Satellite Bus Size

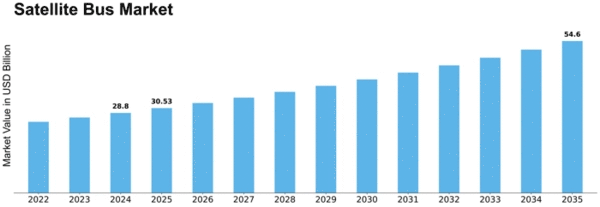

Satellite Bus Market Growth Projections and Opportunities

The Flight Tracking System, an essential surveillance component providing real-time aircraft data and air traffic control, plays a pivotal role in the aviation industry. Continuous innovations in this system, driven by technological advancements and improved software, are transforming the aviation landscape. Major industry players like Honeywell International Inc., Rockwell Collins, and Garmin Ltd are making substantial investments in enhancing flight tracking systems, contributing significantly to market growth.

Several factors are propelling the global flight tracking system market, including the rising demand for new aircraft, a heightened focus on flight safety, constant aircraft monitoring needs, and the increasing adoption of ADS-B (Automatic Dependent Surveillance-Broadcast) flight tracking systems. The demand for real-time aircraft information has surged, leading to a notable increase in flight tracking system sales.

The market is projected to witness a Compound Annual Growth Rate (CAGR) of 6.07% during the forecast period from 2018 to 2023. In 2018, North America took the lead with a market share of 40.79%, followed by Europe and Asia-Pacific with shares of 25.06% and 22.99%, respectively. Notably, the Asia-Pacific region has emerged as a lucrative market, driven by developments in air-to-ground data communication capabilities and increased government expenditures, particularly in countries like China, Japan, and South Korea.

Segmentation of the flight tracking system market includes types, aircraft types, end-users, and regions. The ADS-B segment dominated with the largest market share of 80.20% in 2018, valued at USD 318.2 million, and is expected to witness a CAGR of 6.24% during the forecast period. Concerning aircraft types, the fixed-wing segment held the largest market share of 68.60% in 2018, with a market value of USD 271.5 million, projected to experience a CAGR of 6.50%. In terms of end-users, the commercial segment led with a market share of 54.67% in 2018, valued at USD 217.1 million, and is anticipated to witness a CAGR of 6.17%.

The growth of ADS-B indicates the industry's preference for this advanced surveillance technology, contributing significantly to the overall market expansion. Fixed-wing aircraft continue to dominate the market, and commercial applications drive a substantial share of the demand, emphasizing the importance of flight tracking systems in enhancing safety and operational efficiency in the commercial aviation sector.

The optimistic growth projections indicate a robust future for the flight tracking system market. The industry's inclination toward real-time data and advanced surveillance capabilities, combined with ongoing technological investments, positions flight tracking systems as a crucial component in the dynamic aviation landscape. As the Asia-Pacific region continues to exhibit promising developments, the global flight tracking system market is poised for sustained growth, fostering a safer and more efficient air travel environment.

Leave a Comment