Market Analysis

In-depth Analysis of Transparent Polyamides Market Industry Landscape

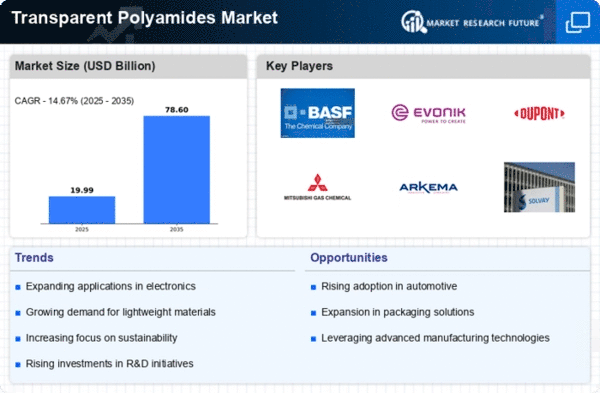

Supply, demand and other developments determine what happens in transparent polyamide marketplace. Known simply as transparent nylon, clear polyamide resins are increasingly sought after due to their flexible characteristics such as high transparency level, superior mechanical strength and resistance against multiple chemicals. A major driver behind this growth has been increased adoption of TPAs across industries like automotive, packaging, electrical & electronics etc.

In automobile applications such as fuel systems engine covers air-intake manifolds just to mention but a few places where these TPAs find use.These materials are lightweight while remaining durable in nature which contributes to fuel efficiency and general performance of a vehicle. As the automotive industry continues to focus on sustainability and energy efficiency, the demand for transparent polyamides is expected to rise.

The packaging sector is also significant in this regard as it impacts positively on transparent polyamide market. Transparent Polyamides can be used in packages that require clarity with resistance to harsh environmental conditions. The material is widely used in food packaging, where both visibility and protection are necessary. With increasing consumer preference for transparency and environmentally friendly packages, the supply of transparent nylon can be maintained at relatively good levels.

Moreover, there is also the presence of electronics sector where transparent polyamides play a significant role. For example, they are commonly used as connectors, insulators or housings for electronic components. In response to growing demand for sophisticated products like smart phones together with advancements made in technology have led to growing need for TPAs having improved properties such as heat resistance or electrical insulation.

Moreover, advancements have occurred within manufacturing processes of these PA 12 polymer materials leading to enhanced productivity while minimizing their ecological footprints. Market players make efforts through R & D investments into improving their TPA properties so that there could be more innovative uses giving them competitive advantage over others businesses in respective industries’ sectors.

Besides, there are also market dynamics arising from regulatory factors as governments globally are increasingly emphasizing on eco-friendly regulations and sustainability. In line with the above trend, the transparent polyamides market has begun developing biodegradable and recyclable versions of this material in an attempt to become more environmentally friendly. This move towards sustainable solutions is consistent with the wider industry’s shift to green practices and circular economies.

Leave a Comment