Vacuum Sensors Size

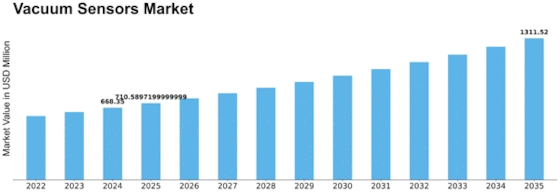

Vacuum Sensors Market Growth Projections and Opportunities

The Vacuum Sensors Market is significantly influenced by various market factors that play a crucial role in shaping its growth and dynamics. One of the primary drivers of this market is the increasing demand for vacuum sensors across diverse industries. As industries continue to evolve and become more technologically advanced, the need for precise and reliable vacuum measurements has surged. Vacuum sensors find applications in sectors such as semiconductor manufacturing, automotive, aerospace, and healthcare, where maintaining specific vacuum levels is essential for optimal performance.

Technological advancements also contribute significantly to the growth of the Vacuum Sensors Market. Ongoing innovations in sensor technology, such as the development of MEMS (Micro-Electro-Mechanical Systems) and smart sensors, have enhanced the performance and efficiency of vacuum sensors. These advancements not only cater to the existing applications but also open doors for new possibilities and use cases. Industries are increasingly adopting advanced vacuum sensor technologies to improve their processes, leading to a positive impact on market expansion.

The global emphasis on energy efficiency and sustainability acts as another driving force for the Vacuum Sensors Market. As industries strive to reduce energy consumption and environmental impact, the implementation of vacuum sensors becomes crucial. These sensors aid in optimizing energy usage by ensuring that vacuum systems operate at the most efficient levels. Consequently, the demand for vacuum sensors has grown as industries seek solutions to meet their sustainability goals while maintaining operational excellence.

Market factors also include the influence of regulatory standards and compliance requirements. Industries must adhere to stringent regulations, particularly in sectors like healthcare and aerospace, where precision and reliability are paramount. Vacuum sensors that meet industry-specific standards and certifications gain a competitive edge, as they instill confidence in end-users regarding the accuracy and safety of their operations. Manufacturers in the Vacuum Sensors Market continually invest in research and development to meet and exceed these regulatory expectations.

Moreover, the market is shaped by economic factors such as global economic conditions, trade policies, and currency fluctuations. Economic stability and growth contribute to increased investments in various industries, fostering the adoption of advanced technologies, including vacuum sensors. On the other hand, economic uncertainties may impact capital expenditure decisions, potentially affecting the pace of market growth.

Competition within the Vacuum Sensors Market is a significant factor that influences product development, pricing strategies, and market share. With several key players vying for market dominance, innovation becomes a key differentiator. Companies focus on developing sensors with enhanced features, better accuracy, and improved durability to gain a competitive advantage. Pricing strategies also play a crucial role, as manufacturers strive to offer cost-effective solutions without compromising on quality.

Leave a Comment