Orthopedic Trauma Devices Market Share

Orthopedic Trauma Devices Market Size, Growth Research Report By Material Type (Bioabsorbable Materials and Non-Absorbable Materials), By Product Type (Internal Fixator and External Fixator), By End-User (Hospitals, Clinics and Orthopedic Centers), and By Region (North America, Europe, Asia-Pacific, And Rest Of The World) – Competitor Industry Analysis and Trends Forecast Till 2035

Market Summary

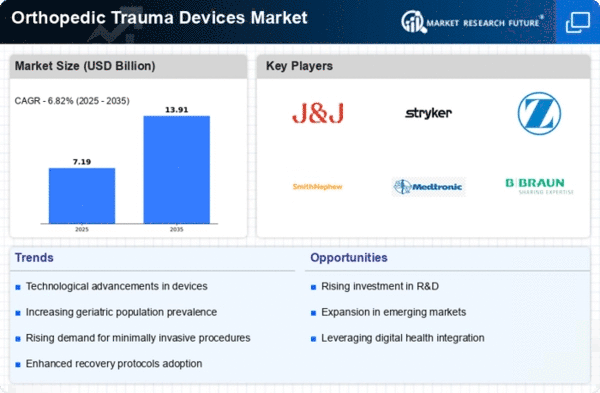

As per Market Research Future Analysis, the Orthopedic Trauma Devices Market was valued at 6.73 USD Billion in 2024 and is projected to grow to 13.91 USD Billion by 2035, with a CAGR of 6.82% from 2025 to 2035. The market is driven by the rising prevalence of osteoarthritis and osteoporosis, increasing traffic injuries, and advancements in product innovation such as smart implants and minimally invasive techniques.

Key Market Trends & Highlights

The orthopedic trauma devices market is witnessing significant growth due to various factors.

- Osteoporosis-related fractures account for over 8.9 million annual fractures globally. Internal fixators dominated the market in 2022 and are expected to grow faster during 2022-2030. North America held a market share of approximately 45.80% in 2022, valued at 2.7 USD Billion. The Asia Pacific region is anticipated to grow rapidly due to an increase in traffic accidents and an aging population.

Market Size & Forecast

| 2024 Market Size | USD 6.73 Billion |

| 2035 Market Size | USD 13.91 Billion |

| CAGR (2025-2035) | 6.82% |

| Largest Regional Market Share in 2022 | North America. |

Major Players

<p>Key players include Stryker, Johnson & Johnson Services Inc., Smith & Nephew, MEDTRONIC, and Braun MELSUNGEN AG.</p>

Market Trends

Rising prevalence of osteoporosis to propel market growth

Due to the increased frequency of osteoporosis and other degenerative bone diseases, the orthopedic trauma devices market is experiencing a growth in market revenue. Osteoporosis-related fractures account for more than 8.9 million annual fractures, according to the International Osteoporosis Foundation (2021). Approximately one in five men and one in three women over 50 are at risk for fractures because of weak bones, according to the article's further information. Less dense, brittle, and vulnerable to fracture, osteoporotic bones change over time.

Thus, the increasing amount of bone fractures in the musculoskeletal system due to degenerative bone illnesses like osteoporosis would boost the demand for orthopedic trauma devices to treat bone-related abnormalities. This is fueling the market for orthopedic trauma devices to increase. Thus, this factor is driving the market CAGR for orthopedic trauma devices.

Furthermore, the rise in traffic injury occurrences is another important element driving the market for orthopedic trauma devices. The World Health Organization brief (2021) on road traffic injuries states that road traffic accidents are the biggest cause of death for children and young adults between the ages of 5 and 29. According to the same factsheet, between 20 and 50 million persons worldwide experience non-fatal injuries in car accidents that leave them disabled. Depending on where the trauma occurs, such injuries may cause significant damage to the limbs.

As a result, it is anticipated that the rise in traffic-related injuries and accidents will help fuel a rise in demand for orthopedic trauma devices, ultimately propelling the market during the forecast period.

However, the market for orthopedic trauma devices is driven by the rise in outpatient operations and the launch of innovative product ideas. The market is driven by the quick development of spine, hip, and knee replacement devices in design and functionality, including smart implants with built-in sensors for real-time data processing and metal-on-metal and metal-on-ceramic implants. The industry's growth is also supported by advancements in tissue engineering and gene editing technologies. As it promotes quick recovery without the risk of metal corrosion, the absorbable polymer is the subject of intensive research by industry participants.

To enable endoscopic minimally invasive spine surgery for service members and veterans, Joimax and Red One Medical teamed together in August 2019. The future of orthopedic trauma devices lies in advances in robotics, machine-navigated medicine, smart implants, nanotechnology, 3D printing, genetics, and tissue engineering. Thus, it is anticipated that this aspect will accelerate orthopedic trauma devices market revenue globally.

<p>The ongoing advancements in orthopedic trauma devices, driven by technological innovations and a growing emphasis on patient-centric care, appear to be reshaping the landscape of orthopedic surgery.</p>

U.S. Food and Drug Administration (FDA)

Orthopedic Trauma Devices Market Market Drivers

Market Growth Projections

The Global Orthopedic Trauma Devices Market Industry is projected to experience robust growth in the coming years. With an estimated market value of 6.73 USD Billion in 2024, the industry is anticipated to expand significantly, reaching 13.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 6.82% from 2025 to 2035. Such projections indicate a strong demand for orthopedic trauma devices driven by factors such as technological advancements, an aging population, and increasing healthcare expenditure. The market's expansion reflects the ongoing commitment to improving orthopedic care and addressing the needs of patients worldwide.

Growing Geriatric Population

The Global Orthopedic Trauma Devices Market Industry is significantly influenced by the growing geriatric population, which is more susceptible to fractures and orthopedic conditions. According to the United Nations, the number of individuals aged 65 and older is expected to double by 2050, leading to an increased demand for orthopedic trauma devices. This demographic shift necessitates the development of specialized devices tailored to the needs of older patients, such as hip and knee implants. As a result, the market is poised for growth, with a projected compound annual growth rate of 6.82% from 2025 to 2035, reflecting the urgent need for effective orthopedic solutions.

Rising Healthcare Expenditure

Rising healthcare expenditure globally is a crucial driver for the Global Orthopedic Trauma Devices Market Industry. As countries allocate more resources to healthcare, there is a corresponding increase in the availability and accessibility of advanced medical technologies, including orthopedic trauma devices. For instance, nations with robust healthcare systems are investing in innovative surgical techniques and rehabilitation programs, which enhance patient care. This trend is likely to stimulate market growth as healthcare providers seek to improve outcomes for patients with orthopedic injuries. The increasing focus on quality healthcare services is expected to contribute to the market's expansion in the foreseeable future.

Increase in Road Traffic Accidents

The Global Orthopedic Trauma Devices Market Industry is also driven by the alarming rise in road traffic accidents, which contribute significantly to orthopedic injuries. According to the World Health Organization, road traffic injuries claim approximately 1.35 million lives annually, with many survivors requiring orthopedic interventions. This trend underscores the need for advanced trauma devices to address the growing number of injuries sustained in accidents. As awareness of road safety increases and preventive measures are implemented, the demand for orthopedic trauma devices is expected to rise, further propelling market growth in the coming years.

Rising Incidence of Orthopedic Injuries

The Global Orthopedic Trauma Devices Market Industry experiences a notable surge in demand due to the increasing incidence of orthopedic injuries. Factors such as an aging population, active lifestyles, and rising participation in sports contribute to this trend. For instance, the World Health Organization indicates that musculoskeletal disorders are among the leading causes of disability worldwide. This growing prevalence of injuries necessitates advanced orthopedic trauma devices, which are projected to drive the market's growth significantly. The market is expected to reach 6.73 USD Billion in 2024, reflecting the urgent need for innovative solutions in orthopedic care.

Technological Advancements in Orthopedic Devices

Technological advancements play a pivotal role in shaping the Global Orthopedic Trauma Devices Market Industry. Innovations such as 3D printing, minimally invasive surgical techniques, and smart implants enhance the efficacy and safety of orthopedic procedures. These advancements not only improve patient outcomes but also reduce recovery times, thereby increasing the adoption of orthopedic trauma devices. As healthcare providers increasingly seek to integrate cutting-edge technology into their practices, the market is likely to witness substantial growth. By 2035, the market is projected to reach 13.9 USD Billion, underscoring the impact of technology on orthopedic trauma care.

Market Segment Insights

Orthopedic Trauma Devices Material Type Insights

<p>The Orthopedic Trauma Devices Market segmentation, based on material type, includes bioabsorbable materials and non-absorbable materials. The non-absorbable materials segment held the majority share in 2022 in the Orthopedic Trauma Devices Market data. Orthopaedics increasingly rely on biodegradable polymers, particularly those from the polyglycolic acid (PGA) and polylactic acid (PLA) families. A technological improvement that is boosting the need for bioabsorbable materials in the orthopedic trauma devices market is the creation of resorbable screws.</p>

<p>Figure 2: Orthopedic Trauma Devices Market, by Material Type, 2022 & 2030 (USD Billion)</p>

<p>Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review</p>

Orthopedic Trauma Devices Product Type Insights

<p>The Orthopedic Trauma Devices Market segmentation, based on product type, includes internal fixator and external fixator. The internal fixator segment dominated the market growth for orthopedic trauma devices in 2022 and is projected to be the faster-growing segment during the forecast period, 2022-2030. Due to the development of sterile surgical techniques, which dramatically decreased the danger of infection, internal fixators are often employed to treat bone abnormalities and fractures. Internal fixation also lessens the likelihood that the shattered bones will repair improperly, lets patients to resume their daily activities sooner, and speeds up recovery.</p>

Orthopedic Trauma Devices End User Insights

<p>The Orthopedic Trauma Devices Market data, based on end user, includes hospitals, clinics and orthopedic centers. The hospital's segment dominated the orthopedic trauma devices market revenue for orthopedic trauma devices in 2022 and is projected to be the faster-growing segment during the forecast period, 2022-2030. The use of orthopedic treatment methods in institutional settings has been prompted by the increasing occurrence of trauma and injury in the world as well as the use of less invasive techniques.</p>

<p>Additionally, the availability of qualified professionals and tools to assist with surgical operations all help to increase the market share for the hospital sector.</p>

Get more detailed insights about Orthopedic Trauma Devices Market Research Report -Forecast to 2034

Regional Insights

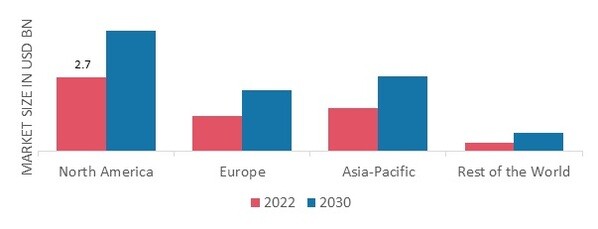

By region, the study provides the market insights for orthopedic trauma devices into North America, Europe, Asia-Pacific and Rest of the World. North America orthopedic trauma devices market accounted for USD 2.7 billion in 2022 with a share of around 45.80% and is expected to exhibit a significant CAGR growth during the study period due to the high prevalence of chronic pain from a variety of causes, including low back pain,arthritis, and neck pain, as well as the growing older population, high illness management knowledge among the general public, and new product introductions in the area.

The rise in the cost of research and development, the existence of important players in the area, and the increased incidence of sports injuries are all contributing factors to the expansion.

Further, the major countries studied in the market report for orthopedic trauma devices are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: ORTHOPEDIC TRAUMA DEVICES MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Asia Pacific orthopedic trauma devices market accounts for the second-largest market share. Several factors are anticipated to boost the market in the Asia Pacific, including an increase in the number of older adults in China and Japan, a startling rise in traffic accidents, and quickly rising economies. It is also anticipated that introducing novel equipment to identify and treat orthopedic problems precisely will fuel market growth. Moreover, China orthopedic trauma devices market held the largest market share, and the India orthopedic trauma devices market was the fastest growing market in the region.

Europe orthopedic trauma devices Market is expected to grow at the fastest CAGR from 2022 to 2030. The region's growing elderly and obese populations are at higher risk of developing bone fractures. In the years to come, the market expansion is anticipated to be fueled by investments in creating superior-quality orthopedic trauma devices. Further, the UK orthopedic trauma devices market held the largest market share, and the Germany orthopedic trauma devices market was the fastest-growing market in the region.

Key Players and Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help the orthopedic trauma devices market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the orthopedic trauma devices industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

One of the primary business strategies adopted by manufacturers in the global orthopedic trauma devices industry to benefit clients and expand the market sector is to manufacture locally to reduce operating costs. In recent years, orthopedic trauma devices industry has provided medicine with some of the most significant benefits. The orthopedic trauma devices market major player such as NVIBIO (UK), BIOTEK (India), DEPUY SYNTHES CompanienOrtho Max Manufacturing Company PVT. Ltd., AUXEIN Medical (India), Stryker, Johnson & Johnson Services Inc. (US), Smith & Nephew, MEDTRONIC and Braun MELSUNGEN AG.

The Stryker Corporation is an American firm with headquarters in Kalamazoo, Michigan. Stryker manufactures a wide range of medical device products, including surgical instruments and surgical navigation systems, endoscopic and communications systems, neurovascular, patient handling and emergency medical equipment, neurosurgical, and spinal devices, as well as other products used in a range of medical specialties. The Stryker Corporation provides orthrobiologics, such as biodegradable solutions for bone repair, which are utilised in soft tissue regeneration, bone healing, and muscle connection to bone.

The American global firm Johnson & Johnson (J&J), established in 1886, creates consumer packaged goods, pharmaceuticals, and medical equipment. The company is ranked No. 36 on the 2021 Fortune 500 list of the largest American corporations by total revenue, and its common stock is a component of the Dow Jones Industrial Average. One of the most valuable firms in the world, Johnson & Johnson is one of just two U.S.-based businesses with a prime credit rating of AAA, which is higher than the rating of the US government.

Key Companies in the Orthopedic Trauma Devices Market market include

Industry Developments

October 2021: The CurvaFix implant was introduced in the US by CurvaFix Inc. According to reports, the implant can be used to treat pelvic and acetabular fractures.

June 2021: For the purpose of preventing infections, Zimmer Biomet introduced Bactiguard-coated orthopedic trauma implants in a few regions in Europe, the Middle East, and Africa. These implants were given the CE mark in January 2021.

Future Outlook

Orthopedic Trauma Devices Market Future Outlook

<p>The Global Orthopedic Trauma Devices Market is projected to grow at a 6.82% CAGR from 2024 to 2034, driven by technological advancements, increasing geriatric population, and rising incidence of orthopedic injuries.</p>

New opportunities lie in:

- <p>Develop smart orthopedic devices integrating IoT for real-time patient monitoring. Expand product lines to include biodegradable materials for sustainability. Leverage telemedicine for post-operative care and rehabilitation services.</p>

<p>By 2035, the market is expected to achieve substantial growth, reflecting advancements and increased demand.</p>

Market Segmentation

Orthopedic Trauma Devices End-User Outlook (USD Billion, 2018-2030)

- Hospitals

- Clinics

- Orthopedic Centers

Orthopedic Trauma Devices Regional Outlook (USD Billion, 2018-2030)

- {"North America"=>["US"

- "Canada"]}

- {"Europe"=>["Germany"

- "France"

- "UK"

- "Italy"

- "Spain"

- "Rest of Europe"]}

- {"Asia-Pacific"=>["China"

- "Japan"

- "India"

- "Australia"

- "South Korea"

- "Rest of Asia-Pacific"]}

- {"Rest of the World"=>["Middle East"

- "Africa"

- "Latin America"]}

Orthopedic Trauma Devices Product Type Outlook (USD Billion, 2018-2030)

- Internal Fixator

- External Fixator

Orthopedic Trauma Devices Material Type Outlook (USD Billion, 2018-2030)

- Bioabsorbable Materials

- Non-Absorbable Materials

Report Scope

| Attribute/Metric | Details |

| Market Size 2024 | 6.73 (USD Billion) |

| Market Size 2025 | 7.19 (USD Billion) |

| Market Size 2035 | 13.91 (USD Billion) |

| Compound Annual Growth Rate (CAGR) | 6.82% (2025 - 2035) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2020 - 2024 |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Material Type, Product Type, End-User and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered | The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | NVIBIO (UK), BIOTEK (India), DEPUY SYNTHES CompanienOrtho Max Manufacturing Company PVT. Ltd., AUXEIN Medical (India), Stryker, Johnson & Johnson Services Inc. (US) |

| Key Market Opportunities | · New product launches and R&D Amongst major key Players |

| Key Market Dynamics | · High incidences of road accidents · Increase in adoption of minimally invasive surgical procedures |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

At what CAGR is the orthopedic trauma devices market projected to grow in the forecast period (2022-2030)?

orthopedic trauma devices market is projected grow at 6.82% CAGR during the assessment period (2025-2034).

What are the major tailwinds pushing the growth of the orthopedic trauma devices market?

Increasing geriatric populaces, ttechnological advances, and increasing road accidents and sport injuries are the major tailwinds pushing the growth of the orthopedic trauma devices market.

Which is the largest segment in the orthopedic trauma devices market?

The bio-absorbable materials segment holds the largest share of the orthopedic trauma devices market.

Which region holds the largest share in the orthopedic trauma devices market?

North America holds the largest share in the orthopedic trauma devices market, followed by Europe and the Asia Pacific, respectively.

Who are the top players in the orthopedic trauma devices market?

BIOTEK (India), Invibio (UK), DePuy Synthes Companies, Auxein Medical (India), Ortho Max Manufacturing Company Pvt. Ltd., Stryker, Smith & Nephew, Johnson & Johnson Services, Inc. (US), B. Braun Melsungen AG, and MEDTRONIC, are some of the major players operating in the orthopedic trauma devices market.

-

--- 'TABLE OF CONTENT

-

Chapter 1. Report Prologue

-

Chapter 2. Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumptions

- Limitations

-

Chapter 3. Research Methodology

- Introduction

- Primary Research

- Secondary Research

- Market Size Estimation

-

Chapter 4. Market Dynamics

- Drivers

- Restraints

- Opportunities

- Challenges

- Macroeconomic Indicators

- Technology Trends & Assessment

-

Chapter 5. Market Factor Analysis

-

Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

- Value Chain Analysis

- Investment Feasibility Analysis

- Pricing Analysis

-

Porter’s Five Forces Analysis

-

Chapter 6. Global Orthopedic Trauma Devices Market, by Material Type

- Introduction

-

Bioabsorbable Materials

- Polyglycolic Acid (PGA)

- Polylactic Acid (PLA)

- Other

-

Non-Absorbable Materials

- Titanium

- Stainless Steel

- Other

- Others

-

Chapter 7. Global Orthopedic Trauma Devices Market, By Product Type

- Introduction

-

Internal Fixator

- Screws

- Plates

- Nails

- Patient-Specific Implants

- Others

-

External fixator

- Rigid Casts

- Unilateral Frames

- Circular Frames

- Others

-

Chapter 8. Global Orthopedic Trauma Devices Market, by End-Users

- Introduction

- Hospitals and clinics

- Ambulatory Surgical Centers

- Orthopedic Centers

- Emergency Departments

- Others

-

Chapter 9. Global Orthopedic Trauma Devices Market, by Region

- Introduction

-

America

- North America

- South America

-

Europe

- Western Europe

- Eastern Europe

-

Asia-Pacific

- Japan

- China

- India

- Australia

- Republic of Korea

- Rest of Asia-Pacific

-

Middle East & Africa

- United Arab Emirates

- Saudi Arabia

- Oman

- Kuwait

- Qatar

- Rest of the Middle East & Africa

-

Chapter 10. Company Landscape

- Introduction

- Market Share Analysis

-

Key Development & Strategies

- Key Developments

-

Chapter 11 Company Profiles

-

Invibio

- Company Overview

- Type Overview

- Financials

- Key Developments

- SWOT Analysis

-

DePuy Synthes Companies

- Company Overview

- Type Overview

- Financial Overview

- SWOT Analysis

-

Ortho Max Manufacturing Company Pvt. Ltd

- Company Overview

- Type Overview

- Financial Overview

- Key Development

- SWOT Analysis

-

Auxein Medical

- Company Overview

- Type/Business Segment Overview

- Financial Overview

- Key Development

- SWOT Analysis

-

Stryker

- Company Overview

- Type Overview

- Financial overview

- Key Developments

- SWOT Analysis

-

Johnson & Johnson Services, Inc.

- Company Overview

- Type Overview

- Financial Overview

- Key Developments

- SWOT Analysis

-

Smith & Nephew

- Overview

- Type Overview

- Financials

- Key Developments

- SWOT Analysis

-

MEDTRONIC

- Overview

- Type Overview

- Financials

- Key Developments

- SWOT Analysis

-

B. Braun Melsungen AG

- Overview

- Type Overview

- Financials

- Key Developments

- SWOT Analysis

-

Integra LifeSciences Corporation

- Overview

- Type Overview

- Financials

- Key Developments

- SWOT Analysis

-

Zimmer Holding Inc.

- Overview

- Type Overview

- Financials

- Key Developments

- SWOT Analysis

- Others

-

Invibio

-

Chapter 12 Appendix

-

List of Tables and Figures

- LIST OF TABLES

- Table 1 Global Orthopedic Trauma Devices Market Industry Synopsis, 2020-2027

- Table 2 Global Orthopedic Trauma Devices Market Estimates & Forecast, 2020-2027, (USD Million)

- Table 3 Global Orthopedic Trauma Devices Market, by Region, 2020-2027, (USD Million)

- Table 4 Global Orthopedic Trauma Devices Market, by Material Type, 2020-2027, (USD Million)

- Table 5 Global Orthopedic Trauma Devices Market, by Product Type, 2020-2027, (USD Million)

- Table 6 Global Orthopedic Trauma Devices Market, by End-User, 2020-2027, (USD Million)

- Table 7 North America: Prescribed Health Apps Market, by Material Type, 2020-2027, (USD Million)

- Table 8 North America: Orthopedic Trauma Devices Market, by Product Type, 2020-2027, (USD Million)

- Table 9 North America: Orthopedic Trauma Devices Market, by End-User, 2020-2027, (USD Million)

- Table 10 US: Orthopedic Trauma Devices Market, by Material Type, 2020-2027, (USD Million)

- Table 11 US: Orthopedic Trauma Devices Market, by Product Type, 2020-2027, (USD Million)

- Table 12 US: Orthopedic Trauma Devices Market, by End-User, 2020-2027, (USD Million)

- Table 13 Canada: Orthopedic Trauma Devices Market, by Material Type, 2020-2027, (USD Million)

- Table 14 Canada: Orthopedic Trauma Devices Market, by Product Type, 2020-2027, (USD Million)

- Table 15 Canada: Orthopedic Trauma Devices Market, by End-User, 2020-2027, (USD Million)

- Table 16 South America: Orthopedic Trauma Devices Market, by Material Type, 2020-2027, (USD Million)

- Table 17 South America: Orthopedic Trauma Devices Market, by Product Type, 2020-2027, (USD Million)

- Table 18 South America: Orthopedic Trauma Devices Market, by End-User, 2020-2027, (USD Million)

- Table 19 Europe: Orthopedic Trauma Devices Market, Material Type, 2020-2027, (USD Million)

- Table 20 Europe: Orthopedic Trauma Devices Market, by Product Type, 2020-2027, (USD Million)

- Table 21 Europe: Orthopedic Trauma Devices Market, by End-User, 2020-2027, (USD Million)

- Table 22 Western Europe: Orthopedic Trauma Devices Market, by Material Type, 2020-2027, (USD Million)

- Table 23 Western Europe: Orthopedic Trauma Devices Market, by Product Type, 2020-2027, (USD Million)

- Table 24 Western Europe: Orthopedic Trauma Devices Market, by End-User, 2020-2027, (USD Million)

- Table 25 Eastern Europe: Orthopedic Trauma Devices Market, by Material Type, 2020-2027, (USD Million)

- Table 26 Eastern Europe: Orthopedic Trauma Devices Market, by Product Type, 2020-2027, (USD Million)

- Table 27 Eastern Europe: Orthopedic Trauma Devices Market, by End-User, 2020-2027, (USD Million)

- Table 28 Asia-Pacific: Orthopedic Trauma Devices Market, by Material Type, 2020-2027, (USD Million)

- Table 29 Asia-Pacific: Orthopedic Trauma Devices Market, by Product Type, 2020-2027, (USD Million)

- Table 30 Asia-Pacific: Orthopedic Trauma Devices Market, by End-User, 2020-2027, (USD Million)

- Table 31 Middle East & Africa: Orthopedic Trauma Devices Market, by Material Type, 2020-2027, (USD Million)

- Table 32 Middle East & Africa: Orthopedic Trauma Devices Market, by Product Type, 2020-2027, (USD Million)

- Table 33 Middle East & Africa: Orthopedic Trauma Devices Market, by End-User, 2020-2027, (USD Million) LIST OF FIGURES

- Figure 1 Research Process

- Figure 2 Segmentation for the Global Orthopedic Trauma Devices Market

- Figure 3 Market Dynamics for the Global Orthopedic Trauma Devices Market

- Figure 4 Global Orthopedic Trauma Devices Market Share, by Material Type 2020

- Figure 6 Global Orthopedic Trauma Devices Market Share, by Product Type, 2020

- Figure 6 Global Orthopedic Trauma Devices Market Share, by End-User, 2020

- Figure 7 Global Orthopedic Trauma Devices Market Share, by Region, 2020

- Figure 8 North America Orthopedic Trauma Devices Market Share, by Country, 2020

- Figure 9 Europe Prescribed Health Apps Share, by Country, 2020

- Figure 10 Asia-Pacific Orthopedic Trauma Devices Market Share, by Country, 2020

- Figure 11 Middle East & Africa Orthopedic Trauma Devices Market Share, by Country, 2020

- Figure 12 Global Orthopedic Trauma Devices Market: Company Share Analysis, 2020 (%)

- Figure 13 Invibio: Key Financials

- Figure 14 Invibio: Segmental Revenue

- Figure 15 Invibio: Geographical Revenue

- Figure 16 DePuy Synthes Companies: Key Financials

- Figure 17 DePuy Synthes Companies: Segmental Revenue

- Figure 18 DePuy Synthes Companies: Geographical Revenue

- Figure 19 Ortho Max Manufacturing Company Pvt. Ltd: Key Financials

- Figure 20 Ortho Max Manufacturing Company Pvt. Ltd : Segmental Revenue

- Figure 21 Ortho Max Manufacturing Company Pvt. Ltd: Geographical Revenue

- Figure 22 Auxein Medical: Key Financials

- Figure 23 Auxein Medical: Segmental Revenue

- Figure 24 Auxein Medical: Geographical Revenue

- Figure 25 Johnson & Johnson Services, Inc.: Key Financials

- Figure 26 Johnson & Johnson Services, Inc.: Segmental Revenue

- Figure 27 Johnson & Johnson Services, Inc.: Geographical Revenue

- Figure 28 Smith & Nephew: Key Financials

- Figure 29 Smith & Nephew: Segmental Revenue

- Figure 30 Smith & Nephew: Geographical Revenue

- Figure 31 MEDTRONIC: Key Financials

- Figure 32 MEDTRONIC: Segmental Revenue

- Figure 33 MEDTRONIC: Geographical Revenue

- Figure 34 B. Braun Melsungen AG: Key Financials

- Figure 35 B. Braun Melsungen AG: Segmental Revenue

- Figure 36 B. Braun Melsungen AG: Geographical Revenue

- Figure 37 Integra LifeSciences Corporation: Key Financials

- Figure 38 Integra LifeSciences Corporation : Segmental Revenue

- Figure 39 Integra LifeSciences Corporation : Geographical Revenue

- Figure 40 Zimmer Holding Inc.: Key Financials

- Figure 41 Zimmer Holding Inc.: Segmental Revenue

- Figure 42 Zimmer Holding Inc.: Geographical Revenue'

Market Segmentation Tab

Orthopedic Trauma Devices Material Type Outlook (USD Billion, 2018-2030)

- Bioabsorbable Materials

- Non-Absorbable Materials

Orthopedic Trauma Devices Product Type Outlook (USD Billion, 2018-2030)

- Internal Fixator

- External Fixator

Orthopedic Trauma Devices End-User Outlook (USD Billion, 2018-2030)

- Hospitals

- Clinics

- Orthopedic Centers

Orthopedic Trauma Devices Regional Outlook (USD Billion, 2018-2030)

- North America Outlook (USD Billion, 2018-2030)

- North America Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- North America Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- North America Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- US Outlook (USD Billion, 2018-2030)

- US Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- US Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- US Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Canada Outlook (USD Billion, 2018-2030)

- Canada Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Canada Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Canada Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Europe Outlook (USD Billion, 2018-2030)

- Europe Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Europe Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Europe Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Germany Outlook (USD Billion, 2018-2030)

- Germany Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Germany Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Germany Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- France Outlook (USD Billion, 2018-2030)

- France Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- France Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- France Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- UK Outlook (USD Billion, 2018-2030)

- UK Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- UK Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- UK Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Italy Outlook (USD Billion, 2018-2030)

- Italy Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Italy Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Italy Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Spain Outlook (USD Billion, 2018-2030)

- Spain Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Spain Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Spain Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Rest Of Europe Outlook (USD Billion, 2018-2030)

- Rest Of Europe Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Rest Of Europe Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Rest Of Europe Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Asia-Pacific Outlook (USD Billion, 2018-2030)

- Asia-Pacific Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Asia-Pacific Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Asia-Pacific Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- China Outlook (USD Billion, 2018-2030)

- China Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- China Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- China Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Japan Outlook (USD Billion, 2018-2030)

- Japan Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Japan Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Japan Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- India Outlook (USD Billion, 2018-2030)

- India Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- India Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- India Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Australia Outlook (USD Billion, 2018-2030)

- Australia Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Australia Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Australia Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Rest of Asia-Pacific Outlook (USD Billion, 2018-2030)

- Rest of Asia-Pacific Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Rest of Asia-Pacific Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Rest of Asia-Pacific Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Rest of the World Outlook (USD Billion, 2018-2030)

- Rest of the World Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Rest of the World Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Rest of the World Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Middle East Outlook (USD Billion, 2018-2030)

- Middle East Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Middle East Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Middle East Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Africa Outlook (USD Billion, 2018-2030)

- Africa Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Africa Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Africa Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Latin America Outlook (USD Billion, 2018-2030)

- Latin America Orthopedic Trauma Devices by Material Type

- Bioabsorbable Materials

- Non-Absorbable Materials

- Latin America Orthopedic Trauma Devices by Product Type

- Internal Fixator

- External Fixator

- Latin America Orthopedic Trauma Devices by End-User

- Hospitals

- Clinics

- Orthopedic Centers

- Rest of the World Orthopedic Trauma Devices by Material Type

- Asia-Pacific Orthopedic Trauma Devices by Material Type

- Europe Orthopedic Trauma Devices by Material Type

- North America Orthopedic Trauma Devices by Material Type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment