-

'

-

OVERVIEW

-

DEFINITION

-

SCOPE OF THE STUDY

-

RESEARCH OBJECTIVE

-

MARKET STRUCTURE

-

ASSUMPTIONS & LIMITATIONS

-

DATA MINING

-

SECONDARY RESEARCH

-

PRIMARY RESEARCH

-

BREAKDOWN OF PRIMARY RESPONDENTS

-

FORECASTING TECHNIQUES

-

RESEARCH METHODOLOGY

-

FOR MARKET SIZE ESTIMATION

-

BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

-

DATA TRIANGULATION

-

VALIDATION

-

OVERVIEW

-

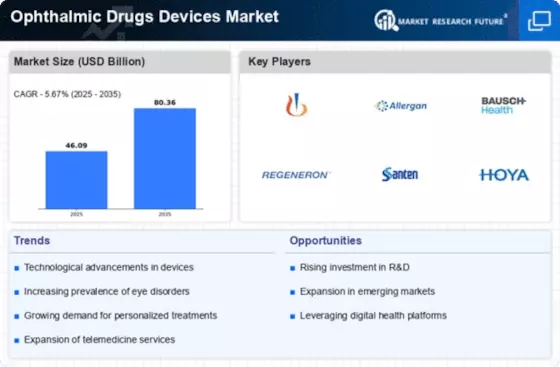

DRIVERS

- RISING PREVALENCE OF OPHTHALMIC DISORDERS

- RISING GERAITRIC POPULATION

-

GROWING NUMBER OF DIABETES CASES

-

RESTRAINTS

- LACK OF AWARENESS REGARDING EYE DISORDERS

- SIDE EFFECTS ASSOCIATED WITH OPHTHALMIC DRUGS

-

OPPORTUNITIES

- INCREASE PRODUCT DEVELOPMENT AND LAUNCHES

-

VALUE CHAIN ANALYSIS

- R&D

- MANUFACTURING

- DISTRIBUTION & SALES

- POST-SALES MONITORING

-

PORTER''S FIVE FORCES MODEL

-

THREAT OF NEW ENTRANTS

-

BARGAINING POWER OF SUPPLIERS

-

THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS

- INTENSITY OF RIVALRY

-

IMPACT OF COVID-19 ON THE OPHTHALMIC DRUGS AND DEVICES MARKET

-

IMPACT ON SUPPLY CHAIN

-

IMPACT ON PRODUCTION

-

IMPACT ON MARKET PLAYERS

-

OVERVIEW

-

DRUGS

- PILOCARPINE

- MICROPINE

- PROVISC

- DIURETICS

- VASOCONSTRICTORS

- FLUOCINOLONE

- BIMATOPROST

- OTHERS

-

DEVICES

- GLASSES AND CONTACT LENS

- OPTICAL DISPENSER

- EYE MASSAGERS

-

SPONGE DEVICES AND EYE CLEANER

-

OTHERS

-

OVERVIEW

-

EYE INFECTIONS

-

ALLERGIC CONJUNCTIVITIS

-

DRY EYES SYNDROME

-

RED EYES

-

INFLAMMATION

-

OTHERS

-

AND DEVICES MARKET, BY REGION

-

OVERVIEW

-

NORTH AMERICA

- US

- CANADA

-

EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- REST OF EUROPE

-

ASIA-PACIFIC

- JAPAN

- CHINA

- INDIA

- AUSTRALIA

- SOUTH KOREA

- REST OF ASIA-PACIFIC

-

REST OF THE WORLD

- MIDDLE EAST

- AFRICA

- LATIN AMERICA

-

OVERVIEW

-

COMPETITIVE BENCHMARKING

-

MAJOR GROWTH STRATEGY

-

IN THE GLOBAL OPHTHALMIC DRUGS AND DEVICES MARKET

-

THE LEADING PLAYERS IN TERMS OF NUMBER OF DEVELOPMENTS

-

IN GLOBAL OPHTHALMIC DRUGS AND DEVICES MARKET

-

KEY DEVELOPMENT ANALYSIS

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

- PRODUCT APPROVAL AND PRODUCT LAUNCH

- COLLABORATION

- AGREEMENT

- ACQUISITION

-

MAJOR PLAYERS FINANCIAL MATRIX

-

SALES (USD MILLION), 2021

- R&D (USD MILLION), 2021

-

JOHNSON AND JOHNSON VISION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

ALLERGAN PLC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

TEVA PHARMACEUTICAL INDUSTRIES LTD.

-

COMPANY OVERVIEW

- FINANCIAL ANALYSIS

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

OCULAR THERAPEUTIX, INC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

BAUSCH & LOMB INCORPORATED

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

SIGHT SCIENCES, INC.

- COMPANY OVERVIEW

- FINANCIAL ANALYSIS

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

MIBO MEDICAL GROUP

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

ALCON

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS 0FFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

BIOTISSUE

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

NUSIGHT MEDICAL

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- KEY STRATEGIES

-

REFERENCES

-

RELATED REPORTS LIST OF TABLES

-

DRUGS AND DEVICES MARKET, BY PRODUCT, 2018–2030 (USD MILLION) AND DEVICES MARKET, FOR DRUGS, BY TYPE, 2018–2030 (USD MILLION) DRUGS AND DEVICES MARKET, FOR DEVICES, BY TYPE, 2018–2030 (USD MILLION) DRUGS AND DEVICES MARKET, FOR DRUGS, BY REGION, 2018–2030 (USD MILLION) DRUGS AND DEVICES MARKET, FOR PILOCARPINE, BY REGION, 2018–2030 (USD MILLION) DRUGS AND DEVICES MARKET, FOR MICROPINE, BY REGION, 2018–2030 (USD MILLION) DRUGS AND DEVICES MARKET, FOR PROVISC, BY REGION, 2018–2030 (USD MILLION) DRUGS AND DEVICES MARKET, FOR DIURETICS, BY REGION, 2018–2030 (USD MILLION) DRUGS AND DEVICES MARKET, FOR VASOCONSTRICTORS, BY REGION, 2018–2030 (USD MILLION)

-

REGION, 2018–2030 (USD MILLION) OPTICAL DISPENSER, BY REGION, 2018–2030 (USD MILLION) FOR EYE MASSAGERS, BY REGION, 2018–2030 (USD MILLION) FOR SPONGE DEVICES AND EYE CLEANER, BY REGION, 2018–2030 (USD MILLION) DRUGS AND DEVICES MARKET, FOR OTHERS, BY REGION, 2018–2030 (USD MILLION) DRUGS AND DEVICES MARKET, BY TREATMENT, 2018–2030 (USD MILLION) DRUGS AND DEVICES MARKET, FOR EYE INFECTIONS, BY REGION, 2018–2030 (USD MILLION) DRUGS AND DEVICES MARKET, FOR ALLERGIC CONJUNCTIVITIS, BY REGION, 2018–2030 (USD MILLION)

-

BY REGION, 2018–2030 (USD MILLION) INFLAMMATION, BY REGION, 2018–2030 (USD MILLION) FOR OTHERS, BY REGION, 2018–2030 (USD MILLION) BY REGION, 2018–2030 (USD MILLION) BY COUNTRY, 2018-2030 (USD MILLION) BY PRODUCT, 2018-2030 (USD MILLION) FOR DRUGS, BY TYPE, 2018-2030 (USD MILLION) MARKET, FOR DEVICES, BY TYPE, 2018-2030 (USD MILLION) MARKET, BY TREATMENT, 2018-2030 (USD MILLION) BY PRODUCT, 2018-2030 (USD MILLION) BY TYPE, 2018-2030 (USD MILLION)

-

2018-2030 (USD MILLION) (USD MILLION)

-

DRUGS AND DEVICES MARKET, FOR DRUGS, BY TYPE, 2018-2030 (USD MILLION) DRUGS AND DEVICES MARKET, FOR DEVICES, BY TYPE, 2018-2030 (USD MILLION) DRUGS AND DEVICES MARKET, BY TREATMENT, 2018-2030 (USD MILLION) AND DEVICES MARKET, BY COUNTRY, 2018-2030 (USD MILLION) BY PRODUCT, 2018-2030 (USD MILLION) DRUGS, BY TYPE, 2018-2030 (USD MILLION) DEVICES, BY TYPE, 2018-2030 (USD MILLION) BY TREATMENT, 2018-2030 (USD MILLION) PRODUCT, 2018-2030 (USD MILLION) TYPE, 2018-2030 (USD MILLION) BY TYPE, 2018-2030 (USD MILLION)

-

2018-2030 (USD MILLION) (USD MILLION)

-

DRUGS AND DEVICES MARKET, FOR DEVICES, BY TYPE, 2018-2030 (USD MILLION) DRUGS AND DEVICES MARKET, BY TREATMENT, 2018-2030 (USD MILLION) AND DEVICES MARKET, BY PRODUCT, 2018-2030 (USD MILLION) FOR DRUGS, BY TYPE, 2018-2030 (USD MILLION) FOR DEVICES, BY TYPE, 2018-2030 (USD MILLION) BY TREATMENT, 2018-2030 (USD MILLION) PRODUCT, 2018-2030 (USD MILLION) TYPE, 2018-2030 (USD MILLION) TYPE, 2018-2030 (USD MILLION)

-

2018-2030 (USD MILLION) (USD MILLION)

-

OPHTHALMIC DRUGS AND DEVICES MARKET, BY PRODUCT, 2018-2030 (USD MILLION) OPHTHALMIC DRUGS AND DEVICES MARKET, FOR DRUGS, BY TYPE, 2018-2030 (USD MILLION) OPHTHALMIC DRUGS AND DEVICES MARKET, FOR DEVICES, BY TYPE, 2018-2030 (USD MILLION) OPHTHALMIC DRUGS AND DEVICES MARKET, BY TREATMENT, 2018-2030 (USD MILLION) OPHTHALMIC DRUGS AND DEVICES MARKET, BY COUNTRY, 2018-2030 (USD MILLION) OPHTHALMIC DRUGS AND DEVICES MARKET, BY PRODUCT, 2018-2030 (USD MILLION) OPHTHALMIC DRUGS AND DEVICES MARKET, FOR DRUGS, BY TYPE, 2018-2030 (USD MILLION) OPHTHALMIC DRUGS AND DEVICES MARKET, FOR DEVICES, BY TYPE, 2018-2030 (USD MILLION) OPHTHALMIC DRUGS AND DEVICES MARKET, BY TREATMENT, 2018-2030 (USD MILLION) DRUGS AND DEVICES MARKET, BY PRODUCT, 2018-2030 (USD MILLION) AND DEVICES MARKET, FOR DRUGS, BY TYPE, 2018-2030 (USD MILLION) AND DEVICES MARKET, FOR DEVICES, BY TYPE, 2018-2030 (USD MILLION) AND DEVICES MARKET, BY TREATMENT, 2018-2030 (USD MILLION) BY PRODUCT, 2018-2030 (USD MILLION) DRUGS, BY TYPE, 2018-2030 (USD MILLION) DEVICES, BY TYPE, 2018-2030 (USD MILLION) BY TREATMENT, 2018-2030 (USD MILLION) PRODUCT, 2018-2030 (USD MILLION) TYPE, 2018-2030 (USD MILLION) TYPE, 2018-2030 (USD MILLION)

-

2018-2030 (USD MILLION)

-

2018-2030 (USD MILLION)

-

BY TYPE, 2018-2030 (USD MILLION) BY TYPE, 2018-2030 (USD MILLION)

-

2018-2030 (USD MILLION)

-

2018-2030 (USD MILLION)

-

BY TYPE, 2018-2030 (USD MILLION) BY TYPE, 2018-2030 (USD MILLION) T'

Leave a Comment