Market Share

Retail Edge Computing Market Share Analysis

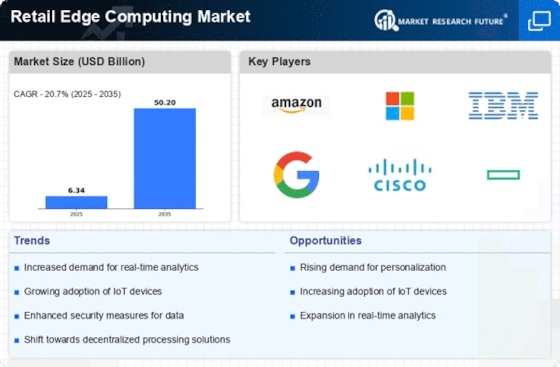

The Retail Edge Computing market has experienced significant trends indicative of the influence that technology has had on the industry. There has been a noticeable shift by retailers towards Edge Computing solutions in recent years, which have been driven by the needs for real-time processing of data, improved customer experiences and an increase in operational efficiency. Another trend evident in this market is deploying Edge Computing infrastructure at or near retail networks’ edges that are close to physical shops and customer touchpoints. This allows for local data analysis, enabling faster decision-making as well as personalized customer experiences. It is aligned with wider industry move towards distributed computing architectures supporting numerous retail applications from stocktaking to in-store analytics. Additionally, there has been an increasing emphasis on the incorporation of Artificial Intelligence (AI) and Machine Learning (ML) capabilities at the edge in the Retail Edge Computing market. Using AI and ML algorithms, retailers are able to study customer behavior, optimize pricing strategies as well as tailor marketing endeavors. It is imperative that this shift be observed specifically in areas such as recommendation engines, demand forecasting and fraud detection where processing data at the edge contributes to improved overall effectiveness of retail operations. The other notable trend is about enhancing in-store customer experience through Edge Computing. Retailers have put some edge devices such as smart shelves, interactive displays and cashierless checkout systems into use. Through local processing of data at the edge, real-time personalized promotions can be provided by retailers thereby reducing checkout times and creating immersive shopping experiences. This is a crucial development given that brick-and-mortar stores are currently employing technology in order to compete with their online counterparts. Besides this, there has also been an increased demand for retail-specific edge devices within the Retail Edge Computing market. Some of these devices include smart cameras; sensors; IoT-devices used in smart store monitoring; foot traffic analysis; inventory tracking among others. These tools are useful for gaining insights into consumer habits and behaviors while streamlining procedures for retailers.

Leave a Comment