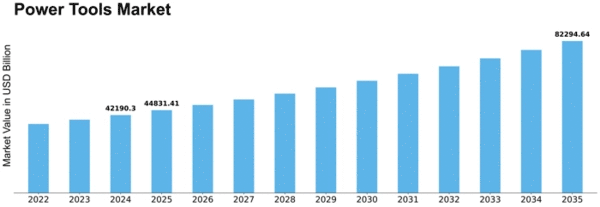

Power Tools Size

Power Tools Market Growth Projections and Opportunities

The Call Control market, encompassing both conventional Private Branch Exchange (PBX) and Internet Convention (IP) PBX systems, is influenced by different variables that shape its elements and development. One of the key drivers is the continuous progress from legacy PBX to IP PBX arrangements. As businesses seek more flexible and scalable correspondence systems, IP PBX offers advantages like expense effectiveness, remote accessibility, and seamless integration with other advanced applications. The shift towards IP-based correspondence reflects a broader trend in the business, lining up with the developing importance of computerized change. Features like video conferencing, mobile integration, and advanced call steering contribute to the appeal of these systems, making them more attractive to businesses searching for comprehensive correspondence arrangements. The size and nature of businesses influence the demand for Call Control arrangements. Small and medium-sized enterprises often seek practical and easy-to-manage PBX systems, while larger enterprises require more sophisticated IP PBX arrangements with extensive adaptability and integration capabilities. Understanding the diverse needs of businesses of different sizes is essential for market players to appropriately tailor their offerings. During periods of economic development, businesses might be more inclined to invest in advanced correspondence systems to improve efficiency and joint effort. Conversely, economic slumps might lead to an emphasis on practical arrangements, driving demand for PBX systems that offer essential functionalities without excessive expenses. Global and regional trends likewise shape the Call Control market. The rise of remote work, accelerated by global events like the Coronavirus pandemic, has increased the demand for flexible correspondence arrangements. Both PBX and IP PBX systems assume a crucial part in enabling remote correspondence and cooperation, making them essential devices in the evolving work landscape.

Leave a Comment