million, 2020-2032)

- Rest of Asia-Pacific Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Rest of Asia-Pacific Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- Asia-Pacific Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- Rest of the World Outlook (USD Million, 2020-2032)

- Rest of the World Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Rest of the World Water Soluble Fertilizer by Product Type

- Rest of the World Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- Rest of the World Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- South America Outlook (USD Million, 2020-2032)

- South America Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- South America Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- South America Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- The Middle East Outlook (USD Million, 2020-2032)

- The Middle East Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- The Middle East Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- The Middle East Water Soluble Fertilizer by Application

- Fertigation

- Foliar

- Africa Outlook (USD Million, 2020-2032)

- Africa Water Soluble Fertilizer by Product Type

- Nitrogenous

- Micronutrients

- Phosphatic

- Potassium

- Africa Water Soluble Fertilizer by Field Type

- Fields

- Horticulture Crops

- Africa Water Soluble Fertilizer by Application

- Fertigation

- Foliar

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment