Synthetic Bio-Based Aniline Market Trends

Synthetic and Bio-based Aniline Market Research Report Information By Type (Synthetic and Bio-Based), By Process (Nitrobenzene and Chlorobenzene), By Application (MDI and Rubber Processing Chemical), By End-Use Industry (Construction, Automotive and Home Furnishing), And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2032

Market Summary

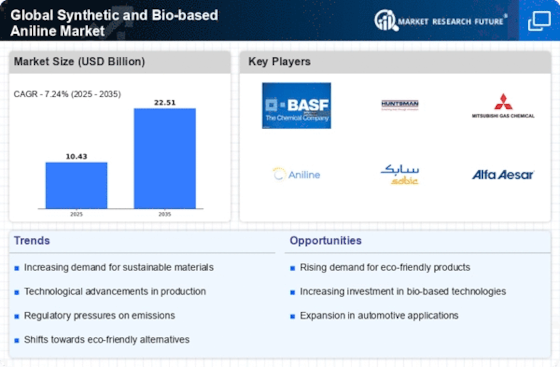

As per Market Research Future Analysis, the Global Synthetic and Bio-based Aniline Market was valued at USD 9.63 Billion in 2023 and is projected to reach USD 18.24 Billion by 2032, growing at a CAGR of 7.24% from 2024 to 2032. The market is driven by increasing demand for aniline products across various industries, with a notable shift towards bio-based aniline due to environmental concerns. The polyurethane rigid foams sector is a significant contributor to market growth, particularly in construction and automotive applications. MDI (methylene diphenyl diisocyanate) remains a dominant application, further propelling the market's expansion.

Key Market Trends & Highlights

Key trends influencing the synthetic and bio-based aniline market include:

- The market is expected to grow from USD 10.43 Billion in 2024 to USD 18.24 Billion by 2032.

- The bio-based segment is leading due to rising consumer demand for eco-friendly products.

- North America is projected to dominate the market, driven by increased construction activity and automotive growth.

- The nitrobenzene process segment generated the most revenue due to its higher product recovery and yield.

Market Size & Forecast

| 2023 Market Size | USD 9.63 Billion |

| 2024 Market Size | USD 10.43 Billion |

| 2032 Market Size | USD 18.24 Billion |

| CAGR (2024-2032) | 7.24% |

| Largest Regional Market Share in 2024 | North America. |

Major Players

Key players include BASF SE, Huntsman International LLC, China Petroleum & Chemical Corporation, Sumitomo Chemical Co., Ltd., and Covestro AG.

Market Trends

Increased demand for polyurethane rigid foams is driving the market growth

Since polyurethane rigid foams have so many uses in the building and automotive industries, demand for them is rising. Laminated insulation panels made of rigid polyurethane foams with a range of facings are created. With resistance to moisture, heat, and electricity, polyurethane foams are chemically stable, lightweight, adaptable, flexible, and durable. As a result of their low compression, they provide better sealing, cushioning, and vibration control properties. They are therefore utilised in the development of both residential and non-residential structures, as well as in the manufacturing, oil, and gas, and other sectors.

Polyurethane foams are used to insulate onshore and offshore pipelines, and they also ensure the efficient functioning of business operations in the oil and gas sector. Rigid polyurethane foam prevents freezing, maintains optimum fluid viscosity, safeguards expensive machinery, and effectively distributes and reuses heat for higher efficiency. The market CAGR for synthetic and bio-based aniline is therefore driven by the high demand for polyurethane rigid foams.

The coatings industry is seeing a rise in demand for MDI. The production of stiff polyurethane (PU) foams, which are in high demand in the automotive, construction, and plastic industries, relies heavily on methylene diphenyl diisocyanate. Due to its use in adhesives, sealants, coatings, etc., there is also a growth in demand for MDI. They are also employed by businesses to apply insulation to building walls and roofs. These are a few of the contributing elements to the increase in MDI demand, which in turn fuels the synthetic and bio-based aniline industry.

The majority of the market for synthetic and bio-based aniline is used to make MDI (methylene diphenyl diisocyanate). This Methylene Diphenyl Diisocyanate is crucial in the creation of stiff polyurethane (PU) foams, which are in high demand in the construction and automotive industries, among others. Laminated insulation panels made of rigid polyurethane foams are created with a range of facings. Chemically stable, adaptable, lightweight, flexible, and durable, polyurethane foams offer resistance to moisture, heat, and electricity. Due to their low compression property, they have superior sealing, cushioning, and vibration control qualities.

So they are employed in the development of both residential and non-residential structures, as well as in the automobile, oil and gas, and other related industries. Thus, driving the synthetic and bio-based aniline market revenue.

The increasing emphasis on sustainable practices is driving a notable shift towards bio-based aniline production, reflecting a broader trend in the chemical industry towards greener alternatives.

U.S. Environmental Protection Agency

Synthetic Bio-Based Aniline Market Market Drivers

Market Growth Projections

The Global Synthetic and Bio-based Aniline Market Industry is poised for substantial growth, with projections indicating a market value of 10.4 USD Billion in 2024 and an anticipated increase to 22.5 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 7.24% from 2025 to 2035. Various factors, including rising demand across multiple sectors such as textiles, pharmaceuticals, and agrochemicals, are likely to drive this expansion. The increasing focus on sustainability and the transition towards bio-based products further enhance the market's potential. As industries adapt to these trends, the market for synthetic and bio-based aniline is expected to flourish.

Rising Demand for Dyes and Pigments

The Global Synthetic and Bio-based Aniline Market Industry is experiencing a surge in demand for dyes and pigments, primarily driven by the textile and automotive sectors. Aniline is a crucial precursor in the production of various dyes, which are essential for coloring fabrics and coatings. As industries increasingly prioritize high-quality and sustainable products, the shift towards bio-based aniline is becoming more pronounced. This trend is expected to contribute significantly to the market's growth, with projections indicating a market value of 10.4 USD Billion in 2024. The increasing adoption of eco-friendly dyes is likely to further bolster the demand for bio-based aniline.

Growth in Pharmaceutical Applications

Pharmaceutical applications represent a vital driver for the Global Synthetic and Bio-based Aniline Market Industry. Aniline derivatives are integral in synthesizing various pharmaceutical compounds, including analgesics and anti-inflammatory medications. The ongoing advancements in drug development and the increasing focus on personalized medicine are likely to enhance the demand for aniline in this sector. As the global pharmaceutical market continues to expand, the need for high-quality aniline is expected to rise. This growth trajectory may contribute to the market reaching an estimated value of 22.5 USD Billion by 2035, reflecting the increasing reliance on synthetic and bio-based aniline in drug formulation.

Expanding Applications in Agrochemicals

The Global Synthetic and Bio-based Aniline Market Industry is witnessing expanding applications in agrochemicals, particularly in the production of herbicides and pesticides. Aniline derivatives are essential in formulating various agrochemical products that enhance crop yield and protect against pests. As the global population continues to grow, the demand for food production is increasing, which in turn drives the need for effective agrochemical solutions. This trend is likely to propel the market forward, as the agrochemical sector increasingly relies on synthetic and bio-based aniline. The growth in this area may contribute to the overall market expansion, with projections indicating a robust future for bio-based aniline.

Technological Advancements in Production

Technological advancements in the production of synthetic and bio-based aniline are playing a crucial role in shaping the Global Synthetic and Bio-based Aniline Market Industry. Innovations in manufacturing processes, such as the development of more efficient catalysts and greener synthesis methods, are likely to enhance production efficiency and reduce environmental impact. These advancements not only lower production costs but also improve product quality, making aniline derivatives more attractive to various industries. As these technologies continue to evolve, they may contribute to the overall growth of the market, supporting the anticipated increase in market value to 10.4 USD Billion in 2024.

Regulatory Support for Bio-based Products

The Global Synthetic and Bio-based Aniline Market Industry is benefiting from increasing regulatory support for bio-based products. Governments worldwide are implementing policies that encourage the use of sustainable materials, which is likely to enhance the market for bio-based aniline. For instance, initiatives aimed at reducing carbon footprints and promoting renewable resources are gaining traction. This regulatory environment is expected to foster innovation and investment in bio-based aniline production, potentially leading to a compound annual growth rate of 7.24% from 2025 to 2035. As more companies align with these regulations, the market for bio-based aniline could see substantial growth.

Market Segment Insights

Synthetic and Bio-based Aniline Type Insights

The synthetic and bio-based aniline market segmentation, based on type includes Synthetic and Bio-Based. The bio-based segment dominated the market due to rising consumer demand for environmentally friendly goods.

Synthetic and Bio-based Aniline Process Insights

The synthetic and bio-based aniline market segmentation, based on process, includes Nitrobenzene and Chlorobenzene. The nitrobenzene category generated the most income. Due to its higher product recovery, quicker reaction rate, and superior yield, nitrobenzene reduction is the most often utilised industrial technique.

Synthetic and Bio-based Aniline Application Insights

The synthetic and bio-based aniline market segmentation, based on application includes MDI and Rubber Processing Chemical. The MDI segment dominated the market. This is because MDI, which produces polyurethane foam, critically depends on synthetic and bio-based aniline. Additionally, a rise in rubber's applications is fueling the worldwide synthetic and bio-based aniline market's expansion throughout the projection period.

Figure 1: Synthetic and Bio-based Aniline Market, by Application, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Synthetic and Bio-based Aniline End-Use Industry Insights

The synthetic and bio-based aniline market segmentation, based on end-use industry includes Construction, Automotive and Home Furnishing. The construction segment dominated the market. This is because construction businesses frequently utilize rigid and spray polyurethane foam since they must adhere to international building requirements for energy efficiency. Buildings that are energy efficient are now preferred by home builders and owners, following a recent trend.

Get more detailed insights about Synthetic and Bio-Based Aniline Market Research Report – Forecast to 2032

Regional Insights

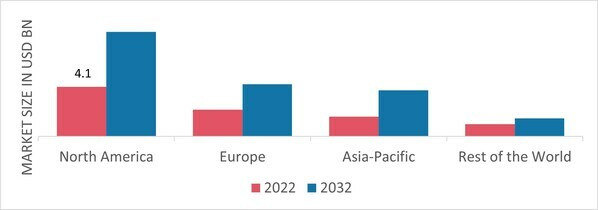

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American synthetic and bio-based aniline market area will dominate this market due to an increase in construction activity following the financial crisis of the previous ten years' recovery. The market for synthetic and bio-based aniline will continue to develop as long as the automobile industry in North America experiences strong growth.

Since nitrobenzene is the main raw material used to produce aniline, the United States' high nitrobenzene production will likewise have a favorable impact on the industry's expansion in North America.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: SYNTHETIC AND BIO-BASED ANILINE MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe synthetic and bio-based aniline market accounts for the second-largest market share due to increased auto production in nations like Germany, France, the UK, and Spain. The growing building industry in the developing nations of Central and Eastern Europe will also have an impact on the European market. Further, the German synthetic and bio-based aniline market held the largest market share, and the UK synthetic and bio-based aniline market was the fastest growing market in the European region

The Asia-Pacific synthetic and bio-based aniline market is expected to grow at the fastest CAGR from 2023 to 2032 due to the expanding automotive and infrastructure sectors. To meet the growing demand from the region's emerging countries, major corporations are increasing their aniline production capacity in China. It is anticipated that rising electronics output in China, Taiwan, and Korea would further fuel the expansion of the Asia Pacific market. Moreover, China’s synthetic and bio-based aniline market held the largest market share, and the Indian synthetic and bio-based aniline market was the fastest growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the synthetic and bio-based aniline market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, synthetic and bio-based aniline industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the synthetic and bio-based aniline industry to benefit clients and increase the market sector. In recent years, the synthetic and bio-based aniline industry has offered some of the most significant advantages to market.

Major players in the synthetic and bio-based aniline market attempting to increase market demand by investing in research and development operations include BASF SE (Germany), Huntsman International LLC. (U.S.), GNFC. (India), China Petroleum & Chemical Corporation (China), Sumitomo Chemical Co., Ltd. (Japan), Tosoh Corporation (Japan), Covestro AG (Germany), Borsodchem Mchz S.R.O. (Czech Republic), SP Chemicals Holdings Ltd. (Singapore), Arrow Chemical Group Corp. (China), and DowDuPont Inc. (U.S.).

Tosoh Corp. is a manufacturer and distributor of petrochemicals, fine chemicals, specialized products, and basic chemicals for industry. It also produces and sells materials for high-tech and specialized industries. Olefins, functional polymers, polyethylene, cement, caustic soda, measuring and diagnostic tools, inorganic and organic fine chemicals, functional materials, and urethane materials are among the company's product offerings. Additionally, it provides services including product delivery and logistics, insurance brokerage, equipment maintenance, and product sale and purchase.

Product manufacturers Covestro Deutschland AG produce polymers. The business manufactures and sells sealants, polycarbonates, polyurethanes, adhesives, coatings, and adhesives. The automotive, building, health, electronics, and medical engineering sectors are all served by Covestro Deutschland. Products range from thermoplastic polyurethane and polycarbonate pellets through isocyanates and polyols for cellular foams, as well as polyurethane-based additives used in the creation of coatings and adhesives. Formerly known as Bayer MaterialScience, it is a Bayer spin-off company that was established in the autumn of 2015.

Key Companies in the Synthetic Bio-Based Aniline Market market include

Industry Developments

February 2022: Launched recently, the Aston Martin DBX707 is the most significant luxury SUV in the world and offers a wide range of gearbox, engine, brake and suspension improvements. Alcantara, Inspires - Comfort, and Inspire Sport come with fully and semi-aniline leather seats that also have embroidered Aston Martin wings on the headrest, a contrast stripe down the middle of the seat, a perforation pattern in the back seat, and a base cushion.

Future Outlook

Synthetic Bio-Based Aniline Market Future Outlook

The Synthetic and Bio-based Aniline Market is projected to grow at a 7.24% CAGR from 2024 to 2035, driven by increasing demand for sustainable chemicals and advancements in production technologies.

New opportunities lie in:

- Invest in R&D for bio-based aniline production methods to enhance sustainability.

- Expand market presence in emerging economies with tailored product offerings.

- Leverage partnerships with automotive and textile industries to drive application-specific innovations.

By 2035, the market is expected to achieve robust growth, reflecting a strong shift towards sustainable aniline solutions.

Market Segmentation

Synthetic and Bio-Based Aniline Type Outlook (USD Billion, 2018-2032)

- Synthetic

- Bio-Based

Synthetic and Bio-Based Aniline Process Outlook (USD Billion, 2018-2032)

- Nitrobenzene

- Chlorobenzene

Synthetic and Bio-Based Aniline Regional Outlook (USD Billion, 2018-2032)

- US

- Canada

Synthetic and Bio-Based Aniline Application Outlook (USD Billion, 2018-2032)

- MDI

- Rubber Processing Chemical

Synthetic and Bio-Based Aniline End-Use Industry Outlook (USD Billion, 2018-2032)

- Construction

- Automotive

- Home Furnishing

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2023 | USD 9.63 Billion |

| Market Size 2024 | USD 10.43 Billion |

| Market Size 2032 | USD 18.24 Billion |

| Compound Annual Growth Rate (CAGR) | 7.24% (2024-2032) |

| Base Year | 2023 |

| Market Forecast Period | 2024-2032 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Process, Application, End- Use Industry and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | BASF SE (Germany), Huntsman International LLC. (U.S.), GNFC. (India), China Petroleum & Chemical Corporation (China), Sumitomo Chemical Co., Ltd. (Japan), Tosoh Corporation (Japan), Covestro AG (Germany), Borsodchem Mchz S.R.O. (Czech Republic), SP Chemicals Holdings Ltd. (Singapore), Arrow Chemical Group Corp. (China), and DowDuPont Inc. (U.S.) |

| Key Market Opportunities | Introduction of the bio-based alternative of aniline by Covestro AG company |

| Key Market Dynamics | Increasing demand for MDI based PU foams |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the synthetic and bio-based aniline market?

The synthetic and bio-based aniline market size was valued at USD 9.63 Billion in 2023.

What is the growth rate of the synthetic and bio-based aniline market?

The synthetic and bio-based aniline market is projected to grow at a CAGR of 7.240% during the forecast period, 2024-2032.

Which region held the largest market share in the synthetic and bio-based aniline market?

North America had the largest share in the synthetic and bio-based aniline market.

Who are the key players in the synthetic and bio-based aniline market?

The key players in the synthetic and bio-based aniline market are BASF SE (Germany), Huntsman International LLC. (U.S.), GNFC. (India), China Petroleum & Chemical Corporation (China), Sumitomo Chemical Co., Ltd. (Japan), Tosoh Corporation (Japan), Covestro AG (Germany), Borsodchem Mchz S.R.O. (Czech Republic), SP Chemicals Holdings Ltd. (Singapore), Arrow Chemical Group Corp. (China), and DowDuPont Inc. (U.S.).

Which type led the synthetic and bio-based aniline market?

The bio-based category dominated the synthetic and bio-based aniline market in 2023.

Which end-use industry had the largest market share in the synthetic and bio-based aniline market?

The construction category had the largest share in the synthetic and bio-based aniline market.

-

'TABLE OF CONTENTS

-

1 Executive Summary

-

2 Scope of the Report

- Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

- Markets Structure 3

-

Market Research Methodology

- Research Process

- Secondary Research

- Primary Research

- Forecast Model 4 Market Landscape

-

Supply Chain Analysis

-

Application Suppliers

-

Manufacturers/Producers

- Distributors/Retailers/Wholesalers/E-Commerce

- End Users

-

Manufacturers/Producers

-

Porter’s Five Forces Analysis

-

Threat of New Entrants

- Bargaining

-

Power of Buyers

-

Bargaining Power of Suppliers

- Threat of Substitutes

- Intensity of Competitive Rivalry 5

-

Bargaining Power of Suppliers

-

Market Dynamics of Global Synthetic and Bio-based Aniline Market

- Introduction

- Drivers

- Restraints

- Opportunities

- Challenges

- Trends/Technology

-

Global Synthetic and Bio-based Aniline Market by Type

- Introduction

- Synthetic

-

6.2.1 Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

-

Bio-based

-

Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region

- Introduction

-

Reduction of Nitrobenzene

- Market Estimates & Forecast

- Market Estimates & Forecast by Region, 2023-2032

-

Substitution of Chlorobenzene

- Market

-

Market Estimates & Forecast, 2023-2032

-

Estimates & Forecast, 2023-2032

- Market Estimates

-

Forecast by Region, 2023-2032

-

Aniline Market, by Application

- Introduction

-

Methylene diphenyl diisocyanate (MDI)

-

Market Estimates & Forecast, 2023-2032

- Market

-

Estimates & Forecast by Region, 2023-2032

-

-

8.3 Rubber Processing Chemicals

-

Market Estimates & Forecast, 2023-2032

- Market

-

Estimates & Forecast by Region, 2023-2032

-

Dyes & Pigments

- Market Estimates & Forecast, 2023-2032

-

Dyes & Pigments

-

Market Estimates & Forecast by Region, 2023-2032

- Pharmaceutical

-

8.5.1 Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

- Agrochemical 8.6.1

-

Market Estimates & Forecast, 2023-2032

- Market

-

Estimates & Forecast by Region, 2023-2032

- Photographic chemical

-

8.7.1 Market Estimates & Forecast

- Market Estimates & Forecast by Region, 2023-2032

- Diphenylamine

-

8.8.1 Market

-

Estimates & Forecast, 2023-2032

- Market Estimates

-

Forecast by Region, 2023-2032

- Others

-

8.9.1 Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast by Region, 2023-2032

-

Synthetic and Bio-based Aniline Market, by End-use industry

- Introduction

- Building & Construction

-

Market Estimates & Forecast, 2023-2032

- Market

-

Estimates & Forecast by Region, 2023-2032

-

Automotive

- Market Estimates & Forecast, 2023-2032

-

Automotive

-

Market Estimates & Forecast by Region, 2023-2032

-

Healthcare

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

- Home Furnishing

-

Healthcare

-

9.5.1 Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

- Electrical & Electronics

-

9.6.1 Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast by Region, 2023-2032

- Others

-

9.7.1 Market Estimates & Forecast

- Market Estimates & Forecast by Region, 2023-2032

- Introduction

- North America

-

-

10.2.1 Market Estimates & Forecast, 2023-2032

-

- Market Estimates & Forecast by Type, 2023-2032

-

- Market Estimates & Forecast by Process, 2023-2032

-

- Market Estimates & Forecast by Application, 2023-2032

-

-

10.2.5 Market Estimates & Forecast by End-use industry

- U.S.

-

-

-

10.2.6.1 Market Estimates & Forecast, 2023-2032

-

-

10.2.6.2 Market

-

Estimates & Forecast by Type, 2023-2032

-

-

-

10.2.6.3 Market Estimates & Forecast by Process

-

-

10.2.6.4

-

Market Estimates & Forecast by Application, 2023-2032

-

-

10.2.6.5 Market Estimates

-

& Forecast by End-use industry, 2023-2032

-

-

10.2.7 Canada

-

-

10.2.7.1 Market

-

Estimates & Forecast, 2023-2032

-

-

-

10.2.7.2 Market Estimates & Forecast by Type, 2023-2032

-

-

10.2.7.3 Market

-

Estimates & Forecast by Process, 2023-2032

-

-

-

10.2.7.4 Market Estimates & Forecast by Application, 2023-2032

- Market Estimates & Forecast

-

by End-use industry, 2023-2032

- Europe

-

10.3.1

-

Market Estimates & Forecast, 2023-2032

-

10.3.2

-

Market Estimates & Forecast by Type, 2023-2032

-

- Market Estimates & Forecast by Process, 2023-2032

-

-

10.3.4 Market Estimates & Forecast by Application

-

-

10.3.5 Market Estimates & Forecast

-

by End-use industry, 2023-2032

-

-

10.3.6 Germany

-

-

10.3.6.1 Market

-

Estimates & Forecast, 2023-2032

-

-

-

10.3.6.2 Market Estimates & Forecast by Type

-

-

10.3.6.3

-

Market Estimates & Forecast by Process, 2023-2032

-

-

10.3.6.4 Market Estimates

-

& Forecast by Application, 2023-2032

-

-

-

10.3.6.5 Market Estimates & Forecast

-

by End-use industry, 2023-2032

-

-

10.3.7. France

-

-

10.3.7.1 Market

-

Estimates & Forecast, 2023-2032

-

-

-

10.3.7.2 Market Estimates & Forecast by Type

-

-

10.3.7.3

-

Market Estimates & Forecast by Process, 2023-2032

-

-

10.3.7.4 Market

-

Estimates & Forecast by Application, 2023-2032

-

10.3.7.5

-

Market Estimates & Forecast by End-use industry, 2023-2032

-

10.3.8 Italy

-

-

-

10.3.8.1 Market Estimates & Forecast, 2023-2032

-

-

10.3.8.2 Market

-

Estimates & Forecast by Type, 2023-2032

-

-

-

10.3.8.3 Market Estimates & Forecast by Process, 2023-2032

-

-

-

10.3.8.4 Market Estimates & Forecast by Application, 2023-2032

-

10.3.8.5 Market Estimates & Forecast by End-use industry

-

-

10.3.9 Spain

-

-

-

10.3.9.1 Market Estimates & Forecast

-

-

10.3.9.2

-

Market Estimates & Forecast by Type, 2023-2032

-

-

10.3.9.3 Market Estimates

-

& Forecast by Process, 2023-2032

-

-

-

10.3.9.4 Market Estimates & Forecast by Application

-

10.3.9.5 Market Estimates & Forecast by End-use industry, 2023-2032

-

-

10.3.10 UK

-

-

-

10.3.10.1 Market Estimates & Forecast

-

-

10.3.10.2

-

Market Estimates & Forecast by Type, 2023-2032

-

-

10.3.10.3 Market Estimates

-

Forecast by Process, 2023-2032

-

-

-

10.3.10.4 Market Estimates & Forecast by Application, 2023-2032

-

10.3.10.5 Market Estimates & Forecast by End-use industry, 2023-2032

-

-

10.3.11 Russia

-

-

-

10.3.11.1 Market Estimates & Forecast, 2023-2032

-

-

10.3.11.2 Market Estimates

-

& Forecast by Type, 2023-2032

-

-

-

10.3.11.3 Market Estimates & Forecast by Process

-

-

10.3.11.4

-

Market Estimates & Forecast by Application, 2023-2032 10.3.11.5

-

Market Estimates & Forecast by End-use industry, 2023-2032

-

- Poland

-

-

-

10.3.12.1 Market Estimates & Forecast, 2023-2032

-

-

10.3.12.2 Market Estimates

-

& Forecast by Type, 2023-2032

-

-

-

10.3.12.3 Market Estimates & Forecast by Process

-

-

10.3.12.4

-

Market Estimates & Forecast by Application, 2023-2032 10.3.12.5

-

Market Estimates & Forecast by End-use industry, 2023-2032

-

Rest of Europe

-

-

-

10.3.13.1 Market Estimates & Forecast, 2023-2032

-

-

10.3.13.2 Market Estimates

-

& Forecast by Type, 2023-2032

-

-

-

10.3.13.3 Market Estimates & Forecast by Process

-

-

10.3.13.4

-

Market Estimates & Forecast by Application, 2023-2032 10.3.13.5

-

Market Estimates & Forecast by End-use industry, 2023-2032

-

Asia Pacific

-

-

10.4.1 Market Estimates & Forecast, 2023-2032

-

-

10.4.2 Market Estimates

-

Forecast by Type, 2023-2032

-

-

10.4.3 Market Estimates

-

Forecast by Process, 2023-2032

-

-

10.4.4 Market Estimates

-

Forecast by Application, 2023-2032

-

-

10.4.5 Market Estimates

-

& Forecast by End-use industry, 2023-2032

-

-

10.4.6 China

-

-

10.4.6.1 Market Estimates & Forecast, 2023-2032

-

-

-

10.4.6.2 Market Estimates & Forecast by Type, 2023-2032

-

-

10.4.6.3 Market Estimates

-

& Forecast by Process, 2023-2032

-

-

-

10.4.6.4 Market Estimates & Forecast by Application, 2023-2032

- Market Estimates & Forecast by End-use industry, 2023-2032

-

10.4.7 India

-

-

-

10.4.7.1 Market Estimates & Forecast, 2023-2032

-

-

10.4.7.2 Market Estimates

-

& Forecast by Type, 2023-2032

-

-

-

10.4.7.3 Market Estimates & Forecast by Process, 2023-2032

-

-

10.4.7.4 Market Estimates

-

& Forecast by Application, 2023-2032

- Market Estimates

-

Forecast by End-use industry, 2023-2032

-

-

10.4.8 Japan

-

-

10.4.8.1 Market Estimates & Forecast, 2023-2032

-

-

-

10.4.8.2 Market Estimates & Forecast by Type, 2023-2032

-

-

10.4.8.3 Market Estimates

-

& Forecast by Process, 2023-2032

-

-

-

10.4.8.4 Market Estimates & Forecast by Application, 2023-2032

- Market Estimates & Forecast by End-use industry, 2023-2032

-

-

10.4.9 Australia & New Zealand

-

-

10.4.9.1 Market Estimates & Forecast

-

-

10.4.9.2

-

Market Estimates & Forecast by Type, 2023-2032

-

-

-

10.4.9.3 Market Estimates & Forecast by Process

-

-

10.4.9.4

-

Market Estimates & Forecast by Application, 2023-2032

- Market

-

Estimates & Forecast by End-use industry, 2023-2032

-

10.4.10

-

Rest of Asia Pacific

-

-

-

10.4.10.1 Market Estimates & Forecast, 2023-2032

-

-

10.4.10.2 Market Estimates

-

Forecast by Type, 2023-2032

-

-

-

10.4.10.3 Market Estimates & Forecast by Process, 2023-2032

-

-

10.4.10.4 Market Estimates

-

& Forecast by Application, 2023-2032

- Market Estimates

-

& Forecast by End-use industry, 2023-2032

- Middle East & Africa

-

-

10.5.1 Market Estimates & Forecast

-

-

10.5.2 Market Estimates & Forecast by Type, 2023-2032

-

-

10.5.3 Market Estimates & Forecast by Process, 2023-2032

-

10.5.4

-

Market Estimates & Forecast by Application, 2023-2032

-

10.5.5

-

Market Estimates & Forecast by End-use industry, 2023-2032

-

10.5.6 GCC

-

-

10.5.6.1 Market

-

Estimates & Forecast, 2023-2032

-

-

-

10.5.6.2 Market Estimates & Forecast by Type, 2023-2032

-

-

10.5.6.3 Market Estimates

-

Forecast by Process, 2023-2032

-

-

- Market Estimates & Forecast by Application, 2023-2032

-

10.5.6.3 Market Estimates

-

Forecast by End-use industry, 2023-2032

-

-

10.5.7 Israel

-

-

10.5.7.1 Market Estimates & Forecast, 2023-2032

-

-

-

10.5.7.2 Market Estimates & Forecast by Type, 2023-2032

-

-

10.5.7.3 Market Estimates

-

& Forecast by Process, 2023-2032

-

-

-

10.5.7.4 Market Estimates & Forecast by Application, 2023-2032

- Market Estimates & Forecast by End-use industry, 2023-2032

-

-

10.5.8 North Africa

-

-

-

10.5.8.1 Market Estimates & Forecast, 2023-2032

-

-

10.5.8.2 Market Estimates

-

& Forecast by Type, 2023-2032

-

-

-

10.5.8.3 Market Estimates & Forecast by Process, 2023-2032

-

-

10.5.8.4 Market Estimates

-

& Forecast by Application, 2023-2032

- Market Estimates

-

Forecast by End-use industry, 2023-2032

-

-

10.5.9 Turkey

-

-

10.5.9.1 Market Estimates & Forecast, 2023-2032

-

-

-

10.5.9.2 Market Estimates & Forecast by Type, 2023-2032

-

-

10.5.9.3 Market Estimates

-

& Forecast by Process, 2023-2032

-

-

-

10.5.9.4 Market Estimates & Forecast by Application, 2023-2032

- Market Estimates & Forecast by End-use industry, 2023-2032

-

-

10.5.10 Rest of Middle East & Africa

-

-

10.5.10.1 Market Estimates & Forecast

-

-

10.5.10.2

-

Market Estimates & Forecast by Type, 2023-2032

-

-

10.5.10.3 Market Estimates & Forecast by Process, 2023-2032

-

-

- Market Estimates & Forecast by Application, 2023-2032 10.5.10.5

-

Market Estimates & Forecast by End-use industry, 2023-2032

- Latin America

-

-

10.6.1 Market Estimates & Forecast

-

-

10.6.2 Market Estimates & Forecast by Type

-

-

10.6.3 Market Estimates & Forecast by Process

-

-

10.6.4 Market Estimates & Forecast by Application

-

-

10.6.5 Market Estimates & Forecast by End-use industry, 2023-2032

-

-

10.6.6 Brazil

-

-

10.6.6.1 Market Estimates & Forecast, 2023-2032

-

-

10.6.6.2

-

Market Estimates & Forecast by Type, 2023-2032

-

-

10.6.6.3 Market Estimates & Forecast by Process, 2023-2032

-

-

10.6.6.4

-

Market Estimates & Forecast by Application, 2023-2032

-

Market Estimates & Forecast by End-use industry, 2023-2032

-

10.6.7 Mexico

-

-

-

10.6.7.1 Market Estimates & Forecast, 2023-2032

-

-

10.6.7.2 Market Estimates

-

Forecast by Type, 2023-2032

-

-

-

10.6.7.3 Market Estimates & Forecast by Process, 2023-2032

-

-

10.6.7.4 Market Estimates

-

& Forecast by Application, 2023-2032

- Market Estimates

-

Forecast by End-use industry, 2023-2032

-

-

10.6.8 Argentina

-

-

10.6.8.1 Market Estimates & Forecast, 2023-2032

-

-

-

10.6.8.2 Market Estimates & Forecast by Type, 2023-2032

-

-

10.6.8.3 Market Estimates

-

& Forecast by Process, 2023-2032

-

-

-

10.6.8.4 Market Estimates & Forecast by Application, 2023-2032

- Market Estimates & Forecast by End-use industry, 2023-2032

-

-

10.6.9 Rest of Latin America

-

-

10.6.9.1 Market Estimates & Forecast

-

-

10.6.9.2

-

Market Estimates & Forecast by Type, 2023-2032

-

-

-

10.6.9.3 Market Estimates & Forecast by Process

-

-

10.6.9.4

-

Market Estimates & Forecast by Application, 2023-2032 10.6.9.5

-

Market Estimates & Forecast by End-use industry, 2023-2032

-

11.2 Market Strategy

-

Key Development Analysis (Expansion/Merger & Acquisitions/Joint Venture/New Product Development/Agreement/Investment)

-

12.1 BASF SE

-

12.1.1 Company Overview

-

Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

- Huntsman International LLC.

-

Financial Updates

-

12.2.1 Company Overview

-

Financial Updates

-

Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis 12.3 GNFC.

-

Product/Business Segment Overview

-

12.3.1 Company Overview

-

Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

- China Petroleum & Chemical Corporation

-

Financial Updates

-

12.4.1 Company Overview

-

Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

- Sumitomo Chemical Co., Ltd.

-

Financial Updates

-

12.5.1 Company Overview

-

Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Financial Updates

-

12.6 Tosoh Corporation

-

12.6.1 Company Overview

-

Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

- Covestro AG

-

Financial Updates

-

12.7.1 Company Overview

-

Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

- Borsodchem Mchz S.R.O.

-

Financial Updates

-

12.8.1 Company Overview

-

Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

- SP Chemicals Holdings Ltd.

-

Financial Updates

-

12.9.1 Company Overview

-

Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

- Arrow Chemical Group Corp.

-

Financial Updates

-

-

12.10.1 Company Overview

-

Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

- DowDuPont Inc.

-

Financial Updates

-

12.10.1 Company Overview

-

Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Financial Updates

-

Bio-based Aniline Market: By Region, 2023-2032

-

America Synthetic and Bio-based Aniline Market: By Country, 2023-2032

-

2023-2032

-

Aniline Market: By Country, 2023-2032

-

East & Africa Synthetic and Bio-based Aniline Market: By Country, 2023-2032

-

Market: By Country, 2023-2032

-

and Bio-based Aniline Type Market: By Regions, 2023-2032

-

North America Synthetic and Bio-based Aniline Type Market: By Country, 2023-2032

-

Table

-

Europe Synthetic and Bio-based Aniline

-

Type Market: By Country, 2023-2032 Table10 Asia-Pacific

-

Synthetic and Bio-based Aniline Type Market: By Country, 2023-2032

-

Middle East & Africa Synthetic and Bio-based Aniline Type Market: By Country

-

2023-2032

-

Aniline Type Market: By Country, 2023-2032

-

Synthetic and Bio-based Aniline Process Market: By Regions, 2023-2032

-

Market: By Country, 2023-2032

-

and Bio-based Aniline Process Market: By Country, 2023-2032

-

Asia-Pacific Synthetic and Bio-based Aniline Process Market: By Country, 2023-2032

-

Aniline Process Market: By Country, 2023-2032

-

America Synthetic and Bio-based Aniline Process Market: By Country, 2023-2032

-

Table19 Global Synthetic and Bio-based Aniline Application

-

Market: By Regions, 2023-2032

-

and Bio-based Aniline Application Market: By Country, 2023-2032

-

Europe Synthetic and Bio-based Aniline Application Market: By Country, 2023-2032

-

Application Market: By Country, 2023-2032

-

East & Africa Synthetic and Bio-based Aniline Application Market: By Country

-

2023-2032

-

Aniline Application Market: By Country, 2023-2032

-

Global Synthetic and Bio-based Aniline End-Use Industry Market: By Regions

-

End-Use Industry Market: By Country, 2023-2032

-

Synthetic and Bio-based Aniline End-Use Industry Market: By Country, 2023-2032

-

Industry Market: By Country, 2023-2032

-

East & Africa Synthetic and Bio-based Aniline End-Use Industry Market: By Country

-

2023-2032

-

Aniline End-Use Industry Market: By Country, 2023-2032

-

Global Type Market: By Region, 2023-2032

-

Process Market: By Region, 2023-2032

-

Application Market: By Region, 2023-2032

-

End-Use Industry Market: By Region, 2023-2032

-

America Synthetic and Bio-based Aniline Market, By Country

-

North America Synthetic and Bio-based Aniline Market, By Type

-

North America Synthetic and Bio-based Aniline Market, By Process By Application

-

Aniline Market, By End-Use Industry

-

and Bio-based Aniline Market, By Country

-

Synthetic and Bio-based Aniline Market, By Type

-

Synthetic and Bio-based Aniline Market, By Process

-

Synthetic and Bio-based Aniline Market, By Application

-

Europe: Synthetic and Bio-based Aniline Market, By End-Use Industry

-

Asia-Pacific: Synthetic and Bio-based Aniline Market, By Country By Type

-

Market, By Process

-

and Bio-based Aniline Market, By Application

-

Synthetic and Bio-based Aniline Market, By End-Use Industry

-

Middle East & Africa: Synthetic and Bio-based Aniline Market, By Country

-

Aniline Market, By Type

-

Synthetic and Bio-based Aniline Market, By Process

-

Middle East & Africa: Synthetic and Bio-based Aniline Market, By Application

-

Market, By End-Use Industry

-

and Bio-based Aniline Market, By Country

-

America Synthetic and Bio-based Aniline Market, By Type

-

Latin America Synthetic and Bio-based Aniline Market, By Process By Application

-

Bio-based Aniline Market, By End-Use Industry

-

Five Forces Analysis of Global Synthetic and Bio-based Aniline Market

-

In 2023, By Country (In %) Aniline Market, 2023-2032

-

Aniline Market Size by Type, 2023

-

and Bio-based Aniline Market by Type, 2023-2032

-

Synthetic and Bio-based Aniline Market Size by Process, 2023

-

Share of Global Synthetic and Bio-based Aniline Market by Process, 2023-2032

-

by Application, 2023-2032

-

FIGURE

-

Global

-

Synthetic and Bio-based Aniline Market Size by End-Use Industry, 2023 Industry, 2023-2032'

Synthetic and Bio-Based Aniline Type Outlook (USD Billion, 2018-2032)

- Synthetic

- Bio-Based

Synthetic and Bio-Based Aniline Process Outlook (USD Billion, 2018-2032)

- Nitrobenzene

- Chlorobenzene

Synthetic and Bio-Based Aniline Application Outlook (USD Billion, 2018-2032)

- MDI

- Rubber Processing Chemical

Synthetic and Bio-Based Aniline End-Use Industry Outlook (USD Billion, 2018-2032)

- Construction

- Automotive

- Home Furnishing

Synthetic and Bio-Based Aniline Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

- North America Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- North America Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- North America Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- North America Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

US Outlook (USD Billion, 2018-2032)

- US Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- US Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- US Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- US Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

CANADA Outlook (USD Billion, 2018-2032)

- CANADA Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- CANADA Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- CANADA Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- CANADA Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

- North America Synthetic and Bio-Based Aniline by Type

Europe Outlook (USD Billion, 2018-2032)

- Europe Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- Europe Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- Europe Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- Europe Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

Germany Outlook (USD Billion, 2018-2032)

- Germany Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- Germany Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- Germany Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- Germany Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

France Outlook (USD Billion, 2018-2032)

- France Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- France Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- France Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- France Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

UK Outlook (USD Billion, 2018-2032)

- UK Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- UK Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- UK Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- UK Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

ITALY Outlook (USD Billion, 2018-2032)

- ITALY Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- ITALY Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- ITALY Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- ITALY Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

SPAIN Outlook (USD Billion, 2018-2032)

- Spain Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- Spain Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- Spain Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- Spain Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

Rest Of Europe Outlook (USD Billion, 2018-2032)

- Rest Of Europe Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- REST OF EUROPE Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- REST OF EUROPE Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- REST OF EUROPE Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

- Europe Synthetic and Bio-Based Aniline by Type

Asia-Pacific Outlook (USD Billion, 2018-2032)

- Asia-Pacific Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- Asia-Pacific Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- Asia-Pacific Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- Asia-Pacific Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

China Outlook (USD Billion, 2018-2032)

- China Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- China Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- China Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- China Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

Japan Outlook (USD Billion, 2018-2032)

- Japan Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- Japan Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- Japan Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- Japan Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

India Outlook (USD Billion, 2018-2032)

- India Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- India Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- India Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- India Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

Australia Outlook (USD Billion, 2018-2032)

- Australia Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- Australia Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- Australia Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- Australia Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

- Rest of Asia-Pacific Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- Rest of Asia-Pacific Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- Rest of Asia-Pacific Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- Rest of Asia-Pacific Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

- Asia-Pacific Synthetic and Bio-Based Aniline by Type

Rest of the World Outlook (USD Billion, 2018-2032)

- Rest of the World Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- Rest of the World Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- Rest of the World Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- Rest of the World Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

Middle East Outlook (USD Billion, 2018-2032)

- Middle East Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- Middle East Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- Middle East Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- Middle East Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

Africa Outlook (USD Billion, 2018-2032)

- Africa Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- Africa Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- Africa Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- Africa Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

Latin America Outlook (USD Billion, 2018-2032)

- Latin America Synthetic and Bio-Based Aniline by Type

- Synthetic

- Bio-Based

- Latin America Synthetic and Bio-Based Aniline by Process

- Nitrobenzene

- Chlorobenzene

- Latin America Synthetic and Bio-Based Aniline by Application

- MDI

- Rubber Processing Chemical

- Latin America Synthetic and Bio-Based Aniline by End-Use Industry

- Construction

- Automotive

- Home Furnishing

- Rest of the World Synthetic and Bio-Based Aniline by Type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment