Market Growth Projections

Technological Advancements

The Global Smart Finance Service Market Industry is experiencing rapid technological advancements, particularly in artificial intelligence and machine learning. These innovations enhance data analytics capabilities, enabling financial institutions to offer personalized services to clients. For instance, AI-driven chatbots are streamlining customer service, while predictive analytics is improving risk assessment. The integration of blockchain technology is also fostering transparency and security in transactions. As a result, the market is projected to reach 11.5 USD Billion in 2024, reflecting a growing demand for sophisticated financial solutions that leverage these technologies.

Regulatory Support and Compliance

Regulatory support plays a crucial role in shaping the Global Smart Finance Service Market Industry. Governments worldwide are implementing frameworks that promote innovation while ensuring consumer protection. For example, initiatives aimed at enhancing data privacy and security are fostering trust in digital financial services. Additionally, regulatory bodies are encouraging the adoption of fintech solutions through favorable policies. This supportive environment is likely to stimulate market growth, as companies navigate compliance requirements while leveraging new technologies to enhance service delivery.

Increased Investment in Fintech Startups

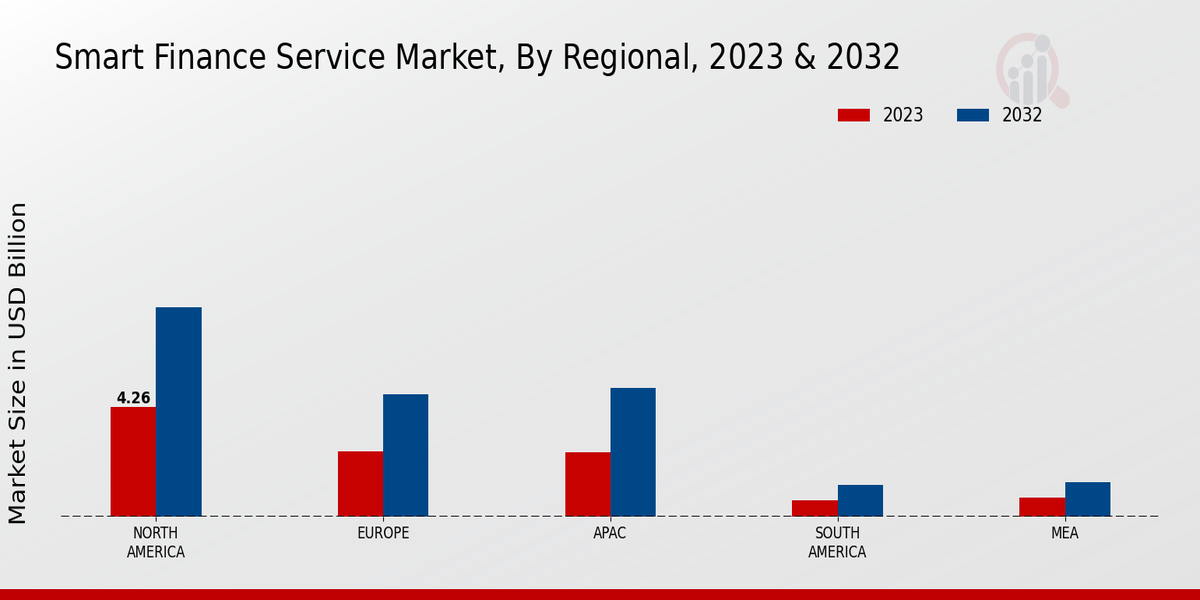

The Global Smart Finance Service Market Industry is witnessing a surge in investment directed towards fintech startups. Venture capitalists and institutional investors are increasingly recognizing the potential of innovative financial solutions that disrupt traditional banking models. This influx of capital is enabling startups to develop cutting-edge technologies and expand their service offerings. As a result, the market is expected to grow at a compound annual growth rate of 8.24% from 2025 to 2035, reflecting the confidence investors have in the future of smart finance services.

Growing Consumer Demand for Digital Services

There is an increasing consumer demand for digital financial services, which is significantly influencing the Global Smart Finance Service Market Industry. Consumers are seeking convenience and efficiency in managing their finances, leading to a surge in mobile banking and online investment platforms. This trend is evident in the rising number of users engaging with fintech applications, which are projected to grow substantially. The market's expansion is expected to continue, with forecasts indicating a growth to 27.4 USD Billion by 2035, driven by the need for accessible and user-friendly financial services.

Global Economic Growth and Financial Inclusion

Global economic growth is a significant driver for the Global Smart Finance Service Market Industry, as it correlates with increased financial inclusion. Emerging markets are experiencing rapid economic development, leading to a greater demand for accessible financial services. This trend is particularly evident in regions where traditional banking infrastructure is limited. By leveraging smart finance solutions, financial institutions can reach underserved populations, thereby expanding their customer base. The ongoing efforts to promote financial literacy and inclusion are likely to further enhance market growth.