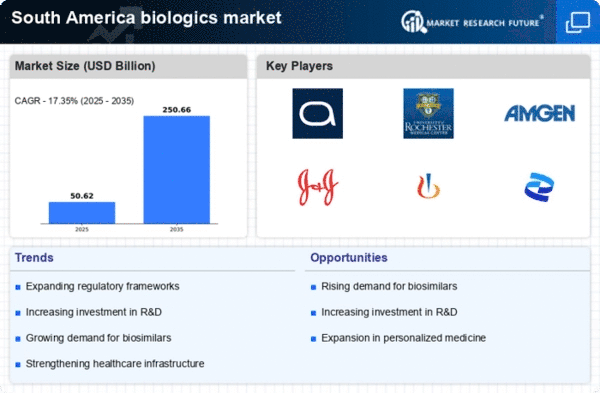

The South America Biologics Market has been experiencing significant growth, driven by advancements in biopharmaceutical technology and an increase in demand for biologics such as monoclonal antibodies, vaccines, and cell therapies. This region is increasingly becoming a focal point for global players due to its expanding healthcare infrastructure, rising prevalence of chronic diseases, and growing biologics production capacity. A key aspect of the competitive landscape lies in the robust presence of significant biopharmaceutical companies that are investing in research and development, as well as strategic partnerships and alliances to enhance their market reach.

The market dynamics are shaped by factors such as regulatory environments, market access challenges, and the need for innovative therapeutics that address local health issues. As the market evolves, understanding the strategies adopted by leading players will be essential for stakeholders aiming to navigate the complexities of the South American biologics sector effectively.AbbVie is a prominent player in the South America Biologics Market, recognized for its strong portfolio of biological therapies aimed at treating complex and chronic conditions such as autoimmune disorders and oncology-related illnesses.

The company has established a commendable market presence, bolstered by its commitment to research and development, which has led to the introduction of innovative therapies.

AbbVie's strategic focus on collaboration with local healthcare providers and regulatory bodies enables it to navigate the regional market efficiently. The company has successfully localized its production and distribution channels to enhance accessibility to its biological therapies. This has not only strengthened its presence in the market but also fostered trust among healthcare professionals. AbbVie’s strength lies in its ability to leverage its scientific expertise while also tailoring its offerings to meet the specific needs of patients in South America.

Johnson and Johnson, another key player in the South America Biologics Market, has made significant strides with its range of biological products specifically designed to treat various conditions within the region. The company’s diverse portfolio includes products for immunology, oncology, and infectious diseases, demonstrating a commitment to addressing the diverse health needs of the South American population. Johnson and Johnson's robust market presence is underpinned by strategic mergers and acquisitions that expand its capabilities and product offerings within the biologics space.

The company's investment in local manufacturing facilities has enabled it to enhance the availability of its biological therapies, ensuring that they are reachable for the patients who need them. With intense research and development initiatives, Johnson and Johnson continues to innovate and adapt, maintaining a competitive edge while adhering to regulatory standards specific to South America. This adaptability ensures its sustained growth in a market that is progressively embracing the potential of biological therapies to improve health outcomes.