South America & Africa Diesel Generator Market Share

South America & Africa Diesel Generator Market by Power Rating (Upto 10 kW, 11 kW - 100 kW and Above 100 kW), by End-User (Residential, Commercial and Industrial), by Portability (Stationary and Portable), by Hybrid System Type (Solar Diesel and Wind Diesel), by Country (Colombia, Nigeria, Peru Congo, Sudan, Guatemala, Tanzania, Kenya, Ethiopia, Bolivia, Uganda and Other Countries) - South ...

Market Summary

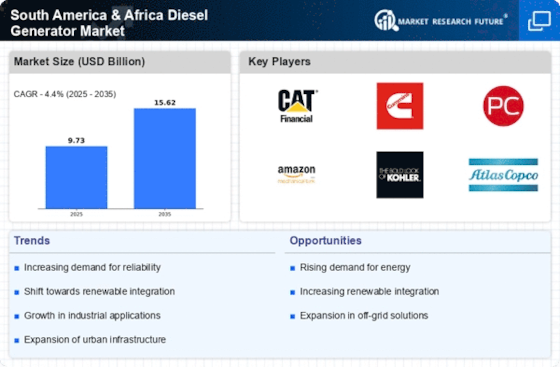

The South America and Africa Diesel Generator Market is projected to grow from 12.5 USD Billion in 2024 to 25 USD Billion by 2035, reflecting a robust CAGR of 6.5%.

Key Market Trends & Highlights

South America & Africa Diesel Generator Key Trends and Highlights

- The market valuation is expected to reach 25 USD Billion by 2035, indicating substantial growth potential.

- From 2025 to 2035, the market is anticipated to expand at a CAGR of 6.5%, showcasing a steady upward trend.

- In 2024, the market is valued at 12.5 USD Billion, laying a strong foundation for future growth.

- Growing adoption of diesel generators due to increasing energy demand is a major market driver.

Market Size & Forecast

| 2024 Market Size | 12.5 (USD Billion) |

| 2035 Market Size | 25 (USD Billion) |

| CAGR (2025 - 2035) | 6.5% |

| Largest Regional Market Share in 2024 | -) |

Major Players

Apple Inc (US), Microsoft Corp (US), Amazon.com Inc (US), Alphabet Inc (US), Berkshire Hathaway Inc (US), Tesla Inc (US), Meta Platforms Inc (US), Johnson & Johnson (US), Visa Inc (US), Procter & Gamble Co (US)

Market Trends

The diesel generator market in South America and Africa is poised for growth, driven by increasing energy demands and the need for reliable power solutions in both urban and rural areas.

International Energy Agency (IEA)

South America & Africa Diesel Generator Market Market Drivers

Growing Energy Demand

The Global South America and Africa Diesel Generator Market Industry is experiencing a surge in energy demand, driven by rapid urbanization and industrialization. Countries such as Brazil and Nigeria are witnessing significant growth in their energy sectors, with electricity consumption projected to rise substantially. In 2024, the market is valued at approximately 12.5 USD Billion, reflecting the increasing reliance on diesel generators for backup and primary power solutions. This trend is likely to continue as populations grow and infrastructure development accelerates, suggesting a robust future for diesel generators in these regions.

Unreliable Power Supply

The prevalence of unreliable power supply in many regions of South America and Africa is a critical driver for the Global South America and Africa Diesel Generator Market Industry. Countries like Venezuela and South Africa face frequent power outages, prompting businesses and households to seek alternative power solutions. Diesel generators provide a reliable backup during these outages, ensuring continuity of operations. As the market evolves, the demand for diesel generators is likely to increase, particularly in urban areas where the impact of power disruptions is most acutely felt, further solidifying the market's growth trajectory.

Technological Advancements

Technological advancements in diesel generator design and efficiency are enhancing the appeal of the Global South America and Africa Diesel Generator Market Industry. Innovations such as improved fuel efficiency and reduced emissions are making diesel generators more environmentally friendly and cost-effective. Manufacturers are increasingly adopting advanced technologies to meet stringent regulatory standards and consumer preferences for greener solutions. This shift not only addresses environmental concerns but also positions diesel generators as viable options for both commercial and residential applications, potentially expanding their market share in the coming years.

Market Trends and Projections

Economic Growth and Investment

Economic growth and increased foreign investment in South America and Africa are driving the Global South America and Africa Diesel Generator Market Industry. Countries like Colombia and Kenya are attracting investments in various sectors, including mining, agriculture, and manufacturing, which require reliable power sources. As these economies expand, the demand for diesel generators is expected to rise, with projections indicating a market value of 25 USD Billion by 2035. This growth is indicative of the broader economic trends in the regions, where energy security is becoming increasingly vital for sustaining development.

Infrastructure Development Initiatives

Infrastructure development initiatives across South America and Africa are propelling the Global South America and Africa Diesel Generator Market Industry forward. Governments are investing heavily in transportation, healthcare, and telecommunications infrastructure, which necessitates reliable power sources. For instance, Brazil's investments in road and rail projects and Nigeria's focus on expanding its telecommunications network highlight the need for diesel generators. This focus on infrastructure is expected to contribute to a compound annual growth rate of 6.5% from 2025 to 2035, indicating a sustained demand for diesel generators as essential components of these projects.

Market Segment Insights

Regional Insights

Key Companies in the South America & Africa Diesel Generator Market market include

Industry Developments

Future Outlook

South America & Africa Diesel Generator Market Future Outlook

The South America & Africa Diesel Generator Market is projected to grow at a 6.5% CAGR from 2024 to 2035, driven by increasing energy demands and infrastructure development.

New opportunities lie in:

- Invest in renewable energy hybrid systems to enhance generator efficiency.

- Develop smart generator technologies for remote monitoring and management.

- Expand distribution networks to penetrate underserved rural markets.

By 2035, the market is expected to achieve robust growth, positioning itself as a critical energy solution.

Market Segmentation

Report Scope

| Attribute/Metric | Details |

| Market Size 2023 | USD 9.2 Billion |

| Market Size 2024 | USD 9.73 Billion |

| Market Size 2032 | USD 12 Billion |

| CAGR | 2.65% CAGR (2024-2032) |

| Base Year | 2023 |

| Forecast Period | 2024 to 2032 |

| Historical Data | 2019 & 2022 |

| Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Power Rating, End-User, Portability, Hybrid System Type, Country |

| Geographies Covered | North America, Europe, Asia-Pacific, and Rest of the World (RoW) |

| Key Vendors | Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Mitsubishi Heavy Industries Engine & Turbocharger, Ltd., AKSA Power Generation, Kohler Co., Rolls-Royce Power Systems AG, Wuxi Kipor Power Co. Ltd, Aggreko PLC, MAN Diesel & Turbo, General Electric Company and Wärtsilä |

| Key Market Opportunities | Growth In Industrialization & Urbanization Access To Electricity In Rural & Remote Areas |

| Key Market Drivers | Surge In Power Outages & Power Failure Growing Demand For Interminable & Dependable Power Supply Growth In Hybrid Renewable Energy Systems |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

Why is the South America & Africa diesel generator market expected to grow substantially?

Increasing power outages is the primary driver of the South America & Africa diesel generator market.

Who are the key contributors to the South America & Africa diesel generator market?

The key contributors are Caterpillar Inc., Generac Holdings Inc., Cummins Inc., Mitsubishi Heavy Industries Engine & Turbocharger, Ltd., Kohler Co., AKSA Power Generation, General Electric Company, Rolls-Royce Power Systems AG, Aggreko PLC, Wuxi Kipor Power Co. Ltd, MAN Diesel & Turbo, and Wärtsilä.

At what CAGR is the South America & Africa diesel generator market poised to expand?

The South America & Africa diesel generator market is poised to mark 2.65% CAGR.

By power rating, which segment is projected to hold the largest market share?

The 11kW-100Kw segment is anticipated to hold the largest market share.

What are the segments of the South America & Africa diesel generator market on the basis of portability?

By portability, the segments are stationary and portable.

What are the segments of the South America & Africa diesel generator market based on hybrid system type?

By hybrid system type, the segments are wind diesel and solar diesel.

Which countries are assessed in the study of the South America & Africa diesel generator market?

The countries studied are Colombia, Uganda, Peru Congo, Nigeria, Sudan, Tanzania, Guatemala, Kenya, Bolivia, Ethiopia, and other countries.

-

Executive Summary

-

-

2

-

Introduction

- Definition 15

-

Scope Of The Study 15

- Assumptions 15

-

Market Structure 16

-

Research Methodology

-

Research Process 17

- Primary Research 18

-

Secondary Research 18

- Market Size Estimation

-

18

- Forecast Model 20

-

4

-

Market Dynamics

- Drivers 22

-

Surge In Power Outages & Power Failure 22

-

Growing Demand For Interminable & Dependable Power Supply 22

-

Growth In Hybrid Renewable Energy Systems 23

-

Growth Drivers: Impact Analysis 24

- Restraints

-

24

-

Rise In Renewable Energy Technologies

- High Operating & Maintenance Cost

- Growth Barriers: Impact Analysis 25

-

Rise In Renewable Energy Technologies

-

Opportunities 25

- Growth In Industrialization

-

& Urbanization 25

- Access To Electricity

-

In Rural & Remote Areas 25

- Trends In

-

Hybrid Opportunities 26

- Generator Technicalities

-

Based On Application/Type 27

- Comparison Of

-

Small Generators Vs. Large Generators 30

-

Market

-

Factor Analysis

- Porter’s Five Forces

-

Analysis 31

- Threat Of New Entrants 32

-

Bargaining Power Of Suppliers 32

- Threat

-

Of Substitutes 32

- Bargaining Power Of Buyers

-

32

- Segment Rivalry 32

-

Supply Chain Analysis 33

-

South America &

-

Africa Diesel Generator Market, By Power Rating

-

Introduction 36

- Upto 10 KW 37

-

KW – 100 KW 37

- Above 100 KW 38

-

7

-

South America & Africa Diesel Generator Market, By End-User

-

Introduction 40

- Residential 41

-

Commerical 41

- Industrial 41

-

8

-

South America & Africa Diesel Generator Market, By Portability

-

Introduction 43

- Stationary 44

-

Portable 44

-

South America & Africa Diesel

-

Generator Market, By Hybrid System Type

- Introduction

-

46

- Solar Diesel 47

-

Wind Diesel 47

- Others 48

-

10

-

South America & Africa Diesel Generator Market, By Country

-

Introduction 50

- Colombia 53

-

Nigeria 56

- Peru 59

-

Congo 62

- Sudan 65

-

Guatemala 68

- Tanzania 71

-

Kenya 74

- Ethiopia 77

-

Bolivia 80

- Uganda 83

-

Other Countries 86

-

Company Profiles

-

Competitive Scenario 89

- Competitive Landscape

-

89

- Product Launch/Development 90

-

Mergers And Acquisitions 91

- Partnerships

-

And Collaborations 92

- Caterpillar Inc. 93

-

Company Overview 93

- Financial Overview

-

93

- Service Offering 94

-

Strategy 96

- Cummins INC. 98

-

Company Overview 98

- Financial Overview

-

98

- Service Offering 99

-

Strategy 101

- Generac Holdings Inc 103

-

Company Overview 103

- Financial Overview

-

103

- Service Offering 104

-

Strategy 105

- Mitsubishi Heavy Industries

-

Engine & Turbocharger, Ltd. 106

- Company

-

Overview 106

- Financial Overview 106

-

Service Offering 107

- Strategy 107

-

AKSA Power Generation 109

- Company Overview

-

109

- Financial Overview 109

-

Service Offering 109

- Strategy 110

-

Kohler Co. 111

- Company Overview 111

-

Financial Overview 111

- Service Offering

-

111

- Strategy 112

-

Rolls-Royce Power Systems AG 113

- Company

-

Overview 113

- Financial Overview 113

-

Service Offering 114

- Strategy 115

-

Wuxi Kipor Power Co. Ltd 117

- Company Overview

-

117

- Financial Overview 117

-

Service Offering 117

- Strategy 118

-

Aggreko PLC 119

- Company Overview 119

-

Financial Overview 119

- Product/Service

-

Offering 120

- Strategy 120

-

MAN Diesel & Turbo 122

- Company Overview

-

122

- Financial Overview 122

-

Product/Service Offering 123

- Strategy

-

123

- General Electric Company 125

-

Company Overview 125

- Financial Overview

-

125

- Product/Service Offering 126

-

Strategy 126

- Wärtsilä Corporation

-

127

- Company Overview 127

-

Financial Overview 127

- Product/Service

-

Offering 128

- Strategy 129

-

12

-

List Of Tables

-

TABLE 1 MARKET SYNOPSIS 14

-

TABLE

-

POWER OUTAGE DATA, SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET 22

-

GENERATOR TECHNICALITIES BASED ON APPLICATION/TYPE 28

-

COMPARISON OF SMALL GENERATORS VS. LARGE GENERATORS 30

-

SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY POWER RATING, 2023-2032

-

(USD MILLION) 37

-

TABLE 6 SOUTH AMERICA &

-

AFRICA DIESEL GENERATOR MARKET, BY END-USER, 2023-2032 (USD MILLION) 41

-

SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY PORTABILITY, 2023-2032

-

(USD MILLION) 44

-

TABLE 8 SOUTH AMERICA &

-

AFRICA DIESEL GENERATOR MARKET, BY HYBRID SYSTEM TYPE, 2023-2032 (USD MILLION) 47

-

SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY COUNTRY, 2023-2032 (USD

-

MILLION) 52

-

TABLE 10 COLOMBIA: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET, BY POWER RATING, 2023-2032 (USD MILLION) 53

-

COLOMBIA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY END-USER, 2023-2032

-

(USD MILLION) 54

-

TABLE 12 COLOMBIA: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET, BY PORTABILITY, 2023-2032 (USD MILLION) 54

-

COLOMBIA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY HYBRID SYSTEM

-

TYPE, 2023-2032 (USD MILLION) 55

-

TABLE 14 NIGERIA:

-

SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY POWER RATING, 2023-2032 (USD

-

MILLION) 56

-

TABLE 15 NIGERIA: SOUTH AMERICA &

-

AFRICA DIESEL GENERATOR MARKET, BY END-USER, 2023-2032 (USD MILLION) 57

-

NIGERIA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY PORTABILITY,

-

2032 (USD MILLION) 57

-

TABLE 17 NIGERIA:

-

SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY HYBRID SYSTEM TYPE, 2023-2032

-

(USD MILLION) 58

-

TABLE 18 PERU: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET, BY POWER RATING, 2023-2032 (USD MILLION) 59

-

PERU: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY END-USER, 2023-2032

-

(USD MILLION) 60

-

TABLE 20 PERU: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET, BY PORTABILITY, 2023-2032 (USD MILLION) 60

-

PERU: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY HYBRID SYSTEM TYPE,

-

2032 (USD MILLION) 61

-

TABLE 22 CONGO: SOUTH

-

AMERICA & AFRICA DIESEL GENERATOR MARKET, BY POWER RATING, 2023-2032 (USD MILLION)

-

62

-

TABLE 23 CONGO: SOUTH AMERICA & AFRICA

-

DIESEL GENERATOR MARKET, BY END-USER, 2023-2032 (USD MILLION) 63

-

CONGO: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY PORTABILITY, 2023-2032

-

(USD MILLION) 63

-

TABLE 25 CONGO: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET, BY HYBRID SYSTEM TYPE, 2023-2032 (USD MILLION)

-

64

-

TABLE 26 SUDAN: SOUTH AMERICA & AFRICA

-

DIESEL GENERATOR MARKET, BY POWER RATING, 2023-2032 (USD MILLION) 65

-

SUDAN: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY END-USER, 2023-2032

-

(USD MILLION) 66

-

TABLE 28 SUDAN: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET, BY PORTABILITY, 2023-2032 (USD MILLION) 66

-

SUDAN: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY HYBRID SYSTEM TYPE,

-

2032 (USD MILLION) 67

-

TABLE 30 GUATEMALA:

-

MILLION) 68

-

TABLE 31 GUATEMALA: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET, BY END-USER, 2023-2032 (USD MILLION) 69

-

GUATEMALA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY PORTABILITY,

-

2032 (USD MILLION) 69

-

TABLE 33 GUATEMALA:

-

(USD MILLION) 70

-

TABLE 34 TANZANIA: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET, BY POWER RATING, 2023-2032 (USD MILLION) 71

-

TANZANIA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY END-USER, 2023-2032

-

(USD MILLION) 72

-

TABLE 36 TANZANIA: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET, BY PORTABILITY, 2023-2032 (USD MILLION) 72

-

TANZANIA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY HYBRID SYSTEM

-

TYPE, 2023-2032 (USD MILLION) 73

-

TABLE 38 KENYA:

-

MILLION) 74

-

TABLE 39 KENYA: SOUTH AMERICA &

-

AFRICA DIESEL GENERATOR MARKET, BY END-USER, 2023-2032 (USD MILLION) 75

-

KENYA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY PORTABILITY, 2023-2032

-

(USD MILLION) 75

-

TABLE 41 KENYA: SOUTH AMERICA

-

76

-

TABLE 42 ETHIOPIA: SOUTH AMERICA & AFRICA

-

DIESEL GENERATOR MARKET, BY POWER RATING, 2023-2032 (USD MILLION) 77

-

ETHIOPIA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY END-USER, 2023-2032

-

(USD MILLION) 78

-

TABLE 44 ETHIOPIA: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET, BY PORTABILITY, 2023-2032 (USD MILLION) 78

-

ETHIOPIA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY HYBRID SYSTEM

-

TYPE, 2023-2032 (USD MILLION) 79

-

TABLE 46 BOLIVIA:

-

MILLION) 80

-

TABLE 47 BOLIVIA: SOUTH AMERICA &

-

AFRICA DIESEL GENERATOR MARKET, BY END-USER, 2023-2032 (USD MILLION) 81

-

BOLIVIA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY PORTABILITY,

-

2032 (USD MILLION) 81

-

TABLE 49 BOLIVIA:

-

(USD THOUSAND) 82

-

TABLE 50 UGANDA: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET, BY POWER RATING, 2023-2032 (USD MILLION) 83

-

UGANDA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY END-USER, 2023-2032

-

(USD MILLION) 84

-

TABLE 52 UGANDA: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET, BY PORTABILITY, 2023-2032 (USD MILLION) 84

-

UGANDA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY HYBRID SYSTEM

-

TYPE, 2023-2032 (USD THOUSAND) 85

-

TABLE 54 OTHER

-

COUNTRIES: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY POWER RATING,

-

2032 (USD MILLION) 86

-

TABLE 55 OTHER COUNTRIES:

-

SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY END-USER, 2023-2032 (USD

-

MILLION) 87

-

TABLE 56 OTHER COUNTRIES: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET, BY PORTABILITY, 2023-2032 (USD MILLION) 87

-

OTHERS: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY HYBRID SYSTEM

-

TYPE, 2023-2032 (USD THOUSAND) 88

-

-

13

-

List Of Figures

-

FIGURE 1 RESEARCH PROCESS OF

-

MRFR 17

-

FIGURE 2 TOP DOWN & BOTTOM UP APPROACH

-

19

-

FIGURE 3 FORECAST MODEL FOR SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET 20

-

FIGURE

-

DRIVERS, RESTRAINTS AND OPPORTUNITIES OF SOUTH AMERICA & AFRICA DIESEL GENERATOR

-

MARKET 21

-

FIGURE 5 GROWTH DRIVERS: IMPACT ANALYSIS

-

FIGURE 6 GROWTH BARRIERS: IMPACT ANALYSIS

-

25

-

FIGURE 7 PORTER'S FIVE FORCES ANALYSIS OF

-

SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET 31

-

SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET SHARE, BY POWER RATING, 2032

-

(% SHARE) 36

-

FIGURE 9 SOUTH AMERICA & AFRICA

-

DIESEL GENERATOR MARKET SHARE, BY END-USER TYPE, 2032 (% SHARE) 40

-

SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET SHARE, BY PORTABILITY, 2032

-

(% SHARE) 43

-

FIGURE 11 SOUTH AMERICA & AFRICA

-

DIESEL GENERATOR MARKET SHARE, BY HYBRID SYSTEM TYPE, 2032 (% SHARE) 46

-

SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET, BY COUNTRY, 2032 (% SHARE)

-

50

-

FIGURE 13 SOUTH AMERICA & AFRICA DIESEL

-

GENERATOR MARKET SHARE, BY COUNTRY, 2032 (% SHARE) 51

-

COLOMBIA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET SHARE, BY POWER

-

RATING, 2032 (% SHARE) 53

-

FIGURE 15 NIGERIA:

-

SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET SHARE, BY POWER RATING, 2032

-

(% SHARE) 56

-

FIGURE 16 PERU: SOUTH AMERICA &

-

AFRICA DIESEL GENERATOR MARKET SHARE, BY POWER RATING, 2032 (% SHARE) 59

-

CONGO: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET SHARE, BY POWER RATING,

-

(% SHARE) 62

-

FIGURE 18 SUDAN: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET SHARE, BY POWER RATING, 2032 (% SHARE) 65

-

GUATEMALA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET SHARE, BY POWER

-

RATING, 2032 (% SHARE) 68

-

FIGURE 20 TANZANIA:

-

(% SHARE) 71

-

FIGURE 21 KENYA: SOUTH AMERICA &

-

AFRICA DIESEL GENERATOR MARKET SHARE, BY POWER RATING, 2032 (% SHARE) 74

-

ETHIOPIA: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET SHARE, BY POWER

-

RATING, 2032 (% SHARE) 77

-

FIGURE 23 BOLIVIA:

-

(% SHARE) 80

-

FIGURE 24 UGANDA: SOUTH AMERICA

-

& AFRICA DIESEL GENERATOR MARKET SHARE, BY POWER RATING, 2032 (% SHARE) 83

-

OTHER COUNTRIES: SOUTH AMERICA & AFRICA DIESEL GENERATOR MARKET SHARE, BY

-

POWER RATING, 2032 (% SHARE) 86

-

FIGURE 26 GROWTH

-

STRATEGIES ADOPTED BY KEY PLAYERS IN SOUTH AMERICA & AFRICA DIESEL GENERATOR

-

MARKET, 2023-2032, (%) 89

-

FIGURE 27 PRODUCT LAUNCH/DEVELOPMENT:

-

% SHARE BY KEY PLAYERS, 2023-2032, (%) 90

-

MERGERS AND ACQUISITIONS: % SHARE BY KEY PLAYERS, 2023-2032, (%) 91

-

PARTNERSHIPS & COLLABORATIONS: % SHARE BY KEY PLAYERS, 2023-2032, (%) 92

-

CATERPILLAR INC. : TOTAL REVENUE VS SEGMENTAL REVENUE (USD MILLION) 93

-

CATERPILLAR INC.: GEOGRAPHIC REVENUE MIX, 2032 (%) 94

-

CATERPILLAR INC.: KEY DEVELOPMENTS, 2032 (%) 96

-

CATERPILLAR INC.: SWOT ANALYSIS 97

-

CUMMINS INC. : TOTAL REVENUE VS SEGMENTAL REVENUE (USD MILLION) 98

-

CUMMINS INC.: GEOGRAPHIC REVENUE MIX, 2032 (%) 99

-

CUMMINS INC.: KEY DEVELOPMENTS, 2032 (%) 101

-

CUMMINS INC.: SWOT ANALYSIS 102

-

FIGURE 38

-

GENERAC HOLDINGS INC : TOTAL REVENUE VS SEGMENTAL REVENUE (USD MILLION) 103

-

GENERAC HOLDINGS INC: GEOGRAPHICAL REVENUE MIX, 2032 (%) 104

-

GENERAC HOLDINGS INC: KEY DEVELOPMENTS, 2032 (%) 105

-

MITSUBISHI HEAVY INDUSTRIES ENGINE & TURBOCHARGER, LTD.: TOTAL REVENUE VS

-

SEGMENTAL REVENUE, 2023-2032 (USD MILLION) 106

-

MITSUBISHI HEAVY INDUSTRIES ENGINE & TURBOCHARGER, LTD.: GEOGRAPHICAL REVENUE

-

MIX, 2032 (%) 107

-

FIGURE 43 MITSUBISHI HEAVY

-

INDUSTRIES ENGINE & TURBOCHARGER, LTD.: SWOT ANALYSIS 108

-

KOHLER CO.: KEY DEVELOPMENTS, 2032 (%) 112

-

ROLLS-ROYCE POWER SYSTEMS AG: TOTAL REVENUE VS SEGMENTAL REVENUE, 2023-2032 (USD

-

MILLION) 113

-

FIGURE 46 ROLLS-ROYCE POWER SYSTEMS

-

AG: GEOGRAPHICAL REVENUE MIX, 2032 (%) 114

-

ROLLS-ROYCE POWER SYSTEMS AG: KEY DEVELOPMENTS, 2032 (%) 115

-

ROLLS-ROYCE POWER SYSTEMS AG: SWOT ANALYSIS 116

-

AGGREKO PLC: TOTAL REVENUE VS SEGMENTAL REVENUE, 2023-2032 (USD MILLION) 119

-

AGGREKO PLC: GEOGRAPHICAL REVENUE MIX, 2032 (%) 120

-

AGGREKO PLC: KEY DEVELOPMENTS, 2032 (%) 121

-

AGGREKO PLC: SWOT ANALYSIS 121

-

FIGURE 53 MAN

-

DIESEL & TURBO: TOTAL REVENUE VS SEGMENTAL REVENUE, 2023-2032 (USD MILLION)

-

FIGURE 54 MAN DIESEL & TURBO: KEY DEVELOPMENTS,

-

(%) 124

-

FIGURE 55 MAN DIESEL & TURBO:

-

SWOT ANALYSIS 124

-

FIGURE 56 GENERAL ELECTRIC

-

COMPANY: TOTAL REVENUE VS SEGMENTAL REVENUE, 2023-2032 (USD MILLION) 125

-

GENERAL ELECTRIC COMPANY: SWOT ANALYSIS 126

-

WÄRTSILÄ CORPORATION: TOTAL REVENUE VS SEGMENTAL REVENUE, 2023-2032

-

(USD MILLION) 127

-

FIGURE 59 WÄRTSILÄ

-

CORPORATION: GEOGRAPHICAL REVENUE MIX, 2032 (%) 128

-

WÄRTSILÄ CORPORATION: KEY DEVELOPMENTS, 2032 (%) 129

-

WÄRTSILÄ CORPORATION: SWOT ANALYSIS 130

South America & Africa Diesel Generator Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment