Market Trends

Introduction

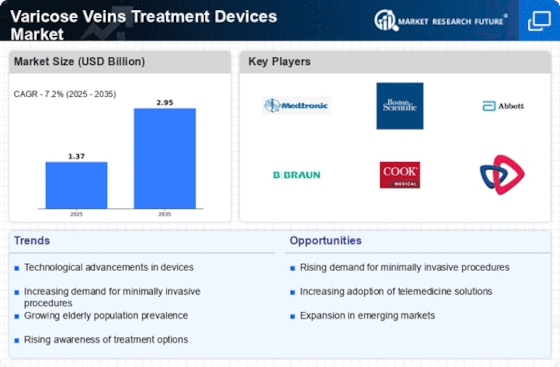

As we progress into 2025, the Varicose Veins Treatment Devices Market is expected to witness significant transformations driven by a confluence of macroeconomic factors. Minimally invasive procedures and laser therapies are reshaping treatment paradigms and enhancing patient outcomes and satisfaction. At the same time, regulatory pressures are intensifying, forcing manufacturers to innovate while adhering to stringent safety and efficacy standards. The market is also influenced by a change in patient behaviour. Awareness of venous health and cosmetic concerns are driving demand for effective treatment options. These factors are crucial for market participants. They will not only determine the direction of product development and market positioning, but also the competitive landscape in an evolving healthcare environment.

Top Trends

-

Minimally Invasive Procedures on the Rise

The smallest possible surgery, endovenous laser treatment (EVLT), is gaining in popularity because of its shorter recovery time and fewer complications. According to industry reports, EVLT has been used by 30 per cent more people in the past three years. In order to improve the effectiveness of the procedure, the leading companies are investing in newer laser technology. This trend will have a positive effect on the cost-effectiveness and patient satisfaction of the treatment, which will also be reflected in future treatment guidelines. -

Technological Advancements in Device Design

The development of biocompatible materials, the integration of smart technology and the design of new devices are transforming treatment possibilities. There are, for example, now products on the market that enable patients to be continuously monitored. This has the potential to improve treatment accuracy and patient compliance. On the basis of a growing amount of individual patient data, a future trend could be towards a more personalised treatment. -

Increased Focus on Patient-Centric Care

In the field of medicine, a change is taking place towards a more patient-oriented care, a more individualized treatment and an improved patient experience. In order to achieve this, more and more health care organizations are adopting patient feedback tools to improve their services. This trend is confirmed by the fact that hospitals implementing this strategy report an increase in patient satisfaction of at least 25 per cent. The future may see the development of new telehealth services for continuous patient engagement. -

Regulatory Support for Innovative Treatments

Regulators are more and more supportive of new therapies, and the approval of new devices is speeded up. For example, the Food and Drug Administration has simplified the approval process for minimally invasive devices, which means that approval is now 40 percent faster. And that is a good thing for companies that want to invest in R&D. Then the treatment possibilities will become wider. Then the competition on the market will also be heightened, and then the technological progress will be accelerated. -

Growing Awareness and Education Initiatives

There has been a notable increase in public education and awareness of the problems of varicose veins and the available treatments. Industry leaders have worked with the health care industry to launch public education programs that have resulted in a 20 per cent increase in patient inquiries about treatment. This is expected to increase the patient population and drive demand for treatment devices. Future efforts may focus on digital platforms to reach a wider audience. -

Integration of Artificial Intelligence in Treatment Planning

Artificial intelligence is being integrated into treatment planning, and this integration is improving both the accuracy of diagnosis and the quality of treatment. Artificial intelligence is being used to analyze data and to make recommendations about treatment. This innovation has the potential to reduce the rate of misdiagnosis by as much as 15 percent. Artificial intelligence is also enabling clinicians to reduce the time spent on administrative tasks. As the technology develops, it will be possible to create even more sophisticated tools to support clinical work. -

Expansion of Outpatient Treatment Facilities

Outpatient clinics are reshaping the provision of varicose vein treatment, enabling patients to have convenient access to the care they need. Recent data show a 35% increase in the number of outpatient clinics offering this service. This trend is driven by the need for cost-effective and effective treatment. Future developments may see hospitals and outpatient clinics working together to improve the delivery of care. -

Sustainability in Device Manufacturing

There are also companies that have a social conscience in the production of devices for the treatment of varicose veins. According to a study, 60 per cent of manufacturers are investing in sustainable materials and processes. Not only do these meet regulatory requirements, they also appeal to environmentally conscious consumers. There is also a shift in the supply chain towards a more sustainable way of working. -

Telemedicine's Role in Post-Treatment Care

Telemedicine is also increasingly used for follow-up care, allowing doctors to monitor patient recovery remotely. A recent survey found that half of all patients prefer teleconsultations for follow-up care. This trend offers patients greater convenience and eases the burden on hospitals. Future developments could see the integration of wearable technology for real-time monitoring. -

Collaborative Research and Development Initiatives

Research and development between industry and university is bringing innovation to varicose vein treatment. Recent collaborations have led to the development of new devices based on the latest technology. The trend is likely to increase the pace of innovation and improve the outcomes of treatment. Future collaborations may focus on unmet clinical needs in the market.

Conclusion: Navigating the Varicose Veins Market Landscape

The market for the treatment of varicose veins is highly competitive and fragmented, with both established and new players vying for market share. The trend towards a greater emphasis on new products and solutions is most marked in North America and Europe, where the well-developed healthcare systems facilitate the introduction of new products. Artificial intelligence (AI) is being increasingly used to increase the accuracy of diagnosis, while automation is being used to reduce the cost of operations. In addition, the focus is increasingly on sustainable products to meet both regulatory requirements and the requirements of consumers. Adapting to the changing needs of patients and their preferences will be essential for the market. This will be the key to securing a leadership position and achieving long-term success in the market.

Leave a Comment