Market Analysis

In-depth Analysis of Saudi Arabia Renewable Energy Market Industry Landscape

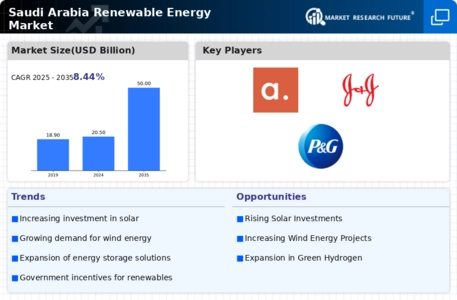

The market dynamics of Saudi Arabia's renewable energy sector reflect a transformative shift driven by a combination of economic, environmental, and geopolitical factors. In recent years, the Kingdom has actively sought to diversify its energy mix, moving away from a heavy reliance on fossil fuels. This strategic initiative is aligned with global efforts to mitigate climate change and reduce carbon emissions. The government's commitment to renewable energy is evident through ambitious targets outlined in the Saudi Vision 2030 plan, aiming to increase the share of renewable energy in the total energy mix.

The primary driver of market dynamics in Saudi Arabia's renewable energy sector is the increasing focus on solar power. The country boasts abundant sunlight, making solar energy a natural choice for sustainable power generation. The vast expanses of desert land provide ample opportunities for large-scale solar projects. The Kingdom has set ambitious goals for solar capacity, with plans to develop gigawatts of solar projects in the coming years. These initiatives not only contribute to reducing the carbon footprint but also stimulate economic growth by creating job opportunities and attracting foreign investments.

Moreover, regulatory frameworks and policy support play a pivotal role in shaping the dynamics of the renewable energy market in Saudi Arabia. The government has implemented various measures, such as the National Renewable Energy Program (NREP), to facilitate the development of renewable projects. The NREP outlines a comprehensive strategy, including competitive auctions, to attract private sector participation in renewable energy ventures. This approach fosters healthy competition, promotes innovation, and ensures cost-effectiveness in project execution.

Collaboration between the public and private sectors is another significant aspect of the market dynamics. The government's partnerships with international energy companies bring in technical expertise, funding, and best practices. These collaborations not only accelerate the deployment of renewable energy projects but also contribute to knowledge transfer, enhancing the local industry's capabilities. The involvement of the private sector also aligns with the broader goal of diversifying the economy and reducing dependence on oil revenue.

Furthermore, advancements in technology have a profound impact on the renewable energy market in Saudi Arabia. The continuous improvement and cost reduction in solar photovoltaic (PV) technology make solar projects increasingly competitive compared to traditional fossil fuel sources. The integration of smart grid systems and energy storage solutions enhances the reliability and efficiency of renewable energy deployment, addressing the intermittent nature of solar and wind power.

Challenges, however, remain a part of the market dynamics. The intermittent nature of renewable sources, such as solar and wind, poses a challenge to maintaining a stable and reliable energy supply. To address this issue, the Kingdom is investing in energy storage technologies and exploring innovative solutions to enhance grid stability. Additionally, the need for skilled workforce and local expertise in renewable energy development is an ongoing concern, prompting efforts to invest in education and training programs.

The market dynamics of Saudi Arabia's renewable energy sector are undergoing a transformative journey, driven by a commitment to sustainability, regulatory support, technological advancements, and international collaborations. As the Kingdom progresses towards achieving its Vision 2030 goals, the renewable energy market is expected to witness further growth, contributing not only to a greener environment but also to the overall economic development and diversification of Saudi Arabia's energy landscape.

Leave a Comment