Passenger Boarding Bridges Size

Market Size Snapshot

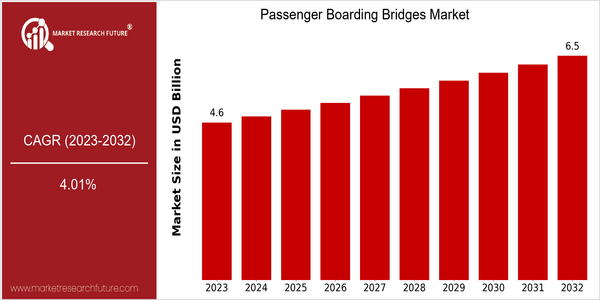

| Year | Value |

|---|---|

| 2023 | USD 4.56 Billion |

| 2032 | USD 6.5 Billion |

| CAGR (2024-2032) | 4.01 % |

Note – Market size depicts the revenue generated over the financial year

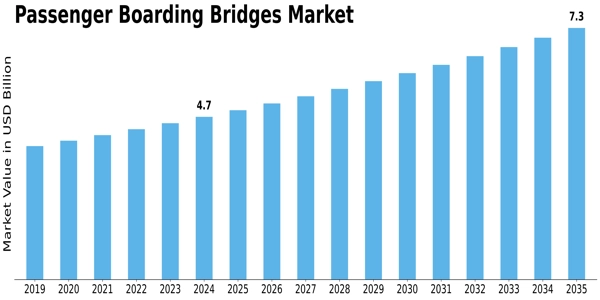

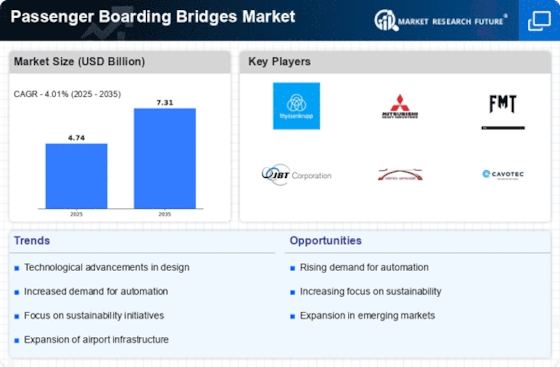

The global Passenger Boarding Bridges market is currently valued at approximately USD 4.56 billion in 2023 and is projected to reach USD 6.5 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.01% from 2024 to 2032. This growth trajectory indicates a steady increase in demand for advanced boarding solutions as airports expand and modernize their infrastructure to accommodate rising passenger traffic and enhance operational efficiency. Several factors are driving this market growth, including the increasing number of air travelers globally, which necessitates the expansion of airport facilities and the adoption of innovative boarding technologies. Additionally, advancements in automation and smart technologies are leading to the development of more efficient and user-friendly boarding bridges. Key players in the industry, such as Thyssenkrupp AG, FMT Aircraft Gate Support Systems, and JBT Corporation, are actively investing in research and development, forming strategic partnerships, and launching new products to enhance their market presence and meet evolving customer needs. These initiatives are crucial in positioning companies to capitalize on the growing demand for sophisticated boarding solutions in the aviation sector.

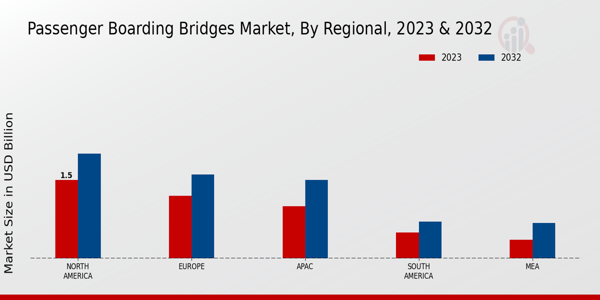

Regional Market Size

Regional Deep Dive

The Passenger Boarding Bridges Market is experiencing significant growth across various regions, driven by increasing air travel demand, airport expansions, and technological advancements. Each region exhibits unique characteristics influenced by local economic conditions, regulatory frameworks, and cultural factors. In North America, for instance, the market is bolstered by a robust aviation sector and ongoing modernization projects, while Europe focuses on sustainability and innovation. The Asia-Pacific region is witnessing rapid airport infrastructure development, particularly in emerging economies, whereas the Middle East and Africa are investing heavily in new airport projects to accommodate rising passenger numbers. Latin America, while still developing, shows promise with increasing investments in airport facilities and services.

Europe

- The European Union has implemented regulations promoting the use of eco-friendly materials in airport infrastructure, including passenger boarding bridges, which is driving innovation in sustainable design.

- Airports such as Amsterdam Schiphol and London Heathrow are adopting advanced boarding bridge systems that integrate digital technologies for better passenger flow management and enhanced safety.

Asia Pacific

- Countries like India and China are rapidly expanding their airport infrastructure, with significant investments in new passenger boarding bridges to accommodate the growing number of air travelers.

- Innovative companies like Thyssenkrupp and JBT Corporation are collaborating with regional airports to introduce automated boarding bridge solutions, enhancing operational efficiency and passenger convenience.

Latin America

- Brazil's recent airport privatization initiatives have opened up opportunities for foreign investment in passenger boarding bridge technology, leading to modernization efforts across the country.

- Airports in Mexico are increasingly adopting smart boarding bridge solutions to improve passenger experience and streamline operations, reflecting a growing trend towards digital transformation in the region.

North America

- The Federal Aviation Administration (FAA) has introduced new guidelines aimed at enhancing the safety and efficiency of passenger boarding bridges, which is prompting airports to upgrade their existing infrastructure.

- Major airports like Los Angeles International Airport (LAX) and Hartsfield-Jackson Atlanta International Airport (ATL) are investing in state-of-the-art boarding bridge technology to improve passenger experience and operational efficiency.

Middle East And Africa

- The UAE's investment in mega airport projects, such as the expansion of Dubai International Airport, is leading to a surge in demand for advanced passenger boarding bridges.

- Governments in the region are prioritizing airport modernization as part of their economic diversification strategies, with countries like Saudi Arabia planning to enhance their airport facilities significantly.

Did You Know?

“Did you know that the first passenger boarding bridge was introduced in the 1950s, revolutionizing the way passengers board and disembark from aircraft?” — Aviation History Journal

Segmental Market Size

The Passenger Boarding Bridges (PBB) segment plays a crucial role in enhancing airport efficiency and passenger experience, currently experiencing stable growth due to increasing air travel demand. Key drivers include the rising need for improved airport infrastructure to accommodate larger aircraft and the growing emphasis on passenger safety and comfort, particularly in the wake of heightened health concerns. Regulatory policies promoting accessibility and safety standards further bolster demand for advanced boarding solutions. Currently, the adoption of PBB technology is in the scaled deployment stage, with notable examples including major airports like Dubai International and Singapore Changi, which have integrated state-of-the-art boarding bridges to streamline operations. Primary applications of PBBs include facilitating passenger boarding and deboarding, especially for international flights, where efficiency and safety are paramount. Trends such as sustainability initiatives are accelerating growth, as airports seek eco-friendly solutions, including energy-efficient boarding bridges. Technologies like automated systems and smart connectivity are shaping the segment's evolution, enhancing operational efficiency and passenger flow management.

Future Outlook

The Passenger Boarding Bridges Market is poised for steady growth from 2023 to 2032, with the market value projected to increase from $4.56 billion to $6.5 billion, reflecting a compound annual growth rate (CAGR) of 4.01%. This growth trajectory is underpinned by the rising demand for efficient airport operations and enhanced passenger experience, driven by the global recovery in air travel post-pandemic. As airports expand and modernize their infrastructure to accommodate increasing passenger volumes, the adoption of advanced boarding bridge technologies is expected to rise significantly, leading to higher penetration rates in both developed and emerging markets. Key technological advancements, such as the integration of smart technologies and automation in passenger boarding bridges, are anticipated to be major drivers of market growth. Innovations like real-time monitoring systems, energy-efficient designs, and enhanced safety features will not only improve operational efficiency but also align with sustainability goals set by various governments and regulatory bodies. Furthermore, the trend towards the construction of new airports and the expansion of existing facilities in regions such as Asia-Pacific and the Middle East will further bolster the demand for passenger boarding bridges, ensuring a robust market outlook through 2032.

Leave a Comment