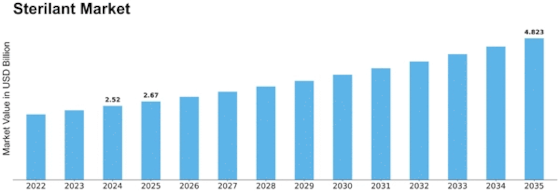

Sterilant Size

Sterilant Market Growth Projections and Opportunities

The sterilant market is influenced by various market factors that shape its dynamics and growth trajectory. One of the primary factors driving this market is the increasing emphasis on infection control and prevention across various industries such as healthcare, pharmaceuticals, and food processing. With the rise in awareness about the importance of maintaining hygiene standards to prevent the spread of diseases, the demand for sterilants has seen a significant uptick.

The process is used for eliminating microorganisms such as fungi, spores, bacteria, viruses, and other biological agents from inanimate objects is called sterilization, and sterilants are the chemicals used in this process. Sterilants are composed of pure chemicals and chemical compounds, such as pure chlorine and peracetic acid. Owing to the ability of sterilants to eradicate spores, they are preferred over disinfectants which are extensively used in pharmaceutical and agricultural industries.

Moreover, stringent regulations and standards imposed by regulatory bodies further contribute to the growth of the sterilant market. Authorities such as the Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA) set guidelines for the use of sterilants in different applications to ensure safety and efficacy. Compliance with these regulations is crucial for companies operating in the sterilant market, thus driving innovation and investment in research and development to meet the required standards.

Technological advancements also play a pivotal role in shaping the sterilant market. The development of new and improved sterilization techniques and products enhances the efficiency and effectiveness of sterilants, driving their adoption across various industries. Innovations such as low-temperature sterilization methods and environmentally friendly sterilants are gaining traction due to their ability to address the limitations of traditional sterilization methods while reducing environmental impact.

Furthermore, the increasing prevalence of infectious diseases and healthcare-associated infections (HAIs) fuels the demand for sterilants in healthcare facilities. Hospitals, clinics, and other healthcare settings require effective sterilization solutions to disinfect medical devices, equipment, and surfaces to prevent cross-contamination and ensure patient safety. As healthcare-associated infections pose a significant threat to public health and healthcare systems, the need for robust sterilization protocols becomes paramount, driving the growth of the sterilant market.

Globalization and international trade also impact the sterilant market, as the exchange of goods and services across borders necessitates stringent sterilization protocols to prevent the spread of pathogens and contaminants. This is particularly relevant in industries such as food processing and agriculture, where products are traded internationally. Stringent sterilization requirements imposed by importing countries drive the demand for effective sterilization solutions, creating opportunities for companies operating in the sterilant market.

Moreover, the increasing focus on sustainability and environmental conservation is influencing the sterilant market. There is a growing demand for eco-friendly sterilization solutions that minimize the use of harmful chemicals and reduce environmental pollution. Biodegradable sterilants and sterilization methods that consume less energy and water are gaining popularity as businesses and consumers alike prioritize environmentally responsible practices.

Additionally, the emergence of new infectious agents and drug-resistant pathogens presents challenges and opportunities for the sterilant market. The need for novel sterilization solutions capable of eliminating emerging threats drives research and innovation in the field. Companies that can develop effective sterilants capable of addressing evolving microbial challenges stand to gain a competitive edge in the market.

Leave a Comment