Market Trends

Key Emerging Trends in the Pitch Based Carbon Fiber Market

Introduction: In the past twenty years, the aerospace & defense industry has seen a surge in the demand for carbon fibers. These fibers have become increasingly popular due to their outstanding performance compared to metals. With high tensile strength, resistance to chemicals, stiffness, low thermal expansion, and lightweight properties, carbon fibers are making a mark in the aerospace & defense sector.

Lightweight Advantage in Aerospace: The aerospace industry previously relied on aluminum for building aircraft because it's a sturdy metal. However, aluminum is heavier than carbon fiber, adding extra weight to the aircraft. Passenger and cargo weight also contribute to this, resulting in increased fuel consumption. To overcome these challenges, the aerospace industry switched from aluminum to carbon fiber as the primary material for aircraft construction.

Boeing and Airbus Adoption: In 2003, Boeing Co became the pioneer in using carbon fiber as the primary construction material for its 787 commercial jetliners. This included crucial parts like the fuselage, wings, tail, and more. Airbus followed suit, manufacturing aircraft like the A350 XWB and A380 with carbon fiber composites. The shift has led to reduced fuel consumption, emissions, maintenance needs, and overall costs. It also enhances the passenger experience by minimizing engine vibrations. Predictions suggest that approximately 9,000 new wide-bodied aircraft will be built with pitch-based carbon fiber composites in the next 20 years.

Defense Applications: Pitch-based carbon fibers find extensive use in defense applications. These fibers are employed in various defense equipment, including vehicles, helmets, weaponry, ballistic missiles, and protective gear. The defense spending globally has seen a steady increase, with the USA contributing 40% to the global military expenditure in 2021. Anticipated further increments in military expenditures by governments, including those of China, the USA, Middle Eastern countries, and Russia, are expected to drive the demand for pitch-based carbon fibers.

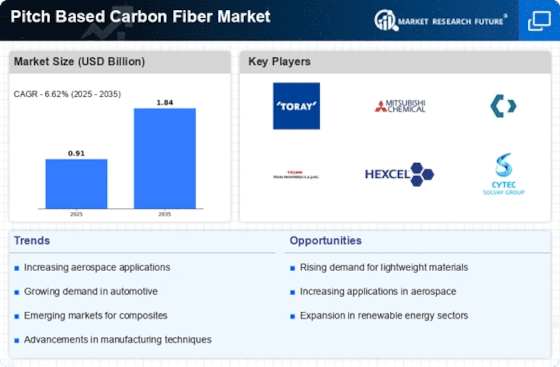

Market Growth Outlook: The growing demand for pitch-based carbon fibers in the aerospace & defense industry is poised to propel the global pitch-based carbon fiber market forward during the forecast period. As more aircraft manufacturers embrace carbon fiber, and defense applications continue to expand, the market is set for substantial growth.

Conclusion: Carbon fibers are revolutionizing the aerospace & defense industry with their lightweight yet durable properties. The transition from traditional materials to carbon fibers is evident in major aircraft manufacturers, signaling a shift toward enhanced performance, reduced costs, and an overall positive impact on the industry.

Leave a Comment