Tobacco Products Market Trends

Tobacco Products Market Research Report: By Product Type (Cigarettes, Cigars, Chewing Tobacco, Snuff), By Consumption Method (Flavored, Non-Flavored, Roll-Your-Own), By Distribution Channel (Retail Stores, Online Stores, Supermarkets), By Demographic (Age, Gender, Income Level) and By Regional (North America, Europe, South America, Asia Pacific, Middle East and Africa)- Forecast to 2035

Market Summary

As per Market Research Future Analysis, the Global Tobacco Products Market was valued at 966.22 USD Billion in 2024 and is projected to reach 1426.02 USD Billion by 2035, growing at a CAGR of 3.60% from 2025 to 2035. The market is influenced by regulatory changes, innovation in product offerings, and shifting consumer preferences towards lower-risk alternatives such as e-cigarettes and heated tobacco products. The market dynamics are shaped by a rising smoking population in developing regions and a growing trend of health-conscious consumers seeking alternatives.

Key Market Trends & Highlights

Key trends driving the Global Tobacco Products Market include regulatory changes, innovation, and demographic shifts.

- Cigarettes are projected to hold a majority share valued at 500.0 USD Billion in 2024.

- The Asia-Pacific region is expected to dominate with a valuation of 270.0 USD Billion in 2024.

- Over 60% of current smokers are willing to consider alternative tobacco options.

- The market is projected to reach 1426.02 USD Billion by 2035.

Market Size & Forecast

| 2024 Market Size | USD 966.22 Billion |

| 2035 Market Size | USD 1426.02 Billion |

| CAGR (2025-2035) | 3.60% |

| Largest Regional Market Share in 2024 | Asia-Pacific. |

Major Players

Key players include China National Tobacco Corporation, Kraft Heinz, Philip Morris International, British American Tobacco, and Japan Tobacco International.

Market Trends

Several important market drivers, including regulatory changes and changing customer tastes, shape the Global Tobacco Products Market. Governments worldwide are enacting tighter rules on tobacco sales, marketing, and packaging to lower smoking rates and safeguard public health. These rules often include higher prices, basic packaging standards, and public area smoking restrictions, which affect the market dynamics. Furthermore, among customers looking for substitutes to conventional smoking, there is a clear movement toward lower-risk goods such as heated tobacco products and e-cigarettes.

Among the possibilities to be investigated in the Global Tobacco Products Market are the growth of product variety and geographical reach. Particularly in developing countries where smoking rates are high, many businesses are spending money creating creative tobacco products that fit various customer tastes. The trend of health-conscious customers seeking alternatives also provides the door for producers to develop plant-based or nicotine-free goods, tapping into the booming wellness sector. Moreover, the use of technology in tobacco products, such as smart features on devices, opens up new possibilities for brand loyalty and involvement.

Recent statistics show a growing acceptance of e-cigarettes and a drop in conventional cigarette use in certain areas. Public opinion and marketing campaigns aimed at younger populations that want contemporary, less dangerous smoking alternatives help to shape this change. The influence of social media and digital marketing is also clear-cut, as businesses use these channels to reach a larger audience properly. Driven by a confluence of regulation, innovation, and changing customer behavior, the Global Tobacco Products Market is changing.

The global tobacco products market is undergoing a transformation, with increasing regulatory pressures and shifting consumer preferences towards less harmful alternatives, suggesting a potential decline in traditional tobacco consumption.

World Health Organization

Tobacco Products Market Market Drivers

Health Awareness Campaigns

The Global Tobacco Products Market Industry is increasingly affected by health awareness campaigns that aim to educate the public about the risks associated with tobacco use. These campaigns, often spearheaded by governmental health organizations, have been effective in reducing smoking rates in various regions. For example, countries that have implemented comprehensive anti-tobacco campaigns have observed declines in smoking prevalence. This heightened awareness may lead to a contraction in traditional tobacco product sales, prompting the industry to pivot towards less harmful alternatives. The impact of these campaigns is likely to shape market dynamics in the coming years.

Increasing Global Population

The Global Tobacco Products Market Industry appears to be influenced by the steady increase in the global population, which is projected to reach approximately 8.5 billion by 2030. This demographic growth is likely to expand the consumer base for tobacco products, thereby driving demand. As more individuals enter adulthood, the potential for tobacco consumption rises, particularly in emerging markets where tobacco use remains prevalent. This trend suggests that the Global Tobacco Products Market Industry could experience substantial growth, contributing to an estimated market value of 844.1 USD Billion in 2024 and potentially reaching 900 USD Billion by 2035.

Evolving Consumer Preferences

Consumer preferences within the Global Tobacco Products Market Industry are shifting, with a noticeable increase in the demand for alternative tobacco products such as e-cigarettes and heated tobacco products. These alternatives are perceived as less harmful compared to traditional cigarettes, appealing particularly to younger demographics. The rise of these products indicates a potential transformation in consumption patterns, which may influence market dynamics. As the industry adapts to these changing preferences, it is likely to see a gradual increase in market value, with projections suggesting a compound annual growth rate of 0.59% from 2025 to 2035.

Market Trends and Projections

The Global Tobacco Products Market Industry is characterized by various trends that influence its trajectory. Current projections indicate a market value of 844.1 USD Billion in 2024, with expectations to reach 900 USD Billion by 2035. The compound annual growth rate during this period is estimated at 0.59% from 2025 to 2035. These figures suggest a relatively stable market environment, with growth driven by factors such as demographic changes, evolving consumer preferences, and technological advancements. Understanding these trends is essential for stakeholders aiming to navigate the complexities of the global tobacco landscape.

Regulatory Changes and Compliance

Regulatory frameworks governing tobacco products are evolving globally, impacting the Global Tobacco Products Market Industry significantly. Governments are implementing stricter regulations on advertising, packaging, and sales, which could alter market strategies. For instance, some countries have introduced plain packaging laws aimed at reducing tobacco consumption. While these regulations may pose challenges for traditional tobacco products, they also create opportunities for innovative marketing strategies and product development. The industry must navigate these complexities to maintain its market position, as compliance could influence overall market growth and consumer engagement.

Technological Advancements in Product Development

Technological advancements are playing a crucial role in shaping the Global Tobacco Products Market Industry. Innovations in product development, such as the introduction of electronic cigarettes and nicotine delivery systems, are transforming consumer experiences. These technologies not only cater to changing consumer preferences but also align with regulatory demands for reduced harm. The integration of technology in tobacco products could lead to increased market penetration, particularly among younger consumers. As the industry embraces these advancements, it is poised for growth, potentially contributing to the projected market value of 900 USD Billion by 2035.

Market Segment Insights

Tobacco Products Market Product Type Insights

The Global Tobacco Products Market generates substantial revenue, projected to be valued at 844.06 USD Billion in 2024, highlighting its robust nature. Within the Product Type segment, several categoriesCigarettes, Cigars, Chewing Tobacco, and Snuffplay crucial roles in shaping market dynamics. Cigarettes hold a majority share, with a value of 500.0 USD Billion in 2024. Their popularity can be attributed to widespread consumption patterns and brand recognition that resonate globally.

Additionally, cigars are anticipated to maintain significance, valued at 120.0 USD Billion, reflecting a growing preference among consumers seeking premium smoking experiences.Chewing tobacco, with a valuation of 80.0 USD Billion, appeals particularly in certain demographics and regions, emphasizing cultural practices and preferences. Snuff, valued at 144.06 USD Billion, signifies an evolving trend where users are leaning towards smokeless options, catering to health-conscious consumers. Collectively, these product types reflect diverse consumption habits in the global market landscape, driven by shifting consumer preferences, ongoing product innovations, and targeted marketing strategies.

The Global Tobacco Products Market statistics indicate adaptability and resilience of the industry, revealing opportunities for growth amidst challenges like regulatory pressures and changing attitudes towards smoking in public health discourse.Understanding the intricacies of this market segmentation allows stakeholders to harness data for strategic planning and forecasting within this enduring industry. The projected valuation of these product types in 2035 exhibits steady growth, confirming Cigarettes at 540.0 USD Billion, Cigars at 130.0 USD Billion, Chewing Tobacco at 85.0 USD Billion, and Snuff at 145.0 USD Billion, empowering businesses to innovate accordingly.

The various preferences for product types reflect the complex fabric of the Global Tobacco Products Market industry, driven by economic factors, cultural influences, and evolving consumer attitudes toward tobacco consumption.This segmentation underscores the significance of each product type, providing clarity for investors and manufacturers navigating the complexities of the market.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Tobacco Products Market Consumption Method Insights

The Consumption Method segment of the Global Tobacco Products Market is critical in shaping market dynamics, influencing preferences and consumption behaviors. This segment encompasses various categories, including Flavored, Non-Flavored, and Roll-Your-Own products, each catering to diverse consumer demographics. Flavored tobacco products have gained traction, appealing particularly to younger adults who seek new and enjoyable experiences. Non-Flavored tobacco remains a staple among traditional consumers valuing simplicity and authenticity.

Meanwhile, Roll-Your-Own products have emerged as a cost-effective alternative, preferred by those seeking customization and personal control over their smoking experience.In 2024, the overall Global Tobacco Products Market is expected to be valued at 844.06 billion USD, reflecting a stable growth trend driven by evolving consumer preferences and regulatory environments. As of 2035, the market is projected to reach 900 billion USD, showcasing a gradual increase that signifies steady demand across the globe. The market growth is supported by increasing tobacco-related innovations, while challenges such as stringent regulations and health awareness present obstacles for manufacturers.

Overall, the Global Tobacco Products Market segmentation illustrates diverse consumption preferences, making it essential for companies to adapt strategies to meet changing consumer demands effectively.

Tobacco Products Market Distribution Channel Insights

The Global Tobacco Products Market, valued at approximately 844.06 USD Billion in 2024, showcases a diverse Distribution Channel segment that plays a crucial role in shaping consumer access to tobacco products. The retail stores segment remains a prominent avenue, providing traditional face-to-face interactions that many consumers prefer, while easily accessible locations boost sales. Additionally, online stores have gained traction, particularly as convenience-driven consumers increasingly turn to digital platforms for purchases.

This trend has been facilitated by advancements in e-commerce, catering to a broader audience seeking privacy in their buying habits.Supermarkets, representing another significant channel, leverage their established shopping infrastructure, ensuring that tobacco products are conveniently available alongside other essential goods. The distribution through these channels collectively enhances the overall Global Tobacco Products Market revenue, catering to varying consumer preferences and shopping habits.

Market statistics show that as the industry evolves, retailers and producers are adapting to regulations while seeking innovative marketing strategies to capture the market dynamics effectively.The interplay of these distribution methods underscores the resilience of the Global Tobacco Products Market, driving growth amid changing societal attitudes towards tobacco consumption.

Tobacco Products Market Demographic Insights

The Global Tobacco Products Market has shown significant trends in demographic segmentation, focusing on factors such as age, gender, and income level. In 2024, the market is projected to be valued at 844.06 billion USD, signifying robust consumer demand across diverse demographics. Age plays a crucial role, as younger populations are increasingly exposed to various tobacco products, influencing future consumption patterns. Gender dynamics also highlight differences in smoking habits, with variations in preferences for product types.

Moreover, income level significantly impacts purchasing power, driving sales in higher-income brackets where premium tobacco products gain traction.This demographic framework enables stakeholders to identify target consumer groups, optimize marketing strategies, and adapt to evolving trends. The Global Tobacco Products Market data illustrates the importance of these demographic factors in understanding market growth, providing valuable insights for businesses looking to navigate the complexities of this industry. As smoking regulations evolve and health awareness increases, opportunities arise to engage with younger consumers while addressing gender-specific preferences and income-related behavior, shaping the future landscape of the Global Tobacco Products Market industry.

Get more detailed insights about Tobacco Products Market Research Report—Global Forecast till 2035

Regional Insights

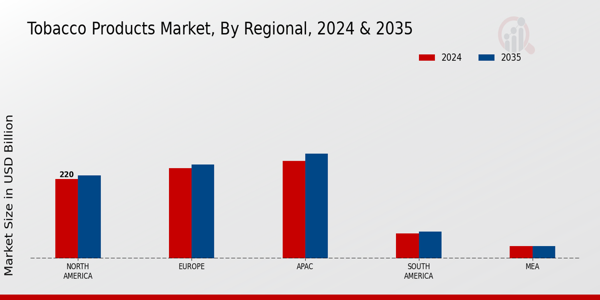

The Global Tobacco Products Market exhibits significant variance across its regional segments, with a total expected valuation of 844.06 USD Billion in 2024. North America, valued at 220.0 USD Billion, contributes a substantial portion, reflecting a mature market with established distribution channels. Europe follows closely with a valuation of 250.0 USD Billion, indicating robust demand amidst varying regulations that influence market dynamics.

The Asia-Pacific (APAC) region dominates regionally with a valuation of 270.0 USD Billion in 2024, driven by a vast consumer base and increasing tobacco consumption trends.South America, with a valuation of 70.0 USD Billion, displays growth potential despite facing regulatory challenges, primarily linked to cigarette consumption patterns. Meanwhile, the Middle East and Africa (MEA) market is valued at 34.06 USD Billion, representing a smaller yet emerging segment with unique cultural consumption habits.

As the Global Tobacco Products Market revenue evolves, understanding these regional dynamics is crucial, highlighting why APAC stands out for future growth opportunities while North America and Europe remain significant for overall market stability and revenue contributions.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Players and Competitive Insights

The Global Tobacco Products Market has become a dynamic field characterized by intense competition between established players and emerging companies. The landscape features a diverse range of products including cigarettes, cigars, roll-your-own tobacco, and smokeless tobacco, each vying for market share amid evolving regulatory frameworks and shifting consumer preferences. As governments implement stricter tobacco control measures and public awareness surrounding the health risks associated with tobacco use grows, companies in this space are compelled to innovate and diversify their offerings.

Strategic alliances, mergers, and brand differentiation play crucial roles in determining a company's standing within the market, and the presence of multinational corporations intensifies this competitive environment.China National Tobacco Corporation holds a significant position within the Global Tobacco Products Market, emerging as one of the world’s largest tobacco manufacturers. With a robust production capacity, the company benefits from China's extensive distribution infrastructure and an expansive domestic consumer base. Its strengths lie in its ability to leverage economies of scale, ensuring cost efficiency while maintaining high product availability.

The company has effectively navigated regulatory landscapes by adapting its marketing strategies to align with local laws, securing its dominance in both national and international markets. Additionally, China National Tobacco Corporation has focused on research and development, which aids in product innovation, thus enhancing its competitive edge globally.Kraft Heinz, while primarily known for its food products, has made notable forays into the Global Tobacco Products Market through strategic diversification. The company's presence in the market is underscored by its commitment to offering high-quality tobacco goods that attract a diverse consumer base.

Key products have included flavored tobacco options and innovative packaging solutions, appealing to younger demographics. Kraft Heinz's strengths lie in its strong brand equity, extensive distribution channels, and a rich portfolio of complementary products that bolster its tobacco offerings. Recent mergers and acquisitions have allowed the company to tap into new markets and enhance its product line, creating a broader reach in the tobacco sector. This strategic approach enables Kraft Heinz to capitalize on emerging trends while maintaining its competitive position within the global arena.

Key Companies in the Tobacco Products Market market include

Industry Developments

Recent developments in the Global Tobacco Products Market underscore a significant shift as several major players adapt to regulatory pressures and changing consumer preferences. Notably, Philip Morris International has been expanding its portfolio with increased investments in smoke-free products, strengthening its position as global demand for traditional tobacco declines. In September 2023, Japan Tobacco International and British American Tobacco announced collaborative initiatives aimed at research into reduced-risk products, showcasing a trend towards innovation in the sector.

Mergers and acquisitions are also shaping the landscape, with Kraft Heinz acquiring Sampoerna's subsidiary, enhancing its footprint in the tobacco snacks segment in August 2023. Additionally, Reynolds American has reported a substantial rise in its market valuation, attributed to the growing acceptance of alternative tobacco products. The overall market has witnessed fluctuations, fueled by regulatory actions and shifting demographics, with increasing health awareness influencing consumption patterns. Key players such as ITC Limited and Altria Group are focusing on sustainability initiatives, aiming to meet evolving regulatory demands while appealing to environmentally conscious consumers.

Global sales data reflect a diversifying market with a potential compound annual growth rate, indicating continued transformation in the tobacco industry.

Future Outlook

Tobacco Products Market Future Outlook

The Global Tobacco Products Market is projected to grow at a 3.60% CAGR from 2025 to 2035, driven by regulatory changes, evolving consumer preferences, and technological advancements.

New opportunities lie in:

- Invest in innovative reduced-risk products to capture health-conscious consumers.

- Expand distribution channels in emerging markets to enhance market penetration.

- Leverage digital marketing strategies to engage younger demographics effectively.

By 2035, the market is expected to stabilize, reflecting gradual growth amidst evolving consumer dynamics.

Market Segmentation

Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Tobacco Products Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Tobacco Products Market Demographic Outlook

- Age

- Gender

- Income Level

Tobacco Products Market Product Type Outlook

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

Tobacco Products Market Consumption Method Outlook

- Flavored

- Non-Flavored

- Roll-Your-Own

Tobacco Products Market Distribution Channel Outlook

- Retail Stores

- Online Stores

- Supermarkets

Report Scope

Report Scope

| Report Attribute/Metric Source | Details |

| MARKET SIZE 2023 | 839.19(USD Billion) |

| MARKET SIZE 2024 | 844.06(USD Billion) |

| MARKET SIZE 2035 | 900.0(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 3.60% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Billion |

| KEY COMPANIES PROFILED | China National Tobacco Corporation, Kraft Heinz, Sampoerna, Japan Tobacco International, Fujian Province Tobacco Company, 0050, Philip Morris International, British American Tobacco, PT Gudang Garam Tbk, Imperial Brands, Altria Group, Swedish Match, ITC Limited, Reynolds American |

| SEGMENTS COVERED | Product Type, Consumption Method, Distribution Channel, Demographic, Regional |

| KEY MARKET OPPORTUNITIES | E-cigarettes and vaping expansion, Smokeless tobacco product demand, Emerging market penetration, Organic tobacco product trend, CBD-infused tobacco products. |

| KEY MARKET DYNAMICS | regulatory changes, health awareness, product innovation, market consolidation, competition from alternatives |

| COUNTRIES COVERED | North America, Europe, APAC, South America, MEA |

| Market Size 2024 | 966.22 |

| Market Size 2025 | 1001.02 |

| Market Size 2035 | 1426.02 |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What was at a the expected Market Was at a the Global Tobacco Products Market in 2024?

The Global Tobacco Products Market was at a 966.22 Billion USD by 2024

-

List of Tables and Figures

- Table of Contents 1. Executive Summary 1.1. Market Overview 1.2. Key Findings 1.3. Market Segmentation 1.4. Competitive Landscape 1.5. Challenges and Opportunities 1.6. Future Outlook 2. Market Introduction 2.1. Definition 2.2. Scope of the Study 2.2.1. Research Objective 2.2.2. Assumption 2.2.3. Limitations 3. Research Methodology 3.1. Overview 3.2. Data Mining 3.3. Secondary Research 3.4. Primary Research 3.4.1. Primary Interviews and Information Gathering Process 3.4.2. Breakdown of Primary Respondents 3.5. Forecasting Model 3.6. Market Size Estimation 3.6.1. Bottom-up Approach 3.6.2. Top-Down Approach 3.7. Data Triangulation 3.8. Validation 4. MARKET DYNAMICS 4.1. Overview 4.2. Drivers 4.3. Restraints 4.4. Opportunities 5. MARKET FACTOR ANALYSIS 5.1. Value chain Analysis 5.2. Porter's Five Forces Analysis 5.2.1. Bargaining Power of Suppliers 5.2.2. Bargaining Power of Buyers 5.2.3. Threat of New Entrants 5.2.4. Threat of Substitutes 5.2.5. Intensity of Rivalry 5.3. COVID-19 Impact Analysis 5.3.1. Market Impact Analysis 5.3.2. Regional Impact 5.3.3. Opportunity and Threat Analysis 6. TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE (USD BILLION) 6.1. Cigarettes 6.2. Cigars 6.3. Chewing Tobacco 6.4. Snuff 7. TOBACCO PRODUCTS MARKET, BY CONSUMPTION METHOD (USD BILLION) 7.1. Flavored 7.2. Non-Flavored 7.3. Roll-Your-Own 8. TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL (USD BILLION) 8.1. Retail Stores 8.2. Online Stores 8.3. Supermarkets 9. TOBACCO PRODUCTS MARKET, BY DEMOGRAPHIC (USD BILLION) 9.1. Age 9.2. Gender 9.3. Income Level 10. TOBACCO PRODUCTS MARKET, BY REGIONAL (USD BILLION) 10.1. North America 10.1.1. US 10.1.2. Canada 10.2. Europe 10.2.1. Germany 10.2.2. UK 10.2.3. France 10.2.4. Russia 10.2.5. Italy 10.2.6. Spain 10.2.7. Rest of Europe 10.3. APAC 10.3.1. China 10.3.2. India 10.3.3. Japan 10.3.4. South Korea 10.3.5. Malaysia 10.3.6. Thailand 10.3.7. Indonesia 10.3.8. Rest of APAC 10.4. South America 10.4.1. Brazil 10.4.2. Mexico 10.4.3. Argentina 10.4.4. Rest of South America 10.5. MEA 10.5.1. GCC Countries 10.5.2. South Africa 10.5.3. Rest of MEA 11. Competitive Landscape 11.1. Overview 11.2. Competitive Analysis 11.3. Market share Analysis 11.4. Major Growth Strategy in the Tobacco Products Market 11.5. Competitive Benchmarking 11.6. Leading Players in Terms of Number of Developments in the Tobacco Products Market 11.7. Key developments and growth strategies 11.7.1. New Product Launch/Service Deployment 11.7.2. Merger & Acquisitions 11.7.3. Joint Ventures 11.8. Major Players Financial Matrix 11.8.1. Sales and Operating Income 11.8.2. Major Players R&D Expenditure. 2023 12. COMPANY PROFILES 12.1. China National Tobacco Corporation 12.1.1. Financial Overview 12.1.2. Products Offered 12.1.3. Key Developments 12.1.4. SWOT Analysis 12.1.5. Key Strategies 12.2. Kraft Heinz 12.2.1. Financial Overview 12.2.2. Products Offered 12.2.3. Key Developments 12.2.4. SWOT Analysis 12.2.5. Key Strategies 12.3. Sampoerna 12.3.1. Financial Overview 12.3.2. Products Offered 12.3.3. Key Developments 12.3.4. SWOT Analysis 12.3.5. Key Strategies 12.4. Japan Tobacco International 12.4.1. Financial Overview 12.4.2. Products Offered 12.4.3. Key Developments 12.4.4. SWOT Analysis 12.4.5. Key Strategies 12.5. Fujian Province Tobacco Company 12.5.1. Financial Overview 12.5.2. Products Offered 12.5.3. Key Developments 12.5.4. SWOT Analysis 12.5.5. Key Strategies 12.6. 0050 12.6.1. Financial Overview 12.6.2. Products Offered 12.6.3. Key Developments 12.6.4. SWOT Analysis 12.6.5. Key Strategies 12.7. Philip Morris International 12.7.1. Financial Overview 12.7.2. Products Offered 12.7.3. Key Developments 12.7.4. SWOT Analysis 12.7.5. Key Strategies 12.8. British American Tobacco 12.8.1. Financial Overview 12.8.2. Products Offered 12.8.3. Key Developments 12.8.4. SWOT Analysis 12.8.5. Key Strategies 12.9. PT Gudang Garam Tbk 12.9.1. Financial Overview 12.9.2. Products Offered 12.9.3. Key Developments 12.9.4. SWOT Analysis 12.9.5. Key Strategies 12.10. Imperial Brands 12.10.1. Financial Overview 12.10.2. Products Offered 12.10.3. Key Developments 12.10.4. SWOT Analysis 12.10.5. Key Strategies 12.11. Altria Group 12.11.1. Financial Overview 12.11.2. Products Offered 12.11.3. Key Developments 12.11.4. SWOT Analysis 12.11.5. Key Strategies 12.12. Swedish Match 12.12.1. Financial Overview 12.12.2. Products Offered 12.12.3. Key Developments 12.12.4. SWOT Analysis 12.12.5. Key Strategies 12.13. ITC Limited 12.13.1. Financial Overview 12.13.2. Products Offered 12.13.3. Key Developments 12.13.4. SWOT Analysis 12.13.5. Key Strategies 12.14. Reynolds American 12.14.1. Financial Overview 12.14.2. Products Offered 12.14.3. Key Developments 12.14.4. SWOT Analysis 12.14.5. Key Strategies 13. APPENDIX 13.1. References 13.2. Related Reports LIST OF TABLES

- TABLE 1. LIST OF ASSUMPTIONS

- TABLE 2. NORTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 3. NORTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 4. NORTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 5. NORTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 6. NORTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 7. US TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 8. US TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 9. US TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 10. US TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 11. US TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 12. CANADA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 13. CANADA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 14. CANADA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 15. CANADA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 16. CANADA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 17. EUROPE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 18. EUROPE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 19. EUROPE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 20. EUROPE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 21. EUROPE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 22. GERMANY TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 23. GERMANY TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 24. GERMANY TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 25. GERMANY TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 26. GERMANY TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 27. UK TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 28. UK TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 29. UK TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 30. UK TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 31. UK TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 32. FRANCE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 33. FRANCE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 34. FRANCE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 35. FRANCE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 36. FRANCE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 37. RUSSIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 38. RUSSIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 39. RUSSIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 40. RUSSIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 41. RUSSIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 42. ITALY TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 43. ITALY TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 44. ITALY TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 45. ITALY TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 46. ITALY TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 47. SPAIN TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 48. SPAIN TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 49. SPAIN TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 50. SPAIN TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 51. SPAIN TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 52. REST OF EUROPE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 53. REST OF EUROPE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 54. REST OF EUROPE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 55. REST OF EUROPE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 56. REST OF EUROPE TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 57. APAC TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 58. APAC TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 59. APAC TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 60. APAC TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 61. APAC TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 62. CHINA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 63. CHINA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 64. CHINA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 65. CHINA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 66. CHINA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 67. INDIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 68. INDIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 69. INDIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 70. INDIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 71. INDIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 72. JAPAN TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 73. JAPAN TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 74. JAPAN TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 75. JAPAN TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 76. JAPAN TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 77. SOUTH KOREA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 78. SOUTH KOREA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 79. SOUTH KOREA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 80. SOUTH KOREA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 81. SOUTH KOREA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 82. MALAYSIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 83. MALAYSIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 84. MALAYSIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 85. MALAYSIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 86. MALAYSIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 87. THAILAND TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 88. THAILAND TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 89. THAILAND TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 90. THAILAND TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 91. THAILAND TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 92. INDONESIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 93. INDONESIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 94. INDONESIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 95. INDONESIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 96. INDONESIA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 97. REST OF APAC TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 98. REST OF APAC TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 99. REST OF APAC TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 100. REST OF APAC TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 101. REST OF APAC TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 102. SOUTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 103. SOUTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 104. SOUTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 105. SOUTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 106. SOUTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 107. BRAZIL TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 108. BRAZIL TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 109. BRAZIL TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 110. BRAZIL TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 111. BRAZIL TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 112. MEXICO TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 113. MEXICO TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 114. MEXICO TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 115. MEXICO TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 116. MEXICO TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 117. ARGENTINA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 118. ARGENTINA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 119. ARGENTINA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 120. ARGENTINA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 121. ARGENTINA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 122. REST OF SOUTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 123. REST OF SOUTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 124. REST OF SOUTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 125. REST OF SOUTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 126. REST OF SOUTH AMERICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 127. MEA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 128. MEA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 129. MEA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 130. MEA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 131. MEA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 132. GCC COUNTRIES TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 133. GCC COUNTRIES TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 134. GCC COUNTRIES TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 135. GCC COUNTRIES TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 136. GCC COUNTRIES TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 137. SOUTH AFRICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 138. SOUTH AFRICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 139. SOUTH AFRICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 140. SOUTH AFRICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 141. SOUTH AFRICA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 142. REST OF MEA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 143. REST OF MEA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY CONSUMPTION METHOD, 2019-2035 (USD BILLIONS)

- TABLE 144. REST OF MEA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 145. REST OF MEA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY DEMOGRAPHIC, 2019-2035 (USD BILLIONS)

- TABLE 146. REST OF MEA TOBACCO PRODUCTS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 147. PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

- TABLE 148. ACQUISITION/PARTNERSHIP LIST OF FIGURES

- FIGURE 1. MARKET SYNOPSIS

- FIGURE 2. NORTH AMERICA TOBACCO PRODUCTS MARKET ANALYSIS

- FIGURE 3. US TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 4. US TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 5. US TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 6. US TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 7. US TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 8. CANADA TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 9. CANADA TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 10. CANADA TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 11. CANADA TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 12. CANADA TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 13. EUROPE TOBACCO PRODUCTS MARKET ANALYSIS

- FIGURE 14. GERMANY TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 15. GERMANY TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 16. GERMANY TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 17. GERMANY TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 18. GERMANY TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 19. UK TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 20. UK TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 21. UK TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 22. UK TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 23. UK TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 24. FRANCE TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 25. FRANCE TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 26. FRANCE TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 27. FRANCE TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 28. FRANCE TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 29. RUSSIA TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 30. RUSSIA TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 31. RUSSIA TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 32. RUSSIA TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 33. RUSSIA TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 34. ITALY TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 35. ITALY TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 36. ITALY TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 37. ITALY TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 38. ITALY TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 39. SPAIN TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 40. SPAIN TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 41. SPAIN TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 42. SPAIN TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 43. SPAIN TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 44. REST OF EUROPE TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 45. REST OF EUROPE TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 46. REST OF EUROPE TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 47. REST OF EUROPE TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 48. REST OF EUROPE TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 49. APAC TOBACCO PRODUCTS MARKET ANALYSIS

- FIGURE 50. CHINA TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 51. CHINA TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 52. CHINA TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 53. CHINA TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 54. CHINA TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 55. INDIA TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 56. INDIA TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 57. INDIA TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 58. INDIA TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 59. INDIA TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 60. JAPAN TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 61. JAPAN TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 62. JAPAN TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 63. JAPAN TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 64. JAPAN TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 65. SOUTH KOREA TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 66. SOUTH KOREA TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 67. SOUTH KOREA TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 68. SOUTH KOREA TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 69. SOUTH KOREA TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 70. MALAYSIA TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 71. MALAYSIA TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 72. MALAYSIA TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 73. MALAYSIA TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 74. MALAYSIA TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 75. THAILAND TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 76. THAILAND TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 77. THAILAND TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 78. THAILAND TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 79. THAILAND TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 80. INDONESIA TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 81. INDONESIA TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 82. INDONESIA TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 83. INDONESIA TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 84. INDONESIA TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 85. REST OF APAC TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 86. REST OF APAC TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 87. REST OF APAC TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 88. REST OF APAC TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 89. REST OF APAC TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 90. SOUTH AMERICA TOBACCO PRODUCTS MARKET ANALYSIS

- FIGURE 91. BRAZIL TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 92. BRAZIL TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 93. BRAZIL TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 94. BRAZIL TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 95. BRAZIL TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 96. MEXICO TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 97. MEXICO TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 98. MEXICO TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 99. MEXICO TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 100. MEXICO TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 101. ARGENTINA TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 102. ARGENTINA TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 103. ARGENTINA TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 104. ARGENTINA TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 105. ARGENTINA TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 106. REST OF SOUTH AMERICA TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 107. REST OF SOUTH AMERICA TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 108. REST OF SOUTH AMERICA TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 109. REST OF SOUTH AMERICA TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 110. REST OF SOUTH AMERICA TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 111. MEA TOBACCO PRODUCTS MARKET ANALYSIS

- FIGURE 112. GCC COUNTRIES TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 113. GCC COUNTRIES TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 114. GCC COUNTRIES TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 115. GCC COUNTRIES TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 116. GCC COUNTRIES TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 117. SOUTH AFRICA TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 118. SOUTH AFRICA TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 119. SOUTH AFRICA TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 120. SOUTH AFRICA TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 121. SOUTH AFRICA TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 122. REST OF MEA TOBACCO PRODUCTS MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 123. REST OF MEA TOBACCO PRODUCTS MARKET ANALYSIS BY CONSUMPTION METHOD

- FIGURE 124. REST OF MEA TOBACCO PRODUCTS MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 125. REST OF MEA TOBACCO PRODUCTS MARKET ANALYSIS BY DEMOGRAPHIC

- FIGURE 126. REST OF MEA TOBACCO PRODUCTS MARKET ANALYSIS BY REGIONAL

- FIGURE 127. KEY BUYING CRITERIA OF TOBACCO PRODUCTS MARKET

- FIGURE 128. RESEARCH PROCESS OF MRFR

- FIGURE 129. DRO ANALYSIS OF TOBACCO PRODUCTS MARKET

- FIGURE 130. DRIVERS IMPACT ANALYSIS: TOBACCO PRODUCTS MARKET

- FIGURE 131. RESTRAINTS IMPACT ANALYSIS: TOBACCO PRODUCTS MARKET

- FIGURE 132. SUPPLY / VALUE CHAIN: TOBACCO PRODUCTS MARKET

- FIGURE 133. TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2025 (% SHARE)

- FIGURE 134. TOBACCO PRODUCTS MARKET, BY PRODUCT TYPE, 2019 TO 2035 (USD Billions)

- FIGURE 135. TOBACCO PRODUCTS MARKET, BY CONSUMPTION METHOD, 2025 (% SHARE)

- FIGURE 136. TOBACCO PRODUCTS MARKET, BY CONSUMPTION METHOD, 2019 TO 2035 (USD Billions)

- FIGURE 137. TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2025 (% SHARE)

- FIGURE 138. TOBACCO PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2019 TO 2035 (USD Billions)

- FIGURE 139. TOBACCO PRODUCTS MARKET, BY DEMOGRAPHIC, 2025 (% SHARE)

- FIGURE 140. TOBACCO PRODUCTS MARKET, BY DEMOGRAPHIC, 2019 TO 2035 (USD Billions)

- FIGURE 141. TOBACCO PRODUCTS MARKET, BY REGIONAL, 2025 (% SHARE)

- FIGURE 142. TOBACCO PRODUCTS MARKET, BY REGIONAL, 2019 TO 2035 (USD Billions)

- FIGURE 143. BENCHMARKING OF MAJOR COMPETITORS

Tobacco Products Market Segmentation

- Tobacco Products Market By Product Type (USD Billion, 2019-2035)

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

- Tobacco Products Market By Consumption Method (USD Billion, 2019-2035)

- Flavored

- Non-Flavored

- Roll-Your-Own

- Tobacco Products Market By Distribution Channel (USD Billion, 2019-2035)

- Retail Stores

- Online Stores

- Supermarkets

- Tobacco Products Market By Demographic (USD Billion, 2019-2035)

- Age

- Gender

- Income Level

- Tobacco Products Market By Regional (USD Billion, 2019-2035)

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Tobacco Products Market Regional Outlook (USD Billion, 2019-2035)

North America Outlook (USD Billion, 2019-2035)

North America Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

North America Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

North America Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

North America Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

North America Tobacco Products Market by Regional Type

- US

- Canada

- US Outlook (USD Billion, 2019-2035)

US Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

US Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

US Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

US Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- CANADA Outlook (USD Billion, 2019-2035)

CANADA Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

CANADA Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

CANADA Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

CANADA Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

Europe Outlook (USD Billion, 2019-2035)

Europe Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

Europe Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

Europe Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

Europe Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

Europe Tobacco Products Market by Regional Type

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- GERMANY Outlook (USD Billion, 2019-2035)

GERMANY Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

GERMANY Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

GERMANY Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

GERMANY Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- UK Outlook (USD Billion, 2019-2035)

UK Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

UK Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

UK Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

UK Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- FRANCE Outlook (USD Billion, 2019-2035)

FRANCE Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

FRANCE Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

FRANCE Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

FRANCE Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- RUSSIA Outlook (USD Billion, 2019-2035)

RUSSIA Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

RUSSIA Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

RUSSIA Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

RUSSIA Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- ITALY Outlook (USD Billion, 2019-2035)

ITALY Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

ITALY Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

ITALY Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

ITALY Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- SPAIN Outlook (USD Billion, 2019-2035)

SPAIN Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

SPAIN Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

SPAIN Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

SPAIN Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- REST OF EUROPE Outlook (USD Billion, 2019-2035)

REST OF EUROPE Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

REST OF EUROPE Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

REST OF EUROPE Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

REST OF EUROPE Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

APAC Outlook (USD Billion, 2019-2035)

APAC Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

APAC Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

APAC Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

APAC Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

APAC Tobacco Products Market by Regional Type

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

- CHINA Outlook (USD Billion, 2019-2035)

CHINA Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

CHINA Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

CHINA Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

CHINA Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- INDIA Outlook (USD Billion, 2019-2035)

INDIA Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

INDIA Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

INDIA Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

INDIA Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- JAPAN Outlook (USD Billion, 2019-2035)

JAPAN Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

JAPAN Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

JAPAN Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

JAPAN Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- SOUTH KOREA Outlook (USD Billion, 2019-2035)

SOUTH KOREA Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

SOUTH KOREA Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

SOUTH KOREA Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

SOUTH KOREA Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- MALAYSIA Outlook (USD Billion, 2019-2035)

MALAYSIA Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

MALAYSIA Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

MALAYSIA Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

MALAYSIA Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- THAILAND Outlook (USD Billion, 2019-2035)

THAILAND Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

THAILAND Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

THAILAND Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

THAILAND Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- INDONESIA Outlook (USD Billion, 2019-2035)

INDONESIA Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

INDONESIA Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

INDONESIA Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

INDONESIA Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- REST OF APAC Outlook (USD Billion, 2019-2035)

REST OF APAC Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

REST OF APAC Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

REST OF APAC Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

REST OF APAC Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

South America Outlook (USD Billion, 2019-2035)

South America Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

South America Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

South America Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

South America Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

South America Tobacco Products Market by Regional Type

- Brazil

- Mexico

- Argentina

- Rest of South America

- BRAZIL Outlook (USD Billion, 2019-2035)

BRAZIL Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

BRAZIL Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

BRAZIL Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

BRAZIL Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- MEXICO Outlook (USD Billion, 2019-2035)

MEXICO Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

MEXICO Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

MEXICO Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

MEXICO Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- ARGENTINA Outlook (USD Billion, 2019-2035)

ARGENTINA Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

ARGENTINA Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

ARGENTINA Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

ARGENTINA Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2035)

REST OF SOUTH AMERICA Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

REST OF SOUTH AMERICA Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

REST OF SOUTH AMERICA Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

REST OF SOUTH AMERICA Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

MEA Outlook (USD Billion, 2019-2035)

MEA Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

MEA Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

MEA Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

MEA Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

MEA Tobacco Products Market by Regional Type

- GCC Countries

- South Africa

- Rest of MEA

- GCC COUNTRIES Outlook (USD Billion, 2019-2035)

GCC COUNTRIES Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

GCC COUNTRIES Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

GCC COUNTRIES Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

GCC COUNTRIES Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- SOUTH AFRICA Outlook (USD Billion, 2019-2035)

SOUTH AFRICA Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

SOUTH AFRICA Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

SOUTH AFRICA Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

SOUTH AFRICA Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

- REST OF MEA Outlook (USD Billion, 2019-2035)

REST OF MEA Tobacco Products Market by Product Type

- Cigarettes

- Cigars

- Chewing Tobacco

- Snuff

REST OF MEA Tobacco Products Market by Consumption Method Type

- Flavored

- Non-Flavored

- Roll-Your-Own

REST OF MEA Tobacco Products Market by Distribution Channel Type

- Retail Stores

- Online Stores

- Supermarkets

REST OF MEA Tobacco Products Market by Demographic Type

- Age

- Gender

- Income Level

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment