Us Kombucha Size

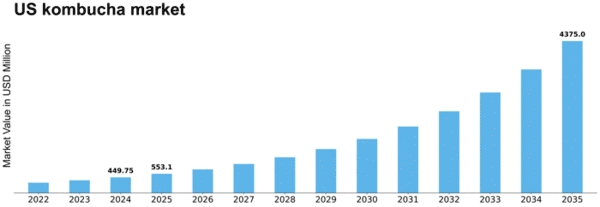

US Kombucha Market Growth Projections and Opportunities

The US kombucha market is influenced by several key market factors that shape its growth, trends, and consumer demand. One significant factor is health consciousness among consumers. As people become increasingly concerned about their well-being, they seek out healthier beverage options, driving the demand for kombucha. This fermented tea is renowned for its probiotic properties and potential health benefits, making it an attractive choice for health-conscious individuals looking to improve their gut health.

Another crucial market factor is changing dietary preferences and lifestyles. With the rise of veganism, vegetarianism, and other alternative diets, there's a growing demand for plant-based products like kombucha. Its natural ingredients and minimal processing appeal to consumers looking for organic and sustainable beverage options. Moreover, as more people adopt holistic approaches to health and wellness, kombucha fits into the narrative of a balanced and mindful lifestyle.

The influence of marketing and branding strategies cannot be overstated in the US kombucha market. Companies invest in creative marketing campaigns to differentiate their products and capture consumers' attention. Eye-catching packaging, compelling brand stories, and endorsements from influencers all play a role in shaping consumer perceptions and driving sales. Effective marketing strategies can also help educate consumers about the benefits of kombucha and dispel any misconceptions surrounding this fermented beverage.

Distribution channels are another important market factor influencing the US kombucha market. While kombucha was once primarily sold in health food stores and specialty shops, it has now become more mainstream, available in supermarkets, convenience stores, and even gas stations. This widespread distribution has significantly expanded the reach of kombucha, making it accessible to a broader consumer base. Additionally, the rise of e-commerce has facilitated direct-to-consumer sales, allowing kombucha brands to reach consumers nationwide without the need for traditional brick-and-mortar retail.

Government regulations and policies also impact the US kombucha market. As a fermented beverage, kombucha falls under the jurisdiction of various regulatory bodies, including the Food and Drug Administration (FDA) and the Alcohol and Tobacco Tax and Trade Bureau (TTB). Compliance with labeling requirements, alcohol content regulations, and food safety standards is essential for kombucha manufacturers to ensure product quality and consumer safety. Changes in regulations or new legislation can affect production processes, labeling practices, and market access, influencing the dynamics of the kombucha industry.

Competitive landscape and market dynamics play a significant role in shaping the US kombucha market. The market is characterized by a diverse range of players, from established beverage companies to small-batch craft brewers and local kombucha artisans. Intense competition fosters innovation and product differentiation as companies strive to carve out their niche in the market. New flavors, unique ingredients, and functional enhancements are continually being introduced to cater to evolving consumer preferences and stay ahead of the competition.

Consumer behavior and preferences also evolve over time, influencing the dynamics of the US kombucha market. While some consumers prioritize taste and flavor variety, others may focus on specific health benefits or seek out organic and locally sourced ingredients. Understanding consumer preferences and staying attuned to market trends is crucial for kombucha brands to remain competitive and adapt their product offerings accordingly. Consumer feedback and market research play a vital role in product development and marketing strategies, ensuring that kombucha brands can meet the ever-changing demands of their target audience.

Leave a Comment