Smart Home Projector Size

Smart Home Projector Market Growth Projections and Opportunities

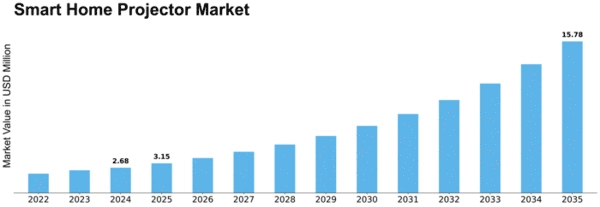

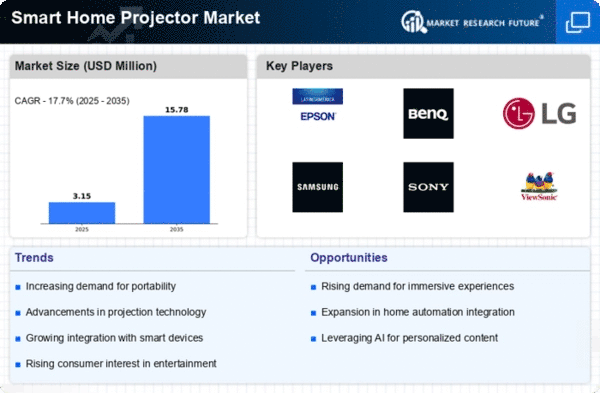

According to MRFR (Market Research Future), the global Smart Home Projector market has been experiencing significant growth in recent years and is anticipated to reach USD 5,595.07 million by 2027, with a Compound Annual Growth Rate (CAGR) of 17.7% during the forecast period from 2021 to 2027. The driving factors for this growth include the increasing number of smart home and smart city projects worldwide and the growing adoption of energy-saving products in smart homes and cities. However, the introduction of large-size smart TVs is expected to pose a challenge to market growth during the forecast period.

The global Smart Home Projector market is categorized based on type, resolution, technology, pricing, sales channel, and region. In terms of type, the market is divided into Android Smart Home Projectors and Linux Smart Home Projectors. The resolution segment includes XGA (1024 x 768 pixels), WXGA (1280 x 800 pixels), HD (1920 x 1080 pixels), 4K (4096 x 2160 pixels), and 8K (7680 × 4320 pixels). The technology segment comprises DLP, LCD, LED, LCoS, and others. Pricing is categorized into low end, mid end, and high end, while the sales channel includes online and offline. Geographically, the market is segmented into North America, Europe, Asia-Pacific, the Middle East & Africa, and South America.

In 2020, North America held the largest market share at nearly 33.9%. This can be attributed to the region's significant growth, high adoption of smart home devices, increased automation of tasks, and rising awareness about the benefits and convenience offered by connected appliances. The North American market is expected to continue its robust growth, with the US being the largest contributor, accounting for 85.9% share in 2020. Meanwhile, Asia-Pacific held the second-largest market share at 30.1% in 2020, driven by the increasing adoption of smart home appliances. China dominates the Asia-Pacific smart home projector market, accounting for 55.6% share in 2020. Europe is positioned third globally, with demand coming from countries such as Germany, the UK, Italy, France, and other Western European countries.

Key players that significantly contributed to the growth of the global smart home projector market include Epson, Panasonic, BenQ, Lenovo Group Limited, LG Electronics Inc, Sony Corporation, XGIMI, Philips N.V., Samsung Electronics, ACER, and others. These players focus on innovation in the smart home projector industry, investing in research and development to provide cost-effective, highly secure, robust performance, and innovative features. Strategic developments such as partnerships, mergers & acquisitions, product enhancements, and global expansion are common among key players to enhance their market share and strengthen their client base.

Leave a Comment