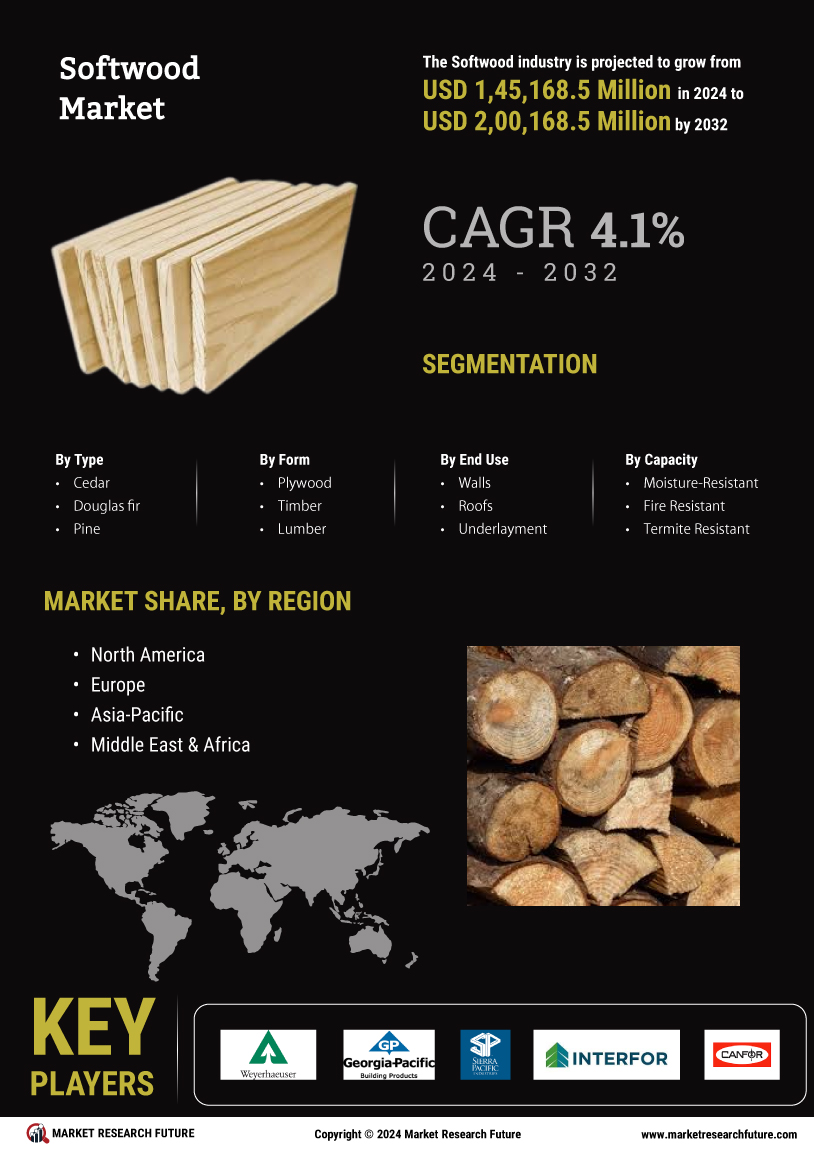

Softwood Market Summary

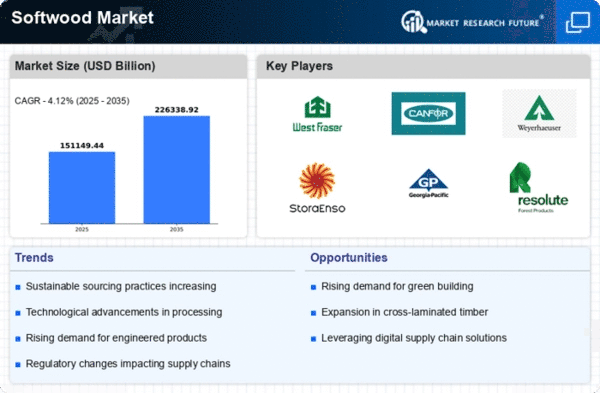

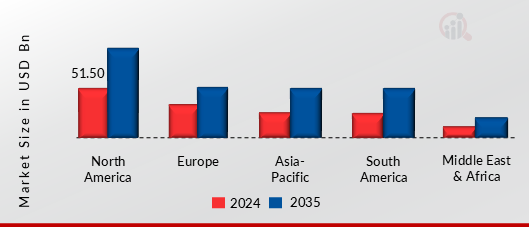

As per Market Research Future Analysis, the global softwood market was valued at USD 145.16 Billion in 2024 and is projected to reach USD 222.92 Billion by 2035, growing at a CAGR of 4.1% from 2025 to 2035. The growth is driven by rapid economic and urbanization growth, particularly in Western and Asian regions, alongside increasing adoption of softwood products in the packaging industry. However, challenges such as lack of forest management and unexpected weather conditions persist. The market is also witnessing a rising demand for sustainable wood products.

Key Market Trends & Highlights

Key trends influencing the softwood market include economic growth and sustainability.

- Rapid economic and urbanization growth in Western and Asia regions is driving demand for softwood, particularly in construction.

- Softwood accounts for approximately 80% of wood used in the manufacturing and packaging sector, highlighting its dominance.

- The lumber segment dominated the softwood market in 2024 and is expected to continue its growth during the forecast period.

- The moisture-resistant segment is projected to grow significantly, driven by the natural properties of cedar and redwood.

Market Size & Forecast

| 2024 Market Size | USD 145.16 Billion |

| 2035 Market Size | USD 222.92 Billion |

| CAGR (2025-2035) | 4.1% |

Major Players

Key players in the softwood market include Weyerhaeuser, Georgia-Pacific, Sierra Pacific Industries, Interfor Corporation, Canfor Corporation, West Fraser Timber, Tolko Industries, UPM, Kronospan, and Metsa Group.