Market Share

Introduction: Navigating Competitive Momentum in Product Life Cycle Management

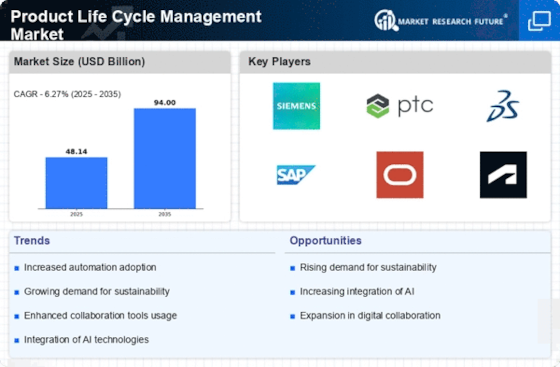

Product life cycle management is undergoing a radical transformation, with the rapid spread of digital technology, the evolution of legislation and the ever-growing consumer expectations of sustainable and efficient products. The market is fiercely contested by manufacturers, system integrators, service companies and a growing number of artificial intelligence start-ups. These digitally driven differentiators are not only transforming operational efficiencies, but also reshaping customer engagement strategies, thereby influencing market positioning. The competitive situation is further exacerbated by the increasing emphasis on green and biometric solutions. Opportunities are emerging, especially in North America and Asia-Pacific, where strategic trends are redefining the nature of PLM practices by 2024–25. C-level managers must stay alert to these developments in order to capitalise on the changing market.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive PLM solutions that integrate various aspects of product development and lifecycle management.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Dassault Systèmes | Strong 3D modeling capabilities | 3D design and PLM | Global |

| Siemens PLM Software | Robust engineering and manufacturing integration | PLM and digital twin solutions | Global |

| SAP SE | Comprehensive enterprise resource planning | Enterprise PLM solutions | Global |

| Oracle Corporation | Strong data management and analytics | Cloud-based PLM | Global |

Specialized Technology Vendors

These vendors focus on niche areas within PLM, providing specialized tools and technologies.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| PTC | Leading IoT integration | PLM and IoT solutions | Global |

| Aras Corporation | Flexible and open-source platform | Enterprise PLM | Global |

| Arena Technologies | Cloud-based collaboration tools | PLM for electronics | North America |

| Omnify software | Focus on compliance and quality management | PLM for manufacturing | North America |

Industry-Specific Solutions

These vendors provide tailored PLM solutions for specific industries, enhancing relevance and usability.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Autodesk, Inc. | Strong design and visualization tools | PLM for architecture and engineering | Global |

| Infor, Inc. | Industry-specific cloud solutions | PLM for manufacturing and distribution | Global |

| Apparel magic | Specialized for the apparel industry | PLM for fashion and textiles | North America |

Consulting and Integration Services

These vendors provide consulting and integration services to enhance PLM implementations and strategies.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Accenture PLC | Strong consulting and digital transformation expertise | PLM strategy and implementation | Global |

Emerging Players & Regional Champions

- Sierra PLM (US) – Provides cloud-based PLM solutions for small and medium-sized manufacturers. It has recently won a contract with a leading clothing manufacturer to optimize its product development process. It is a challenger to the established vendors, offering more flexible and affordable solutions.

- InnoTech Solutions (Germany): focuses on integrating machine learning and artificial intelligence into PLM systems, has recently completed a project for a large automobile supplier to improve the efficiency of product development, complements the traditional vendors with its advanced analytics.

- Apex PLM (India): The company provides a specialized solution for the textile industry. It has teamed up with a local manufacturer to optimize its supply chain. It has positioned itself as a regional champion by addressing the industry-related needs that the large vendors often ignore.

- The Brazilian company NextGen PLM is a pioneer in the field of Product Lifecycle Management. It has recently started a pilot project with a food manufacturer in the region to improve compliance and traceability. By focusing on regulatory requirements that are specific to the region, it is challenging the established players.

Regional Trends: By 2023, the tendency to use cloud-based PLM solutions will have become very strong in North America and Europe, driven by the need for collaboration and scalability. Also, the integration of artificial intelligence and machine learning will be gaining importance, especially in the automotive and textile industries where innovation and efficiency are key. The emergence of new players will be able to seize opportunities for these new developments. Moreover, regional champions will develop local solutions adapted to the needs of local industries.

Collaborations & M&A Movements

- Siemens and PTC entered into a partnership to integrate their PLM solutions, aiming to enhance digital twin capabilities and improve product development efficiency in the manufacturing sector.

- Dassault Systèmes acquired the cloud-based PLM provider, Centric Software, to expand its portfolio and strengthen its position in the fashion and consumer goods industries.

- SAP and Accenture collaborated to develop industry-specific PLM solutions that leverage AI and machine learning, targeting improved operational efficiency for their joint clients.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Biometric Self-Boarding | Zebra Technologies, SITA | Several large airports have been equipped with a biometric self-boarding system from Zebra. These systems have improved the flow of passengers and reduced waiting times. SITA’s Smart Path technology has been adopted by several carriers and has proved its worth in streamlining the boarding process. |

| AI-Powered Ops Mgmt | IBM, Siemens | AI based on IBM's Watson has been used in many cases of business management, enabling the prediction of future trends and thus improving the decision-making process. However, the integration of AI into the Siemens PLM system allows real-time data analysis and improves the efficiency of the entire production process. |

| Border Control | Gemalto, Thales | Biometric control systems ensure security and efficiency at border crossings. Thales has implemented smart border solutions in several countries, reducing waiting times and enhancing the experience of travellers. |

| Sustainability | SAP, Oracle | The solutions of the SAP SUEZ company help companies to monitor and manage their own impact on the environment. In this way, a lower carbon footprint in the manufacturing industry can be achieved. Oracle's cloud applications support sustainable business practices by providing an overview of resource management and waste reduction. |

| Passenger Experience | Amadeus, Travelport | Amadeus has developed passenger-experience solutions which have a measurable impact on the satisfaction of travelers. Travelport's platform is based on a unified, end-to-end experience, which has led to the creation of a network of partner airlines. |

Conclusion: Navigating the Product Life Cycle Landscape

Product life cycle management (PLM) is a market characterized by high competitiveness and significant fragmentation. Both the market’s incumbents and new entrants compete for market share. Competition is fierce in the global PLM market. The most recent developments are focused on the need for automation and the drive towards sustainability as companies seek to optimize their processes and meet the changing needs of consumers. The market’s established players are able to take advantage of their established market presence and are developing new services based on artificial intelligence and automation. While the new entrants are focusing on flexibility and innovation to disrupt the established business models. The ability to harness artificial intelligence, automate and promote sustainable practices will be key for the vendors that want to establish themselves as market leaders. These are the capabilities that decision-makers must focus on to exploit the emerging opportunities.

Leave a Comment