Market Analysis

In-depth Analysis of Refurbished Electronics Market Industry Landscape

The refurbished electronics market is characterized by a dynamic set of market dynamics that collectively shape its growth and evolution. Consumer demand is a primary driving force behind these dynamics. As technology advances, consumers seek more affordable options to access the latest devices. The refurbished electronics market addresses this demand by offering pre-owned devices that have been restored to optimal functionality. The ebb and flow of consumer preferences for cost-effective yet reliable gadgets significantly influence the market's trajectory, driving manufacturers and retailers to adapt to changing needs.

Environmental considerations also play a crucial role in the market dynamics of refurbished electronics. With a growing emphasis on sustainability, consumers are increasingly drawn to the eco-friendly aspect of refurbished devices. The circular economy, which promotes the reuse and recycling of products, aligns with the ethos of the refurbished electronics market. As environmental awareness continues to rise, the market is likely to experience increased demand from consumers seeking to minimize electronic waste and reduce their ecological footprint.

Economic factors contribute significantly to the market dynamics of refurbished electronics. In times of economic uncertainty or downturns, consumers often become more price-sensitive, leading to an increased interest in affordable alternatives. The refurbished electronics market benefits from this trend, providing consumers with access to reliable devices at lower price points. Economic fluctuations, therefore, have a direct impact on the market's growth, influencing purchasing decisions and driving demand for refurbished products.

Technological advancements and innovations in the refurbishment process contribute to the market's dynamics. As refurbishment techniques become more sophisticated and quality control measures improve, refurbished electronics gain credibility in the eyes of consumers. The continuous enhancement of the refurbishment process ensures that pre-owned devices meet or exceed the performance standards of new products. This technological progress not only boosts consumer confidence but also positions the refurbished electronics market as a viable and competitive alternative to traditional retail.

Global and regional regulations also play a role in shaping the dynamics of the refurbished electronics market. Some regions may impose strict regulations on electronic waste disposal, encouraging consumers and businesses to explore sustainable options like refurbishment. Government initiatives and incentives that promote the circular economy further influence market dynamics, fostering a positive environment for the growth of the refurbished electronics sector.

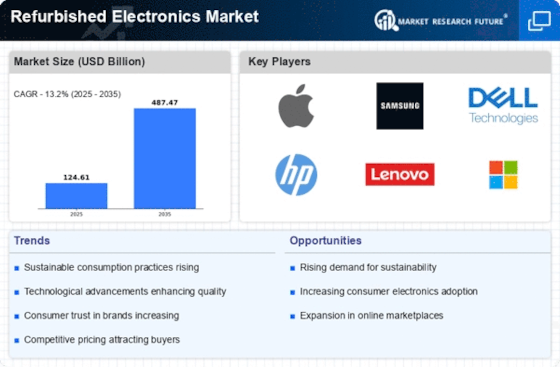

Moreover, the competitive landscape and the strategies adopted by market players contribute to the market dynamics. Companies engage in strategic pricing, brand differentiation, and customer-centric approaches to gain a competitive edge. The emergence of new players, partnerships, and mergers and acquisitions can alter the market dynamics, affecting the overall competitiveness and attractiveness of the refurbished electronics market.

Consumer perceptions and attitudes toward refurbished products are also dynamic factors influencing market dynamics. Education and awareness campaigns are essential to overcoming skepticism and building trust in the reliability of refurbished electronics. As consumers become more informed about the benefits of refurbished devices, their acceptance of these products is likely to increase, further driving market dynamics.

Leave a Comment